Match Group: The Dating App Empire You Need To Swipe Right On

Summary

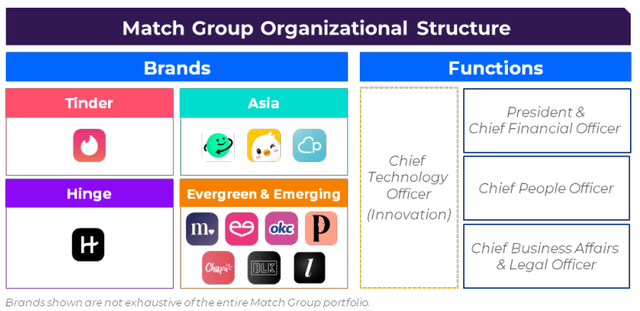

- Match Group is the dominant player in the online dating space with a wide and deep portfolio of dating apps and websites, including Tinder, the most downloaded dating app.

- Match Group's executive leadership intends to invest most of its resources and energy into Tinder and Hinge, with plans to increase Tinder's marketing spend and continue expanding Hinge's popularity.

- Match Group's competitive advantages stem from network effects and economies of scale, giving them a wide economic moat that is difficult for new competitors to overcome.

- Match Group's risks include the problem of supply and demand, cannibalization between its many brands, and the threat of pricing competition from other dating apps.

- Despite these risks, Match Group is still an attractive long-term investment at current prices and there are options strategies, such as covered calls and synthetic covered calls, that can be used to generate income from the stock in the near term.

Damir Khabirov/iStock via Getty Images

Hello there, Seeking Alpha readers! Today I want to talk about an undervalued stock with a wide economic moat that I think you need to be swiping right on: Match Group (NASDAQ:MTCH).

About Match Group

If you're not familiar with Match Group, let me catch you up. They're the folks behind the wildly popular dating apps Tinder, Hinge, and Meetic - you know, the apps that are responsible for countless awkward first dates and occasional love stories. Match Group has been dominating the online dating space for a while now, and they're not slowing down anytime soon.

The company’s dating portfolio consists of four out of the top five brands in North America. That's right, they've got more hits than Ricky Martin (if you don’t know who Ricky Martin is, ask your parents). And Tinder, their biggest app, is the most downloaded dating app in the world. What’s surprising is it’s still the undisputed king even after introducing monetization features and charging users in 2015.

Its portfolio is not only deep, it’s wide too. With over 45 different dating apps and websites, Match Group has something for everyone.

But Tinder and Hinge are its two mainstays and are likely the future of the company.

Page 4 of Match Group's Q4 2023 Shareholder Letter

Match Group's executive leadership intends to invest most of its resources and energy into Tinder and Hinge.

Leadership also expects to increase Tinder’s marketing spend by two percentage points in 2023 to reinvigorate the brand. Here’s an excerpt from the company’s most recent shareholder letter:

Tinder plans to launch its first-ever global marketing campaign this quarter. From its inception, Tinder grew rapidly through strong, organic word-of-mouth, so there was less of a need to market. However, over time, this lack of marketing has contributed to a narrow brand perception that does not celebrate the breadth of relationship possibilities Tinder creates every day. Through a fresh, multi-channel brand campaign, Tinder will have the opportunity to showcase the full range of what it offers and develop a more accurate brand story that resonates with its core audience. We believe that investing to build and properly position Tinder's brand will, over time, help engage both new and previous users, and cement its position as a premiere global dating app.

[Source: Page 7 of Match Group's Q4 2023 Shareholder Letter]

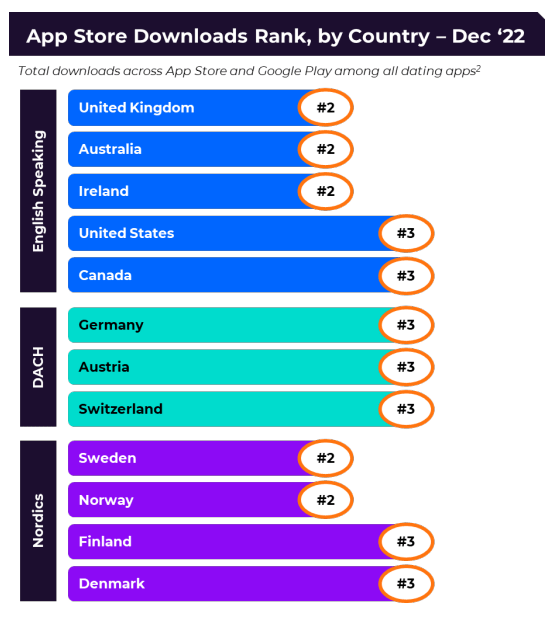

Regarding Hinge, Match Group acquired that company in 2019, after acquiring a 51% stake in the company the year prior. The app is growing rapidly and is the second and third most popular dating app in many significant countries around the world:

