Medical Properties Trust Yielding 15.5%: Fish Or Cut Bait?

Summary

- Here we are again, back to this battleground REIT Medical Properties Trust, Inc.

- Shares are now yielding a whopping 15.5%.

- Now, on to the obvious question: Are you going to fish or cut bait?

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

ronstik

I was having dinner this week with several of my trusted analysts at Wide Moat Research and the subject of Medical Properties Trust, Inc. (NYSE:MPW) came up. As most everyone knows, this real estate investment trust, or REIT, has been a battleground stock that's now yielding a whopping 15.5%.

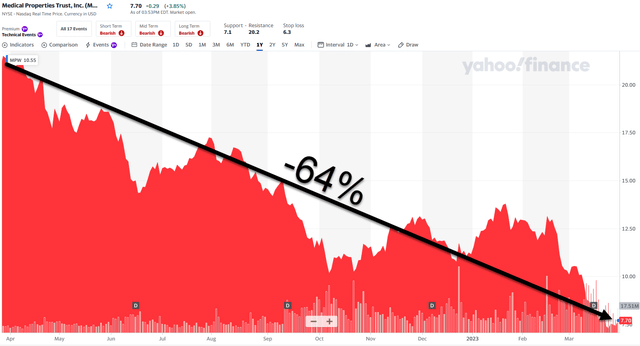

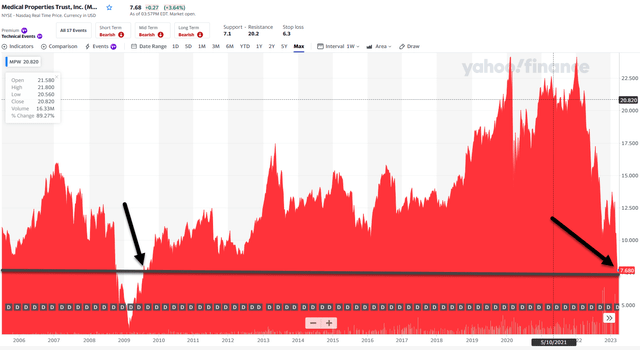

Shares are now trading at an insane price of $7.69 which is the lowest price seen since the Great Recession. Many investors have run for the hills, fearful that they would take substantial losses due, while others are on still on the fence wondering whether to fold up shop.

As I explained to Dividend Sensei (aka Adam), "overconfidence contributes to a litany of investor errors, including inadequate diversification, extreme security selection, and destructive market timing."

Fortunately, we've maintained modest exposure, recognizing that MPW's outsized operator concentration, high leverage, and elevated cost of capital deliver significant headwinds.

In my last article, we downgraded MPW to a Spec Buy based on lower 2023 guidance, elevated cost of capital, and a dangerous payout ratio. Currently, MPW's Equity Yield is a whopping 18.8%.

As requested, I wanted to provide an update on the company and determine whether it's time to fish or cut bait...

The Basics

Medical Properties Trust is an internally managed real estate investment trust that acquires and develops net-leased healthcare facilities. MPW was founded in 2003 by Edward K. Aldag, Jr., who still serves as the company’s Chief Executive Officer.

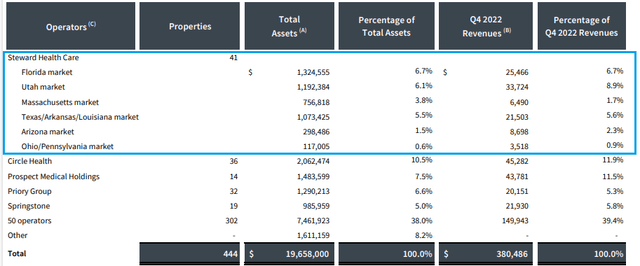

At year-end 2022, MPW had investments in 444 properties that contain approximately 44,000 licensed beds and are managed by 55 operators. They are located in 31 U.S. States, 7 countries in Europe, Australia, and South America.

Asset Mix

MPW has multiple property types including general acute care hospitals, behavioral health centers, inpatient rehabilitation facilities, long-term care hospitals, and urgent care facilities.

