Devon: Top Acreage, Cost Leadership And Shareholder-Focused Capital Allocation

Summary

- DVN boasts a strong financial position and prudent investment strategy, focusing on generating free cash flow and maintaining a low net leverage of 0.5x EBITDA.

- DVN's advantageous acreage and peer-leading supply costs enable superior well performance and top-tier returns, with a projected 10,000 BOE per day increase by Q1 2023.

- The company's shareholder-friendly capital allocation strategy includes a base dividend, variable dividend, and strategic buybacks, resulting in an effective dividend yield of 12%.

- DVN's inherent cost advantage and strategic asset portfolio, particularly in the Permian Basin and Bakken footprint, lead to better returns on investment and growth prospects.

- Despite market volatility and uncertainties, DVN's commitment to high returns through dividends and share buybacks makes it an attractive investment.

grandriver

In this article, I will explore Devon Energy Corporation (NYSE:DVN)'s investment potential, focusing on its strong financial position and prudent investment strategy, advantageous acreage and peer-leading supply costs, and shareholder-friendly capital allocation. Although the shares appear to be fairly priced with an estimated NAV of $51 per share, I recommend buying the shares due to the high return to shareholders via dividends and share buybacks. I will examine DVN's inherent cost advantage and asset portfolio, as well as the valuation and growth prospects amid the backdrop of uncertainty and market volatility in the oil and natural gas industries.

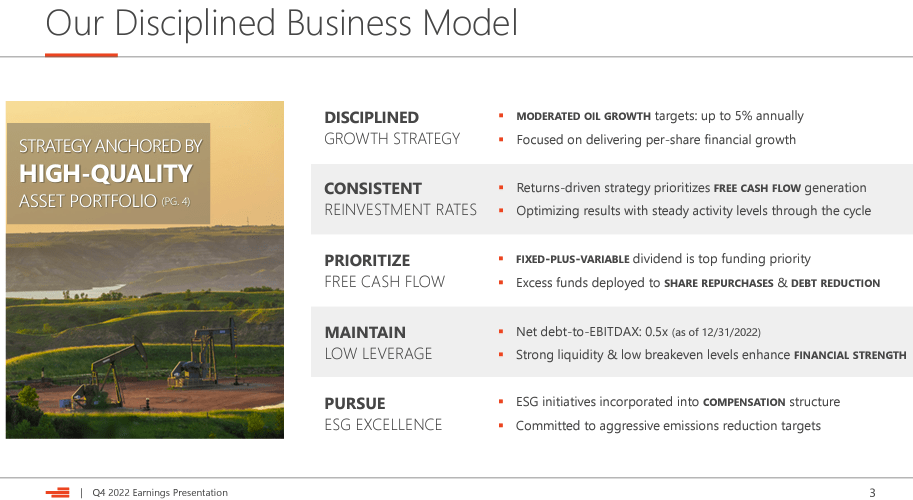

Reason 1: Strong Financial Position and Prudent Investment Strategy

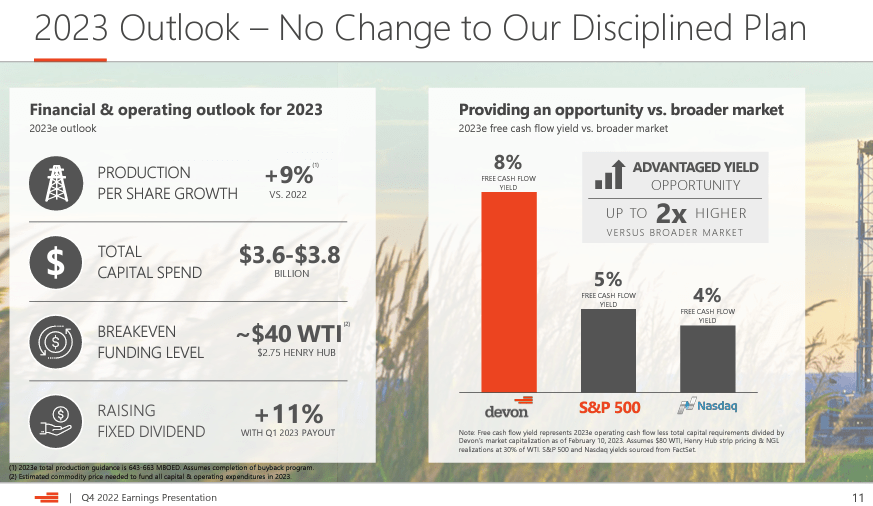

DVN showcases a robust financial position and a track record of astute investment strategies. DVN has consistently maintained a healthy balance sheet and refrained from overspending during upcycles. Management adheres to its strategy of capping oil growth at a maximum of 5%, prioritizing free cash flow generation, and allocating excess funds to share repurchases and debt reduction while maintaining low net leverage of 0.5x EBITDA. This approach guarantees that any surplus cash during periods of higher commodity prices will be returned to shareholders rather than reinvested in new drilling ventures.

