4 Dividend Stocks To Buy In April 2023

Summary

- All 4 of these stocks are trading at a discount to their historical average.

- These companies have the ability to outperform regardless of the economic backdrop.

- Every company on today's list pays a safe and growing dividend.

- Looking for a portfolio of ideas like this one? Members of iREIT on Alpha get exclusive access to our subscriber-only portfolios. Learn More »

Mongkol Onnuan

April has arrived and just like that we are one quarter of the way through 2023. Three quarters remain and a lot more unknown about what the future holds for the stock market:

- Are Interest rates done rising?

- Will interest rates be cut at the end of the year?

- Is the financial sector on the brink of another crisis?

- Are we heading towards a recession?

A lot of questions for investors, but very few answers. What we do know is that there are some high-quality stocks trading at great valuations and they are presenting a great buying opportunity.

Today we are going to look at four dividend stocks to consider buying in the month of April.

4 Dividend Stocks For April

Dividend Stock #1 - Bristol Myers Squibb

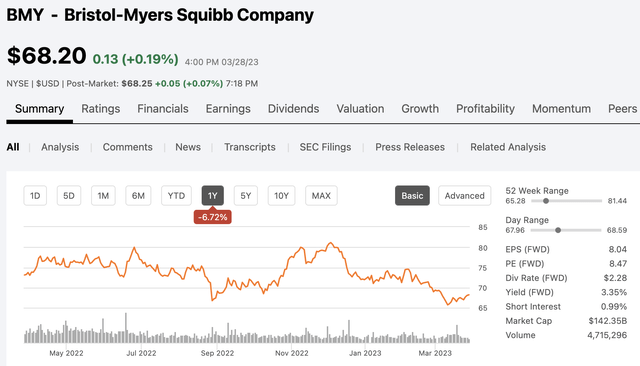

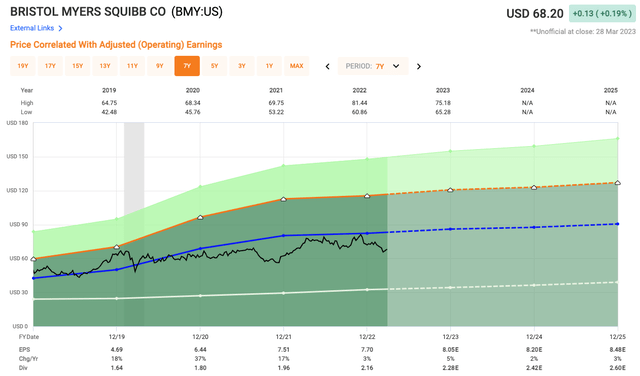

Bristol-Myers Squibb (BMY) is a pharmaceutical company that sells its products worldwide. They offer products for hematology, oncology, cardiovascular, immunology, and neuroscience. BMY currently has a market cap of $142 Billion. Over the past 12 months, shares of BMY are down roughly 7%.

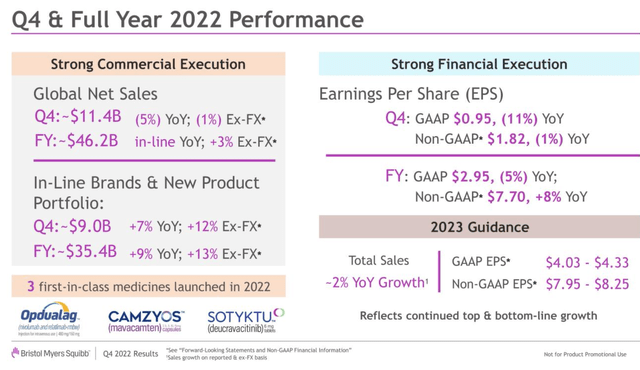

In 2022, the company generated $46.2 billion in sales which was in line with prior year, but up 3% if we take out the currency effect. Adjusted EPS for the year was $7.70, which was an 8% increase year over year.

