The Case For A Double-Digit Diamondback Dividend Yield

Summary

- In this article, we start by discussing my view on oil prices, which consists of a bull case to triple digits once demand expectations rebound.

- Diamondback Energy is a Texas-based onshore producer operating in the Permian. The company has efficient operations, high-quality inventory, and a healthy balance sheet.

- On top of expected stock price outperformance, FANG is a great source of energy dividends, thanks to its commitment to distributing 75% of its free cash flow.

- The combination of a safe base dividend and variable dividend could lead to a double-digit yield at elevated oil prices.

peshkov

Introduction

In September, I wrote an article calling Diamondback Energy (NASDAQ:FANG) the FANG of the next decade. Since then, a lot has happened, including a steep decline in energy prices tied to high recession chances. However, energy prices are still elevated, and energy stocks are rebounding after weakening in recent weeks. In this article, I will update my FANG bull case based on new developments in the oil industry and my expectations that oil prices could quickly enter triple-digit territory the moment demand expectations bottom.

This could turn FANG into a dividend powerhouse with a double-digit dividend yield on top of aggressive buybacks.

So, let's get to it!

Brent's At $80 (And Why That Matters)

I'm not hoping for a prolonged period of elevated oil prices - I'm merely preparing for it. If anything, the years between the commodity peak of 2011 and 2021 were extremely good for the global economy. Low inflation allowed rates to remain low, which supported the massive gains of some well-known tech stocks and the market in general.

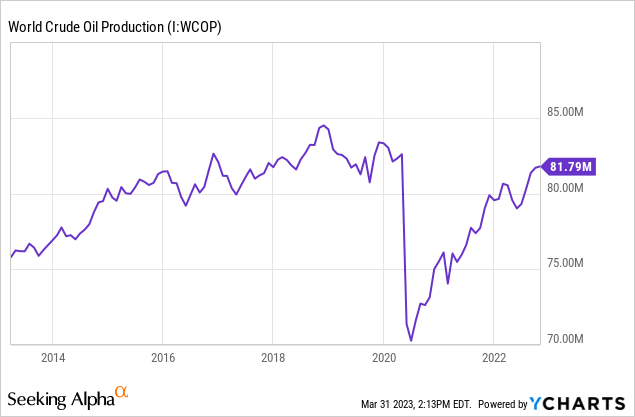

Now, that's changing. Demand is still high, yet oil supply growth has fallen off a cliff. World crude oil production is below its pre-pandemic peak. It hasn't grown since 2016.

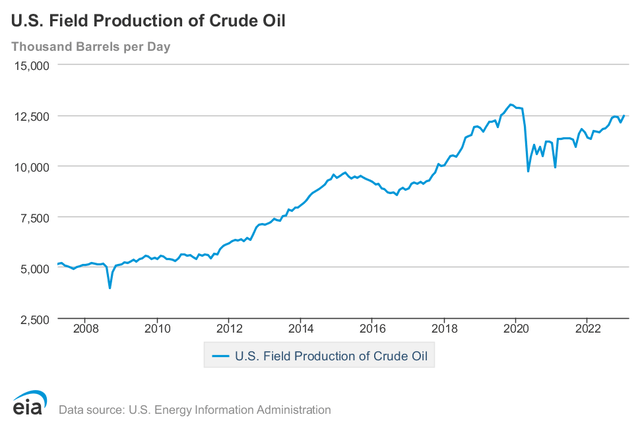

The same goes for oil production in the United States, which is still below its prior highs, despite improving production numbers.

Energy Information Administration

Related to this, I wrote an article last month titled The Shale Revolution Is Dead, Long Live EOG Resources, and ConocoPhillips! In that article, I highlighted some of the biggest issues facing the supply side of shale oil, which was the biggest driver of oil supply growth since the Great Financial Crisis.

For example, major producers are running out of good wells to drill.

Oil production from the best 10% of wells drilled in the Delaware portion of the Permian was 15% lower last year, on average, than top 2017 wells, according to data from analytics firm FLOW Partners LLC. Meanwhile, the average well put out 6% less oil than the prior year, according to an analysis of data from analytics firm Novi Labs.

As I wrote in that article, Chevron (CVX), one of the largest companies in the world, experienced a 42% decline in oil production from new wells in the Permian region in 2020 compared to wells that began production in 2018. Additionally, the top 10 new wells saw a decrease of around 25% in productivity.

