MarketWise: The Financial Knight In Shining Armor For Mom-And-Pop Investors

Summary

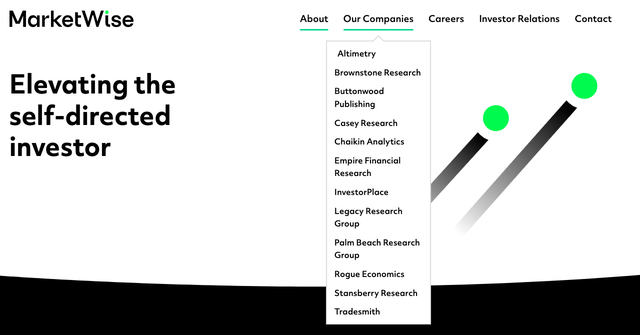

- MarketWise, Inc. offers high-grade financial research, applications, and training for retail investors in the booming online trading era.

- The company is committed to trimming costs, including professional fees and severance costs, and increasing sales and marketing spend ratio on the GAAP P&L.

- Despite declining revenues and deflated landing page visits, MKTW has managed to maintain margins and retain high-value subscribers.

shapecharge/E+ via Getty Images

About MarketWise: Empowering the Average Investor in a Booming Financial Era

As MarketWise, Inc. (NASDAQ:MKTW) surfs the crest of the subscription services wave, it dazzles with its cornucopia of high-grade financial research, applications, and training for the average American. Thriving in the golden age of online trading and democratized financial data, people are seizing the reins of their fiscal destinies like never before, and investment guidance has become a hot commodity. With the youth diving headfirst into the investment pool and the silver-haired crowd seeking financial security, this self-directed investing revolution shows no signs of abating. MKTW emerged as the savior of the retail investor, furnishing them with institutional-grade research without breaking the bank. They view themselves as a godsend in a world where the individual investor's pockets simply can't compete with those of the big guns. In this David-and-Goliath landscape, MKTW's value proposition appears primed on the surface to lure in the swelling tide of retail investors eager to conquer the market.

Not one to rest on its laurels, the company is also funneling resources into state-of-the-art CRM systems, AI-powered subscriber data analysis, and a veritable treasure trove of customer information. This intel-gathering operation enables MKTW to deftly navigate the whims and preferences of its clientele, tailoring their offerings with laser-like precision. Moreover, the company's appetite for expansion is insatiable, fueled by both organic development and strategic mergers. They're on the prowl for the best and the brightest in content creation and marketing, while their status as a public company grants them access to the alluring nectar of public currency - a powerful tool for bankrolling larger acquisitions. This multifaceted approach to growth means that MKTW is flexing its muscles, ready to carve out an even larger share of the booming retail investor market.

Reality Check: Marketwise Struggles with Conversions

The company released their Q4 report yesterday and we learned that their bottom line took a hit, but like a scrappy underdog in a boxing match, MarketWise tightened its belt, improving margins and keeping its high-rollers hooked on additional subscriptions. In the first half of 2022, not only did the company generate $254 million in billings but also recognized an adjusted CFFO of $28 million for a margin of 11%. As business declined to $206 million by year's end, their adjusted CFFO grew to $31.5 million and reached 15.3% - with fourth quarter margins reaching 18.2%.

Meanwhile, management conceded that the Schwab trading data and their sunny Q1 outlook didn't quite see eye to eye. They laid the blame on downbeat market sentiment and banking industry shenanigans, both of which put a damper on conversion rates. Landing page visits may be up, but the conversions are the lifeblood needed for those juicy billings. Overall, the conversions from active free subscribers have dropped significantly below normal numbers. Thus, this company is struggling to understand how they can reach out and engage effectively while inspiring these readers to click and buy something. Sadly enough they still haven't quite figured it out yet but remain determined to find the market's pulse and what messages will capture attention most successfully.

Yet, when it comes to marketing efficiency, MarketWise has been trimming the fat, keeping cash expenditure rates steady between Q3 and Q4, and aiming for a similar trend in Q1. To buff up their sales and marketing spend ratio on the GAAP P&L, MarketWise needs billings to bounce back - a prospect tied to market sentiment and those elusive conversion rates.

Marketwise Seeks Messaging for Product Appeal

As we shift gears to severance and professional fees, MarketWise shone a spotlight on the one-time severance cost of $7.7 million and professional fees of $1.3 million. They're committed to wrangling these fees going forward. Although tight-lipped about future expenses, the company is determined to slash professional fees, either by bringing them in-house or axing them in a cost-trimming extravaganza.

Customer engagement and the free-to-paid subscriber tango are also on the company's radar. With macro volatility throwing a wet blanket over engagement, and as mentioned above, the company is constantly testing the waters with fresh ideas and content to charm readers into making that coveted leap from free to paid subscribers. While they can orchestrate content and themes like maestros, MarketWise can't quite tame the wild beast that is market sentiment - a major player in both customer engagement and conversion rates.

And when discussing churn, the company believes it has processed the churn from the largest cohorts and that they are behaving like other cohorts in terms of the percentage of subscribers left on their list. The churn appears to have stabilized, while the new ads lag. Regarding content, the company's technology offerings, such as Altimetry, have shown positive results and lower churn rates.

Finally, with an eye on inorganic growth opportunities, MarketWise is prowling the M&A landscape, apparently with a tantalizing pipeline of deals under scrutiny. Though they're keeping their cards close to the chest regarding specifics, the company is exploring ways to deploy capital in a shareholder-pleasing smorgasbord of accretive transactions, buybacks, and dividends.

Takeaway

As Marketwise trudges through the muck of dwindling revenues, deflated landing page visits, and a gasping paid subscriber base, it's hard not to wince. And yet, like a stubborn phoenix trying to rise from the ashes, the company manages to claw back some semblance of dignity by slashing costs and polishing margins. All while a loyal band of well-heeled, ultra-high-value subscribers can't resist the siren call of additional subscriptions. Given the assumption that the company can grow its earnings per share by 10% annually over the next five years, I anticipate an EPS of $0.17 in five years. Considering this and a price-earnings ratio of 15, it is my opinion that a "buy" rating is appropriate right now with a fair value cost per share reaching up to $2.55 - which happens to be closely aligned with its 50 day moving average on the weekly chart.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MKTW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.