Why Ares Capital Is A Better Buy Than Main Street For The Coming Recession

Summary

- ARCC and MAIN are widely regarded to be among the top blue chip BDCs and for good reason.

- While MAIN certainly has its advantages, we believe that ARCC significantly outshines MAIN right now.

- We share three reasons why ARCC is a better buy than MAIN as we head into the coming recession.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

Artur Didyk

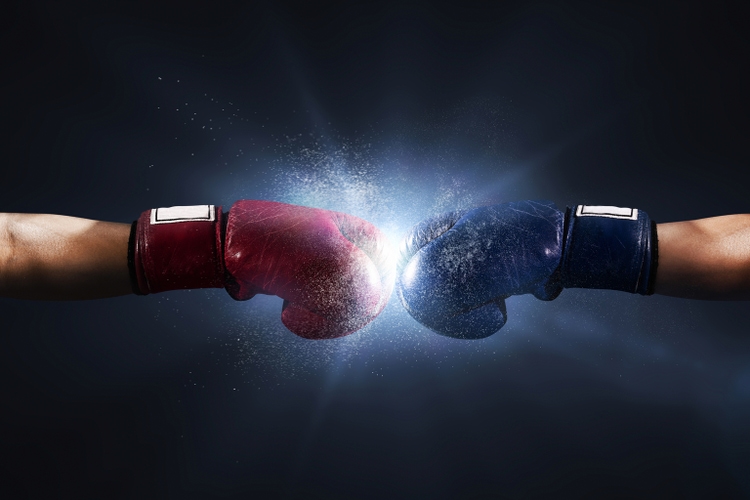

Ares Capital Corp (NASDAQ:ARCC) and Main Street Capital (NYSE:MAIN) are widely regarded to be among the top blue chip BDCs and for good reason. Both have generated substantial long-term outperformance than the broader stock market (SPY):

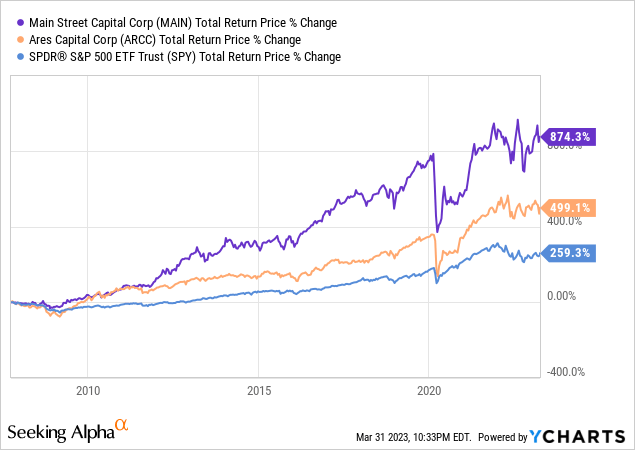

They have also significantly outperformed the broader BDC sector (BIZD):

MAIN certainly has its advantages, such as:

- Internal management that gives it a lower management expense

- A superior long-term total return track record to ARCC

- The ability to generate growth more easily due to its stock price's vastly superior premium to NAV, enabling it to issue stock and reinvest it more accretively than ARCC can.

That said, we believe that ARCC still significantly outshines MAIN right now. In this article we share three reasons why ARCC is a better buy than MAIN at the moment.

#1. Better Positioned For An Economic Downturn

Given the numerous recession indicators that are flashing right now - the sharp yield curve inversion, the banking sector turmoil, GDP growth numbers slowing to a crawl, persistently high inflation driving Federal Reserve tightening ever higher, and an ever-growing chorus of bearish outlooks being issued by businesses and highly regarded economists - it is prudent to favor more defensive business models right now, all else being equal.

When it comes to evaluating MAIN vs. ARCC in terms of recession resistance, this is really a no-brainer. This is because ARCC's portfolio is more conservatively invested, with greater exposure to debt investments than MAIN has. This in part explains MAIN's superior total return performance over the long-term relative to ARCC as its greater exposure to equity investments has fueled outperformance during the recent prolonged economic expansion.

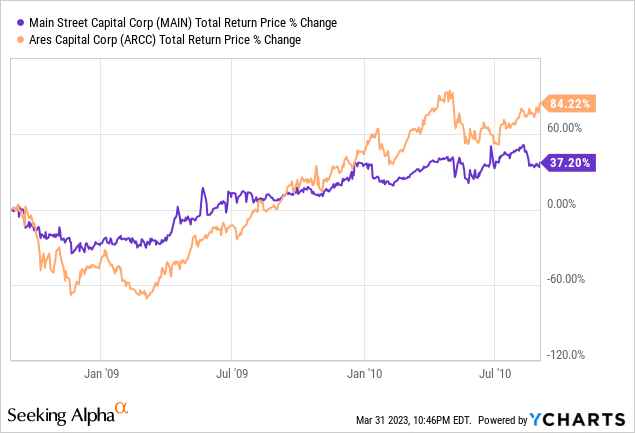

MAIN's greater recession sensitivity was displayed in ARCC's meaningful outperformance during the Great Recession:

