The Retirees Guide To An Upcoming Recession

Summary

- Tech sector layoffs are accelerating as an era of "free money" causes companies to re-think the speed of innovation and product development.

- The unintended consequences created by requiring employees to head back to the office.

- The mortgage industry is silently suffering and highly compensated positions no longer exist in the current market.

- Given all of this information, what should a retiree consider doing with their retirement portfolio?

- We recently closed some positions in the tech sector and provide ideas of stocks to consider and avoid.

naphtalina/iStock via Getty Images

The goal of this article is to discuss some of the headwinds we are facing in the economy and some of the current challenges we are facing that are not commonly discussed by mainstream news. I am hoping that with this information we can generate some productive conversation in the comments section that gives retirees more information so that they can consider making changes in their retirement portfolios. This is a very dense article with a lot of interconnected ideas.

Most economists would agree that the definition of a recession matches the definition provided in the dictionary: "A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters." Of course, there are a number of other factors that play into this such as unemployment, interest rates, how much money the government is willing to pump into the system, etc.

Ironically, these additional factors have increased the bureaucratic involvement to the point where we have actually seen two recessions in recent years where the GDP fell in two successive quarters. The first recession took place in 2020, and then again most recently in 2022, and both events were characterized by two consecutive quarters of GDP declines. One could make the argument that 2020 doesn't count due to circumstances tied to lockdowns, but the 2022 event seems to be ignored by most economists.

The financial sector is struggling and layoffs make the headlines daily even as the unemployment numbers from the Bureau of Labor Statistics say that the rate is 3.6% as of February 2023 and the total number of unemployed people stands at 5.9 million. I don't know about you, but I find it appalling that economists and government agencies are trying to convince us that we have one of the lowest unemployment rates ever. As a manager who recently hired for a mid-level underwriting position, I can tell you that intuition tells me the unemployment figures are far more challenging than our current models indicate.

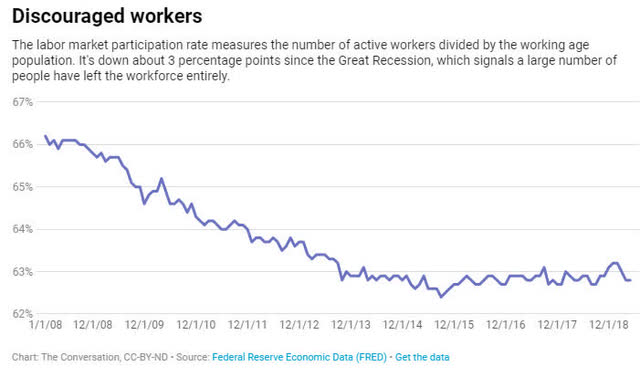

Unemployment And Participation Rates

What the unemployment figures don't tell us is the participation rate in the workforce (this is measured by taking all active workers divided by the working-age population). Workers who were previously employed and who have been unemployed for too long become discouraged and effectively stop looking for work thus reducing the participation rate.

FRED - Labor Participation - 2023-3 (FRED - St Louis Federal Reserve)

The unemployment rate does not account for the reduced participation rate, in fact, the unemployment rate actually benefits from a lower participation rate because it allows the unemployment rate to only account for people who are considered to be actively looking to work. This is a trend that actually began prior to COVID lockdowns and was exacerbated by the increased number of people who could continue to avoid working by receiving government assistance, eviction/foreclosure protection, and deferring student loan payments. There were also a number of individuals who used the safe haven of mom and dad's basement as a refuge during this time.

Discouraged Workers - 2023-3 (Federal Reserve Economic Data)

According to economist Michael Klein, in his article, Forget the Low Job Growth, the Number of People Who've Stopped Looking for Work Is the Real Problem, the participation rate in the workforce has steadily dropped from 2008 through the end of 2014. During this time, the participation rate went from 66% down to 63% (see image above) after significant fluctuations during the time frame of COVID lockdowns but has managed to return to 62.5% as of February 2023. At the time Klein wrote the article, a 3% drop translated to approximately 6 million people no longer participating in the workforce, and with that number at 62.5%, we could estimate the number is probably closer to 7 million. Now, it would be unfair to say that all 7 million people have valid reasons for no longer participating in the workforce, however, we also can't say that all 7 million people stopped looking for work for a good reason. Even if we assume that half of these individuals stopped looking for work for legitimate reasons, that still leaves 3.5 million people who really should be included in the unemployment rate. If we included these 3.5 million discouraged people in the unemployment rate I would expect the number to be much closer to 5.9%.

