Micron Is Grossly Overvalued With No Room For Error

Summary

- Micron Technology is suffering from a classic commodity market downturn, with a significant impact on prices. The company has high capital requirements, which devastate profits.

- Micron has suspended buybacks after purchasing billions above the current price. What's remaining is a token dividend of less than 1% and no net cash position.

- We believe that Micron's estimate that the downturn will end in the next few quarters is optimistic in light of other macroeconomic risks and Samsung's goal to increase market share.

- We're currently running a sale for our private investing group, The Retirement Forum, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

vzphotos

Micron Technology, Inc. (NASDAQ:MU) remains an almost $70 billion company despite a devastating quarter. Despite being a high-tech company, the company remains fundamentally susceptible to the commodity nature of the technology markets. As we'll see throughout this article, Micron remains heavily overvalued, especially with continued macroeconomic risk.

Micron Overview

Micron Technology, Inc. has a unique portfolio of assets, but the company is working to maintain technological competitiveness as demand drops.

The company is expecting improving supply-demand scenarios going into the end of the year. However, it's simultaneously investing in technological competitiveness, while laying off 15% of employees, and managing node ramps. It's a tough line to follow, crushing morale through layoffs, but expecting top-tier work.

Unfortunately, Micron is trapped by Samsung Electronics Co., Ltd. (OTCPK:SSNLF). As the largest player in the market, Samsung wants to remain competitive, and it's been avoiding cutting capital spending or delaying new nodes to nearly the same extent. Samsung is hoping to use the downturn to capture market share from Micron, and that's likely to be expensive.

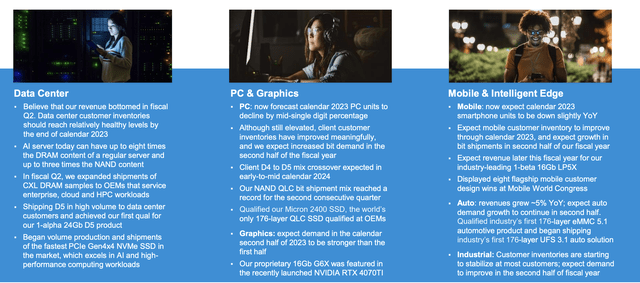

This highlights the company's forecast for the end markets. The company sees data centers as having bottomed out, and it's not wrong to highlight that there is potential in demand for DRAM from AI servers. However, realistically we expect AI demand to be primarily restricted to the largest companies such as Alphabet/Google (GOOG), Microsoft Corporation (MSFT), etc.

The company is ramping up new volume production here, and that could help the company. For PC & Graphics, the company is forecasting a delay for the year still. The company is qualifying new SSDs and production, but overall, it can't avoid where the market currently is. For Mobile & Intelligent Edge, it's also expecting YoY decline, although it's still introducing new technology.

Micron Industry and Company Outlook

The company's industry outlook has moderated, however, it still hasn't addressed the competition risk.

The company's expectations have moderated for industry demand growth as customers maintain strong inventories and end-market demand goes down. It's worth noting that this is also after the immediate boost from Open AI, we expect that the initial spike from companies such as Google panicking will be stronger than the slow increase from new AI servers.

The company expects that bit supply growth will be lower than demand-supply growth, which will help inventories. However, this doesn't account for the actions of other companies (such as Samsung) which are avoiding increasing their bit supply.

Micron's Financial Performance

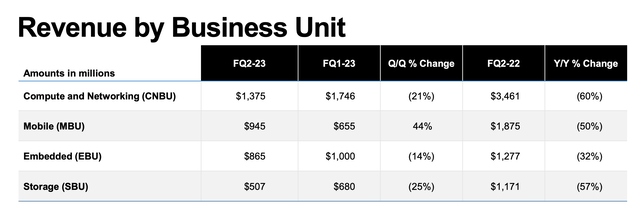

Financially, Micron's business units have underperformed across the board, including QoQ.

The company's revenue is down roughly 50% YoY across the board and QoQ the company saw another 10-15% drop in revenue. Revenue of $3.7 billion is a massive hit for a company whose expenses don't drop nearly in line with revenue decreases, as capital expenditures remain very elevated. The company had a -31.4% gross margin with $2.1 billion in net losses.

The company's free cash flow ("FCF") struggled substantially. The company had $343 million in cash from operations, but capital expenditures of $2.2 billion burned that up. That resulted in -$1.8 billion in FCF as the company temporarily suspended buybacks and has a token dividend of 0.7%. It's worth noting, over the last 4 years, the company repurchased 8% of its float.

The company has rapidly cut its capital expenditures and now anticipates $7 billion for the year, but long term, if the company wants to maintain competitiveness, we don't know if it'll be able to decrease that much further. More so when cash flow from operations is $300 million, even that number means -$6 billion in annual FCF.

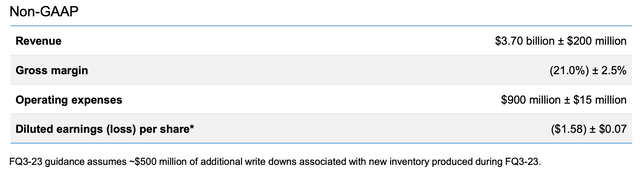

Micron's Guidance

Micron is guiding for another quarter with $3.7 billion in revenue at a -21% gross margin with $900 million worth of operating expenses. The company expects to lose $1.58/share. From Micron's perspective, this is another quarter that will likely cost the company another $1 billion in cash flow that it needs from somewhere.

Micron still has a slight net debt despite its buildup of cash and liquidity, which means it can handle tightening capital markets but that shareholders will begin losing their capital quite quickly. At some point, debt will need to be paid off. We also think that the company's expectations for a quicker recovery are mistimed, as we expect the market to continue to struggle.

Soft vs. Hard Landing

Outside of the direct risks of market demand changes and Samsung's changes, there's still a substantial risk of the overall market.

The Fed is working to control inflation rates and believes it can achieve a soft landing in the market versus a hard landing. It's confident it can still do so. However, historically, a hard landing has been more likely than a soft landing for the company. Especially with the risks of a fight over the debt ceiling, we see a hard landing as a realistic scenario.

In that case, as the economy struggles, Micron Technology, Inc. could see demand crater from its already precarious position. That could increase the difficulty of the position the company is in substantially and hurt its ability to drive future shareholder returns.

Thesis Risk

The largest risk to our thesis is the speed of a recovery in the markets. Micron Technology, Inc. has proven time and time again that it can generate profits in a bull market. Should the downturn turn around so that Micron can ramp up capital expenditures again and fend off Samsung, the company can easily justify its valuation in a bull market.

Conclusion

Micron Technology, Inc. is part of the oligopoly in the DRAM industry, and historically it's done a strong job of fending off competition and continuing to survive. However, we see some things that indicate this time might be different as an investment, including continued strength in the company's stock price and Samsung's goal to increase its market share.

Micron Technology, Inc.'s shares are 6x where they bottomed during the last major downturn in 2016. Micron is losing cash each and every day, and it doesn't have the cash position to defend itself from a protracted downturn. As a result, we recommend not investing in Micron Technology, Inc. at the current time.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.