Rising Interest Rates: Unum Group's Double-Edged Sword

Summary

- Unum Group has delivered incredible results in 2022.

- Increasing bond yields are a long-term opportunity, but the balance sheet is bleeding in the short-to-medium-term.

- Hold off from investing until the macroeconomic environment is more certain and investor sentiment eases up.

- Although has the potential to 2.4x over the next ten years, I expect further short-term downside.

Phiwath Jittamas

Investment Thesis

Unum Group (NYSE:UNM) is a strong employer benefits insurance company with stable fundamentals, but as an investor you need to be aware of how the macro-environment is steering The Company. Since year-end 2021, its fixed-maturity portfolio has lost almost 20% of its fair value and I expect this to continue given further rate hikes ahead. Investors need not be too weary, though. UNM has a prudent management team that has entered into appropriate hedges to mitigate the interest rate risk in the U.S. After weighing The Company's leading market position in certain employer benefits as well as prudent management against the macroeconomic backdrop, I recommend you to Hold for the time being.

Unum Background:

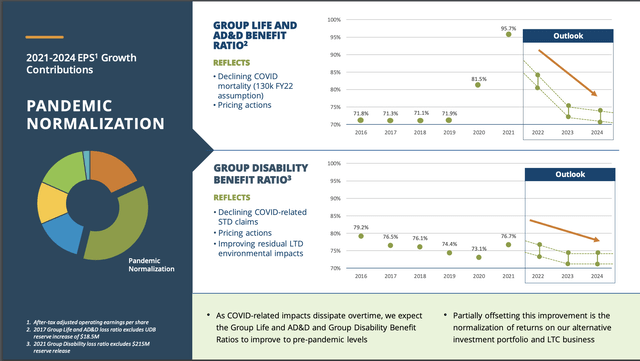

Unum Group is a life and health insurance company that provides employee benefits mainly in the United States, United Kingdom, and Poland. The coronavirus pandemic was a big headwind for UNM (The Company). The reason for this is that The Company was obligated to pay for employees' medical expenses that were incurred due to the pandemic. This led to their Group Life and AD&D benefit ratio increasing dramatically during 2020 and 2021.

Unum Benefit Ratios (Unum Investor Day Presentation)

The quicker-than-expected recovery of covid-related mortality rates also led to a quicker-than-expected growth in The Company's earnings per share in 2022. Consider, for example, the 2022 Investor Day Outlook where CEO Rick McKenney guided for modest a 4-7% after-tax adjusted EPS growth in 2022. Instead, UNM delivered 43%! These unexpected results led to massive share price gains at every single quarterly earnings report for 2022 and UNM's shares are up ~24% over the past year.

Unum's Growth Drivers

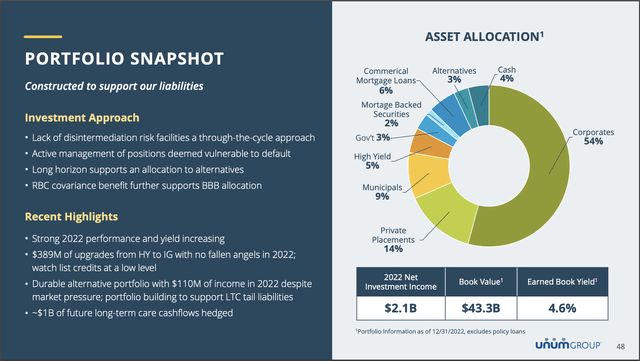

In order to understand the UNM investment thesis, we must dissect The Company's business model. Like any other insurance company, UNM collects premiums from customers (in their case small to large enterprises) and invests them primarily in fixed-maturity securities. If the insurance company can steadily grow premiums (UNM has grown premiums by 3% since 2020), while maintaining a good risk profile and investing these premiums successfully, then the insurance company can be extremely profitable. For FY 2022, UNM received $9.6 billion in premium income while paying out / reserving benefits amounting to $6.9 billion. Furthermore, The Company's investment profile looks like the following:

Investment Portfolio (UNM 2023 Outlook Meeting)

