- News

- Business News

- India Business News

- Bank lending to NBFCs 2x of industries in FY23

Trending Topics

Bank lending to NBFCs 2x of industries in FY23

In an indication that finance companies are playing a greater role in lending to businesses, bank loans to non-banking finance companies (NBFCs) in the first 11 months of FY23 were twice the disbursement to industries.

MUMBAI: In an indication that finance companies are playing a greater role in lending to businesses, bank loans to non-banking finance companies (NBFCs) in the first 11 months of FY23 were twice the disbursement to industries.

Banks lend to NBFCs who in turn finance small businesses and individuals. In the first 11 months of the current fiscal (April 2022 to February 2023), banks increased their loans to NBFCs by Rs 2.8 lakh crore. During the same period, banks lent Rs 1.35 lakh crore to industries.

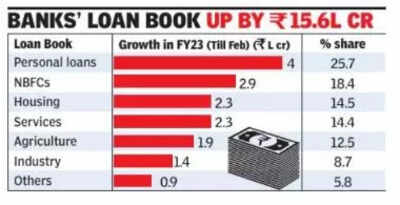

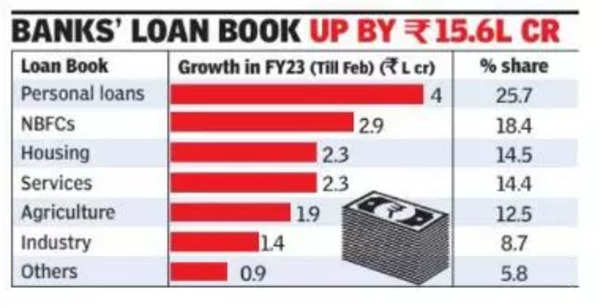

Considering that banks grew their overall loan book by Rs 15.6 lakh crore up to February 2023, the share of NBFCs in incremental lending works out to 18.5% as against 8.7% for industries.

The bulk of the bank lending (Rs 6.3 lakh crore or 40% of incremental advances) went into personal loans. Of this, Rs 2.3 lakh crore or 14.5% of total fresh advances were for home loans. For banks, their personal loan book has seen a 20% growth in the first 11 months of FY23, which is nearly thrice the 7% growth in credit to industry.

Banks lend to NBFCs who in turn finance small businesses and individuals. In the first 11 months of the current fiscal (April 2022 to February 2023), banks increased their loans to NBFCs by Rs 2.8 lakh crore. During the same period, banks lent Rs 1.35 lakh crore to industries.

Considering that banks grew their overall loan book by Rs 15.6 lakh crore up to February 2023, the share of NBFCs in incremental lending works out to 18.5% as against 8.7% for industries.

The bulk of the bank lending (Rs 6.3 lakh crore or 40% of incremental advances) went into personal loans. Of this, Rs 2.3 lakh crore or 14.5% of total fresh advances were for home loans. For banks, their personal loan book has seen a 20% growth in the first 11 months of FY23, which is nearly thrice the 7% growth in credit to industry.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE