JEPI Vs. PDI: Which Is The Better Buy?

Summary

- Market volatility is growing and putting risk assets under pressure.

- As to JPMorgan Equity Premium Income ETF and PIMCO Dynamic Income Fund, both income funds offer investors double-digit yields and can help fight inflation.

- However, I think one income fund has the advantage.

Bet_Noire

There is no shortage of exchange-traded funds for investors to choose from. Thousands of exchange-traded funds ("ETFs") and closed-end funds ("CEFs") manage trillions of dollars in the market.

The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), an exchange-traded fund, and the PIMCO Dynamic Income Fund (PDI), a closed-end fund, are two of the most discussed income-oriented funds for income investors.

Because of their monthly distributions and high yields, both income funds are appealing to passive income investors.

With interest rates rising, I believe one income fund has a distinct advantage, which I will discuss here.

JEPI Vs. PDI: One Key Difference

For passive income investors, I previously discussed the JPMorgan Equity Premium Income ETF and the PIMCO Dynamic Income Fund. Both funds currently provide investors with yields in excess of 11%.

The JPMorgan Equity Premium Income ETF provides passive income investors with access to a diversified portfolio of S&P 500 companies at a low cost.

Exxon Mobil Corporation (XOM), Comcast Corp. (CMCSA), Visa Inc. (V), and The Coca-Cola Company (KO) are among the companies with a long history of dividend growth. The fund's managers are also permitted to sell S&P 500 index (SP500) call options in order to generate additional income for the fund's investors.

The PIMCO Dynamic Income Fund, on the other hand, invests primarily in fixed income instruments such as commercial mortgage-backed securities and other high yield instruments such as emerging market debt.

As a result, the fund is much more vulnerable to changes in interest rates, which is also the primary distinction between JEPI and PDI. If you expect the central bank to keep raising interest rates, the PIMCO Dynamic Income Fund is probably not the best option.

The value of fixed income investments is inversely related to the direction of interest rates, which means that as the central bank raises interest rates, the value of PDI's fixed income investments falls.

The JPMorgan Equity Premium Income ETF does not face this issue because its portfolio is primarily comprised of equity securities and call options.

Which Income Fund Offers The Better Yield?

The JPMorgan Equity Premium Income ETF currently offers a dividend yield of 11.9% to passive income investors, while the PIMCO Dynamic Income Fund yields 14.8%. The higher yield is due to the higher risk associated with PIMCO's fixed income portfolio, as explained in the preceding paragraph.

Which Income Fund Should You Choose Based On Valuation?

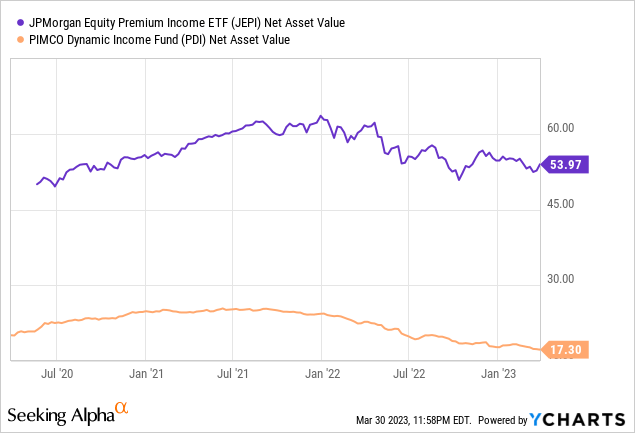

Closed-end funds and exchange-traded funds typically trade around net asset value and rarely trade at a high premium or discount to net asset value. Both funds are trading at close to net asset value.

JEPI is trading at a 0.09% premium to NAV, while PDI is trading at a 3.88% premium to NAV. However, the net asset value premium for the PIMCO Dynamic Income Fund has recently dropped significantly as investors fear further rate hikes, which are expected to have a large impact on the PDI's net asset value.

Other Differences

In terms of portfolio size, JEPI is roughly five times larger than PDI. JEPI manages approximately $22.2 billion in assets, while PDI manages $4.37 billion. JEPI also has a more appealing fee structure than PDI.

The expense ratio of the JPMorgan Equity Premium Income ETF is 0.35%, whereas the PIMCO Dynamic Income Fund is 2.00%, which is a significant difference. Because a lower expense ratio allows passive income investors to keep a larger portion of their profits (which compound over time), JEPI is a far more appealing fee structure arrangement than PDI.

Unique Investment Risks

Both income funds are solid income investments in my opinion, as they offer double-digit dividend yields and make monthly distributions. However, as previously stated, there is a risk difference between these two funds. The PIMCO Dynamic Income ETF invests in fixed-income securities whose value is determined by the direction of interest rates rather than the long-term earnings growth prospects of S&P 500 companies.

If the central bank continues to raise rates in 2023, PDI's net asset value may remain under pressure, whereas a slowing in the pace of rate hikes may indicate easing pressure on PDI's net asset value.

The net asset value of JEPI is primarily determined by the earnings and dividend performance of high-quality S&P 500 stocks. As a result, I anticipate that JEPI will deliver better NAV performance in a rising-rate environment.

Interest rate cuts and a recession, on the other hand, would likely benefit PDI more than JEPI because fixed income instruments such as mortgage-backed securities and bonds have less downside in a recession than equities.

My Conclusion

Both income funds can assist passive income investors in combating inflation while also providing double-digit yields and monthly distributions.

I prefer the JPMorgan Equity Premium ETF to the PIMCO Dynamic Income ETF because the fund's income is generated by a high-quality portfolio of dividend-paying stocks from the S&P 500 index, while the market still faces significant interest rate risk.

As long as inflation remains a problem, the central bank is likely to raise interest rates in the future. JEPI also has a slightly better NAV premium valuation than the PIMCO Dynamic Income Fund and a more competitive fee structure.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of JEPI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.