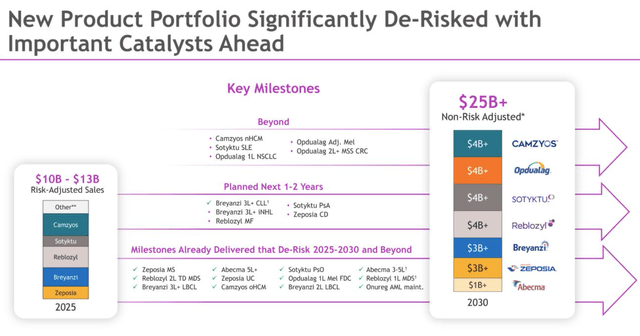

Bristol Myers is an exciting opportunity moving forward due in large part to their strong portfolio, but also their loaded pipeline which is expected to add $25 Billion or more to the top line by the year 2030.

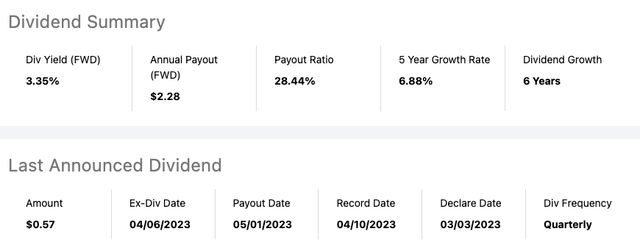

BMY currently pays an annual dividend of $2.28 per share which equates to a dividend yield of 3.35%. Over the past five years, the company has increased the dividend by 7% per year. In addition, they have a low payout ratio of less than 30%, meaning there's plenty of room to grow the dividend moving forward. BMY has increased the dividend for six consecutive years.

Analysts are looking for 2023 EPS of $8.05 (5% growth yoy), which equates to a forward P/E of 8.5x, a single digit multiple which is very low for a company like BMY. Over the past five year, shares of BMY have traded at an average multiple of 10.7x and over the past decade its been closer to 17x, so some major value right now when looking at BMY.

In addition to all this, BMY has an A+ credit rating which speaks to the safety and quality of their balance sheet.

Dividend Stock #2 - British American Tobacco

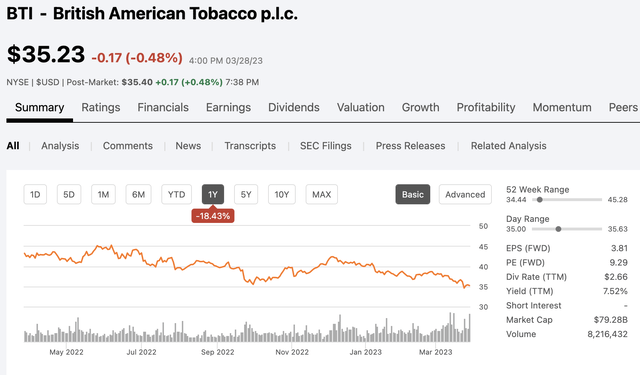

British American Tobacco (BTI) is another global company that sells tobacco and nicotine products to consumers worldwide. They are a global king when it comes to vape and cannabis products, and are the fastest growing when it comes to the big three tobacco companies, which are: BTI, Altria Group (MO), and Philip Morris International (PM).

BTI currently has a market cap of $79 Billion and over the past 12 months, shares are down 18%.

In 2022, the company generated $33.4 billion in sales which was down from prior year, but looking ahead, they are expected to return to growth in the coming years. EPS on the year was $4.48, which was in-line with the prior year.

BTI is interesting due in part that more consumers are moving away from traditional tobacco products and BTI is aligned quite well for consumers looking at vape and cannabis, creating solid long-term growth prospects for the company. PM has no real cannabis products, and Altria has some exposure with its investment in Canadian cannabis company Cronos Group (CRON).

Next, let's look at the dividend which is currently slated at $2.80 per share, which equates to a HIGH dividend yield of 7.9%. With BTI you get a very high yield, but not much in terms of growth.

Now let's look at valuation. Analysts are looking for 2023 EPS of $4.70 per share which equates to a forward P/E of 7.5x, even lower than BMY which we just looked at. Over the past five years, shares of BTI have traded at an average multiple of 9x and over the past 10 years it has been closer to 12.5x.

Looking ahead, analysts are looking for 8% EPS growth in 2023 followed by 5% in 2024. BTI is also on the edge of an A credit rating as they currently sit at a solid BBB+ rating, which is still very solid.