Company presentation

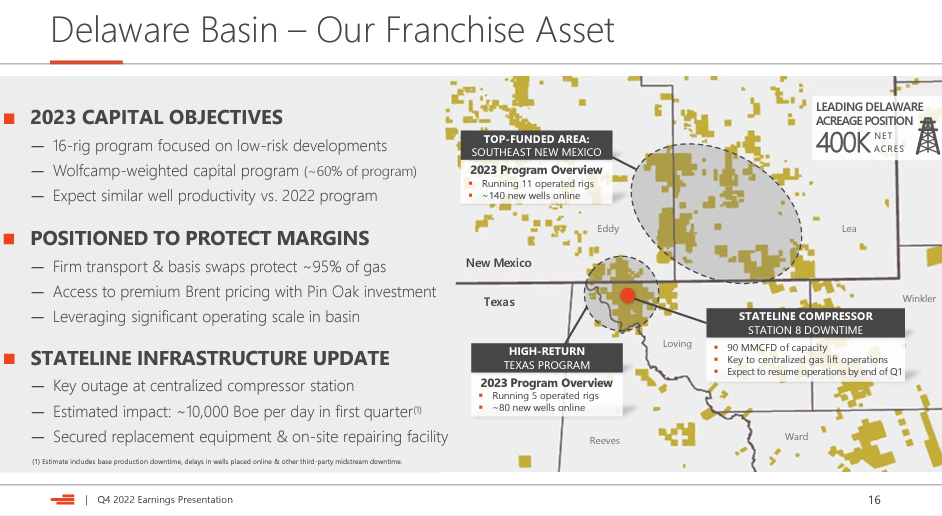

Reason 2: Advantageous Acreage and Peer-Leading Supply Costs

DVN's acreage is advantageously situated in the heart of the basins in which it operates. This leads to superior well performance and top-tier supply costs. For instance, DVN is allocating capital to low-risk developments within the Delaware basin. In this location, DVN benefits from premium Brent pricing. The projected impact amounts to 10,000 BOE per day by the first quarter of 2023.

Company presentation

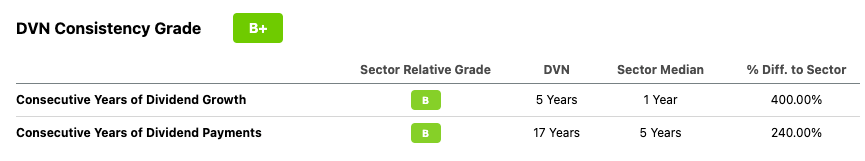

Reason 3: Shareholder-Friendly Capital Allocation

DVN's investor-friendly capital allocation strategy offers substantial returns to shareholders via a base dividend, variable dividend, and strategic buybacks. By limiting growth to 5% per year, DVN sidesteps the common issue of overspending during upcycles that many upstream firms face.

DVN has been distributing dividends for 17 years, with significant growth in the last 5 years from $0.30 per share in 2018 to $5.17 in 2022 (including the variable dividend).

Seeking Alpha

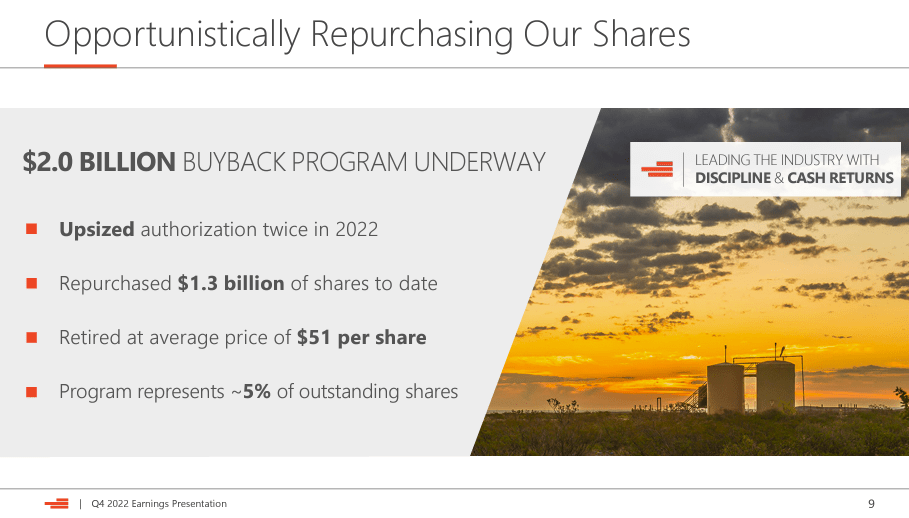

Furthermore, DVN still has $700 million remaining in its $2 billion buyback program, which represents approximately 2% of outstanding shares.

