Realty Income: A Higher Inflation Rate Could Mean Higher Dividends

Summary

- Given that 84.7% of its portfolio is tied to rent increases, we believe O may continue to record excellent top and bottom-line growth through FY2024.

- Income investors may want to add the stock here for an improved forward dividend yield of 5.25%, compared to its 4Y average of 4.24% and sector median of 4.28%.

- There is a reason why O remains a blue chip REIT stock, which continues on its path of 26 years of consecutive dividend growth.

- Do not miss this correction.

Bill Oxford/E+ via Getty Images

The Rising Inflation Investment Thesis

Realty Income (NYSE:O) remains one of the REITS that we have been monitoring, on top of W. P. Carey Inc. (WPC) and Medical Properties Trust (MPW). One of the common traits shared by these three REITs is that part of their rentals are tied to the inflation trend, allowing their rental revenue to generally increase over time.

By FY2022, O reported that up to 10.83K (+1.2K YoY) of its in-place leases provided for increases in rentals through the rising inflation. Given that these leases comprised 84.7% of its portfolio, it is unsurprising that the company has reported an excellent increase in its top line thus far.

The REIT reported an excellent expansion in its rental revenues by +60.5% YoY to $3.11B for the latest fiscal year, significantly aided by the acquisition of 1.3K properties in 2022 and the merger with VEREIT completed on November 01, 2021. If we were to look closer, we think its same-store rental growth to $2.45B would be more telling of the resultant inflation-tied leases, increasing by +1.8% YoY or $42.72M, on a constant currency basis.

While percentage rent (rent based on a percentage of the client's gross sales) comprised less than 1% of O's rental revenue, the increase to $14.9M (+129.2% YoY and +192.1% from FY2020) was impressive indeed.

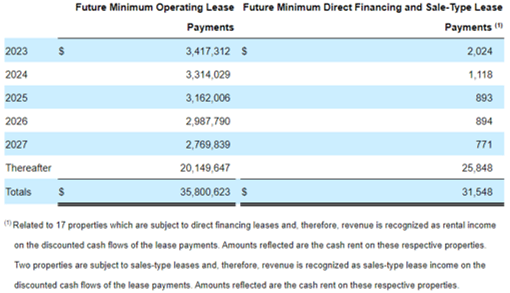

O's Future Minimum Operating Lease Payments

Seeking Alpha

Therefore, it is unsurprising that O has projected a few more years of excellent annual rental revenue, or termed operating lease payments, in the annual report. The company expects to record a minimum FY2023 revenue of $3.41B, suggesting an increase of at least +3.64% YoY.

It is also important to highlight that FY2022's revenues of $3.29B are much improved by +13.4% from the previous projections of $2.9B, suggesting a potentially positive impact from the rising inflationary pressures. As a result, with the Fed's projected terminal rate of up to 5.25% and a pivot only likely from 2024 onwards, the tailwinds to the REIT's top lines remain highly robust, in our view.

Naturally, there might be some headwinds to O's bottom lines, since its interest expenses also increased to $465.2M (+43.7% YoY) in FY2022, attributed to its long-term debts of $16.46B. Then again, it appeared that O's weighted-average interest rate of 3.15% (+0.04 points YoY) were still relatively reasonable, compared to the Fed's most recent hike to 5%, WPC's interest rate of 2.7%, and MPW's 3.3% in FY2022

In addition, O had competently managed its operating expenses in response to the rising costs, with its general and administrative expenses as a percentage of total revenue declining to 4.4% (-0.5 points YoY) in FY2022. Its property expenses as a percentage of total revenue also moderated to 1.3% (-0.2 points YoY) at the same time.

While there had been some cash flow impacts on its tenants, specifically Cineworld (since September 2022), O also managed to collect 100% of the former's contractual monthly rents through February 2023. This was on top of the $35.6M of cumulative reserves on 31 of its properties by December 2022, tempering some of the default headwinds while moderating its provision for impairment to $25.9M (-33.5% YoY) at the same time.

Furthermore, the REIT's occupancy rate remained excellent at 99% (+0.5 points YoY) with a weighted average lease term of 9.5 years, despite the uncertain macroeconomic outlook. The robust risk management was also demonstrated by its well-diversified portfolio across 84 industries, with Dollar General (DG), the company's largest tenant, comprising only 4% of its annualized contractual rent in FY2022.

Lastly, up to 81.9% of O's portfolio was comprised of retail spaces, with a subset of 43.3% of grocery/ convenience store/ dollar store/ quick service/ drugstores. Given the essential services offered by these retail spaces and the sustained spending index in the February CPI report at +0.4% MoM and +6% YoY, the company's prospects remain more than decent over the next few years, in our view.

This is on top of the REIT's decent cash/equivalents at $171.1M (-33.8% YoY), expanded credit facility/ commercial paper programs to $8.25B (+106.2% YoY), and minimal debts due through 2024 at $850M.

So, Is O Stock A Buy, Sell, or Hold?

O, MPW, WPC 6Y NTM Price / AFFO Per Share

O is currently trading at a NTM Price / AFFO Per Share of 15.55x, lower than its 3Y pre-pandemic levels of 19.13x and 1Y mean of 16.79x. The same moderation has been observed with its peers, WPC and MPW as well, with the latter overly correcting due to the tenant's bankruptcy and cash flow issues. It is apparent that the peak recessionary fears have contributed to this drastic correction, with things remaining volatile due to the uncertain macroeconomic outlook.

However, we reckon that this pessimism is unwarranted, given our estimates of O's FY2024 AFFO/ share of $4.15 (based on the REIT's rental revenue projection and similar operating expenses), expanding from FY2022 levels of $3.94 and FY2019 levels of $3.32.

In addition, the REIT has been consistently increasing its monthly dividend payouts, continuing its streak for the past 26 years. Combined with the rental increases seemingly tied to the inflation rate and the company's excellent projections in the minimum operating lease payments, we reckon existing investors may enjoy at least two more years of excellent dividend payouts, if not more.

O 1Y Stock Price

Therefore, based on these numbers, we reckon the O stock looks very attractive here, significantly aided by the stellar forward dividend yield of 5.25% based on the current stock prices. The yield is based on our projection of a consistent 0.2% increase in its monthly dividends, as observed for the first three months of 2023, totaling a payout of up to $3.29 by the year's end.

Combined with the fact that the stock is trading very attractively below its 50/ 100/ 200-day moving average, income investors may want to add more O here, significantly supported by the March 2023 bottom.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.