ERTH Should Really Be Scared By Interest Rates: Sell

Summary

- ERTH is a themed ETF that invests in environmentally-friendly companies.

- Overall, the ETF is well-diversified, but it has a high exposure to growth companies, which typically do not perform well in periods of rising interest rates.

- In March, despite the rally of major indexes, ERTH performed poorly.

- In my opinion, the ETF will continue its negative trend until the central banks stabilize interest rates.

Hiroshi Watanabe

The ERTH ETF (Invesco MSCI Sustainable Future ETF) (NYSEARCA:ERTH) is a themed ETF that invests in environmentally responsible companies and their sustainable technologies. The main constituents of the ETF are innovative and established companies in the fields of green energy, sustainable water, and pollution prevention.

Despite the importance of its investment theme, the ETF is currently underperforming and is likely to continue to do so in the coming months as its constituent companies are highly sensitive to the current macroeconomic environment.

ETF characteristics

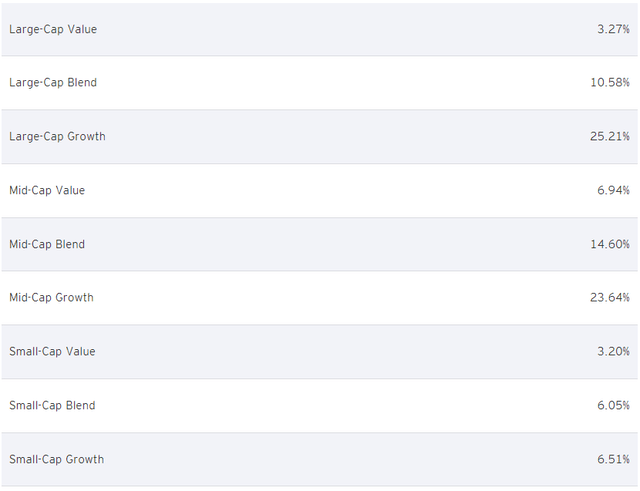

The ERTH ETF mainly consists of large and mid-cap companies in the growth or blend categories. Large-Cap Growth companies represent 25.21%, while Mid-Cap Growth companies represent 23.64%, and Small-Cap Growth companies represent 6.51%, making up over 50% of the growth sector. Conversely, value companies represent less than 15%, which makes the ETF more volatile and, in a certain sense, riskier, but it also offers the possibility of higher returns.

Market Cap & Style Allocations (Invesco)