The Bureau of Labor and Statistics gives validation to this estimate in their February article The Employment Situation.

The number of persons not in the labor force who currently want a job was little changed at 5.1 million in February. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job. (See table A-1.)

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force was little changed at 1.4 million in February. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also changed little over the month at 363,000. (See Summary table A.)

A topic that I find relevant that isn't popular in the news is the number of working-age men (classified as ages 25-54) who are able-bodied and not gainfully employed. The article Why are so many men unemployed? discusses the complicated history of male unemployment among able-bodied men and how it has swung to a level even higher than what was seen in World War II. The number of able-bodied men who were not employed stood at 13.6% in 1940 prior to the U.S. involvement in WWII. This number dropped to 6% on average by the 1960s but continued to climb thereafter. In 2010, this number reached a gut-wrenching 16% of working-age men (which means that 1 out of every 6 able-bodied men was earning no wages). As someone who has been employed in some capacity since 14 years old, I can't imagine the idea of not being employed in this working-age range and personally believe that the regression that takes place when someone doesn't have purpose leads to consequences later on that are much more difficult to quantify.

What makes this more concerning is that for every unemployed person there are approximately two job openings available. This seems to speak to the fact that workers may see these job openings as beneath them and therefore they are not willing to accept a job that on the basis they believe they deserve more. It might be easy to assume that men in this category would likely be less educated but the article notes that statistics suggest 40% of men that fall in this category have some level of college education with almost 20% having completed their bachelor's degree.

As a final thought, I am not sure about the number of men who choose to take work where 1099's are the primary method of payment (making them contracted workers) and if this impacts the participation rate and unemployment. Many 1099 employees don't understand the taxable consequences and therefore may be employed but possibly haven't been filing their taxes. I see this in my work on a regular basis where deposits are coming in but the borrower has no taxable income because they choose to not report or in some cases simply don't understand the consequences. I haven't been able to find how this form of income is treated (especially because it is not uncommon to see workers in these fields fail to properly file taxes and set money aside to pay for Social Security, federal taxes, etc.).

Tech Sector Trends & Unemployment

Tech companies have thrived off of the cheap money supply (low-cost debt) that has flooded the system over the last several years and now that monetary policy is changing I believe that the tech companies are putting more thought into how they allocate their capital along with the cost of employee salaries needed to make that happen. In 2023, the tech sector has announced a total of 121,205 layoffs for the first two full months of the year and when we add the estimated figures from March this number increases by roughly 60,000, of which, 48,000 alone come from Accenture (ACN), Amazon (AMZN), Microsoft (MSFT), and Meta (META).

Another interesting trend in the tech sector is the idea that employees need to return to working in the office (at least some of the time) and the backlash it has generated. I have actually spoken with people who previously worked in a large city like Seattle or Portland but who decided to move to more affordable cities when working from home became the norm during COVID lockdowns. In some cases, this could be especially complicated for someone who moved to a city like Austin, Texas (which currently ranks fifth in the nation for layoffs) and now faces the potential of needing to move as a requirement of employment.

Depending on their situation, when their employer asked them to return to the office they didn't even know that they had moved to another city, and in one specific story, the person I talked to changed his profession significantly before letting his employer know that he didn't even live in Portland anymore and that he had no intention of ever returning. As an employee who has a flexible work arrangement, I can honestly say that I enjoy working from home every now and then to avoid disruption when working on certain projects, otherwise, I prefer to be in the office and able to collaborate because it is much easier to determine what processes need to be improved/changed when I can interact with those who are performing them on a daily basis.