The majority of UNM's portfolio is in corporate bonds, and private placements are the runner-up. Their book has a yield of 4.6%, which is strong in comparison to industry peers Primerica (PRI) with an average yield of 3.44%, Lincoln National (LNC) at 4.18%, Globe Life Inc. (GL) with a book yield of 5.19%, and Aflac Incorporated (AFL) with a book yield of 5.15% in its U.S. segment. The opportunity for these companies, along with UNM, is to increase their book yield by locking in higher yields as the U.S. Federal Reserve is raising interest rates. UNM CFO, Steve Zabel, said the following regarding the investment portfolio on the Q4 earnings call:

"Moving now to investments; we continue to see a good environment for new money yields and risk management. Purchases made in the quarter continue to be at levels above our portfolio yield, and we experienced an overall increase in portfolio yield in the fourth quarter. In addition, we are pleased with the ongoing progress with our interest rate hedge program for long-term care."

A Double-Edged Sword:

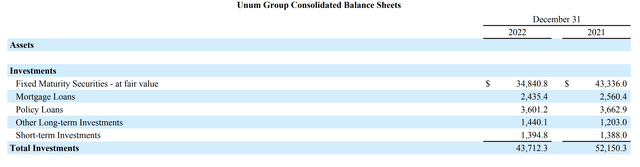

Since interest rates are rising sharply, bond prices are falling sharply. This is the other edge of the interest rate's sword. As an investor in UNM, you need to be aware of the unrealized losses that The Company has built up in its fixed-income portfolio.

Change in Investment Value (Unum Annual Report 2022)

In 2022, The Company has $8.5 billion less in its fixed-maturity portfolio (based on the change in fair value) compared to the prior year. As rates continue to rise, I expect the value of their investment portfolio to continue decreasing. Rising rates are an inherent risk factor in the insurance business as, for example, AFL has a fixed-maturity portfolio that went from $94 billion to $72 billion during the same period. LNC also experienced losses on its balance sheet, in which its fixed-maturity portfolio moved from $118 to $99 billion in fair value. Important to remember, though, is that the insurance industry is not affected nearly as much to rate rises as the banking industry. Banks, just like insurance companies, are sitting with huge unrealized losses on their balance sheet. The key difference between a bank is that they operate on a trust-based system. As soon as one depositor is worried about their bank's financial position, so are the depositor's neighbors, friends, and colleagues - this phenomenon forces the bank to realize its losses to pay back depositors. The insurance industry offers, on the other hand, a sticky product - basically a contract - that locks their customer's money up which they can invest into fixed-maturity assets, among others. Therefore, insurance companies cannot experience a 'run', in which customers demand their money back which would also force insurance companies to realize their losses. Instead, insurance companies experience a stress test when they need to pay out a large amount of benefits, which can be due to systemic factors such as the pandemic. UNM experienced a covid shock because it had to pay out a large number of claims for covid sickness and covid deaths - a phenomenon that raised their 'Benefits & Change in Reserves' item on the balance sheet by a staggering $1.5 billion.

In short, UNM and its peers should experience a net gain in the long run from rising interest rates. Since these companies don't have the same inherent risk as banks, they will be able to absorb losses in the short term and gain on higher-yielding portfolios in the long run.

Worries Subdued:

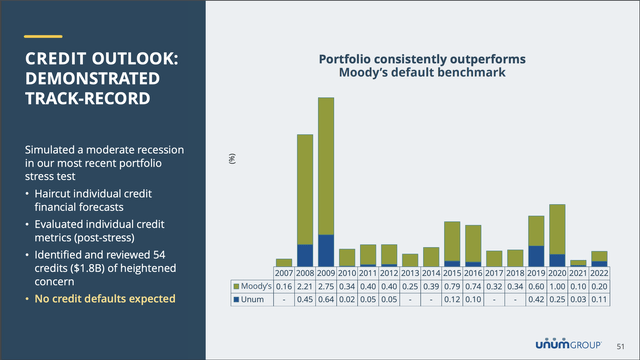

Moody's, the bond-rating agency, publishes a monthly default risk % in the overall market. UNM triumphed over their portfolio default risk track record in comparison to Moody's benchmark all the way back to 2007 in their most recent investor presentation.