Devon Energy (DVN), a major producer operating in the Delaware basin, previously drilled highly productive wells in an area called Boundary Raider. These wells produced an impressive average of over 342,000 barrels over a nine-month period in 2020. However, the average output of these wells dropped significantly to approximately 167,000 barrels in the following year, according to FLOW President Tom Loughrey.

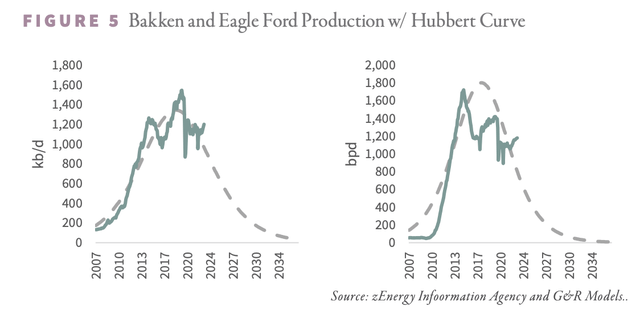

Furthermore, energy experts Goehring & Rozencwajg, who have been on top of this issue for a while, predicted the production decline in Barnett and Fayetteville production and now see similar developments in Bakken and Eagle Ford. These basins could soon see a decline in growth.

Goehring & Rozencwajg

This is a part of their findings:

Interestingly, the Permian has been the only basin to grow drilling activity since the end of 2019. In the Bakken and Eagle Ford, activity remains 10% below pre-COVID levels, whereas, in the Permian, activity is 5% above late-2019 levels. The answer is the superior inventory of remaining Tier 1 locations. Unfortunately, this superior inventory is being drawn down. We estimate that closer to 45% of all Tier 1 Permian locations have been drilled. The Permian is quickly approaching the same level of development as the Bakken and Eagle Ford in 2019. Our models tell us the results will be similar: Permian production will peak, plateau, and decline much sooner than anyone expects.

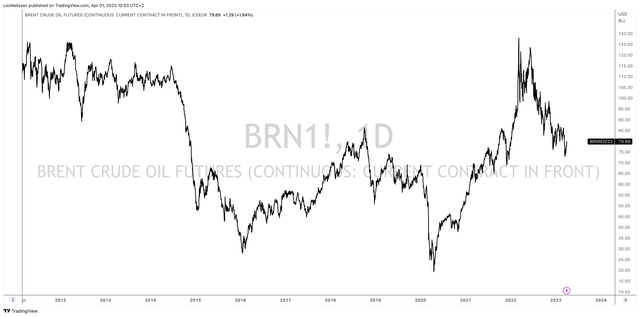

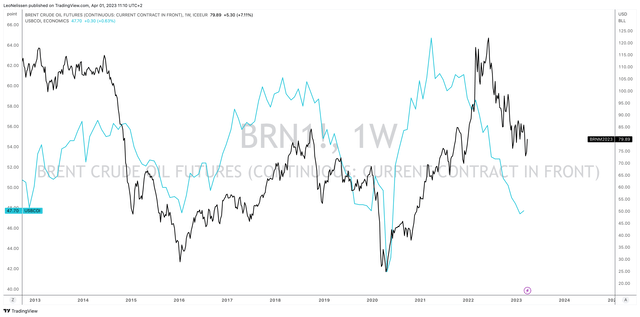

With that said, oil is back at $80. Prices bounced off last week's lows when banking fears pushed oil prices to a new cycle low.

TradingView

Despite high recession odds and significant weakness in economic indicators like the ISM manufacturing index, crude oil is still trading at elevated levels witnessed during the peak of the prior oil cycle (2018). If the supply situation was better, oil would be trading much lower. For example, after 2018, oil prices suffered from both lower demand and strong supply growth. Now it only faces headwinds from demand.