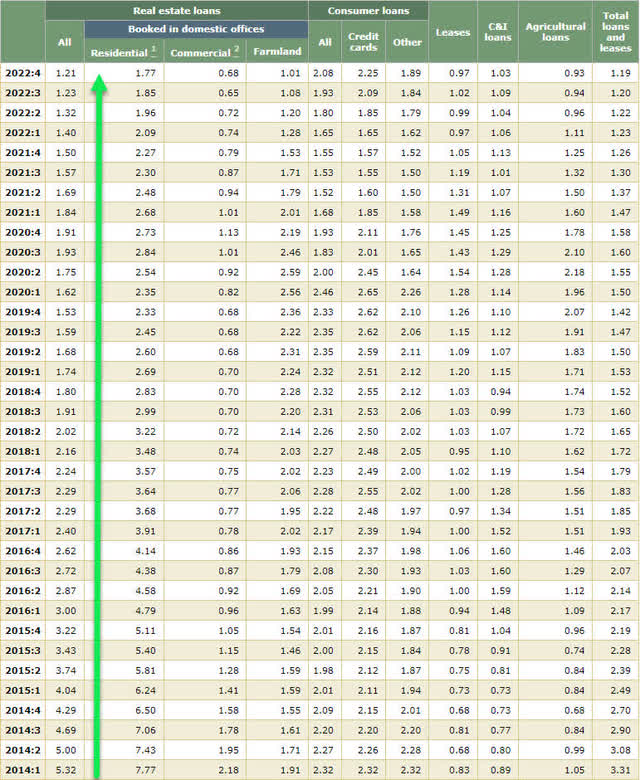

Delinquency Rates & Mortgage Industry Woes

We have seen a considerable number of borrowers who are pulling massive amounts of equity out of their homes in recent years. When I was a loan officer from 2011 - 2017 nearly everything I did was refinance-based because borrowers were able to take advantage of improving home prices and drop their interest rates and term while keeping their payments the same. Today's borrowers are putting themselves at huge risk in the event they are forced to move and must sell their house at a reduced price (or potentially unable to sell it at all).

Another scenario that isn't being talked about is that most Home Equity Lines of Credit (HELOCs) are interest-only payments but unless you have it at a fixed term the rate remains variable. One credit union I previously worked for offered a promo rate of 2.99% for one year and then normal rates would apply after. If someone borrows $100K @ 2.99% the interest-only payment during the draw period is going to be around $250/month. Those same loans when the rate adjusts will be moving to an interest-only payment of $750/month. Even though the borrower is qualified on being able to handle loan repayment there is a huge difference between the borrower being able to afford (qualify on paper) and actually managing their funds in a way that allows them to comfortably make payments.

This creates a scenario where there is an increasing risk of foreclosure and non-performing assets at a time when liquidity in the financial sector is a major issue. Loan performance over the last several years has been very strong but for all the wrong reasons (government assistance, loan payment deference, mortgage forbearance, etc.), and the Federal Reserve Delinquency Rates show that delinquency rates through the end of 2022 were practically nonexistent.

Loan Delinquency Rates - 2023-3 (Federal Reserve)

If you click the link above and continue scrolling, you will find that the last time delinquency rates were this low was prior to the financial meltdown in 2008. On a positive note, there are much better checks in place (no more ninja mortgage loans and stronger private mortgage insurance) but contrary to what many public figures and politicians promote, we are still allowing very unqualified borrowers to buy homes because there are enough no/low down payment programs that simply require the applicants be employed and to provide the necessary documents to verify income but do not actually address underlying habits. I see loan requests daily where the primary issue is that the borrower had poor role models or refuses to engage with positive habits like building emergency savings, etc.

I recently received a promotion and hired my first direct report which helped me put my finger on the pulse of the mortgage industry. The position we hired for is a full-time consumer underwriter whose primary focus is on retail products such as personal loans, auto loans, and home equity loans but the number of applicants with mortgage-specific specializations made up at least half of the applicants who applied. Of those with mortgage-specific specializations, around 95%+ lived in a city other than the one where my credit union is located. After reading nearly 200 resumes for underwriter applicants it confirmed my suspicions that even underwriters with track records of over 20 years with the same company were not immune to the cuts that needed to be made. Even worse, for every underwriter cut, this would represent several loan officers that would normally provide the pipeline of applications to be underwritten. As a previous employee of Umpqua Bank, now under Columbia Banking System (COLB), it was disheartening to read that the home loan unit cut half of its employees in January 2023.

