TMV: Continue To Buy Aggressively On Tradeable Bottoms

Summary

- Although prices may dip short term, we believe Direxion Daily 20+ Year Treasury Bear 3x Shares ETF will continue to rally.

- Recent U.S. bank bailouts are inflationary in nature and bullish for TMV.

- More and more U.S. dollars continue to chase U.S. goods. This is confirmed through a low U.S. savings rate and high credit card debt.

richcano

Intro

We last wrote about Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA:TMV) in August last year, when we stated that momentum was likely to continue in the leveraged short bond fund. At the time, we reiterated our BUY call in the short instrument (the price of TMV at the time was trading at approximately $103 per share). Although shares of the ETF have traded in a rangebound fashion over the past few months, TMV has still managed to return just over 11% over the past 7 months or so. In fact, the return on investment was actually 74%+ after a mere 2 months, as TMV rallied sharply into a November top of approximately $180 a share. Since then, we have pulled back substantially (the current price is approximately $113 a share) but we still maintain shares of TMV (over the long term) and will trade much higher here.

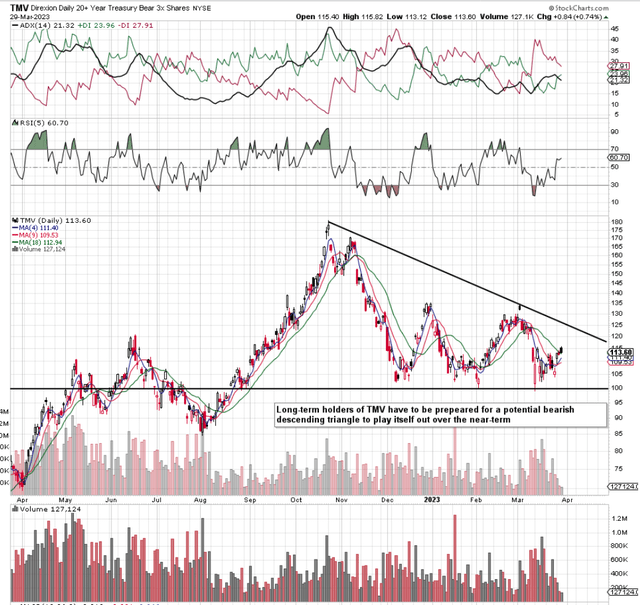

Despite our long-term bullishness, most investors will not be able to handle the volatility which TMV brings to the table, which is why one must have a clear time horizon on how long one is willing to hold this leveraged fund over time. Take the present scenario for example. As we see below, shares of TMV are potentially undergoing a bearish descending triangle as underside support close to the $100 level has been threatened on multiple occasions over the past three to four months. Suffice it to say, the best way to trade TMV is to buy when the 4-day moving average is above both the 9-day & 18-day (confirmed buy signal when the 9-day also crosses above the 18-day) and liquidate when the opposite holds true. This ensures you will be holding the fund for short-term periods (Limited Decay) and you always will be trading in alignment with the established trend.

TMV Technical Chart (StockCharts.com)

Over time, however, we believe rallies will continue to be much stronger in nature than TMV's corresponding declines. Here is some commentary that points to the same.

Recent US Bank Failures Is Inflationary

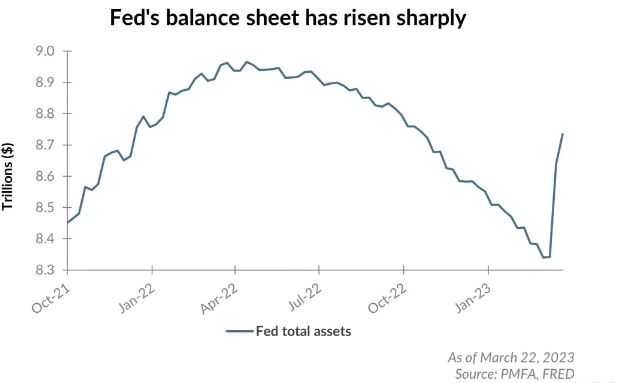

After the recent bank failures in the U.S., the U.S. government rushed to assure that depositors' funds were safe in those institutions. Therefore, U.S. bondholders (or anyone owning U.S.-denominated assets) need to ask themselves where did this bailout money come from. The reason is that if it was created (which looks likely considering the recent spike in The Federal Reserve's balance sheet), this rescue will end up being inflationary in nature.

Federal Reserve Balance Sheet (fred.stlouisfed.org)

Now, although the Federal Reserve raised interest rates last week by one quarter percentage point, the hike fell well short of initial expectations. More importantly, though, consensus is now only predicting one further one-quarter interest rate hike in 2023. This is bullish for a short bond fund such as TMV because the Fed still has not managed to bring interest rates above the current prevailing rate of inflation in the U.S. and more importantly change public perception with respect to how consumers spend U.S. dollars.

Suffice it to say, given how delicate the banking system is, we believe the best-case scenario for the U.S. interest-rate wise is a Fed fund rate of just over 5%. With reported inflation at 6%, this will not be enough to get consumers, in general, to start saving dollars instead of spending them. This is backed up by the very low savings rate in the U.S. along with the very high spending rate (both of which are typical in high inflation environments when currency holders do not want to hold cash).

What about a worst-case scenario however in the banking system? What if contagion bears its ugly head and the system needs more backstopping by the Federal Reserve to ensure capital is protected? This is when inflation could really turn into high gear, which would be bullish for TMV.

Therefore, TMV should continue to do well on two fronts. Rising interest rates (although now at a lower rate) will continue to suppress bond prices, and nominal returns will continue to trail inflation rates. These trends are not conducive to long-bond returns, which is why TMV should continue to be bought aggressively on tradeable bottoms.

Conclusion

Although Direxion Daily 20+ Year Treasury Bear 3x Shares ETF has traded in a rangebound fashion over the past 3 to 4 months, quantitative tightening in the U.S. seems to be at the end of its cycle. This has ramifications for bond markets in that if inflation starts accelerating once more, a short-leveraged fund like Direxion Daily 20+ Year Treasury Bear 3x Shares ETF should do very well. We look forward to continued coverage.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TMV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.