Albemarle's Valuation Is Approaching Attractive Levels

Summary

- With the EV frenzy still in full swing, Albemarle's stock price recently rose to all-time high levels that were starting to become unattractive from an investor's point of view.

- With a stock price decline of about 1/3 from all-time highs reached last fall, its Forward P/E ratio now falls in line with much of the broader mining sector.

- After a stellar 2022 in terms of its financial results, this year is forecast to be another strong year for revenue growth, as well as other financial metrics.

- While the global EV market is set to continue to grow at a robust pace, which should further boost Albemarle's long-term financial prospects, we should not ignore potential headwinds such as EV affordability for the middle class.

Just_Super/iStock via Getty Images

Investment thesis

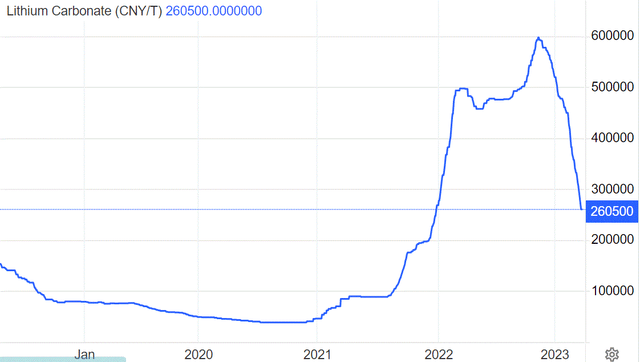

After reaching an all-time record high a few months ago, Albemarle's (NYSE:ALB) stock price declined by about a third. The decline in the stock price corresponds with a steep drop in lithium prices, rather than anything that is company-specific. Albemarle's financial results continued to be stellar throughout last year, and its forecast for 2023 looks bright as well. It remains to be seen whether some revisions will have to be announced in response to the steep plunge in lithium prices, but even so, there are fundamental metrics that suggest that its current valuation is starting to be attractive, even if financial results will not measure up to guidance. The steep decline in lithium prices will at some point reverse given the ongoing sales gains of EVs we are seeing in the global auto market. At times, the supply/demand balance will shift into oversupply, but demand will nevertheless be robust in the coming years and decades, even though the EV trend will face some significant headwinds and barriers along the way. The time to consider buying lithium mining stocks like Albemarle is precisely when the price of lithium experiences a soft period as is the case right now.

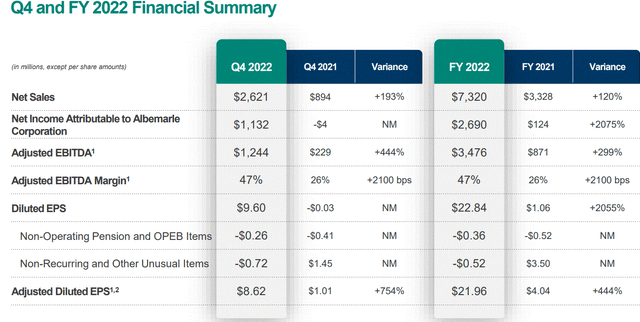

Albemarle posted robust financial results for 2022 and it expects this year to be solid as well

As we can see, 2022 was a stellar year for Albemarle, which fully explains the all-time high we saw in ALB stock price. Revenues more than doubled, mostly on the back of a robust lithium price environment.

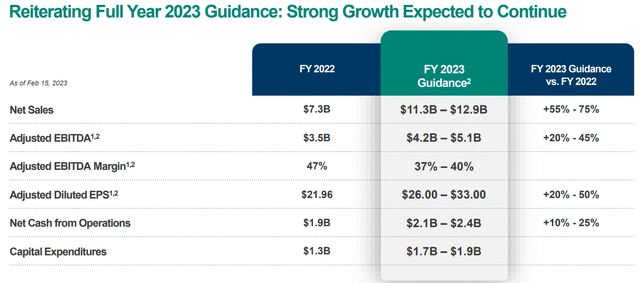

For 2023 Albemarle expects to see another year of robust revenue growth, which will come with better results by other measures as well.

While there are plenty of reasons to believe in Albemarle's positive forecast for this year, we should be mindful of the fact that lithium prices may have the final word in regard to whether Albemarle's bullish projections for 2023 will pan out or not.

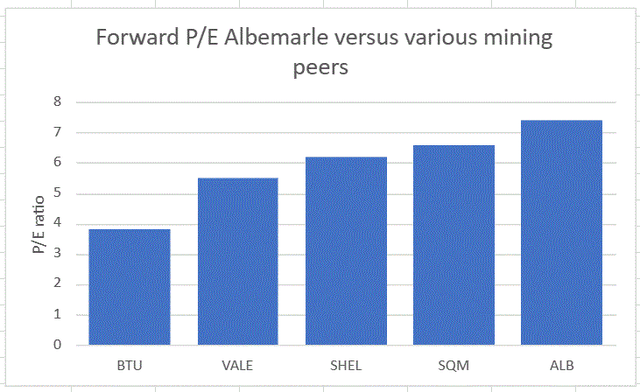

Albemarle is trading at a forward P/E of around 7, which puts it almost on par with non-growth miners

Albemarle financial metrics (Seeking Alpha)

As the chart above shows, there has been a recent pullback in Albemarle's stock price, which had the effect of bringing its P/E ratio down to just over 7 currently.

