Pimco Active Bond ETF: Modestly Outperforming Bond Fund

Summary

- The BOND ETF is an actively managed bond fund that invests across the credit sprectrum, mostly in domestic U.S. fixed income securities.

- It pays a modestly high 6.4% distribution yield. However, investors should note that the fund has only earned an average annual return of 0.6% over 5 years.

- Compared to aggregate bond ETFs, the BOND ETF outperforms by an average of 30-40 bps p.a. after fees.

- With the Fed possibly done hiking interest rates for this cycle, the outlook for bonds is improving.

- On a relative basis, I expect the bond experts at PIMCO to be able to outperform by capitalizing on potential credit dislocations from a pending recession.

Kameleon007

The Pimco Active Bond ETF (NYSE:BOND) is an actively managed bond ETF that aims to deliver superior risk-adjusted returns. Historically, the BOND ETF has delivered modest returns that have been 30-40 bps better than aggregate bond funds like the AGG and BND. For investors looking for broad bond exposure, the BOND ETF may be a good risk-adjusted investment, particularly as the Fed may be done hiking interest rates for this cycle.

With an incoming recession, the opportunity set for the bond experts at PIMCO could also be expanding, which should allow them to outperform in the coming years.

Fund Overview

The Pimco Active Bond ETF (BOND) is an actively managed bond ETF with a mandate that can invest outside of its benchmark to earn higher risk-adjusted returns.

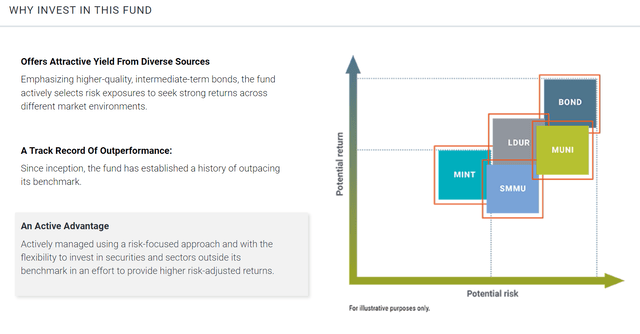

Within Pimco's bond offerings, the BOND ETF is considered higher risk, but with commensurately higher potential returns (Figure 1).

Figure 1 - How BOND fits within Pimco's offerings (pimco.com)

The BOND ETF has $3.2 billion in assets and charges a 0.55% expense ratio.

Portfolio Holdings

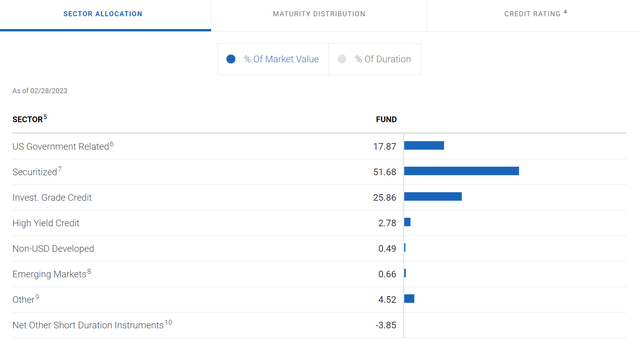

The BOND ETF holds over 1,000 positions with a portfolio effective duration of 5.9 years as of March 30, 2023. Figure 2 shows the BOND ETF's sector allocation. The ETF has 17.9% allocated to U.S. treasuries, 25.9% invested in investment grade credit, and 51.7% invested in securitized securities like Agency mortgage-backed securities ("MBS"), non-Agency MBS, commercial mortgage backed securities ("CMBS"), etc.

Figure 2 - BOND sector allocation (pimco.com)