General acute care hospitals make up the majority of MPW’s assets with 202 properties representing 68.1% of total assets and 75.2% of fourth quarter revenues. Behavioral health facilities is MPW’s 2nd largest category with 67 properties making up 13.9% of total assets and 13.6% of fourth quarter revenues.

Tenants

Medical Properties Trust has high tenant concentration, particularly with its top tenant Steward Health Care. In total, Steward leases 41 properties that makes up 24.2% of MPW’s total assets and 26.1% of MPW’s 2022 fourth quarter revenues. After Steward, Circle Health and Prospect are their largest tenants, making up 11.9% and 11.5% of fourth quarter revenues respectively.

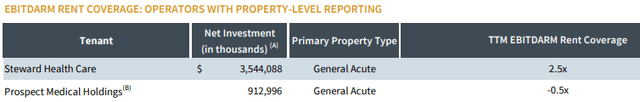

As of the fourth quarter of 2022 Steward Health Care had 2.5x rent coverage as measured by their trailing twelve-month (“TTM”) EBITDARM. This provides some comfort as Steward can cover their rent two and a half times over; of more concern is Prospect’s TTM EBITDARM rent coverage of -0.5x.

As previously mentioned, Prospect made up 11.5% of MPW’s revenue in the fourth quarter. In their latest 10-K Report, MPW stated that up until the fourth quarter of 2022, Prospect was current but is now past due on rent and interest payments.

MPW has taken steps to lower their exposure to both Steward and Prospect. In October of 2022, MPW entered an agreement to sell 3 properties operated by Prospect to Yale for roughly $457 million.

The transaction is expected to close in 2023 once regulatory approval has been granted and Yale acquires the operations from Prospect. Upon completion, Yale’s acquisition of Prospect’s operations will provide additional liquidity, which should help improve Prospect’s rent coverage.

In February 2023, MPW agreed to lease its Utah hospital portfolio (5 hospitals) which are currently leased to Steward to CommonSpirit Health. The transaction is expected to close once CommonSpirit acquires the operations from Steward and regulatory approval has been granted. The Utah real estate represents approximately 6% of MPW’s total gross assets, and Steward’s concentration will decline by this amount.

Both examples highlight MPW’s efforts to lessen their exposure to Steward and Prospect and to further diversify their tenant base.

Pipeline Health, which is a much smaller tenant, filed for bankruptcy protection in 2022. In early 2023, MPW announced that Pipeline will assume the existing terms for their Los Angeles Hospital Master lease. The lease rate and escalator remains unchanged and MPW is able to collect all rent that accrued during Pipeline’s bankruptcy.

Short Campaign

There have been multiple short campaigns against MPW over the last year.

Firms like Hedgeye and Viceroy Research have made numerous allegations against MPW, including excessive spending on corporate planes, management resignations (The COO retired, did not resign), shady accounting practices, overpaying for properties to assist the tenant’s ability to make rent, and issuing loans to tenants so they can make rent. Hedgeye asserts that there is an inherent risk of MPW’s tenant credit and believes the dividend payment is at risk.

Some of these accusations have more merit than others. It’s true that MPW does have several corporate jets, but they also have properties all around the world, so it really comes down to whether the planes should have been leased or purchased.

And it is true that MPW has issued loans to Steward, but MPW does not give the money to Steward, it collects interest on the loans. MPW is very familiar with Steward’s operations and if they didn’t believe the loans could be paid off, they probably wouldn’t have issued the loan.

Finally, MPW’s dividend payout ratio is now on the high side, so there could be potential for a possible dividend cut, but so far, the dividend is covered and has not been cut, so any suggestion of the same is merely speculation.

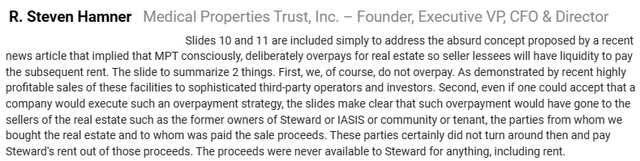

Steven Hamner, the CFO and Director of MPW, addressed the accusation that MPW overpays for properties to assist the tenant with their rent obligations in a 2022 earnings call. He highlighted that the money MPW pays for properties goes to the owner of the property, not the operator:

I’m sure you’ve heard the saying “put your money where your mouth is” – well, the founder and current CEO owns 4,322,690 shares as of January 24, 2023.