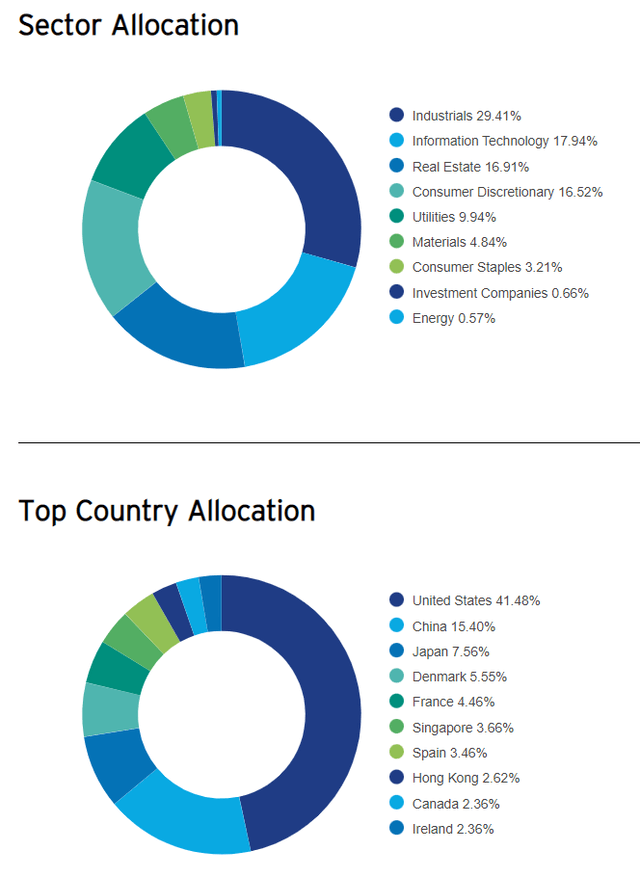

The ETF is well-diversified across sectors, with most industries not representing more than 30% of the ETF. The Industrial sector is in first place (29.41%), followed by Information Technology (17.94%), and Real Estate and Consumer Discretionary at 16.91% and 16.52%, respectively.

In terms of geographic distribution, the ETF is biased towards the United States, which represents 41.48% of the total weight. China is in second place (15.40%), followed by Japan (7.56%).

Sector and Geography Allocation (Invesco)

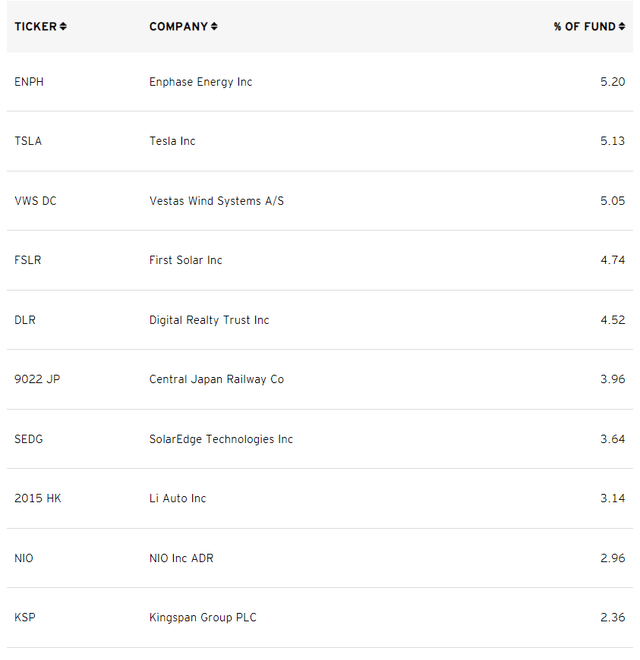

The top holdings of the ETF consist of large-cap companies with estimated high growth potential. Enphase Energy (NASDAQ:ENPH)(5.20%) and Tesla (NASDAQ:TSLA)(5.13%) are in the first two places, followed by other disruptive companies such as SolarEdge Technologies (NASDAQ:SEDG) and NIO Inc. (NYSE:NIO), as well as more established and mature companies such as Vestas Wind Systems (OTCPK:VWDRY) or Central Japan Railway (OTCPK:CJPRY).

Overall, the ETF is well-diversified from every perspective. However, the high exposure to growth companies with high multiples places it under the problem of volatility in current market conditions.

Interest rates are ERTH's major threat

While the ETF is generally well-diversified, its geographical composition reveals that 75% of the index's weight is represented by countries that are currently adopting a restrictive monetary policy, raising interest rates and reducing liquidity in the market. Given that 85% of the companies in the index are of the growth type and at least 60% have medium to low capitalization, it is easy to see how this does not benefit their performance on the market.

In general, growth companies tend to perform well in an environment of low interest rates, where financial resources are easily available to support growth through low-cost debt. However, during periods of quantitative tightening, there has historically been a rotation in favor of value stocks, which do not necessarily need to rely on debt to fund their operations. In the ERTH ETF, value stocks only represent 15% of the portfolio thus making the ETF more vulnerable to interest rate hikes that favor value over growth.

In my view, the ETF could continue to underperform until there are signs of a pivot or at least stabilization in interest rates. Furthermore, with inflation well above the 2.00% target in Europe, central banks are likely to continue raising interest rates for some time to come. Therefore, it is almost certain that the ETF will continue to underperform.