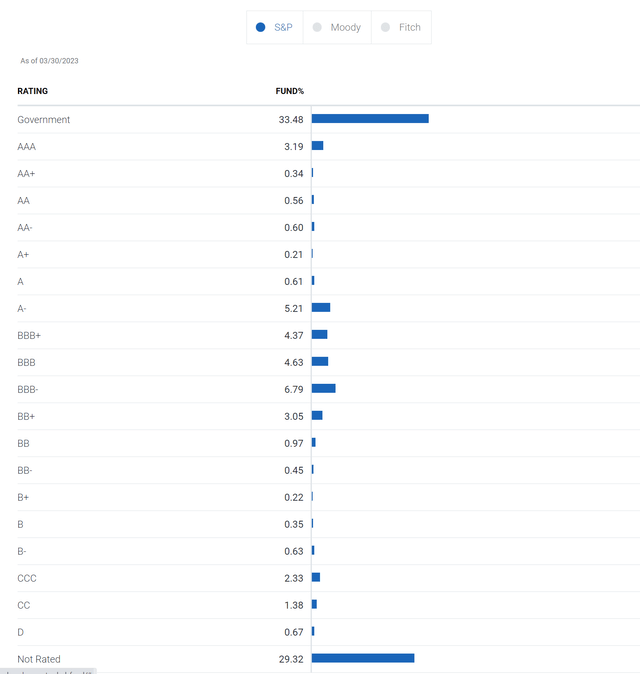

Figure 3 shows the fund's credit quality allocation. 33.5% of the fund is government backed, 26.5% is investment grade (BBB- to AAA), and the rest are non-investment grade ("junk") or not rated.

Figure 3 - BOND credit quality allocation (pimco.com)

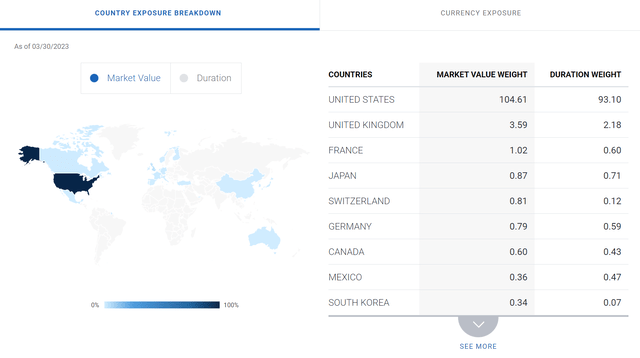

The BOND ETF is mostly domestic U.S. focused, although it does hold a smattering of international securities (Figure 4).

Figure 4 - BOND is U.S. domestic focused (pimco.com)

Distribution & Yield

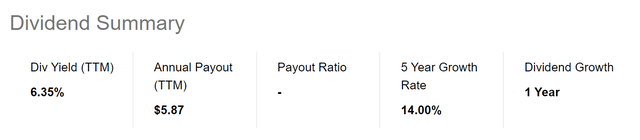

The BOND ETF pays a modestly high monthly distribution, with a trailing distribution of $5.87 / share or 6.4% yield (Figure 5).

Figure 5 - BOND distribution yield (Seeking Alpha)

Returns

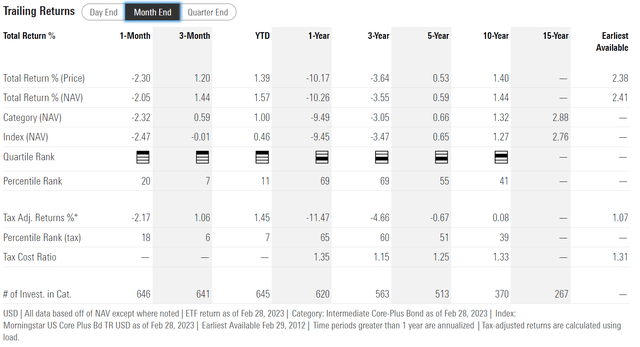

Figure 6 shows the historical returns of the BOND ETF. The BOND ETF has provided generally modest returns, with 3/5/10Yr average annual returns of -3.6%, 0.6% and 1.4% respectively to February 28, 2023.

Figure 6 - BOND historical returns (morningstar.com)

Note that while BOND's historical performance has been modest, it could be a result of the asset class. Bonds in general have suffered one of the worst years in history in 2022 due to the Fed's interest rate hikes.