Company presentation

DVN features a distinctive dividend program consisting of a fixed dividend and a variable dividend tied to the amount of generated free cash flow. The fixed dividend receives funding first, with up to 50% of the remaining free cash flow being allocated to shareholders through a variable dividend. Once the dividend is funded, the residual free cash flow is directed towards share buyback initiatives and ongoing enhancement of DVN's financial standing.

Considering the oil and natural gas prices mentioned in the valuation section, I anticipate a 2023 EBITDA of $9 billion and a free cash flow of $12 per share. Under the existing policy, $6 per share would be returned to shareholders through dividends and share buybacks, resulting in an effective dividend yield of 12%.

Company presentation

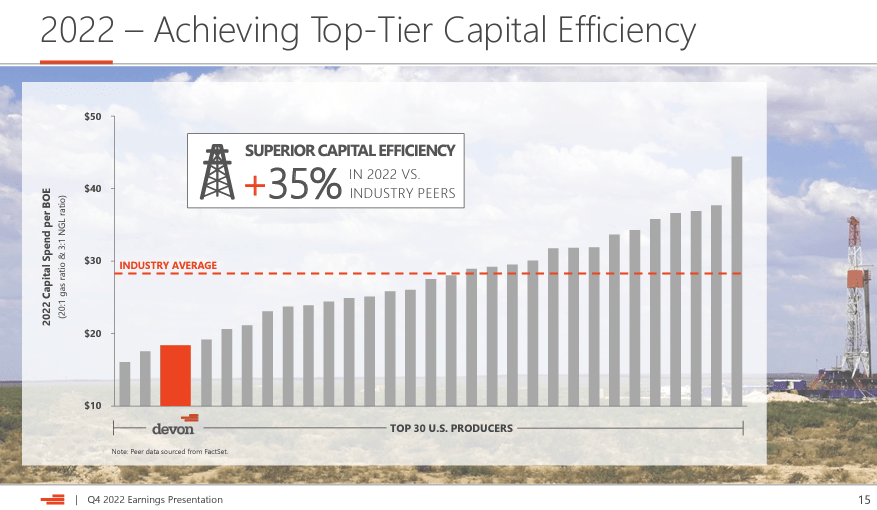

Reason 4: Inherent Cost Advantage and Asset Portfolio

DVN's inherent cost advantage is driven by the acreage it holds, particularly in the Permian Basin, which is the cheapest source of crude oil in the US. DVN's location on the Texas-New Mexico border allows it to focus on areas with impressive initial flow rates, thus spreading fixed costs more thinly and delivering better returns on investment. DVN's Bakken footprint also overlaps the core of the play, where well results are typically strongest.

Company presentation

The rest of the portfolio, in Oklahoma and Wyoming's Powder River Basin, is more speculative in terms of position on the cost curve.

Valuation and Growth Prospects

Currently, the shares appear to be fairly priced, as I estimate the NAV at $51 per share. I use a cost of capital of 10.4%, based on an unlevered beta of 1.14 for exploration and production companies. In accordance with the EIA forecast, I anticipate WTI prices in 2023 to be $82 per barrel, declining to $75 per barrel in 2024. For natural gas (Henry Hub) prices, I also concur with the EIA and expect prices to be around $3 per thousand cubic feet for both 2023 and 2024. My long-term assumptions for WTI and Henry Hub prices are $60 per barrel and $3.30 per thousand cubic feet, respectively.

Uncertainty and Market Volatility

As with most E&P firms, a deteriorating outlook for oil and natural gas prices would pressure DVN's profitability, reduce cash flows, and drive up financial leverage. An increase in federal taxes, or a revocation of the intangible drilling deduction that US firms enjoy, could also affect profitability and reduce my fair value estimates. DVN's asset portfolio also includes prospective acreage leased on federal land in New Mexico, making it vulnerable to potential permit bans or restrictions.

Conclusion

DVN presents a compelling investment opportunity due to its robust financial position, advantageous acreage, and shareholder-friendly capital allocation. While the shares may appear fairly priced at the moment, DVN's commitment to delivering high returns to shareholders through dividends and share buybacks makes it an attractive option for investors. Additionally, DVN's inherent cost advantage and strategic asset portfolio further enhance its prospects for growth and resilience in the face of market volatility.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.