At today’s price, that is worth roughly $32 million. A year ago, it would have been worth much more. I don’t think the CEO wants to overpay for properties or issue loans that will go into default or anything else to destroy the value of MPW.

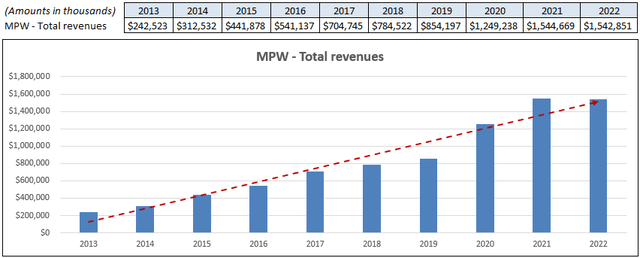

Revenue and Earnings

MPW’s revenue has increased each year since 2013 with the exception of 2022 when revenue fell by approximately $2 million. To put this in perspective, in 2013 MPW generated $242 million in total revenue, compared to 2022 when they generated $1.5 billion.

MPW Form 10-K (compiled by iREIT)

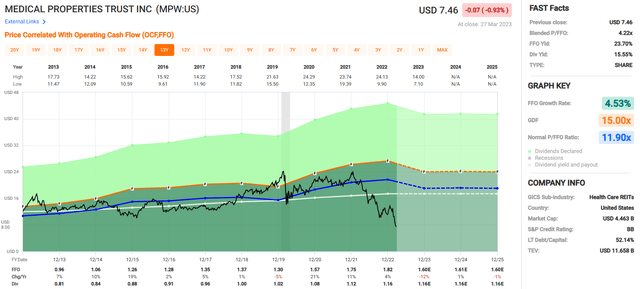

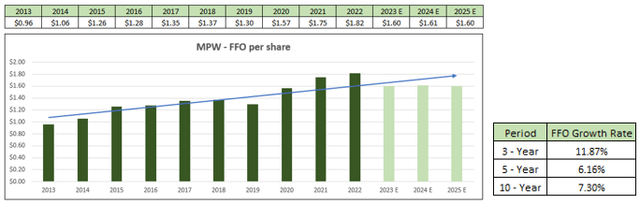

Likewise, MPW’s funds from operations (“FFO”) has increased each year from 2013 to 2022 with the exception of 2019 when it fell by 7 cents per share. MPW’s FFO per share in 2013 came in at $0.96 per share, compared to $1.82 per share in 2022.

Over a 3-year period, they have an FFO growth rate of 11.87%, over a 5-year period their FFO growth averages 6.16%, and over a 10-year period MPW’s average growth rate is 7.30%. Analysts expect FFO to drop by -11% in 2023 and then fall -1% in both 2024 and 2025.

FAST Graphs (compiled by iREIT)

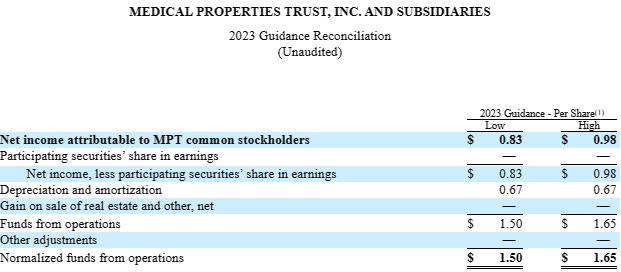

2023 Guidance

Initial guidance provided by MPW for NFFO (“normalized FFO”) in 2023 was reported at $1.50 per share at the low end to $1.65 per share at the high end.

The mid-point of $1.57 per share represents a 13.7% decline in NFFO from 2022 levels and was below the consensus estimate of $1.63 per share.

The low end of guidance at $1.50 per share assumes the worst-case scenario for its tenant Prospect in that no rent or interest would be paid.

The more likely scenario is that MPW receives rent from Prospect’s California and Connecticut operations, but not from their Pennsylvania operations. All in all, the guidance was disappointing, and shares fell sharply on the day it was released.