Performance

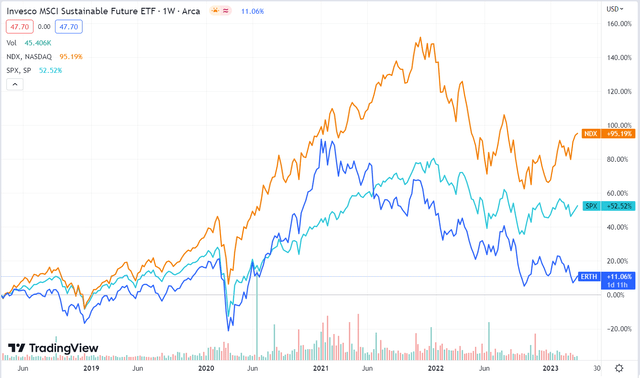

Over the past 5 years, ERTH has performed poorly, underperforming both the SPX and NDX. ERTH returned +11.06%, with a yield of 1.18%, while SPX returned +52.52%, and NDX returned +95.19%.

It is noteworthy that starting from the first months of 2021, ERTH began to decline, while the other two indexes reached their peak only in November 2021. This confirms the thesis that the ETF is extremely sensitive to a tight monetary policy. Indeed, with the end of quantitative easing, the ETF immediately began to drop as it contains companies with high multiples that were overvalued at the end of 2020. The decline continued fairly linearly as quantitative tightening continued.

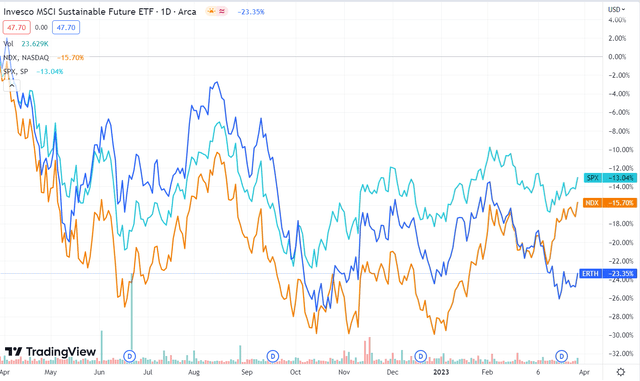

Another interesting chart is in regards to the 1-year performance of the same indexes. Here too, ERTH performed poorly (-23.35%), while SPX and NDX lost more or less half. Furthermore, a worrying trend can be observed in the last month where the two indices began a rally, but ERTH continued to decline.

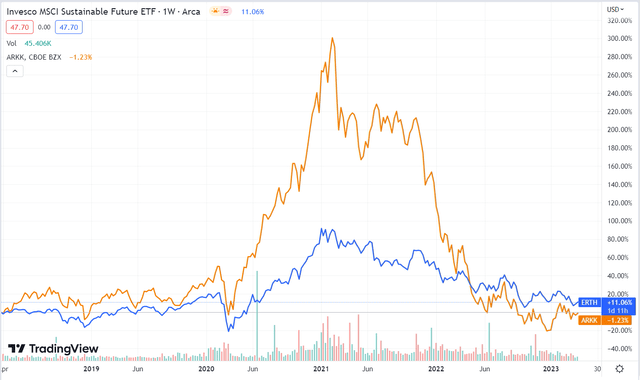

Finally, if we compare the ARKK ETF with ERTH, we can see that the two ETFs have a similar trend, despite the difference in percentage returns. Both began to perform poorly in the first quarter of 2021. Therefore, although ERTH and ARKK have different investment themes, the types of companies they hold are similar: mid-cap growth companies that are too sensitive to interest rates and market liquidity.

Bottom line

In conclusion, ERTH is certainly a noteworthy ETF given the importance of its investment theme. However, in the current market conditions, ERTH is likely to perform poorly, as the companies within it are highly sensitive to the macroeconomic environment. For this reason, I give ERTH a "Sell" rating.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.