USFR: Better Than Your Bank Deposit Account

Summary

- USFR provides exposure to floating rate treasury notes.

- It has an annualized 4.7% distribution yield.

- It's a no-brainer to invest excess cash into 3-month T-bills that provide 13x the interest income than the average bank deposit account.

- USFR provides that convenience for a 0.15% management fee.

Dilok Klaisataporn

The WisdomTree Floating Rate Treasury Fund (NYSEARCA:USFR) provides exposure to floating rate treasury notes. Floating rate treasury notes are essentially the same as rolling 3 month T-Bills quarterly.

I think the USFR ETF is suitable for investors who want to earn high yields on their excess cash that is an order of magnitude better than bank deposit rates.

Fund Overview

The WisdomTree Floating Rate Treasury Fund provides investment performance of floating rate treasury notes. It tracks the Bloomberg U.S. Treasury Floating Rate Bond Index.

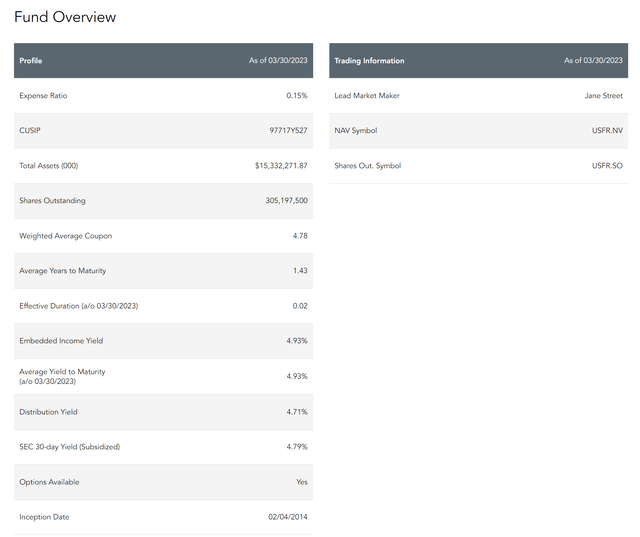

The USFR ETF has over $15 billion in assets and charges a relatively low 0.15% net expense ratio (Figure 1).

Figure 1 - USFR fund details (wisdomtree.com)

What Are Floating Rate Treasury Notes?

Unlike fixed rate notes which pay an interest coupon that is fixed at the time of issuance, floating rate notes pay an interest rate that is reset each quarter. The floating rate is determined at the weekly 13-week treasury bill ("T-Bill") auction.

If yields at the T-Bill auction rise week to week, investors in floating rate treasury notes could receive greater interest income than from a fixed coupon treasury note.

Although floating rate treasury notes are not technically considered 'money market' securities as they have maturity greater than a year, the rate-reset feature makes them functionally equivalent to owning T-bills and rolling them at maturity. The U.S. Treasury decided to offer floating rate notes as an alternative for investors who were rolling three-month T-bills every quarter.

Portfolio Holdings

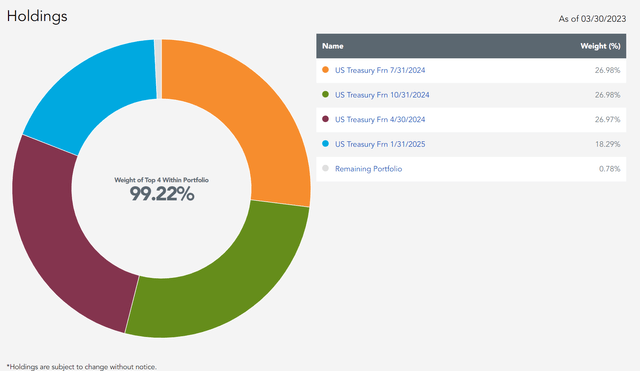

Figure 2 shows the USFR ETF's holdings. As designed, the fund only holds floating rate treasury notes with various maturity dates.

Figure 2 - USFR holdings (wisdomtree.com)

Distribution & Yield

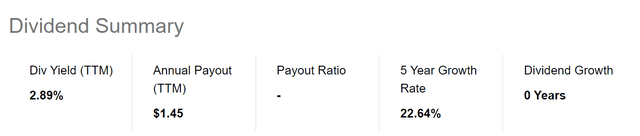

The USFR ETF has a 30 Day SEC yield of 4.79% and pays a monthly distribution. USFR has paid a trailing 12 month distribution of 2.9%, but the distribution has been rising as the Fed had been increasing Fed Funds rates (Figure 3).

Figure 3 - USFR distribution yield (Seeking Alpha)

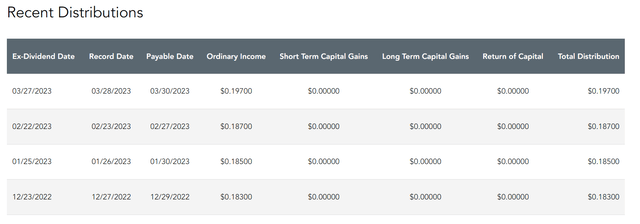

The most recent distribution of $0.197 / unit was paid on March 30, 2023 and would annualize to a 4.7% distribution yield (Figure 4).

