Caledonia Mining: Investors Finally Seem To See The Potential Here

Summary

- Production has increased by well over 20,000 ounces of gold over the past two years.

- Share price gains are mainly off the rise in production. Expect more significant gains as the price of the metal is now gaining traction.

- Caledonia's growth profile along with its cheap valuation is the main calling cards in this play.

studiocasper

Intro

We last wrote about Caledonia Mining Corporation Plc (NYSE:CMCL) in January of last year when we issued a strong Buy rating on the stock. Reasons for our ultra-bullish stance at the time were plentiful. Record production and a well-covered dividend (which was being increased at an accelerated rate) demonstrated that the gold miner's financials were heading in the right direction. However, since Caledonia at the time was not meaningfully growing its bottom-line earnings, shares found it difficult to gain much traction (Which actually led to many investors making the cardinal sin of bailing out of their positions).

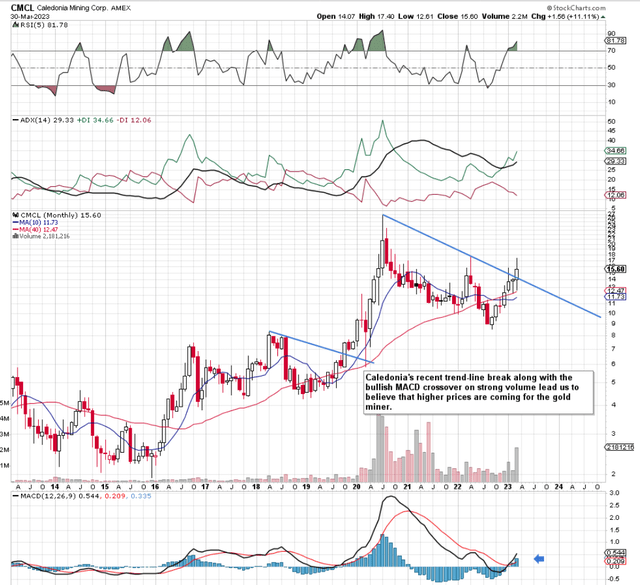

Fast forward 14 months and many investors who unluckily sold their holdings probably regret their decision. Shares are up approximately 30% which in fact is a total return of almost 36% if one includes the dividend reimbursements. Furthermore, the strong upturn in the share price has resulted in a clean upside trend-line break on the long-term chart as well as a MACD bullish crossover. MACD crossovers are especially noteworthy on long-term charts due to the amount of information that the indicator digests concerning the stock's long-term momentum and trend direction. In fact, investors only need to look at the similar setup we had in mid-2019 when similar technical conditions led to a significant move in shares of Caledonia.

Caledonia Mining Long-Term Chart (Stockcharts.com)

Unfounded Bearish Arguments

We have been harping on about the quality of this company for some time now but surprisingly many investors remain bearish in this play. Common bearish reasons given are the lack of more established mines, the poor jurisdiction of Zimbabwe concerning the Blanket mine, and the potential that Caledonia's flagship asset could run out of gold in a few years time. While all of these scenarios are obviously possible, bearish investors must remember that Caledonia's technical chart has already incorporated these potential risks into the stock but yet has dismissed them to a large degree (When considering recent bullish share-price action).

Bullish Fundamentals

When it boils down to it, Caledonia remains a strong buy in our opinion because its valuation remains very cheap when compared to the growth profile of the company. For example, in fiscal 2022, the company reported 80,775 ounces of gold with an average gold price of $1,772 per ounce. For fiscal 2023, management is guiding approximately 92,500 ounces of gold (At its midpoint) as positive contributions from Bilboes start to gain traction. Not only is the increase in production significant but the fact that the price of gold continues to gain traction. In fact, we outlined in a recent article that we believe there is a very strong possibility that gold recently printed its eight-year cycle low. If this ends up being the case (Which will be confirmed if gold can break out to new highs shortly), then this would be bullish for the whole gold mining sector and especially companies with depressed valuations such as Caledonia mining.

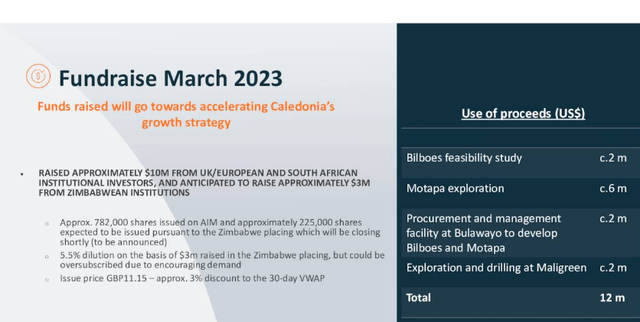

This is why (in the grand scheme of things), the share dilution associated with recent fundraising initiatives (surrounding investment in Bliboes & Motapa) is pretty insignificant given the strength of Caledonia's balance sheet (low debt to equity ratio of 6.54%) and bullish forward-looking fundamentals. The reason is that sales and earnings are expected to grow by up to 20% in fiscal 2023 and shares trade with a forward non-GAAP earnings multiple of a mere 5.93.

Caledonia Mining: Recent Fundraising Initiatives (Seeking Alpha)

High Return On Capital

However, a better valuation metric that really takes Caledonia's strong balance sheet into account is the company's return on capital metric. This metric gives us an insight into how much gains we can potentially make going forward and how Caledonia will need to invest its profits.

The formula for our version of return on capital is Operating earnings divided by the sum of Net Fixed Assets + Net Working Capital. We do not include short-term debt plus cash & short-term investments in the calculation (Net working capital) as these metrics can result in distortions in the final calculation and we use operating earnings to gauge how Caledonia's asset base is being used to generate those very same earnings.

When we input the numbers for fiscal 2022 (In Millions), we get $44.4 / ($196.6 + $11.6). This gives us a ROC result of 21.3% which is well above the average ROC percentage in this sector.

Conclusion

To sum up, Caledonia is just off the back of reporting a successful year where growth is expected to continue going forward. The technicals have just given a strong long-term buying signal. If you are on the sidelines, do not let this opportunity pass you by. We look forward to continued coverage.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CMCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.