The Simply Good Foods Company Q2 2023 Earnings Preview: Pricey Heading Into Earnings

Summary

- The Simply Good Foods Company continues to grow but this doesn't make the company an ideal prospect.

- Despite management having bullish expectations for the current fiscal year, analysts have a mixed review that's at risk of missing the mark.

- Add on top of this uncertainty the fact that shares look pricey, and there are better opportunities for investors to consider at this time.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Juanmonino/iStock Unreleased via Getty Images

The four times each year that a publicly traded company announces its regularly scheduled financial results for its most recently completed fiscal quarter is a great time to take a pulse on the health of the enterprise in question. This gives investors the opportunity to evaluate whether or not their investment thesis still makes sense, irrespective of how share price performance has been leading up to that point. One firm that is due to report earnings soon for the second quarter of its 2023 fiscal year is The Simply Good Foods Company (NASDAQ:SMPL). For those not familiar with the business, it operates as a consumer packaged food and beverage company that focuses on the nutritious snacking market. Examples include protein bars, ready-to-drink shakes, sweet and salty snacks, confectionery products, and more.

Leading up to the earnings release, investors have a great deal to think about. Despite the fact that the business has been growing revenue at a steady pace and that management is targeting fairly attractive growth this year, analysts believe that revenue will take a slight step back. Even so, the expectation is for bottom line results to grow nicely. What the company delivers when it announces its financial results will set the tone for share price performance until the company's next earnings release, so it's important to understand what's at risk. At present, SMPL stock looks rather pricey, both on an absolute basis and relative to similar firms. Because of this, investors would be wise to tread a bit cautiously at this time.

Weak sales and strong earnings

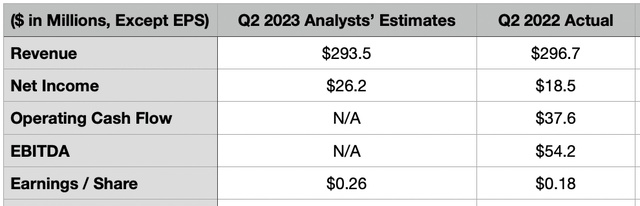

On Wednesday, April 5th, before the market opens, the management team at The Simply Good Foods Company is expected to announce financial results covering the second quarter of the company's 2023 fiscal year. On the top line, analysts anticipate revenue for the business coming in at $293.5 million. This represents a decrease of 1.1% compared to the $296.7 million in revenue the business reported the same quarter one year earlier. Truth be told, I find this forecast to be a bit perplexing. I say this because it runs counter to how the company has performed recently and it's contrary to what management has been forecasting.

Author - SEC EDGAR Data

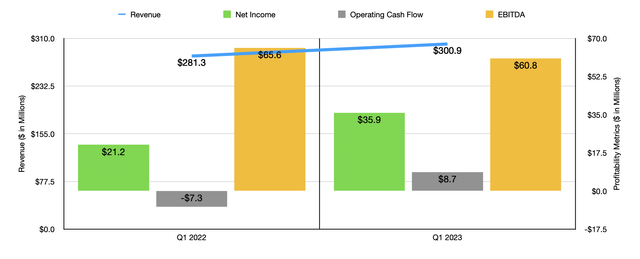

Take the first quarter of the 2023 fiscal year as an example. Sales during that time came in at $300.9 million. That's nearly 7% higher than the $281.3 million reported the same quarter one year earlier. This sales growth came about even though the company saw a 16.5% drop in revenue year over year associated with its international operations and a 1.1% hit associated with its decision to shift from the direct sales of its Quest frozen pizza business to instead licensing it. The growth, according to the company, was driven by price increases that were made effective in the fourth quarter of last year and by growth in the company's e-commerce business thanks to higher volume.

Author - SEC EDGAR Data

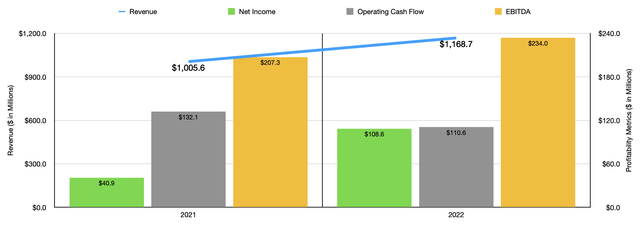

It's not just the most recent completed quarter that fared well. For 2022, revenue of $1.17 billion was 16.2% higher than the $1.01 billion generated in 2021. On top of this, management has also said that revenue growth for 2023 as a whole should be quite positive. In the past, the company said that its long-term target revenue growth rate would be between 4% and 6% per year. But in the first quarter earnings release, management asserted that 2023 would see revenue growth that is ‘slightly above’ this range for 2023. For the purpose of my own analysis of the company, I will construe this message as implying sales growth for this year of 7%.