Page 9 of Match Group's Q4 2022 Shareholder Letter

Here’s what the company said about Hinge in its most recent shareholder letter:

Hinge® continues to be the brightest spot in our portfolio and a critical contributor to Match Group’s growth, driven by ongoing strength in its core English-speaking markets and its burgeoning popularity across newly launched European markets. Justin McLeod, founder and CEO of Hinge, will now report directly to BK [Bernhard Kim, CEO]. Justin’s founder-led creative vision and guiding principles will remain front and center for Hinge as it continues its global expansion and grows into an even more significant part of our portfolio.

[Source: Page 4 of Match Group's Q4 2023 Shareholder Letter]

Now, let’s take a look at Match Group’s competitive advantages and its risks and challenges.

Competitive Advantages

So, what makes Match Group so special? Well, for starters, they have a wide economic moat. That's fancy investor lingo for "they're really good at protecting their turf."

Match Group’s economic moat is primarily rooted in what are commonly referred to as “network effects.” The more people who use Match Group's services, the more valuable those services become for every user. It's like the opposite of a pyramid scheme. Allow me to explain:

Match Group's dating apps are basically the cool kids' table of the online dating world. They've got millions of users (over 16 million paid users as of Q4 2022 and many more free users), making it harder for new competitors to break in. It's like trying to join a clique in high school - good luck if you're not already in. And the more people who join Match Group's apps, the more valuable they become to existing users, creating a beautiful cycle that gives Match Group a serious advantage over new entrants.

It's the classic chicken and egg problem. Because let's face it, nobody wants to join an empty dating app. The whole point is to have options, people! So, if someone is looking for love (or just some casual swiping), using one of Match Group’s popular apps is an obvious choice (even if it costs the user a bit of money).

Besides network effects, Match Group also has an “economies of scale” thing going for it. Match Group has created a portfolio of apps and websites that attract individuals at different stages of their lives when seeking relationships. For example, younger users seeking casual relationships are drawn to Tinder, while older users looking for more of a long-term relationship would use Match Group's long time market leader, Match.com. And with over 500 million single adults in North America, Western Europe, and other important areas of the world, that's a lot of potential customers.

Of course, Match Group isn't without its competitors. But with its broad brand portfolio and network effect, I think the company will maintain its competitive advantage. And who knows, maybe they'll even break out into adjacent markets and start offering matchmaking services for dogs!

Risks and Challenges

No investment comes without risks. Here are the top three risks I see.

First up, we've got the classic problem of supply and demand. As Match Group makes it easier for people to find love, they need to spend more money to market to and acquire new customers. It's like trying to fill up a swimming pool with a leaky hose. Sure, you're making progress, but you're also wasting a lot of water (and money). This could result in increased expenses required to market to and acquire new customers and ultimately depress margins—something Wall Street is already concerned about given Match Group’s recent financial performance.

Then there's the issue of cannibalization. With so many different brands and services, there's always the risk that one will eat into the market share of another. It's like a dating Hunger Games, with different apps fighting for survival. And let's be real, nobody wants to be the first one voted off the island. Will Hinge infringe on Tinder’s turf? It might be too early to tell and some investors are not waiting to find out.

But perhaps the biggest risk of all is pricing. Sure, Match Group has a network effect that's stronger than a shot of espresso, but that doesn't mean they're invincible. Competitors like Bumble, eHarmony, and Spark Networks are nipping at their heels, and could attempt to compete on price or even offer their platforms for free, thereby depressing margins for the entire industry. Match Group will need to continue innovating to improve the dating experience and stay one step ahead of competitors.

