Alibaba: Smaller And More Focused Going Forward

Summary

- We believe BABA's internal break-up is a great idea for the company and shareholders alike, given the humongous operation and minimal growth thus far.

- The restructuring is timely as well, pointing to China's ambitious GDP target of 5% in 2023, on top of the supposed relaxation of regulatory crackdowns ahead.

- Nonetheless, investors who decide to dip their toes in here need to be aware of the developing restructuring story, on top of the uncertain macroeconomic outlook and the volatile geopolitical situation.

Ildo Frazao/iStock via Getty Images

The Restructuring Investment Thesis

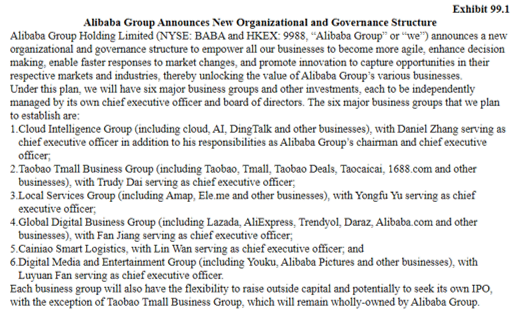

It appears that Alibaba Group Holding Limited (NYSE:BABA) is no longer in the hot seat, with the company opting to split up Jack Ma's empire into six smaller bite-size autonomous parts.

The timing of the restructuring was interesting indeed, at a time when China unexpectedly reopened after three years of Covid Zero Policy and attempting to achieve a 2023 GDP target of 5%, compared to 2022 levels of 3.9%. While there might be no link whatsoever, Jack Ma was also spotted in China, after two years of "sabbatical."

Combined with Jack Ma's ceding of majority control in January 2023, it was unsurprising that BABA has rallied by roughly 16% over the past few days, further underscoring Mr. Market's optimistic sentiments, as highlighted by Xin Sun, a senior lecturer at King's College London:

Economic growth back on track is probably the greatest political priority the [Communist] Party faces at the moment, and a more optimistic entrepreneurial class is key to this. In so doing, the government intends to signal its warmth towards private sector and investors-if even Jack Ma is perceived as having been pardoned, everyone else should feel safe and welcome. (CNBC)

If we are to look at BABA as a whole, the restructuring process is good for the company, in our opinion, since it provides the individual management teams with strategic autonomy over their business direction. Shareholders may be glad about the "break-up" as well, since it offers more clarity into individual segments' performances. On top of that, shareholders may finally opt out of segments not aligned with their portfolio profiles.

BABA's Restructuring

Seeking Alpha

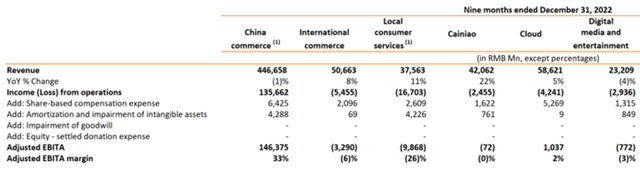

Let us explain further. The current BABA is almost akin to Amazon (AMZN), a humongous basket of different moving parts, performing different roles in multiple end markets. The former provides services and revenue performances as described above and below:

BABA's Revenue/EBITA By Segment

Given the breadth and depth of BABA's existing operations, it is unsurprising that the company has opted to restructure the business as such, with the CEOs responsible for their own segment's performance. This is on top of breaking down the giant's "disorderly expansion of capital," placing the regulatory responsibility on each CEO's shoulders.

We are particularly interested in the company's strategy in the Digital Media/Entertainment (DME), attributed to TikTok's meteoric rise thus far. The latter revolutionized the streaming/social media platform, forcing giants like Meta Platforms (META) and Alphabet (GOOG) (GOOGL) to similarly offer short-form videos to keep up with consumers' changing demands.

For now, BABA's Youku offers on-demand video streaming, similar to Netflix (NFLX). However, it is apparent that TikTok's success has displaced advertising dollars from Youku and its competitors, including Tencent (OTCPK:TCEHY), Baidu (BIDU), and Kuaishou.

By FY2022, TikTok had reported up to $1.5B of in-app purchase revenues, expanding by +66% YoY. This was on top of the $41B in video ad revenue, comprising $13B internationally and $28B domestically. Compared to META's global video ad revenues of $30B and GOOG's $28B, it was apparent that the targeted advertising in BABA's DME segment had drastically underperformed, with revenues of RMB23.2B ($3.36B) in the first three quarters of 2022.

Furthermore, Omdia projects that TikTok's market share may further grow from 22% in 2022 to 37% in 2027, triggering the expansion of its video ad revenue to $120B. Its international revenue is expected to grow at a CAGR of 27.62% to $44B, with domestic revenues expanding by 22.1% to $76B.

Therefore, BABA's DME segment needs a strategic and focused management team, especially given the intensifying domestic competition, minimal growth, and negative margins thus far. This is on top of the unprofitable international e-commerce segment and decelerating growth in the cloud market. Combined with the three years of the Zero Covid Policy and the impact of Beijing's tech crackdown, there is no doubt that restructuring is the right path for the empire.