MPW Earnings Release

Dividend History

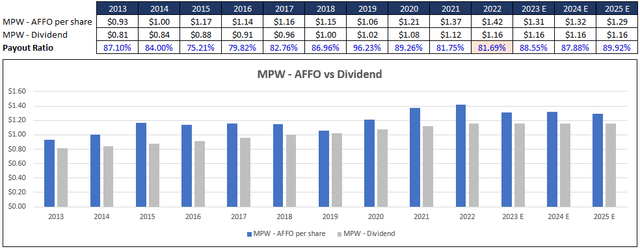

MPW has increased its dividend each year from 2013 to 2022 and has an average growth rate of 3.79% over that time period. Additionally, since 2013 MPW has covered its dividend with its adjusted funds from operations (“AFFO”) and has not had a payout ratio of 100% or greater.

In 2022 MPW’s AFFO payout ratio was 81.69%, which is within its normal range, however analysts expect the payout ratio to increase to 88.55% in 2023, which is higher than I’d like to see. It’s not a foregone conclusion that MPW will cut its dividend, but with a payout ratio close to 92% it does raise some concern.

FAST Graphs (compiled by iREIT)

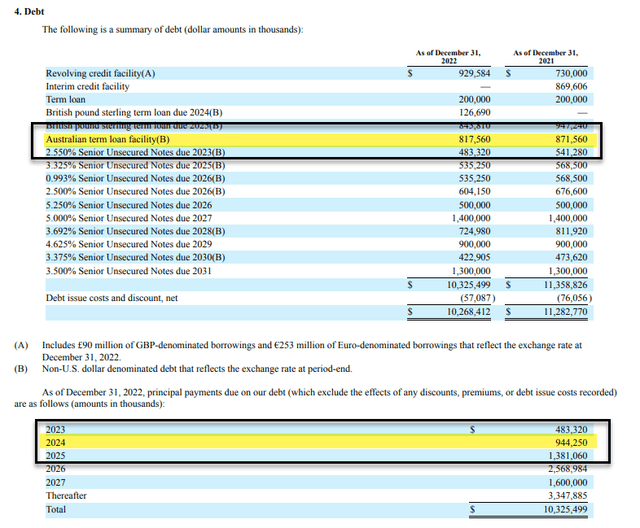

Debt Metrics

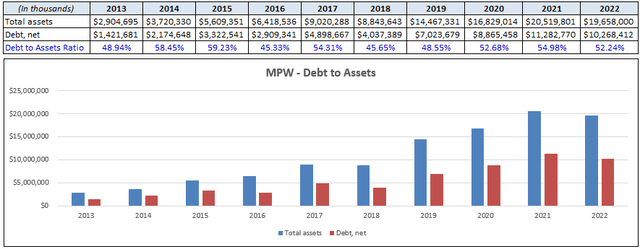

MPW has reasonable debt metrics with an adjusted net debt / annualized EBITDAre of 6.4x, a fixed charge coverage ratio of 2.7x, and a debt to asset ratio of 52.24%. They have a weighted average interest rate of 3.608% and 89% of their debt is fixed rate. MPW does not have an investment grade credit rating. S&P recently downgraded MPW’s rating from BB+ to BB.

MPW Form 10-K (compiled by iREIT)

For S&P, an issue rated BB is regarded as having "significant speculative characteristics" and "while such obligations will likely have some quality and protective characteristics, these may be outweighed by large uncertainties or major exposures to adverse conditions."

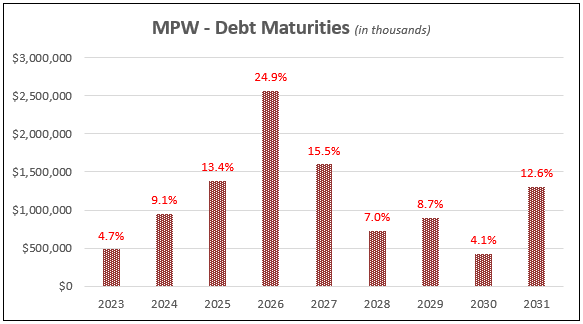

MPW has $483.3 million in debt that matures in 2023 which represents 4.7% of their total debt. In 2024 $944.3 million matures which is 9.1% of their total debt. Larger maturities come due in years 2025 (13.4% of debt), 2026 (24.9% of debt), and 2027 (15.5% of debt). As of February 17, 2023, MPW’s total liquidity was approximately $1.2 billion.