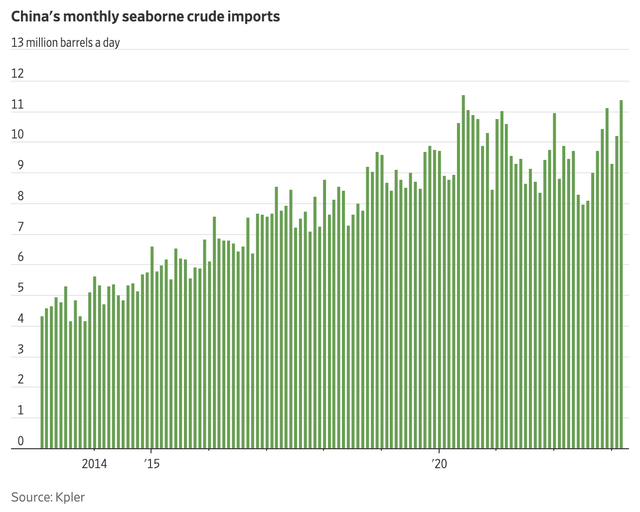

Not only that, demand is actually improving. For example, the Chinese economic reopening that started last year has caused its appetite for crude oil to accelerate. China's monthly seaborne crude imports have reached a new post-pandemic high.

Wall Street Journal

With that said, market participants expected OPEC to comment on potential production cuts. After all, the banking crisis put tremendous pressure on an already weak global economy (regardless of the Chinese reopening).

As reported by Bloomberg, OPEC is sticking to its 2 million barrel-per-day cut, which was announced in October of last year.

Saudi Energy Minister Prince Abdulaziz bin Salman has been particularly clear that current output targets shouldn’t be changed. The quota limits, which amounted to a 2 million barrel-a-day cut in production when they were agreed in October, are “here to stay for the rest of the year, period,” he said last month.

What's interesting here is that once demand bottoms, OPEC may be forced to increase production instead of cutting it. In that scenario, it is also not expected that OPEC will change its mind, which could fuel any future uptrends in oil.

Based on that context, the chart below shows Brent crude oil (again). However, this time, I added the ISM Manufacturing Index. This index has been a good predictor of oil price trends, as it indicates economic demand changes. This index started to lose momentum going into 2022. This decline was followed by a steep surge in oil prices after Russia invaded Ukraine.

TradingView

While it's hard to predict when it will happen, I expect oil prices to reach triple digits once demand expectations rebound. $100 could be a new normal in such a situation and cause inflation to return.

I'm not hoping that this situation will occur, but I believe it will. Hence, I'm looking for ways to protect my portfolio, which includes buying high-quality oil assets. These oil assets did wonders for my portfolio in both 2021 and 2022, when inflation forced a rotation from growth to value stocks.

What Makes FANG So Special

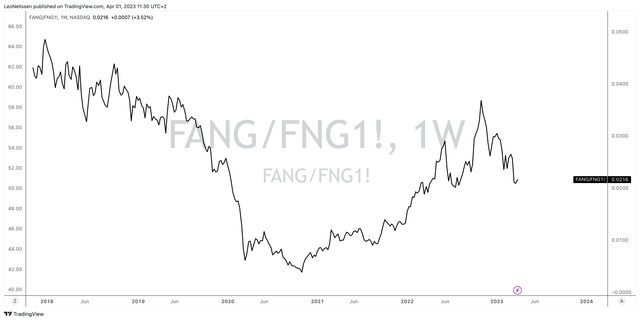

When I make the case that Diamondback with the ticker FANG is better than FANG stocks, I am essentially saying that I believe that this energy stock will outperform the biggest tech stocks on the market (the FANG+ stocks).

Prior to 2021, Diamondback didn't stand a chance against the tech giants (neither did its energy peers). Inflation was falling, oil production growth was strong, and the Fed was supporting markets. In 2021, that changed. Production growth started to slow, demand remained high, and inflation increased, forcing the Fed to hike rates.

The chart below displays the ratio between Diamondback Energy's stock price and FANG+ futures (a basket of the largest tech stocks).

TradingView

While energy stocks have underperformed tech stocks this year (so far), I believe that energy will outperform tech on a prolonged basis, supported by the aforementioned energy bull case.

So, what's Diamondback Energy?

With a market cap of $25 billion, Midland-TX-based Diamondback is one of America's largest onshore oil producers. The company focuses on the exploitation of unconventional oil and gas reserves in the Permian Basin in West Texas. In this area, the company specializes in horizontal development of the Spraberry and Wolfcamp formations of the Midland Basin and the Wolfcamp and Bone Spring formations of the Delaware Basin, both of which are part of the larger Permian Basin in West Texas and New Mexico.