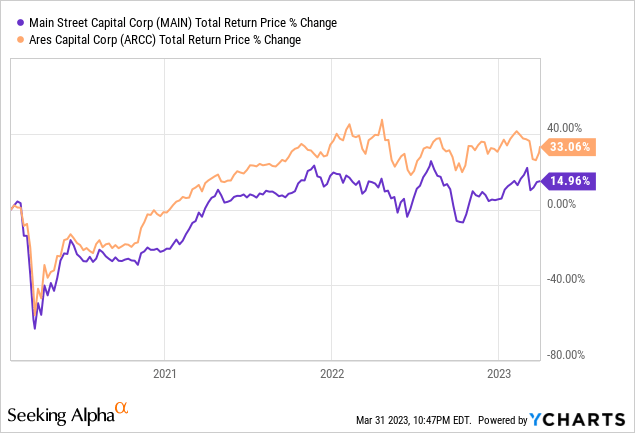

ARCC also meaningfully outperformed MAIN during the COVID-19 outbreak:

Ultimately, we expect this to play out once again in the coming economic downturn.

Another big advantage that ARCC enjoys over MAIN for weathering a recession is that ARCC is backed by its major global alternative asset manager Ares Management (ARES), which gives it vastly superior scale, deal flow, data-driven market insights, and ability to monitor and support investments and pursue recoveries in the event of a default. As management stated on their latest earnings call:

Today, we believe we employ the largest direct lending team in the United States with approximately 170 dedicated investment professionals. We believe that the scale of our team enables us to have complete market coverage by industry and by geography and to drive compelling opportunities in every channel that we target.

#2. Significantly Better Dividend Yield

Another big reason why ARCC is a more attractive investment than MAIN right now is simply by virtue of its significantly superior dividend yield. At the end of the day, BDCs are inherently income vehicles. This stems from the fact that they are exempt from corporate income taxes due to their requirement to pass through at least 90% of their net income to shareholders via dividends. As a result, the yield they pay out - and can sustain - is extremely important to determining the total return potential of a BDC.

ARCC wins this competition hands-down with a 10.5% forward dividend yield whereas MAIN offers a substantially lower 6.9% dividend yield. That means that MAIN will have to make up a 360-basis point deficit via valuation multiple expansion and/or per share growth if it is to generate superior total returns to ARCC.

Moreover, while MAIN's dividend looks very sustainable right now, so does ARCC's.

ARCC's spillover income is over 2.5x its current regular quarterly dividend rate, providing a cushion to support the dividend even in a serious recession. The safety of the dividend is also supported by the improvement in the investment portfolio's quality, with the average size of ARCC's counterparty improving significantly throughout 2022, particularly in Q4.

As management pointed out on the Q4 earnings call:

At year-end 2022, the weighted average EBITDA of our portfolio companies reached $275 million, an increase from $162 million at the end of 2021 and meaningfully above the weighted average from 5 years ago of $62 million. We believe this offers significant benefits to Ares Capital as we grow as larger companies generally have stronger credit profiles as a result of more diverse revenue streams, broader customer bases and more experienced management teams.

With a strongly supported dividend payout and an enormous edge over MAIN in the yield department, it is hard for us to see how MAIN will meaningfully outperform ARCC moving forward.

#3. Much Greater Margin Of Safety

Last, but not least, ARCC's valuation is significantly lower than MAIN's, giving it much greater margin of safety as we enter a period of increasing economic uncertainty.

MAIN trades at 1.5x its NAV while ARCC trades at 1x its NAV. This means that when buying MAIN you are paying a 50% premium relative to ARCC's assets. While it is true that MAIN's expense ratio is a bit lower than ARCC's, this is not even close to being enough to compensate for this differential, especially when you consider the aforementioned point about where we are in the economic cycle. As a result, we expect MAIN to suffer from multiple contraction as the economy sours whereas ARCC should continue to trade at least in-line with its NAV.

This - combined with the likelihood of ARCC going toe-to-toe with (or even besting) MAIN in terms of managing portfolio distress as well as ARCC's vastly superior dividend yield - means that ARCC is highly likely to outperform MAIN through the upcoming recession, just as it did in the previous two recessions.

Investor Takeaway

Both MAIN and ARCC are high quality BDCs and have strong pedigrees that are well-deserved. We understand that many investors - especially retirees - depend on one or both of these find companies for income that funds their retirement lifestyle.

While we are not necessarily bearish on MAIN right now, we think that ARCC is hands-down the better bet at the moment, especially when taking into account the broader macroeconomic situation.

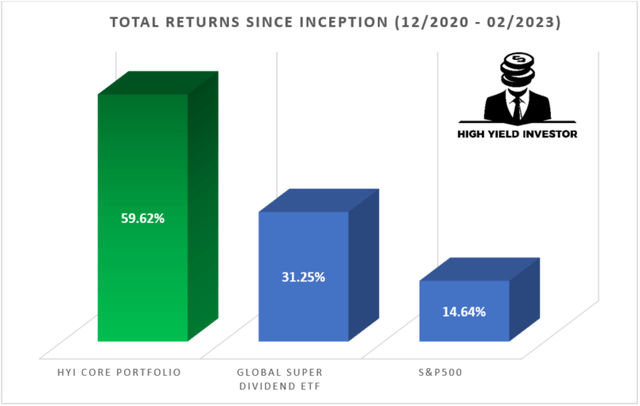

As a result, we are long ARCC along with several other blue chip undervalued BDCs at High Yield Investor, but are remaining on the sidelines with MAIN for now.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a $251 discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.