Sunnova: Dual Beats As Revenue Goes Parabolic

Summary

- Sunnova reported year-over-year revenue growth of 200% for its last reported fiscal 2022 fourth quarter.

- Strong growth continues on the back of new customer adds and an increasing take up of its battery storage solution.

- Cash and equivalents of $360 million as of the end of the fourth quarter have helped form a material runway as profitability improves.

Bilanol/iStock via Getty Images

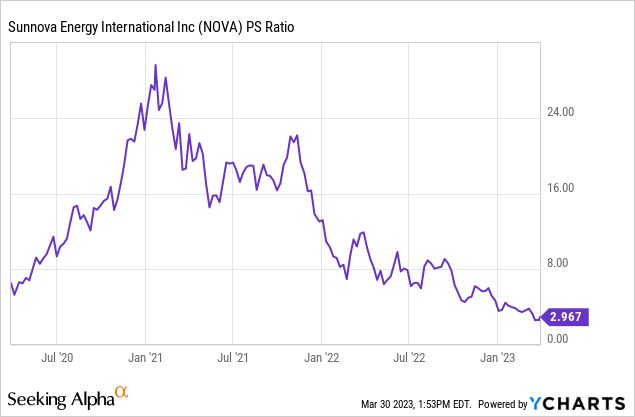

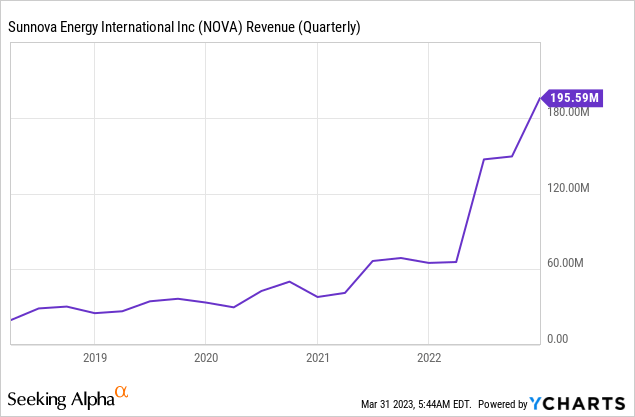

Sunnova's (NYSE:NOVA) fiscal 2022 fourth quarter earnings report was strong with revenue surging by 200% against the ramping momentum of US home solar installs. However, profitability remains problematic and the common shares are down 18% year-to-date to trade on a $1.7 billion market capitalization. With total fiscal 2022 revenue at $557.7 million, the company currently trades at a price to fiscal 2022 sales multiple of 3x, its lowest-ever level since going public in 2019 and down from its historical high of more than 30x.

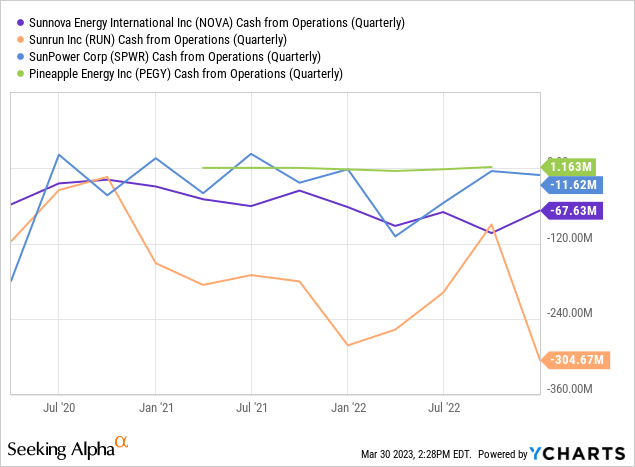

Does this represent a buy-in point? It depends. The company reported a net loss of $29 million for its fourth quarter which was growth from a loss of $14 million in the year-ago period. There is a distinct lack of profitability across the home solar space and Sunnova is going up against much larger players. Indeed, the largest pureplay public home solar company Sunrun (RUN) last reported negative cash from operations of $304 million with most of Sunnova's home solar peers at different levels of burning cash.

Critically, the broader adoption of home solar in the US is still in a relatively early stage with just 3.7% of US homes having rooftop solar installed. The current zeitgeist is characterized by buoyant government support combined with macro factors from an energy crisis to Russia's war on Ukraine that has supercharged previously tepid vigor around the adoption of home solar.

Ramping Revenue Growth But Profitability Concerns Persist

To be clear, Sunnova's poor performance this year reflects still persistent macro headwinds as early hopes for a possible dovish pivot by the Fed dissipated into fear around the failure of Silicon Valley Bank. Hence, 2023 will see bearish angst around a rising Fed Funds rate and Sunnova's unprofitability continues to dominate the direction of its common shares with short interest now at 25%. Indeed, whilst GAAP EPS of -$0.18 was a beat by $0.26 on consensus estimates and was an improvement on EPS of -$0.30 in the year-ago quarter, it was not a strong enough improvement for the stock price to react positively.

Sunnova reported fiscal 2022 fourth quarter revenue of $195.6 million, a 200.8% increase from the year-ago quarter and a beat by $55.84 million on consensus estimates. The company added 33,000 customers during the fourth quarter to bring its total to 279,400 as of the end of the fiscal year. Sunnova also added 87,000 customers through 2022, 31% of its total customers with the rate of customer additions increasing by 61% over 2021. These had a weighted average contract life remaining of 22.3 years with Sunnova expecting $500 million in cash inflows over the next 12 months as of the end of the fourth quarter.

Revenue growth has truly gone parabolic with record fourth quarter revenue on the back of strong customer additions and a growing attach rate for its battery storage solutions. This was 15.2% as of the end of the fourth quarter, up 400 basis points from an attach rate of 11.2% in the year-ago comp.

The company thinks it can maintain the bullish momentum and is guiding for customer additions to be not less than 115,000 through 2023. This will set 2023 to be a record year with revenue likely to be in the range of $800 million to $950 million. Hence, Sunnova's forward price-to-sales multiple stands at 1.94x using the midpoint of this range.

A Healthy Cash Balance

Sunnova ended the quarter with total cash of $546 million against negative cash flow from operations of $67.6 million. This cash burn was a small increase on negative outflows of $62.4 in the year-ago quarter. Core headwinds facing Sunnova remain the operating expenses required for scaling to meet demand and rising interest expenses. The latter was $71.5 million for the fourth quarter, a new record and up sequentially from $18.3 million in the third quarter. This was from a total debt of $5.4 billion as of the end of the fourth quarter. Sunnova added a new $50 million secured revolving loan credit facility post-period end to continue what now stands at its most marked period of levered growth.

I've not been enthusiastic about taking a position in Sunnova on the back of its net losses even as revenue growth maintains a strong upward momentum that's now ramping. This might change in the near future with the strong case for US home solar uptake being reflected by a wall of secular growth demand. Hence, even though the market is being pursued by several competitors with no clear competitive advantages over each other, Sunnova still faces material growth in the quarters ahead. This should push its revenue multiple lower if the commons stays constant from here to present prospective investors with an opportunity to buy without the safety of a profitable business.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.