On the bottom line, the picture is the exact opposite in terms of what analysts anticipate. They currently believe that earnings per share will come in at $0.26, with adjusted earnings per share totaling $0.30. By comparison, earnings per share in the second quarter of 2022 came out to $0.18. Based on the number of shares outstanding as of the end of the first quarter this year, hitting the target the analysts expect would imply net income of $26.2 million, while adjusted earnings would be around $30.2 million. Last year during the second quarter the company earned $18.5 million.

Author - SEC EDGAR Data

Almost beyond any doubt, this improvement, if it comes to fruition, will be driven by higher margins. Those margins, in turn, would be attributable to the aforementioned price increases initiated late last year. However, I don't believe that such an improvement is likely. After all, management did forecast adjusted EBITDA growth this year to be in line with the increase in sales. The fact of the matter is that adjusted EBITDA can be somewhat massaged, so if management is forecasting growth in line with sales, then it's likely that earnings per share will rise at that rate or lower. There is recent precedent for a decline in profitability.

During the first quarter of this year, the company saw its gross profit margin hit 36.9%, down from the 41.4% reported one year earlier. Higher costs associated with raw materials, packaging, and other issues, more than offset the benefit of price increases. Overall, net income in the first quarter of $35.9 million was comfortably above the $21.2 million reported one year earlier. But that surge was driven largely by the absence of a loss in fair value change of a warrant liability that the company had to contend with in the first quarter of 2022 and by a reduction in income tax expense, as well as a few other items. Investors should also be paying attention to other profitability metrics during this time. For context, operating cash flow in the second quarter of 2022 was $37.6 million. Meanwhile, EBITDA was $54.2 million.

Shares still look lofty

In the middle of May of last year, I wrote an article discussing whether or not it made sense for investors to consider The Simply Good Foods Company to be a serious investment prospect. Although I acknowledged that the business had exhibited attractive growth over the prior few years, even going so far as to say that the company was a high-quality operator, I also concluded that shares looked a bit pricey for me, even after factoring in said quality. This led me to rate the business a ‘hold’ to reflect my view of the time that shares should generate returns that would more or less match the broader market moving forward. Since then, that is more or less what has happened. While the S&P 500 is up 1.4%, shares of The Simply Good Foods Company have generated upside of only 0.3%.

Author - SEC EDGAR Data

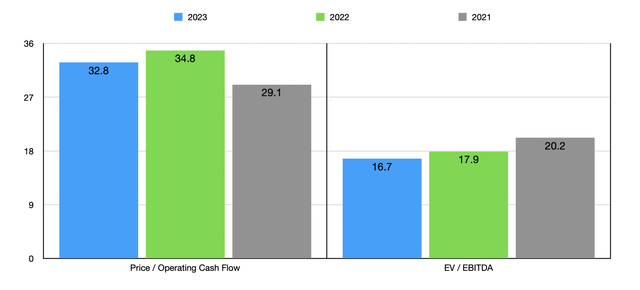

If we assume that management is correct about the growth that EBITDA should see, and if we apply that same growth assumption to operating cash flow, the firm still looks pricey at this time. On a forward basis, the firm would be trading at a price to adjusted operating cash flow multiple of 32.8 and at an EV to EBITDA multiple of 16.7. In the chart above, you can see how this pricing compares to pricing if we use data from 2021 or 2022. And in the table below, you can see how the company is priced compared to five similar firms. Using both valuation metrics, I calculated that the company is more expensive than four of the five firms in each scenario.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Simply Good Foods Company | 34.8 | 17.9 |

| Lancaster Colony Corporation (LANC) | 27.9 | 26.6 |

| TreeHouse Foods (THS) | 17.6 | 17.7 |

| Nomad Foods (NOMD) | 10.2 | 10.1 |

| Hostess Brands (TWNK) | 13.8 | 13.3 |

| Premium Brands Holdings Corporation (OTCPK:PRBZF) | 43.8 | 13.0 |

Takeaway

Operationally speaking, The Simply Good Foods Company continues to grow nicely, though analysts somehow believe that the company will experience a pullback when it reports earnings in the coming days. I think this is unlikely, even factoring in recent weakness overseas. I would also be surprised if earnings come in as strong as analysts expect. Even with the price increases initiated last year, the company reported margin compression in the first quarter and management has not indicated that strong growth on the bottom line would exist this year. The first quarter did see a nice increase year over year, but that was largely due to one-time events. On top of this, the stock looks a bit lofty, both on an absolute basis and relative to similar firms. Given these myriad factors, I would make the case that the firm is, at best, a ‘hold’ right now and might even warrant some downside if things don't go well when they report.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.