In addition to that, Diamondback owns the general partner and 56% of the limited partner interests in Viper Energy (VNOM), a public owner of oil and natural gas properties. FANG is Viper's largest customer.

High Reserves & Production Growth

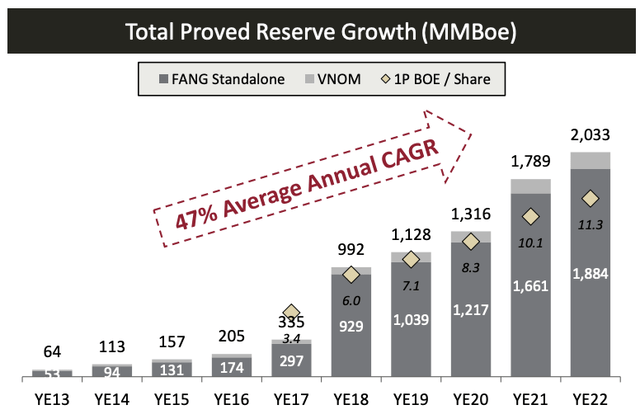

FANG brings a number of qualities to the table that make it a great long-term oil play. For starters, it has large-quality reserves. FANG is sitting on 2,033 million barrels of oil equivalent, which is an increase of 14% compared to 2021. Roughly 70% of these inventories are currently being exploited. 53% of these reserves consist of oil.

Thanks to new developments and M&A, the company's reserves have increased by 47% per year since 2013.

Diamondback Energy

That said, in 2023, the company aims to boost production by 16% to 259 thousand barrels of oil per day. In order to achieve this, the company is boosting its capital budget by 34% to $2.6 billion.

Normally this is the part where I want to show you how much production the company has hedged, as it impacts realized selling prices.

However, as the company has a smart hedging program tight to its dividend plans, we might as well start with the dividend.

The Attractive FANG Dividend (And Healthy Balance Sheet)

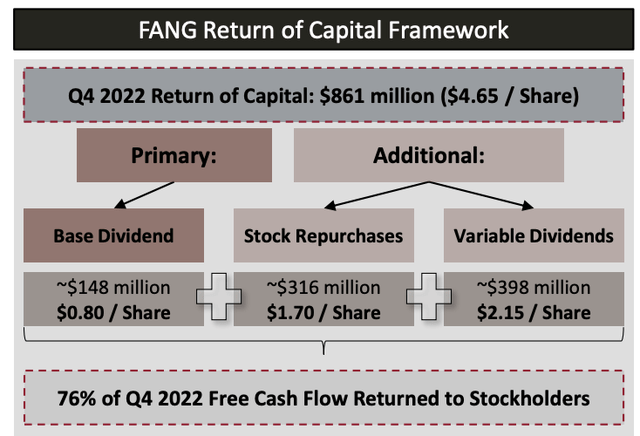

FANG not only has high inventories and production in America's most profitable basin, but it also has a shareholder-friendly approach when it comes to distributing free cash flow. The company aims to return 75% of its free cash flow to shareholders. This includes a base dividend, special dividends, and buybacks.

In 4Q22, the company returned $861 million to shareholders. $316 million of this consisted of buybacks.

Diamondback Energy

Since the company initiated its dividend in 2018, the annual average dividend growth has been 10% per year.

One of the reasons why the company is able to distribute and grow its dividend, in the first place, is its balance sheet. The company ended 2022 with a net leverage ratio of less than 0.1x EBITDA. Just 19% of its $1.2 billion net debt portion is set to mature within five years. While the company's success doesn't depend on it, this buys the company a lot of time in the current high-rate environment.

Based on that context, the current base dividend is $0.80 per share. The base dividend was hiked by 6.7% in February. This base dividend translates to a 2.4% yield.

Maintaining this dividend costs roughly $550 million per year. The company has these costs covered at $40 WTI. This is impressive, and it highlights the company's efficient operations, even in times of high inflation.

In order to protect this dividend, the company is hedging its production. FANG aims to hedge 50% to 60% of its production going into a particular quarter.

Even if oil prices were to crash, the company would not have to cut its base dividend, which is good news for long-term investors who will (more likely than not) experience a number of cycles that involve subdued prices.

That said, the upside is high. At $80 WTi, the company estimates to have a free cash flow yield of almost 15%. This implies that returns to shareholders will be close to 11%. Please note that the current stock price is at levels that were used for these calculations in February. Oil prices of $100 could lead to returns close to 14% of the company's market cap.