BOND vs. AGG & BND

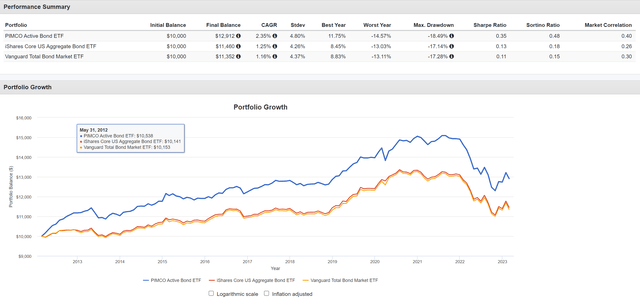

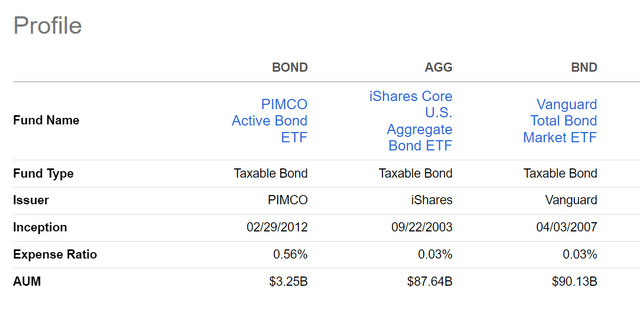

Comparing the BOND ETF against passive aggregate bond ETFs like the iShares Core U.S. Aggregate Bond ETF (AGG) and the Vanguard Total Bond Market ETF (BND), we can see that since BOND's inception (March 2012 to February 2023), the BOND ETF has delivered superior CAGR returns (2.4% CAGR vs. 1.3% for AGG and 1.2% for BND) and similar risk (4.8% volatility vs. 4.3% volatility for AGG and 4.4% volatility for BND) as the aggregate bond ETFs. This leads to a better Sharpe Ratio of 0.35 for BOND vs. 0.13 and 0.11 respectively for AGG and BND (Figure 7).

Figure 7 - Comparing BOND to AGG and BND since inception (Author created using Portfolio Visualizer)

However, it is noteable that much of the outperformance occured in 2012, when BOND was first launched. In the stub year 2012, BOND returned 11.8% vs. 3.0% for AGG and 2.5% for BND.

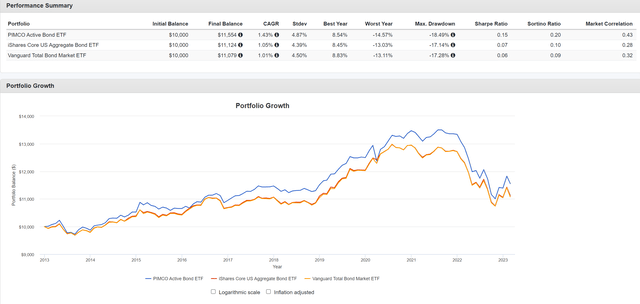

If we were to run the same comparison using January 2013 as the start date, BOND's outperformance is much more modest, with CAGR returns of 1.4% vs. 1.1% for AGG and 1.0% for BND (Figure 8).

Figure 8 - Comparing BOND to AGG and BND since January 2013 (Author created using Portfolio Visualizer)

Many funds have strong returns out of the gate as smaller assets under management give managers more flexibility to find investments that outperform.

Nonetheless, the BOND ETF does generate alpha compared to the overall bond market, as measured by AGG and BND, even if the difference is only 30-40 bps per year after fees. On the topic of fees, the BOND ETF charges much higher fees than the two passive bond funds mentioned (Figure 9).

Figure 9 - BOND vs. AGG and BND fund details (Seeking Alpha)

Why Buy Bonds Now?

After a historically bad year in which bond investors lost on average 13.1%, measured by the 2022 total return of the AGG ETF, why should we buy bonds now? Isn’t the Fed still raising interest rates to combat inflation?

The answer depends on your outlook for Fed monetary policy and more importantly, long-term interest rates. While it is true that up until a few weeks ago, the Fed was still intent on raising interest rates ‘higher for longer’ to fight inflation, I believe recent events in the banking sector may have changed their calculus.

Specifically, the unrelenting rise of interest rates in the past year was one of the root cause of several recent bank failures, as higher interest rates led to unrealized mark-to-market ("MTM") losses on long-term securities to accumulate on the banks' balance sheets. Further compounding the problem was the rise in money market yields (money market yields track short-term interest rates), which prompted depositors to seek these higher yielding investments instead of bank deposits.

The outflow of bank deposits caused a solvency crisis, as weak banks like SVB Financial Group (SIVB) had to sell their underwater securities portfolios to fund their deposit outflows, realizing the MTM losses and needing to raise capital. Being unable to raise capital, SIVB suffered a classic bank run as even more depositors fled, ultimately causing the bank to fail.