Dividend Stock #3 - American Tower

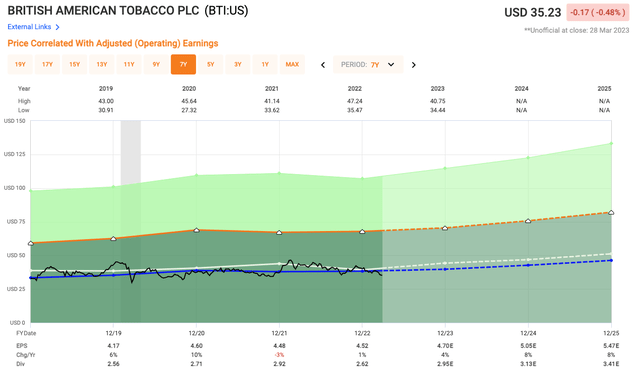

American Tower (AMT) is one of the largest REITs on the market today and they are the premiere REIT when it comes to cell towers. Cell Towers are a necessity in this day in age when everything is dependent on data, cellular devices, and speed. Telecom companies like Verizon (VZ), AT&T (T), and T-Mobile (TMUS) rent space on these towers. Towers can hold multiple tenants, and the more tenants, the greater the margin. As 5G continues to roll out, it creates more demand for a company like AMT.

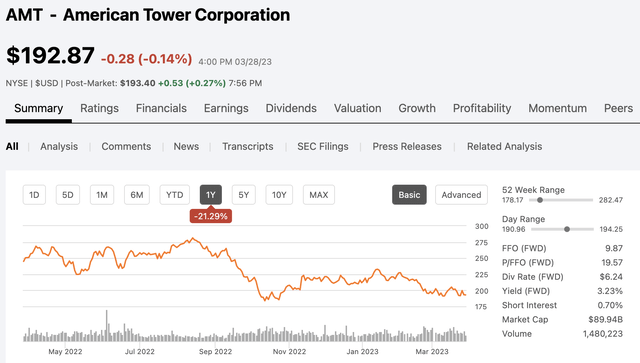

AMT currently has a market cap of $90 billion and over the past 12 months, like many in the REIT space, shares are down more than 20%.

In 2022, the company generated $10.71 billion in sales which was a 14% increase year over year and analysts are looking for another great year in 2023.

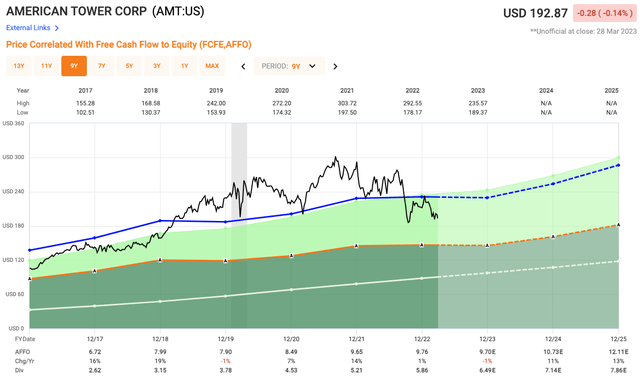

When it comes to REITs, you do not want to look at EPS, instead we use Adjusted Funds From Operation or AFFO. In 2022, AFFO was $9.76 per share, up 1% over prior year.

Being that the company is a REIT, they are required to pay at least 90% of their taxable income out to shareholders in the form of dividends. One reason you typically see higher yields from REITs.

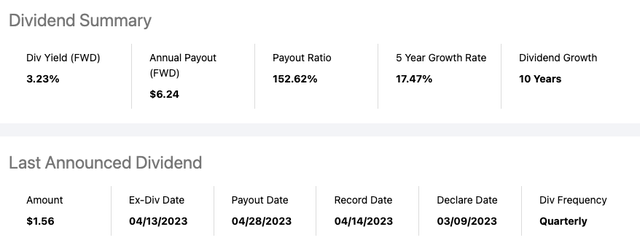

AMT doesn't quite offer much in terms of high yield, but what they do offer is tremendous dividend growth, which is unusual for a REIT. AMT pays an annual dividend of $6.24 per share, which equates to a dividend yield of 3.2%. Over the past five years, the company has increased the dividend at an average annual rate of 17%, which is tremendous growth. AMT has increased their dividend for 10 consecutive years.

