Devon Energy: Technicals Improving, Cash Flow Remains Robust

Summary

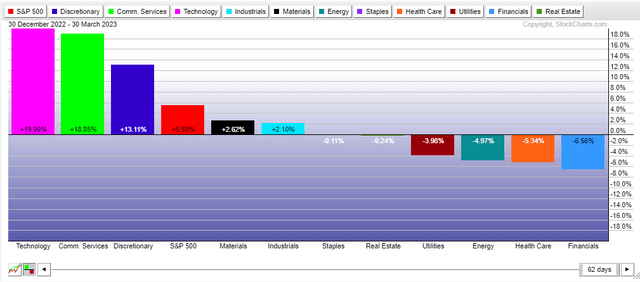

- The Energy sector is one of the worst-performing areas in Q1 as oil prices have declined.

- Following a nearly 50% retracement of the 2020-22 rally, I see shares of Devon as looking better on the chart while still featuring an attractive fundamental valuation.

- Ahead of earnings in early May, I outline some price levels to monitor.

pandemin

The Energy sector is slated to post a negative Q1 return after stellar performances in both 2021 and 2022. The long-duration trade worked over the last few months as so many investors were positioned to the value and cyclical trade coming into this year. With falling interest rates at times, a banking crisis, and lower oil prices, what worked in 2022 did not do well in Q1.

I now see shares of Devon Energy as a value case, given its low P/Es and ample free cash flow. And now that the stock shows some signs of bottoming on the chart ahead of earnings, I am upgrading shares to a buy.

YTD Sector Returns: Lower Oil Prices Pressure Energy

According to Seeking Alpha, Devon Energy Corporation (NYSE:DVN), an independent energy company, explores for, develops, and produces oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Anadarko, Williston, Eagle Ford, and Powder River Basin. The company was incorporated in 1971 and is headquartered in Oklahoma City, Oklahoma.

Back in February, DVN missed earnings expectations and saw 2023 capex above estimates. The $0.09 miss was coupled with an in-line revenue figure that was higher by just 0.7% on a YoY basis. In its outlook, the firm's lackluster guidance voiced a tough year ahead, and investors continued to sell shares. DVN did not notch a low until mid-March near $44 after climbing to near $80 in Q4 2022.

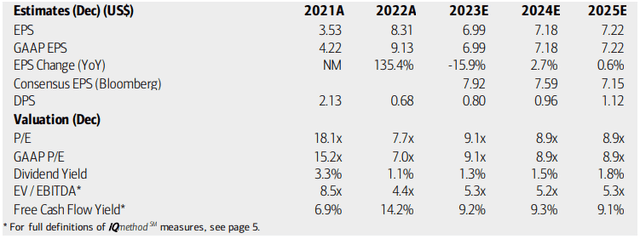

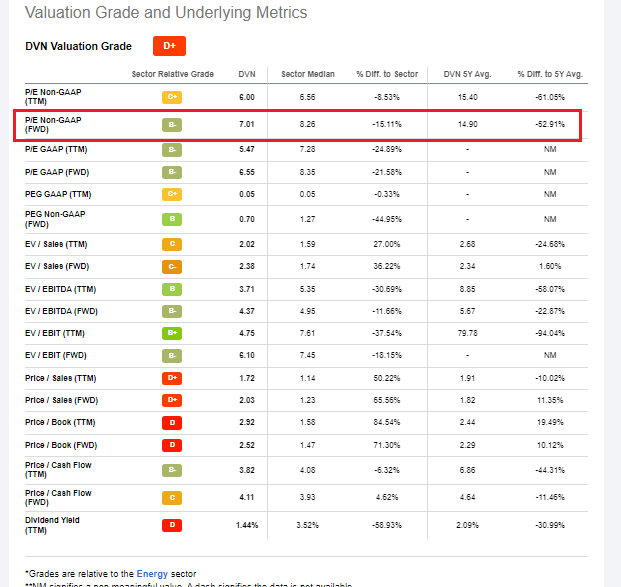

On valuation, analysts at BofA see earnings falling more than 15% this year but then recovering modestly in 2024 and 2025. The Bloomberg consensus forecast is more upbeat about this year and next, however. With rising dividends and both its operating and GAAP P/Es in the single digits, I see the stock as attractively priced today following a significant move lower from its highs last year.

With an EV/EBITDA ratio less than half that of the market's average and now trading at less than 10x free cash flow (given the latest stock price drop), many metrics suggest there is a value case. While sluggish EPS growth may be in store, if we assign just a 12 multiple (below the 14.9 5-year average) to a conservative $7 of EPS, that's an $84 stock.