In other words, excluding buybacks, investors are set for prolonged double-digit dividends if oil prices work their way up to triple digits. Even in the $80 to $100 range, dividends are expected to be close to 10%.

The current annualized dividend yield is 8.7%.

Outperformance & Valuation

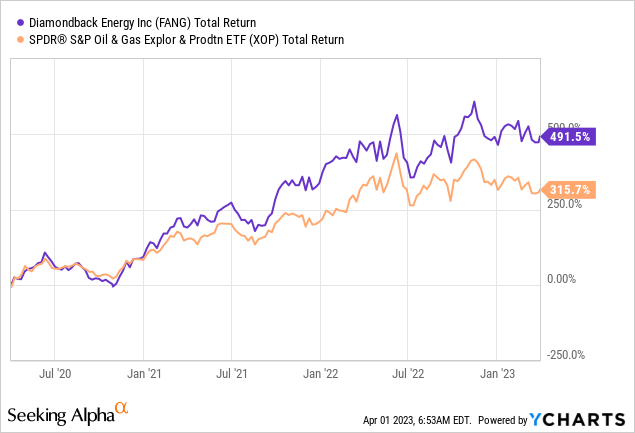

The mix of low-cost production, high inventories in top-tier locations, a healthy balance sheet, and high shareholder commitment has caused the stock to outperform its peers by a wide margin over the past three years (and consistently since its IPO). I expect this to continue. It's also why I moved FANG on my top-energy plays list before I wrote this article.

The valuation is tricky, as it is mainly dependent on the price of oil.

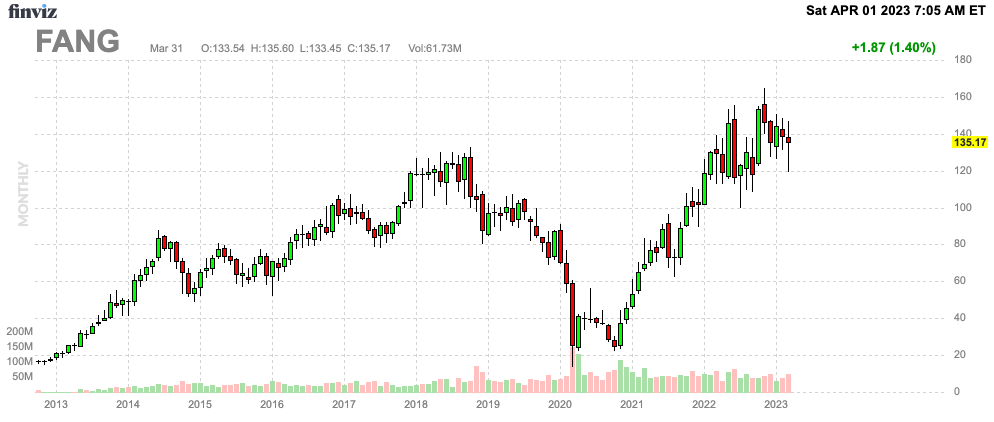

Even at $80 WTI (we're close to that), the company is in a good spot to maintain a high single-digit dividend yield. That's a good deal. If oil were to rally to more than $100, backed by rising demand, I believe that the stock has the power to rise to $200.

FINVIZ

The only reason why I do not own FANG shares is that I already have close to 20% energy exposure.

Takeaway

In this article, we discussed my view on the bull case for oil. While current demand fears are keeping a lid on oil prices, I expect a sustained bull market the moment demand expectations return. At that point, we'll witness the full force of subdue supply growth and rising long-term demand.

One of the best ways to play this is by buying FANG. This Texas-based driller has efficient operations, high-quality inventories, a safe base dividend at $40 WTI, and shareholder commitment that is likely to lead to a double-digit dividend yield the moment oil moves above $100.

While FANG is a very cyclical way to get access to a high yield, it's one of the best ways to buy energy dividends.

Needless to say, investors need to be aware of the cyclical risks and the fact that the biggest part of the dividend is variable. This needs to be taken into account when assessing the viability of adding FANG to a (dividend) portfolio.

Other than that, I think FANG is a fantastic play to combine both income and a high likelihood of outperforming returns on a long-term basis.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DVN, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.