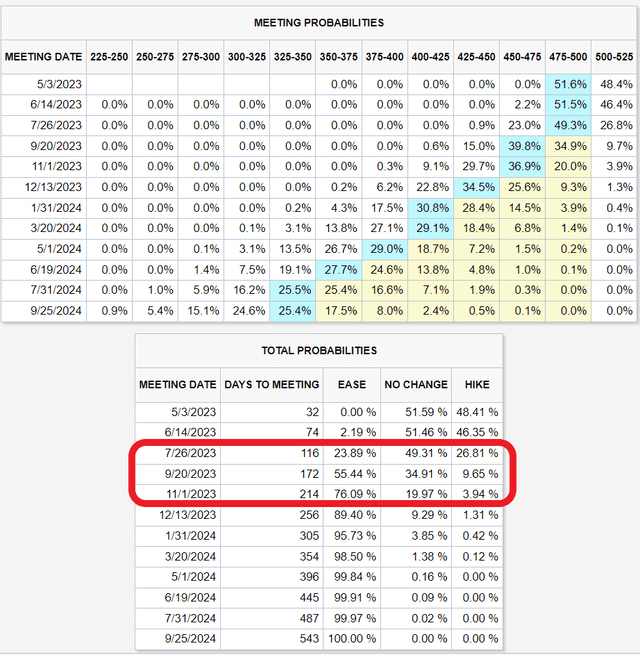

Historically, in past interest rate hiking cycles, we see the Fed and other central banks hiking interest rates until they ‘break something’. I believe we have now reached the breaking point where cracks are starting to emerge in the real economy as banks are becoming insolvent. Therefore, I believe the Fed is likely to stop raising interest rates soon. In fact, many bond traders believe March was the last rate hike, and they have started to price in Fed rate ‘cuts’ to start in the second half of the year (Figure 10).

Figure 10 - Traders expect the Fed to beginng cutting rates in H2/2023 (CME)

If bond traders are correct and the Fed starts cutting interest rates, then that should be positive for bond ETFs like BOND.

Recession Is The Key Risk

Of course, the reason the Fed may be cutting interest rates in the second half of the year could be because of a pending recession. In fact, reading between the lines of the Fed's latest Summary of Economic Projections ("SEP"), the Fed itself appears to be projecting a 3-quarter recession beginning in Q2/2023.

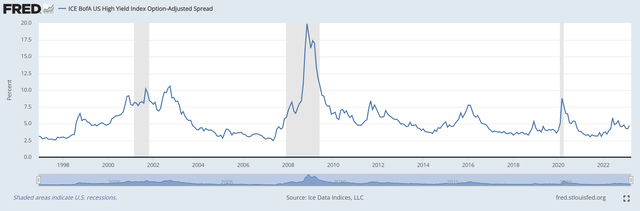

if the economy does suffer a recession in the coming months, then BOND’s credit sensitive investments could suffer, as credit spreads typically widen during recessions (Figure 11).

Figure 11 - Credit spreads spike during recessions (St. Louis Fed)

However, given the BOND ETF’s relatively large weighting in treasuries and investment grade bonds, I believe the BOND ETF should do fine. Moreover, I trust the bond experts at PIMCO to prove their worth during the coming recession and add significant alpha from capitalizing on credit dislocations.

Recall from figure 7 above, 2012 was a fantastic relative performance year for the BOND ETF. Another reason the BOND ETF could have outperformed in 2012 was because the fund manager had access to a wider set of investment opportunities at the time. 2012 was soon after the Great Financial Crisis of 2008/2009 and the European Debt Crisis of 2010/2011, and global markets were rife with dislocated asset prices. If a similar crisis scenario plays out, the BOND ETF may be able to outperform in the coming years.

Conclusion

The Pimco Active Bond ETF is an actively managed bond ETF that aims to deliver superior risk-adjusted returns. Historically, the BOND ETF has delivered modest returns that have been 30-40 bps better than aggregate bond funds like the AGG and BND. For investors looking for broad bond exposure, the BOND ETF may be a good risk-adjusted investment.

Coming off one of the worst investment years for bonds in history, I believe the outlook for fixed income securities is improving as the Fed may be done hiking interest rates for this cycle. With a looming recession on the horizon, the opportunity set for the bond experts at PIMCO could also be expanding, which should allow them to outperform in the coming years.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.