MPW Supplemental (compiled by iREIT)

Valuation

Due to the selloff over the past year, MPW now trades for a P/FFO of 4.22x which is significantly below its normal P/FFO multiple of 11.90x. There is no doubt that MPW faces some near-term headwinds which is reflected in their 2023 guidance, but this stock has declined by over 60% in the past year, which I think is a bit excessive.

Between the short campaigns, tenant issues, and the overall macro environment I believe the selloff has been overdone. Over the past decade MPW has delivered strong results and over the long term I believe they will return to growth. At iREIT we rate Medical Properties Trust a Spec BUY.

Latest News

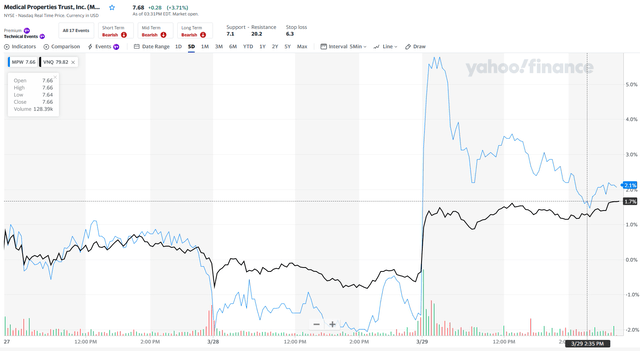

Yesterday, MPW announced that it had agreed to sell Healthscope in Australia to HMC Capital for A$1.2 billion ($803.1 million).

HMC Capital, which manages HealthCo, will raise $125 million in new equity to help fund its commitment, while HealthCo is planning to raise $325 million, according to an Australian Financial Review report.

This morning, shares in MPW bounced +5.4% until settling back down to +2.1.

It appears that the source (Australian Financial Review) was just speculating, as MPW confirmed to me that they did not announce the news, although MPW did not deny it, either.

Based on filings, it appears that MPW purchased the Australian asset for $897.9 million and it was funded with an $837 million Australian term loan in July 2019 (balance as of Feb 2023 was $851 million). Thus, it appears that if the news is true, MPW could take an accounting loss of $48 million.

Nonetheless, the news (again not confirmed) is positive, as MPW would reduce its short-term debt maturities, as the Australian debt is one of the largest maturities in 2024. MPW has already stated it has ample cash to cover the 2023 maturities via the sale of the Connecticut portfolio ($300 mm) and Steward repayment ($150 mm).

So, again, if the Australian deal is true, it will de-risk MPW’s debt stack for 2023 and 2024, and we all know that a lot could happen between now and 2025.

So, in conclusion, we’re maintaining the Spec Buy recommendation, and hopefully Medical Properties Trust, Inc. will announce something soon with regard to the latest rumor, which we view as positive.

As for me, I have a modest stake in MPW, although I did dollar-cost average into shares a few weeks ago. Normally a modest position for me is around 2% (of my REIT exposure), and the only reason that I would add more shares is if the shares drop more to around $7.00.

For value investors who have a higher risk tolerance profile, now could be one of the best times to back up the truck, given there are catalysts in place (Utah, Connecticut, and Australia) that provide great clarity to the company's short-term debt maturities.

That being said, I decided to commence a new "bottom fisher portfolio" for iREIT on Alpha members. When I was a private real estate investor, I owned a company called "CarpCo" which was designed as a deep value play, much like carp (i.e., fish) that often live on mud-bottomed ponds and eat just about anything for survival.

UPDATE (3/29/23 at 6:30 pm): Since the original article was published MPW announced the sale of the Australian real estate investments operated by Healthscope based on a 5.7% cap rate, resulting in anticipated cash proceeds sufficient to fully prepay the AUD$1.2 billion term loan. MPW's CEO said,

“The sale of this portfolio by means of a competitive process, in the midst of an extraordinary disruption to global capital markets, demonstrates the breadth and resilience of demand for hospital infrastructure assets.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 15,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.