Nonetheless, it remains to be seen when BABA's restructuring may be completed, given the uncertain macroeconomic outlook and volatile geopolitical landscape, potentially impacting their valuations and amount of capital raised. Furthermore, no further details have been offered on the "IPO," since it is unknown if the new subsidiaries may attempt offshore listing in the US or Hong Kong.

On one hand, there are chances that the capital raise may trigger shareholder dilution, depending on the individual management team's approach. If the spin-off is done in the same manner as AT&T (T) and Warner Bros. Discovery (WBD), then existing investors may also each receive a certain quantity of new individual shares for each business, depending on the eventual market valuations.

On the other hand, we think BABA may prefer to approach the situation as how Tencent has with Tencent Music Entertainment Group (TME). The former may keep majority stakes and voting rights in individual subsidiaries, while issuing a certain amount of new shares to the public.

This strategy may raise a certain amount of cash eventually kept in the subsidiaries' balance sheet, given international e-commerce, local consumer services, and Cainiao's lack of profitability. It is unlikely that the parent company may keep the raised capital, given BABA's excellent liquidity of RMB519.21B or the equivalent of $75.39B by the latest quarter.

Naturally, these are simply our conjectures, since it is also possible that things remain "as is" for the intermediate term. The Wall Street Journal reported that "the listing status of Alibaba's shares in New York and Hong Kong won't be affected," with "teams such as research, data management, finance, and human resources to be spread across subsidiaries." Only time may tell how the situation develops.

So, Is BABA Stock A Buy, Sell, Or Hold?

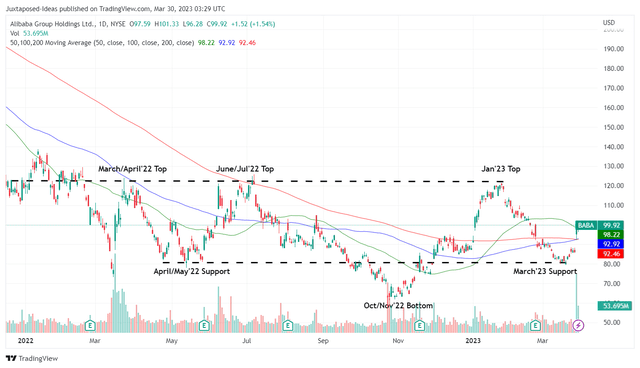

BABA 1Y Stock Price

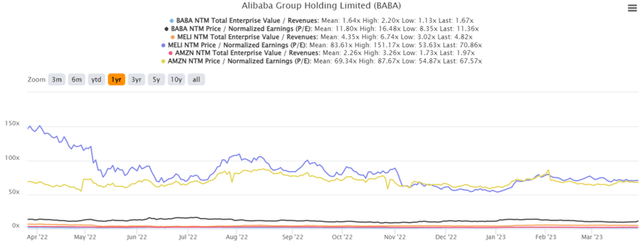

The BABA stock has already recorded an impressive recovery, after the news of the restructuring was released. It appeared that Mr. Market is similarly optimistic about its prospects ahead, given the upgrade in its NTM P/E valuations to 11.36x at the time of writing.

Nonetheless, based on its projected FY2024 EPS of $9.94, we are looking at a moderate price target of $112.91, suggesting a minimal upside potential of 13%. As a result, while the news has been optimistically received, we reckon it may be more prudent to pause here and observe the situation a little longer, due to the reduced margin of safety.

Otherwise, investors with higher risk tolerance and long-term investing trajectory may still add BABA here, due to the supposed relaxation of the regulatory crackdown in China's tech industry.

For example, DiDi released a statement that it planned to expand its geographical footprint and services in 2023, after finally returning to the domestic app stores in January 2023. The ride-hailing company was previously banned from China's app stores in July 2021, after "forcibly listing" the stock in the US in June 2021.

The same positive sentiments have been observed in the domestic gaming industry here and the property market here, signaling a potential turnaround ahead.

BABA, AMZN, & MELI 1Y EV/Revenue and P/E Valuations

Assuming that all geopolitical risks are lifted, it is not overly bullish to assume a re-rating of BABA's valuations nearer to its e-commerce/logistics/cloud/fintech peers.

This includes AMZN at EV/NTM Revenue of 1.97x and NTM P/E of 67.57x, and MercadoLibre (MELI) at 4.82x/70.86x, respectively. In the best-case scenario, BABA's price target may then be upgraded all the way to $596.40 in our view, nearer to its peers at a P/E of 60x.

However, it remains to be seen if/when that rerating event may happen, significantly destabilized by the Ukraine war and ongoing issues between the US and China, including the Chips ban/solar trade tariff/spy balloon/TikTok's potential ban, amongst others. Therefore, investors who buy in now also need to calibrate their expectations accordingly.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, NFLX, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.