Buying American With CompX

Summary

- CompX has a rock-solid balance sheet, with no long-term debt and $130 million in tangible book value.

- The company has recently been returning excess capital to shareholders and seems like it has the capability to continue to do so.

- DCF models suggest the company is trading at a slight premium to future cash flow generation potential, though near-term special dividend realization could compensate for this.

hdagli/E+ via Getty Images

Executive Thesis

CompX International (NYSE:CIX) has a rock-solid balance sheet. The company carried no long-term debt and had $130 million in tangible book value at the end of 2022. Additionally, the company has been returning capital to shareholders, with $2.75/share paid in 2022, including $1.75 of special dividends. CIX is a mature low growth business, being an American manufacturer of boat parts and security systems for the mid to higher end markets. Although I believe the company is trading at a premium to optimistic estimates of future cash flow generation, the tangible book value adds to the margin of safety. Currently, I believe the shares are trading slightly above fair value, and income-oriented investors might be interested in current dividends as well as speculating on future special dividends.

Company Overview

CompX International is an American security and recreational marine parts manufacturer, with factories in South Carolina, Illinois and Wisconsin. Of note, the majority of the company's voting shares are controlled by one family through the Contran Corporation. The Contran Corporation also has controlling interests in Valhi (VHI) and Kronos Worldwide (KRO).

Can the Special Dividends Continue?

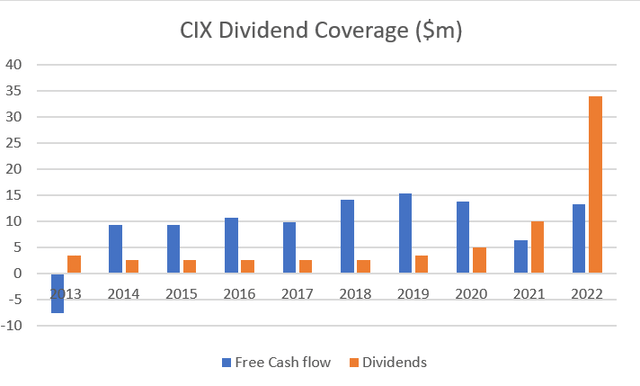

This Writer, Data from Morningstar

As is indicated in the above chart, the company has been building up a large surplus net of dividends over the last 10 years, and in the last 2 years has immensely increased shareholder payments. At the end of 2022, the company had $60 million in cash and marketable securities on the balance sheet, down from $76.5 million in 2021. It appears there is still excess cash available to be returned to shareholders, though it's difficult to tell what the company will be doing with the cash in the short term. Operations can likely continue generating excess cash though, and if the company maintains a conservative dividend policy in the short term, special dividends will probably be inevitable in the long term.

Valuation

The Company is projecting $3 million in capex as well as reduced operating income in 2023 due to softening demand and input prices remaining elevated. Over the next few years, I assumed operating income and free cash flow would be restored to more historic norms. As the company sells its products in the mid to higher tier markets, I assumed this would assist with maintaining margins and the company would be able to increase free cash flow at 4%/year over the long term until its eventual decline. This gives us an estimated present value of the company's future cash flows of $180 million.

Risks

US Manufacturing is expensive

The company has operations exclusively in the US, and manufacturing is relatively expensive mainly due to lower labor costs in other countries. The company partially offsets this by operating in the mid to higher tier markets for its products, but there's no guarantee customers will continue to prefer their products over foreign competitors.

Ownership Structure

The company is controlled by Contran Corporation, which also has controlling interests in other companies including VHI and KRO. What is best for the Contran Corporation may not align beneficially with CIX minority interests.

No Guarantee of Special Dividends

As the company is trading at above our estimated present value of future cash flows, part of the price being paid is for the strong balance sheet, with $130 million in equity. The company may feel it needs to keep more capital in the business, and shareholders may not be able to realize this value any time soon.

Dependence on Raw Material Prices

The company purchases inputs such as brass and stainless steel for its products, which have risen in price over the last year and are projected to continue to do so going into 2023. Further price increases may erode margins for the company reducing cash flow available to shareholders.

Conclusion

Although CIX is selling above our $180 million estimates of the present value of future cash flows, the company has $130 million in tangible book value and has recently been returning more capital to shareholders via increased dividends and special dividends. If the company continues this trend in the near term, the total realizable value by equity holders will likely be higher than the DCF model estimates. The current tangible book value combined with the future cash flow generation potential may justify the current market quotation of $225 million. Income oriented investors might be interested in collecting dividends which have been well covered around a 5% yield and speculating on further special dividends. As there is no guarantee the company will continue these payments in the near term, I would like a larger margin of safety before investing in the company.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VHI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.