So there you have it, folks. Match Group's love empire may be strong, but it's not invincible. They've got some risks to contend with, but I believe they can overcome them. After all, love conquers all, right?

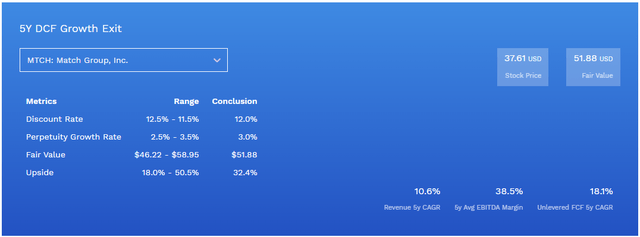

Valuation

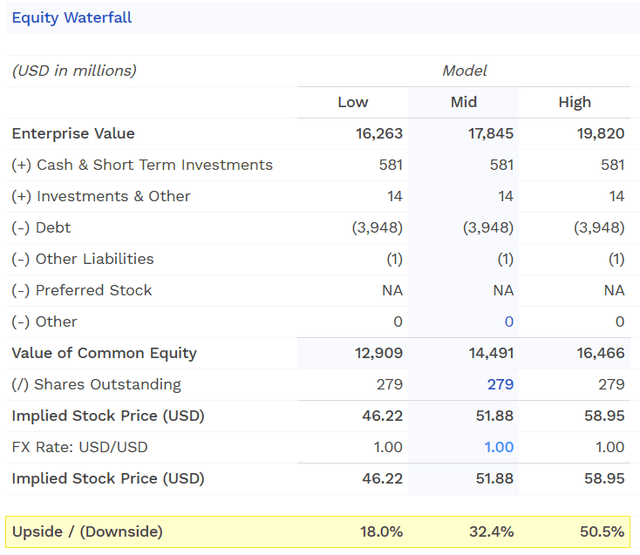

I think Match Group is undervalued. As of the date of this writing, the stock is trading for $37.61 per share. I used one of my favorite websites, Finbox, to help me build a DCF model based in large part on analyst projections. I believe Match Group is fairly valued at about $52 per share, meaning I see about 32% upside. Here’s a quick summary of my model:

Finbox.com

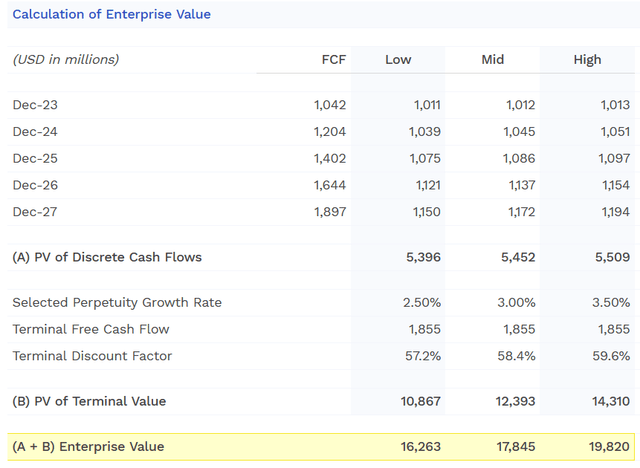

The table below shows projected free cash flows to the firm (FCF) each year (both nominal and discounted). The model assumes that Match Group will generate over $1 billion of FCF this year—these are cash flows available to both debt and equity stakeholders.

Finbox.com

Now, Match Group has $581 million of cash in the bank and nearly $4 billion in debt, so we need to translate the fair value of the entire enterprise to the fair value of a single share of equity. The table below shows the calculations.

Finbox.com

You can see the full DCF model here.

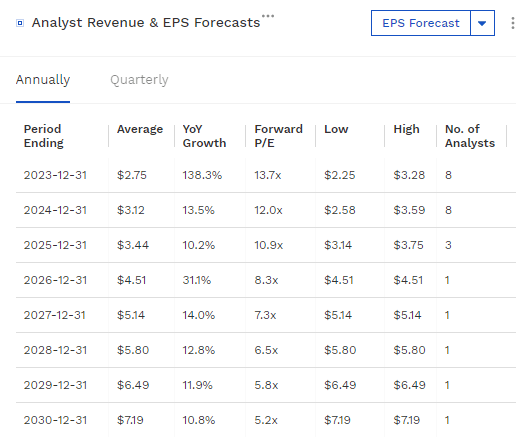

On the earnings front, analysts estimate that Match Group will generate $2.75 per share in earnings this year and $3.12 next year. This equates to a 2023 and 2024 price-to-earnings (P/E) ratio of 13.7x and 12.0x, respectively. This would in turn be an earnings yield (the reciprocal of P/E) of 7.3% and 8.3%, respectively. With 10 year treasury rate at about 3.5%, this is a premium of 4 to 4.5%.