Devon: Earnings, Valuation, Free Cash Flow Forecasts

DVN: Valuations Appear Compelling

Seeking Alpha

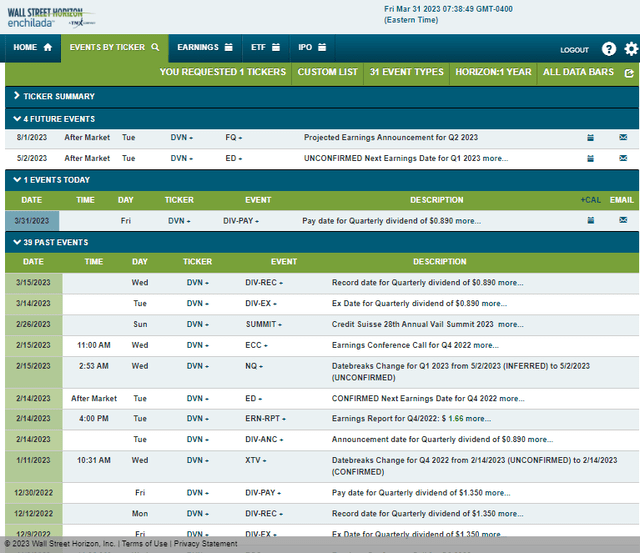

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Tuesday, May 2, AMC. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

The Options Angle

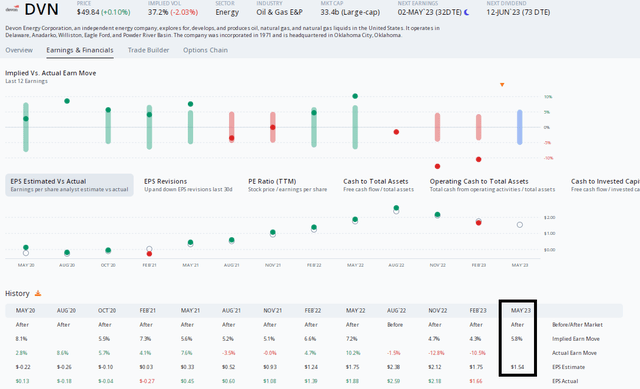

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.54 which would be an 18% decline from $1.88 of per-share profits earned in the same period a year ago. While Devon has a strong EPS beat rate history, topping analysts' estimates in 10 of the last 12 quarters, the stock has traded lower post-earnings in the previous three instances.

This time around, the options market has priced in a 5.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the May 2 reporting date. Given that the stock has moved more than 10% in three of the past four events, I am included to go long premium at that price. Let's check out the chart for some key levels to watch.

DVN: Cheap Options Ahead of Earnings In May

The Technical Take

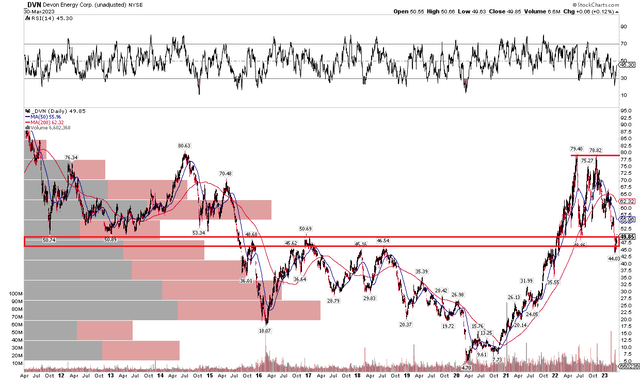

After retracing about 50% of the March 2020 through early 2022 advance, I see shares as having fallen to a key support area. Back in January, I was bearish on DVN, given some trouble chart patterns, but now that shares have fallen significantly to long-term support, a buy case can be made with more conviction.

Notice in the view below that the mid-$40s to around $50 has been a key point of polarity for this Energy equity. And with the 50% retracement having been nearly touched in the low $40s, I assert that enough of a pullback has taken place. Long here with a stop under $43 is a favorable risk/reward setup. Back to our options play, long calls at the $50 strike while perhaps selling a $44 put is a viable wager once the earnings date nears.

DVN: 50% Retracement To Long-Term Mid-$40s Support

The Bottom Line

Given the material pullback, I am a buyer on DVN on both fundamentals and technicals despite an expected YoY earnings decline expected in its May Q1 report.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.