In 2023, analysts are looking for AFFO of $9.70 per share, similar to 2022 which equates to a forward P/AFFO of 19.8x. For comparable purposes, over the past five years, shares of AMT have traded at an average AFFO multiple of 25x. The current valuation is something last seen during the October 2022 and before that last seen in 2019. Analysts are looking for continued AFFO growth moving forward with flat in 2023 followed by double digit growth in each of the two following years.

American Tower has a BBB- credit rating from S&P, which is lowest on our list today, but still solid nonetheless.

Dividend Stock #4 - Realty Income

Realty Income (O) is the golden child when it comes to REITs. They are one of the most popular REITs on the market.

Realty Income is a net lease REIT primarily operating within the retail sector, but they have also recently ventured into gaming by purchasing the Wynn Resort & Casino from Boston Harbor in 2022.

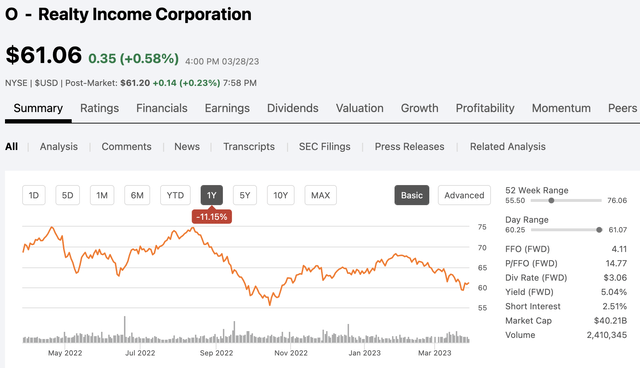

Realty Income currently has a market cap of $40 billion and over the past 12 months, shares are down 11%.

The company has seen positive AFFO growth in 26 of the past 27 years, which is quite impressive and they are known to have a strong portfolio of investment grade tenants. Some of those tenants include:

- Dollar General (DG)

- Walgreens (WBA)

- CVS Health (CVS)

- Tractor Supply Co (TSCO)

- The Home Depot (HD)

- Kroger (KR)

The REIT is more well known for its dividends, its monthly dividend that is, after all they have coined themselves "The Monthly Dividend Company."

Realty Income is also on the prestigious dividend aristocrat list, one of only three REITs on the list, as they have paid a growing dividend for more than 25 consecutive years.

The company currently pays an annual dividend of $3.06 per share which equates to a yield of 5% and this is where the value comes in. Over the years, any time Realty Income shares have yielded 5%, it has proven to be a great time to buy and this is the first time in a while where the yield has grown to that.

Yield is predicated not only on the dividend being paid, but also the price action, and with shares down 11% over the past 12mo, we are seeing this juicy yield.

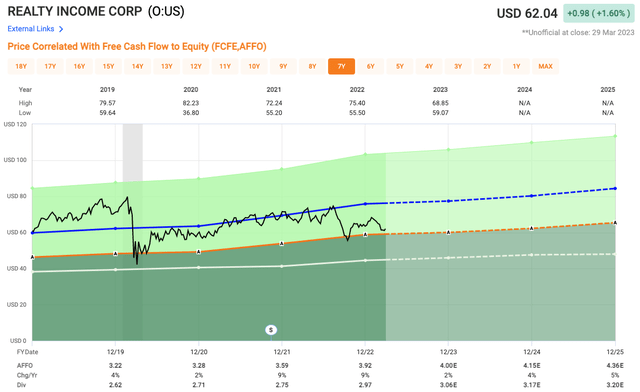

In terms of valuation, Realty Income looks rather undervalued. Analysts are looking for $4.00 AFFO in 2023, which equates to a forward P/AFFO of 15.2x. Over the past five years, shares have traded at an average AFFO multiple of 19.3x, which is also in line with their 10 year average. Analysts are looking for AFFO growth of roughly 5% each of the next few years.

Realty Income is the gold standard when it comes to REITs, and it shows through their A- credit rating that allows them to obtain favorable financing, which is a huge advantage when being a REIT.

Investor Takeaway

April has often been a good month for investors, but all bets are off with the amount of uncertainty investors face in 2023. As such, I continue to look for opportunities in high-quality dividend paying stocks like the four we looked at today. All four of these companies are trading well below their historical averages.

In the comment section below, let me know which of these four dividend stocks you like BEST at today's valuation.

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Disclosure: I/we have a beneficial long position in the shares of BMY, AMT, O, MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.