UNM Default Risk (2023 Investor Presentation pg. 51)

As you can see, UNM has had a considerably low default risk. I have followed this company since 2020, and I believe its track record is in part due to the prudent nature of the management team. This year, in the wake of the fastest rate hike cycle in the United States' recent history, The Company is hedged against the risk. Steve Zabel continues on the earnings call:

"We are pleased with the ongoing progress with our interest rate hedge program for long-term care. Since the start of 2023, we continued to expand the program and entered into an additional $200 million of treasury hedges, bringing the program to approximately 25% of near-term estimated investable cash flows in Unum America."

With very significant yet appropriate hedges in place, The Company is not running any large risk against further rate hikes.

Unum Group's Service Product:

UNM has doubled its investment rate since 2019, chiefly on technology platform R&D. Unknown to most is that UNM is a leading Leave Management solutions provider as well as a Coordinated Enrollment provider (Investor Presentation pg 28). UNM is using the technology to expand its value-added to employers and employees, which can create a platform ecosystem dynamic in which the employer becomes locked into the offering. The broad range of their offering and incredible market share in the employee benefits market make this Company unique.

Valuation:

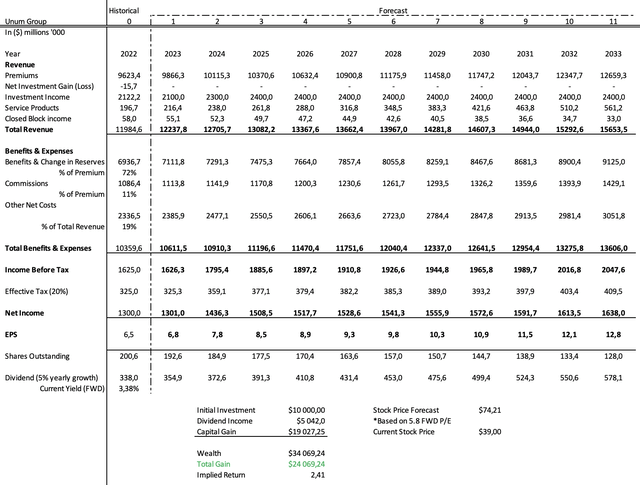

The Company is expecting an ROE between 17-19% for FY 2023 (pg. 24). Furthermore, the stock is trading for a forward P/E of 5.63 and a forward dividend yield of 3.47%. The Company will be raising its repurchase program run rate by 50% in the latter half of this year and is planning to continue to increase the common stock dividend (pg. 14). This is a sign that The Company financials are strong since it is both returning capital to shareholders while investing in its core business. I have complimented the article with a ten-year projection of The Company's income statement, in which I will now present my assumptions.

- Premiums will grow 2.5% per year

- Service Products as HR management will grow 10% per year in line with the industry (pg. 19)

- The closed block segment will decline -5% per year

- Share repurchases will amount to 4% per year

- Dividends will grow by 5% per year

- The final valuation is based on a 5,8 FWD P/E

An important note is that Unum includes investment income from the closed block segment, which amounted to $58 million in 2022, and the Unum U.S. segments fee-based leave management service which amounted to $196.7 million in 2022 in "Other Income". UNM's closed block segment will continue to decline due to a reinsurance agreement that they entered into during 2020 - in short, they cede 75% of their insurance premiums to the reinsurance company Global Atlantic Financial Group. Since their service product is growing on a stand-alone basis, I disaggregate "Other Income" in my forecast.

In all, I forecast that a $10,000 investment will amount to $34,069 in 2033.

Conclusion:

While I am optimistic about Unum's long-term growth drivers, the current macroeconomic headwinds will lead to further declines in The Company's bond portfolio as well as higher unemployment, which both have adverse effects on the employee benefits insurance company from Chattanooga, Tennessee. UNM is completely investable at its current valuation of $7.5 billion - the stock could even appreciate by 2,4x over the next ten years -, but I believe UNM stock could continue its recent downtrend based on the current investor sentiment. The insurance industry is facing similar declines in their asset portfolios to banks, therefore the negative investor sentiment is even more likely to spread to UNM. In all, I recommend holding off from investing for the time being, but be sure to keep a keen eye on UNM as a long-term investment.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of UNM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.