Don't forget that the mortgage industry made a significant shift after 2008 with production shifting from traditional financial institutions to independent mortgage brokers. Independent mortgage brokers have been responsible for the majority of the mortgage production (compared to traditional financial institutions like banks and credit unions) and these entities are not able to compete in an environment where volume has been reduced because they have traditionally relied on referrals from real estate agents who are looking to get their prospective buyers preapproved. Independent mortgage brokers often have a wider variety of programs available to them compared to traditional financial institutions which makes them ideal for a realtor who is looking for the easiest way to qualify borrowers that range from first-time homebuyers to those who are very well qualified. Independent mortgage brokers are typically reliant on funding lines of credit that are now being revoked or charged higher rates which compresses margins that much further.

As these companies shut down operations it is likely going to leave a wake of unemployed mortgage lenders that will be forced to transition into different professions because it seems unlikely these jobs will return anytime soon.

The Loss Of Highly Compensated Positions

What do the tech sector and the mortgage/real estate industries have in common? The employees in these sectors are all typically highly compensated employees making a minimum six-figure income, and those who are high-producing loan officers/realtors they can potentially make high six-figure or low seven-figure incomes (at least they were when I was employed at Umpqua). I expect that the loss of these jobs will have a major trickle-down effect over the next 12 months on many of the industries who benefited from the real estate market in particular. I expect to see the following industries hurt the most as the fallout from the layoff of tech employees and mortgage lending operations:

- Construction companies - Specifically those that build and remodel homes.

- Trades - Electricians, plumbers, heavy equipment operators

- Engineered materials manufacturers and distributors.

- Sales - Big ticket items such as appliances, RVs, boats, cars, etc.

Of course, there will be pain felt by other sectors but these are industries that I see experiencing the most pain from the current headwinds.

What Should Investors Do?

We have begun the transition of John and Jane's portfolio towards lower-risk assets and getting more specific about what the stocks held in certain industries. Considering the risks above, the following industries should be monitored closely in your portfolio and potentially reduced/eliminated:

- Tech Sector

- Finance Sector

- Consumer Discretionary Sector

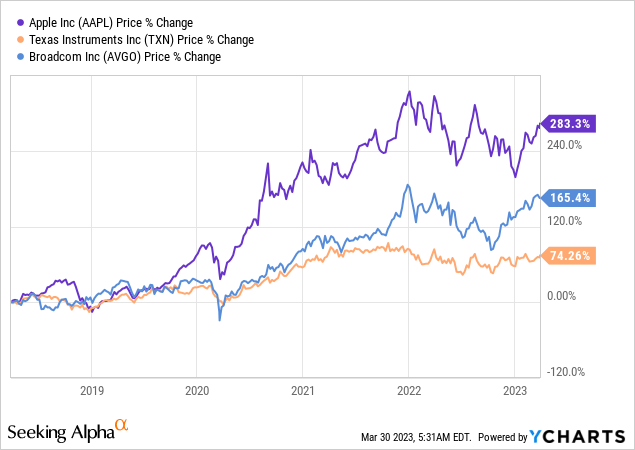

Tech Sector - I am specifically referring to companies that are more speculative and have untested products or who are highly dependent on a single product line and lack diversification in their revenue stream. Additionally, there are some tech sector plays that are much more resilient because they are manufacturers of products that people want and in many cases won't live without. Companies like Apple (AAPL), Texas Instruments (TXN), and Broadcom (AVGO) are all examples that may be considered part of the tech sector but they provide products that are required by devices we use every day.

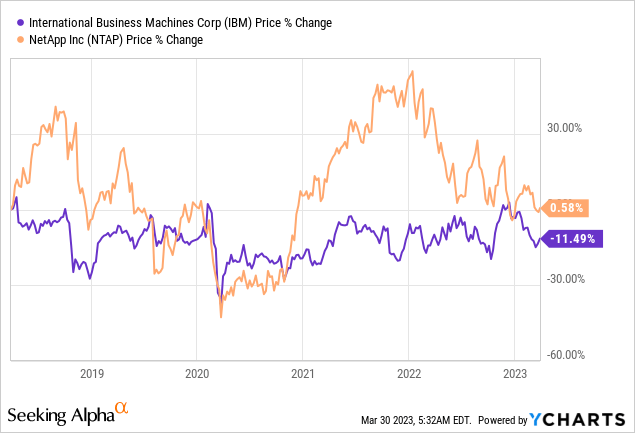

The types of companies we recently eliminated include International Business Machines (IBM) and NetApp (NTAP) from Jane's Retirement Account because they provide a service that is useful but isn't necessarily required by the types of products consumers use on a daily basis. I personally don't believe these companies will fail but I don't think their current price points are well supported in the event a recession takes place.