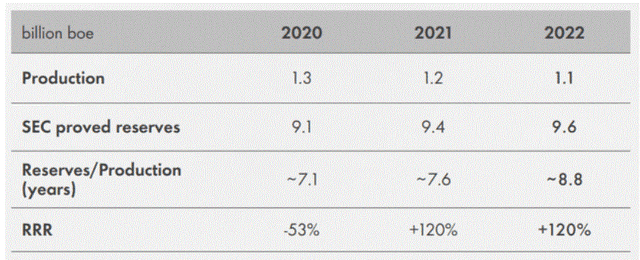

I opted to compare Albemarle's current P/E versus not only lithium mining peer SQM (SQM) but also against a number of commodities miners that are arguably not in a growth business, such as Peabody (BTU), which is a coal miner. Shell (SHEL) is losing upstream production volumes, not only because the oil & gas industry is no longer seeing much volume growth, but because the company-specific reserve situation is rather precarious, with only about 8-9 years' worth of proven reserves.

To help put things into perspective, Albemarle which is set to continue seeing robust volume production growth going forward for many years, and even decades to come is trading at just a small premium when measured by P/E versus Shell, which as we can see, it is now experiencing a yearly decline in upstream oil & gas production of about 10%. Looking at it from this angle, Albemarle is not expensive at current valuation levels.

The global long-term lithium supply/demand picture looks decent, but there are reasons to expect demand-side disappointment along the way

Both supply and demand for lithium are set to grow at a blistering pace in the next few years, with a doubling rate in both supply & demand set to happen every half a decade or so. The lithium bull story tends to emphasize the demand side of the equation. The bearish thesis tends to focus more on the massive supply capacities that are being added by miners. The impressive nature of both trends tends to make either one of the two arguments very persuasive.

In my view, both supply and demand will continue to see robust growth, with both more or less growing in parallel at a roughly equal pace. However, the lithium market will be very volatile, because at times there will be very short-term shortfalls in supplies, while at other times demand will fall short of expectations. These triggers of volatility will continue to offer investors buying opportunities, as well as an opportunity to take profits when lithium prices move higher, pushing lithium mining stocks higher as well.

As far as potential supply-side surprises go, there is always the issue of project delays, due to technical issues. Periods of lower lithium prices may also convince some miners to slow down project development, and in some cases, they may even opt to scrap certain projects that may be deemed a profitability risk, given certain forward lithium price point assumptions.

On the demand side, we could have some unpleasant surprises in my view. As I pointed out some years ago, there is an issue that is seldom discussed and considered in regard to EV market penetration. Within the ranks of the Western middle class in particular, there may be significant resistance to giving up on ICE-powered cars, in favor of similarly priced EVs that will offer much-reduced utility for the money that they can afford to pay. Certain developing world markets might encounter a similar resistance for EVs to move out of the luxury car segment of the overall market and win over the middle class.

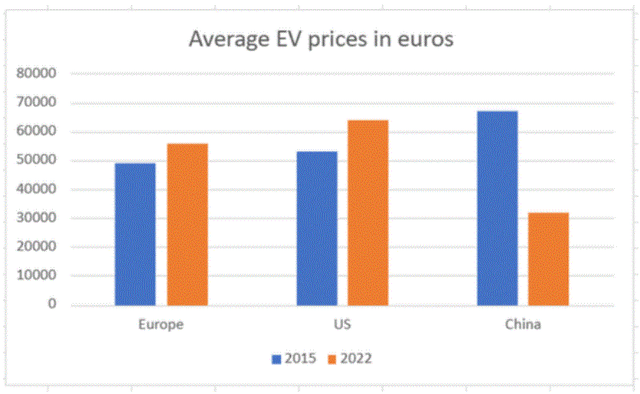

There is a reason why in both the US market, as well as the European market the average sale price of an EV actually increased, contrary to expectations that prices will go down. China's EV market seems to be acting as it has been predicted over the years, with lower-priced EV sales bringing the average sale price of EVs much lower than they were selling almost a decade ago. Some might be tempted to extrapolate that most middle-income nations around the world will see a similar trend. I think it still remains to be seen if this will be the case or not. The continued inroads of EVs in the global car market are heavily dependent on being able to offer the global middle class more than just a city car, for a price that the global middle class can afford.

Investment implications:

A few months ago I wrote an article on Albemarle, rating it as a sell, given that it was near its all-time highs, while the lithium market price was headed for a downturn. At this point, both Albemarle's stock price as well as the lithium market price reached levels, where we can start expecting a turnaround to be on the horizon, therefore it is now worth keeping an eye out for a good entry point. The robust EV sales growth trend should continue for years to come, although, as I pointed out, there are some significant market barriers, which I do not foresee will disappear anytime soon.

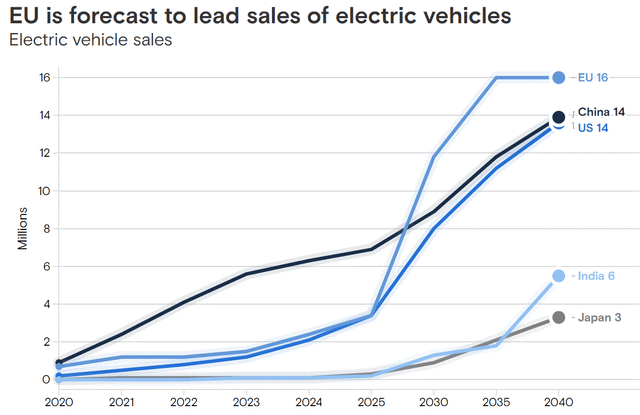

Even though I find EV sales forecasts, such as this one provided by Goldman Sachs (GS) to be wildly over-optimistic, it cannot be denied that this is a growth industry, which makes lithium a growth industry as well. Finding a good entry point to be invested in a solid lithium mining stock like Albemarle is an attractive way to participate in what is the biggest shift in automotive technology for over a century.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.