Finbox.com

Technical Setup

Match Group’s stock is currently trading at $37.61, which is near its 52-week low of $34.62. It’s unclear whether the bottom is in, but the stock is likely to find some support at those recent lows. But it doesn’t mean it can’t go even lower. And, frankly, this chart is not looking very bullish. That said, I don’t expect the stock to make any major moves (up or down) until after the company reports earnings on May 2nd.

StockCharts.com

A Conservative Way to Generate Income from Match Group Using Options

For all you savvy investors out there, let's talk about options. Specifically, let’s talk about two options strategies: (1) covered calls and (2) synthetic covered calls (sometimes referred to as poor man’s covered calls, which sounds like a sad attempt at a superhero name).

Covered Calls

Let’s start with covered calls. A covered call is an options trading strategy where an investor who owns 100 shares of stock sells a call option on that same stock. This allows the investor to earn income from the premium received from selling the call option, while also limiting potential losses if the stock price were to decrease.

I like to compare covered calls to running a short-term rental businesses like Airbnb (ABNB) or Turo (TURO), but instead of collecting rents on vacation homes and sports cars we’re collecting rents on stocks. Allow me to elaborate —

When you put on a covered call trade, by basically “leasing” your upside in the underlying stock (above a certain level) to Mr. Market for a specified period of time (say 30 days). The time value portion of the option premium you collect from Mr. Market is just like rental income. No matter what happens to the underlying stock price (whether up, down, or sideways), you get to keep that fee. If you sell an at-the-money (ATM) or out-of-the-money (OTM) option, the entire premium is time value and will decay over the life of the option. I think of the option premium collected from Mr. Market from the sale of this 30-day option as my monthly rent check.

So, how would I play Match Group in a somewhat conservative way before earnings on May 2nd. As of the date of this writing, I would consider doing the following since I believe the downside in MTCH stock is limited:

(1) Buy 100 shares of MTCH stock for $37.55 per share for a cost of $3,755.

(2) Sell the $38 strike call option expiring on April 28, 2023 for $195.

The total net cost to put this trade on would be $3,560.

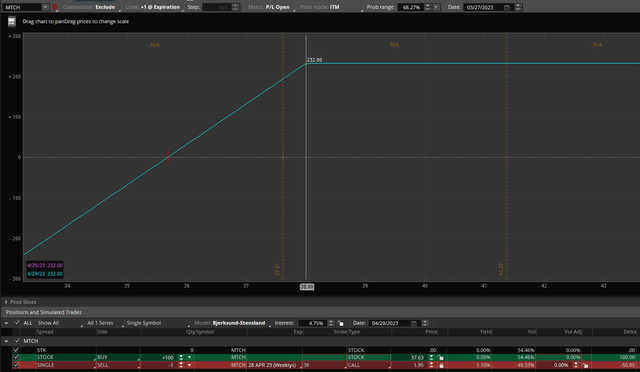

Here’s the profit loss diagram:

Self Created (ThinkorSwim)

As you can see, if MTCH is trading at the exact same price as the original purchase price ($35.61) when the call option expires on April 28, 2023, you’ll have a profit of $195 per share in 28 days. That’s because you get to keep the $195 of option premium you collected from Mr. Market when you leased him your upside in the stock above $38 per share. This is your rent. It’s yours to keep it no matter what.

If the stock price is at or above $38 per share when the call option expires on April 28, 2023, you’ll have a profit of $240 per share in 28 days. This profit is comprised of $195 from selling the near-dated option to Mr. Market and $45 from price appreciation on your 100 shares of MTCH (from $37.55 to $38.00 is $0.45 per profit per share x 100 =$45). This is a return of 6.7% on capital at risk in 28 days or 88% annualized. Not too shabby.