Figure 4 - USFR recent distributions (wisdomtree.com)

Returns

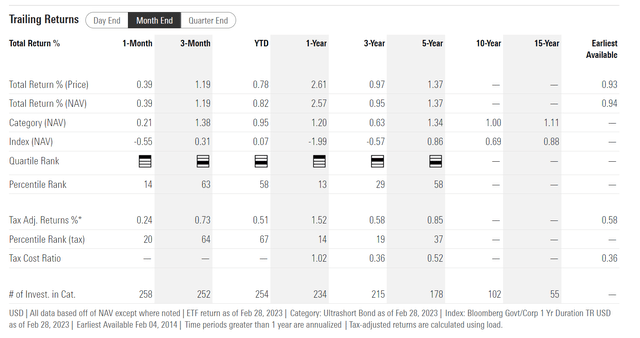

Figure 5 shows the returns of the USFR ETF. Investors owning the USFR ETF are unlikely to get rich. However, they also would not likely suffer capital losses, as the fund invests in ultra-safe floating rate treasuries that essentially have zero credit and limited interest rate risk.

Figure 5 - USFR historical returns (morningstar.com)

T-Bills Better Than Bank Deposits

Months before the recent bank deposit saga with the U.S. regional banks like SVB Financial, I have been writing articles on high-yield / low-risk investments like the US Treasury 3 Month Bill ETF (TBIL) as a place for investors to park their cash instead of bank deposits.

The yield differential is simply too great to ignore and the recent headline risk with potential bank deposit haircuts (although the government ultimately decided to protect all depositors at SVB Financial) have further raised the urgency for investors to move their money out of bank deposits.

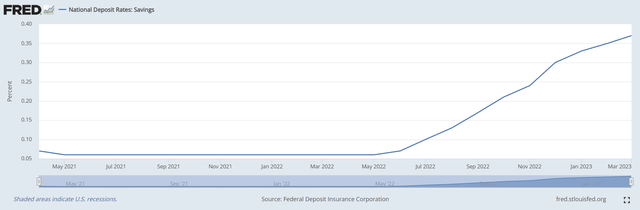

For example, on a national level, the deposit rate your local bank is still minuscule, at just 0.37% (Figure 6).

Figure 6 - Deposit rates remain minuscule (St. Louis Fed)

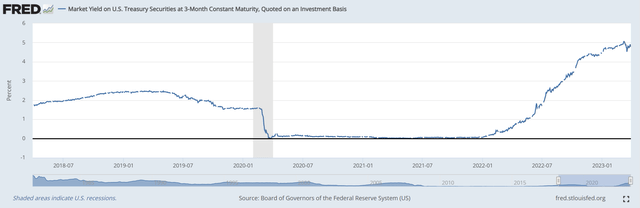

However, 3-month treasury bills are now yielding 4.8% (Figure 7).

Figure 7 - 3 month T-bills are yielding 4.8% (St. Louis Fed)

What investor would not want to earn 13x more interest income by simply switching from bank deposits to treasury bills for their cash that is not required on a day-to-day basis?

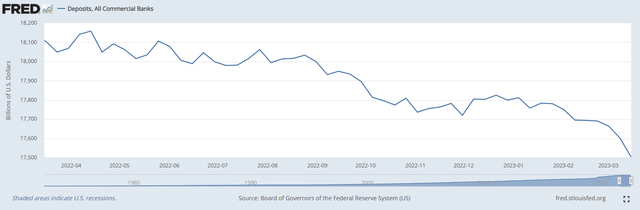

That is why on a trailing 12 month basis, U.S. commercial banks have seen more than $600 billion in deposit outflows, including $98 billion in the week ending March 15, 2023 (Figure 8).

Figure 8 - Deposits have been fleeing banks (St. Louis Fed)

This massive bank deposit flight is the main driver behind the recent regional bank failures, as banks like SVB had to raise liquidity to fund deposits leaving the door, forcing them to realize mark-to-market ("MTM") losses in securities portfolios.

USFR Vs. TBIL

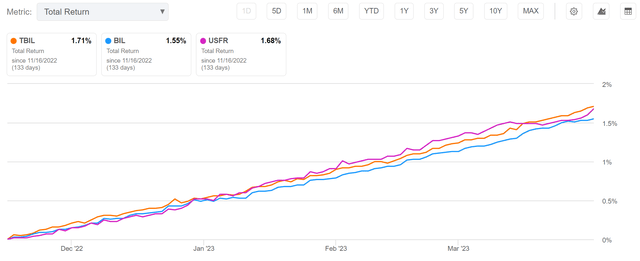

Speaking of the TBIL ETF, it has performed as expected since my article in November, delivering 1.7% in total returns to March 30, 2023 (Figure 9). The USFR ETF, also based upon resetting 3-Month T-Bill rates, has returned an almost identical 1.7%.

Figure 9 - TBIL and USFR have delivered nearly identical returns (Seeking Alpha)

The main differentiating factors between TBIL and USFR is that the USFR is a much larger fund, with more than $15 billion in assets versus only $600 million for TBIL. USFR is also offered by WisdomTree, a global firm with $90 billion in AUM versus TBIL, which is managed by F/m, a $4 billion boutique investment manager.

So for investors who require better liquidity and/or desire to invest with a more well-known investment manager, USFR may be a better option than TBIL.

Conclusion

The USFR ETF aims to provide exposure to floating rate treasury notes. Although floating rate treasury notes are technically not money market instruments, they provide essentially the same function with exposure to resetting 3 month T-Bill rates.

With the rise in short-term interest rates in the past year, investors finally have a chance to earn high, low-risk yield that is an order of magnitude better than bank deposit rates. I think the USFR ETF is suitable for investors who want to earn high yields on their excess cash.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TBIL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.