Financial Sector - When talking about the finance sector I'm not just referring to traditional financial institutions because I would also include mortgage REITs (mREITs). I don't typically include most insurance/reinsurance companies in this group because they are not subject to the same type of risk that brought down Silicon Valley Bank (SIVB). When a bank or mREITs funds long-duration loans with extremely low-interest rates the risk is that they will have to hold onto those long-term assets because they can't afford to sell off a mortgage at half the going interest rate without taking a large loss (who would pay full price for a 3% note when they can buy a 6% note?).

The average duration of the 30-year mortgage note was approximately seven years (this is primarily due to borrowers selling their homes or refinancing a loan) which caused the note to be paid off early. My current 30-year mortgage was originated at 3.875% in April 2022 and as a result, I do not foresee any event where we would sell, refinance, or attempt to pay it off too early because we are borrowing money at a rate that is dirt cheap by today's standards. Banks & mREITs do not make money by holding these low-yield assets long-term (they would rather sell them and collect the profit immediately and then put those deposits back to work repeating the same cycle) whereas insurance companies play the long game by holding low-risk assets with a laddered maturity schedule of their investments that far exceed the projected needs calculated by actuaries while satisfying capital requirements. This is why most insurance companies offer lower yields but are very stable. Our current favorite insurance company is Old Republic International (ORI) but we also have Allianz (OTCPK:ALIZF) on the watch list.

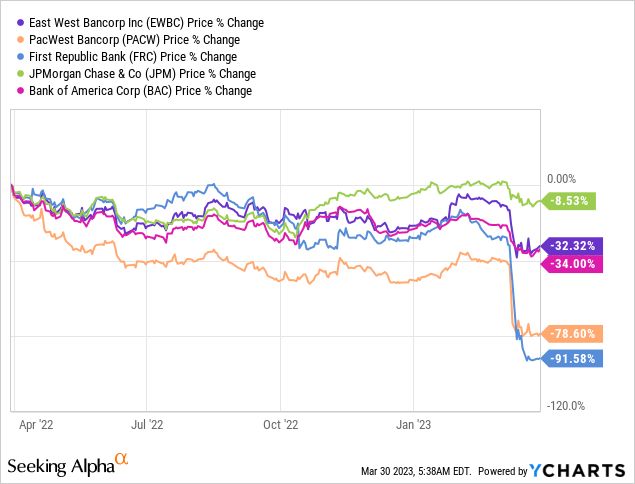

If looking to increase exposure to banks I would encourage investors to really consider their risk tolerance. We recently discussed selling and buying back shares of East West Bancorp (EWBC) but that's because I am very confident that they were lumped in with other institutions. Sticking with larger financial institutions is really the safest strategy moving forward.

I personally am not a fan of entities with heavy exposure to credit cards and who do not have a physical presence. These lenders make money by making their products accessible and spending large sums of money on marketing (think Samuel L Jackson for Capital One) (COF). With credit card debt reaching a record high it is going to be important to have a relationship with the borrower and determining reasonable limits that were designed to reduce exposure presents a lot of risks. Discover (DFS) is another institution I would avoid based on its February delinquency and charge-off rates.

- Discover Financial (NYSE:DFS) credit card delinquency rate in February was 2.74%, compared with 2.67% in January and 1.79% in February 2022.

- Net charge-off rate was 3.40%, up from 2.81% in January and 2.02% in February 2022.

- Loans as of February 28 totaled $89.6B, compared with $90B at January 31 and $73.1B at February 28, 2022.