And even if the stock price has dropped slightly when the call option expires on April 28, 2023, the trade will still be profitable. In fact, by my calculation, the trade won’t go negative until the stock price has dropped below $35.60 per share. This is because the $195 of rent is offsetting losses on the 100 shares as the price decreases until all $195 of rent has been exhausted.

Synthetic Covered Calls

Now, what if we could get even better returns than the covered call strategy while risking even less overall? Let’s talk synthetic covered calls. Here’s the cool thing -

Instead of buying 100 shares of MTCH, I could buy a long-dated, deep-in-the-money call option with an 85+ delta. Without getting too in the weeds, delta tells us that the option will provide upside and downside exposure similar to X number of shares of the underlying stock where X is delta. So, if we were to buy a call option with an 85 delta, every $1 increase in the underlying stock price will increase the option's value by approximately $85. Similarly, every $1 decrease in the underlying stock price will decrease the option’s value by approximately $85. This means buying an 85 delta call option is similar to buying 85 shares. But the real kicker is that it costs less to buy an 85 delta call option (even a long-dated one) than it does to buy 85 shares of the underlying stock.

Looking at MTCH as an example, I could buy a $25 strike call option expiring on January 19, 2024 (almost 300 days from now) for $1,530. I’ll call this call option my “LEAPS Option” (the term “LEAPS” is just a fancy name for long-dated options). This particular LEAPS Option has a positive delta of 87, meaning it gives me approximately 87 shares worth of long exposure to MTCH stock. If I were to buy 87 shares instead of the option, I would need to spend $3,266.85 ($37.55 * 87). That’s more than double the cost.

I could then do the same thing as in the covered call example above and sell the $38 strike call option expiring on April 28, 2023 for $195. But by buying the LEAPS Option instead of 100 shares, I’m essentially creating a synthetic covered call (this sounds like something out of a sci-fi movie). My net cost for this synthetic covered call is $1,335 ($1,530 paid for the $25 strike LEAPS option less $195 collected from selling the near-dated $38 strike call option).

My profit/loss diagram for this synthetic covered call would look something like this:

Self Created (ThinkorSwim)

As you can see, if MTCH is trading at $38 per share when the near-dated call option expires on April 28, 2023, you’ll have a profit of about $200 per share in 28 days. This profit is comprised of $195 from selling the near-dated option to Mr. Market and a little bit of profit from price appreciation in the LEAPS Option offset somewhat by time decay on the LEAPS Option (there is about $1 per day of time decay on the LEAPS Option). That’s a potential return of 15% on capital at risk (the $1335 paid for this position) in 28 days, or 195% annualized. Again, not too shabby.

As an aside, you may be noticing the slight downward droop in profits as the price increases above $38 per share. This is due to the fact that the LEAPS Option has 87 shares worth of long exposure instead of 100 shares worth in the covered call example. So, as the underlying stock price increases, the near-dated short call option is creating losses slightly faster than the LEAPS Option is creating gains (technically your LEAPS Option is increasing in delta as the underlying stock price increases, but not fast enough to keep pace with the near-dated short call option).

One easy way to remedy this slight drop in profits as the price increases, is to buy 10 shares of MTCH when opening the synthetic covered call trade. This provides an additional 10 shares of long exposure and bumps the delta of your long position to 97 from 87.

So, there you have it, folks. Options may seem scary, but they can be a conservative way to make some cash. And if you're feeling adventurous, you may want to give synthetic covered calls a try. But my suggestion is to not double the number of synthetic covered calls just because they’re cheaper. That’s a quick way to get yourself into trouble. Take the savings and hold it for a rainy day.

Conclusion

Well, well, well, look who's made it to the end of this stock analysis extravaganza! Give yourself a round of applause, my friend. To sum things, I think Match Group stock is an attractive long-term investment at current prices. Sure, Match Group is facing some challenges and may need to spend more money to attract new users, but they've got a wide economic moat and a portfolio of dating apps that's more diverse than a box of chocolates. Given my view of limited downside, I’m also looking at a couple ways to generate income from Match Group in the near term using options. So, if you're looking for a stock to swipe right on, Match Group might just be the one for you.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MTCH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not warrant the accuracy of any data provided in this article. My conclusion in this article is solely my opinion. You should not treat any opinion expressed in this article as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the author's opinion.