We see strong BDCs as a better bet during this time even though we have seen share prices regress recently I believe it is a buying opportunity whereas the pullback in the price for banks has more uncertainty. BDCs that we currently like are Main Street Capital (MAIN) and Owl Rock Capital (ORCC). Neither company is particularly cheap but their net interest income (NII) has been benefitting tremendously from the increased interest rates. There is an increased risk of default but historically MAIN's portfolio has performed exceptionally well even during challenging times.

Consumer Discretionary - I operate my credit union's indirect lending platform (financing vehicles for borrowers directly at local dealerships) and I originally believed that we would see a slowdown in vehicle purchases as interest rates increased. To my surprise, there has been almost no slowdown in the purchase of vehicles because when Americans want their new vehicle they are willing to pay the price to get it.

When it comes to less necessary items such as boats, RVs, and other power sports I'm not so sure that the same idea will hold true (one exception I will make is for motorcycle people because I'm convinced that many of them would give up their firstborn child before they would give up their motorcycle and they tend to own multiple motorcycles). For this reason, I am steering clear of companies like Thor Industries (THO), LCI Industries (LCII), Polaris (PII), MarineMax (HZO), etc. Admittedly, I like PII more than the others because it is diversified around multiple areas of power sports and typically focuses on lower-cost items than RVs or boats which can easily become six-figure purchases. A big driver of increased sales of these items was the rapid increase in home equity that consumers were able to draw on to purchase these items.

Even during difficult times, consumers will still spend money which is why we prefer to focus on companies like Lowe's (LOW) or Home Depot (HD). Both stores benefitted from the real estate boom over the last decade but I also believe that they will benefit from consumers who will not be able to upgrade their house due to lack of affordability so they will choose to improve the residence they already have. Other retailers that I believe will perform reasonably well are companies like TJ Maxx (TJX) and Ross (ROST).

Conclusion

On a positive note, retirees can be thankful that we are finally operating in an interest rate environment where fixed income opportunities exist that actually provide a reasonable yield compared to the record low deposit rates seen over the last decade. Over the last decade, borrowers have benefited from record-low interest rates that our parents and grandparents probably thought were never possible. Simply put, the reasons to avoid borrowing money have increased and my generation is finally experiencing what it means to have what was previously considered "normal" interest rates.

Those who have made it to retirement age with a reasonable-sized nest egg can now consider shifting those funds from the volatility of the stock market to the safety and security of certificates of deposit, bonds, and treasuries. There are also higher-yield options like preferred stock (much of which is available at a significant discount to PAR value and therefore presents an opportunity to generate additional returns if shares are redeemed after their call date.

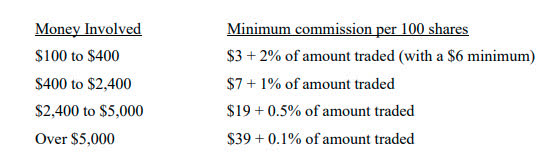

While the markets can be a scary place, the average investor today has more options at their disposal (and in many cases these options are available at minimal to no cost) compared to what was available even 20 years ago. It can be easy to forget that investing used to be something only available to those privileged enough with geographic proximity (Wall Street) and who also had the means to make those purchases. Consider the following NYSE commissions from 1959 - 1968 discussed in an article published by Columbia University.

NYSE Trading Costs - 1959 to 1968 (Charles M Jones - Columbia University)

John and Jane February Articles

The Retirees' Dividend Portfolio: John And Jane's February 2023 Taxable Account Update

The Retiree's Dividend Portfolio, Jane's February Update: SVB's Failure Presents Opportunity

The Retiree's Dividend Portfolio, John's February Update: Opportunities In Energy Stocks

Disclosure: John and Jane are two retirees whom I help with the management of their retirement portfolio and regularly publish articles about their portfolio. John and Jane are long the following companies mentioned in this article: Apple, Broadcom, Columbia Banking System, East West Bancorp, Lowe's, Main Street Capital, Old Republic International, Owl Rock Capital, and Texas Instruments.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, COLB, EWBC, HD, LOW, MAIN, MSFT, ORI, TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article reflects my own personal views and I am not giving any specific or general advice. All advice that is given is done so without prejudice and it is highly recommended that you do your own research. This article was written on my own and does not reflect the views or opinions of my employer.