A New Reason To Be Bullish On Medical Properties Trust

Summary

- Medical Properties Trust announced that it struck a deal to sell off its assets in Australia, enabling it to pay off a large amount of debt.

- Cash flow is likely to fall in response to this, but the transaction should have a net positive impact on leverage.

- This further de-risks the business and justifies some rather attractive upside moving forward.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Solskin/DigitalVision via Getty Images

March 29th proved to be a really good day for investors in Medical Properties Trust (NYSE:MPW). Even though the news was not confirmed while the market was open, the company saw its share price close up 3.8% in response to a report saying that the firm had decided to sell off its assets in Australia and that it would use those proceeds to pay down debt. Given the amount of leverage the company has, this is a wise move to make. It will have a marginal impact on cash flows based on my assessment. But the reduction in overall leverage and the impact it will have on the company's valuation should more than make up for this. This further solidifies my view that the company is a ‘strong buy’ prospect at this time, and it's making me consider adding further to my position moving forward.

A great development from down under

The first real discussion that I could dig up involving Medical Properties Trust possibly selling its properties in Australia came from BofA Securities analyst Joshua Dennerlein when he downgraded the company in the middle of March. In his downgrade, he cited that new debt costs for the company could be in the range of 10% to 11% as opposed to the 3.5% currently in place. Of particular interest was the company's Australian term loan for roughly $817.6 million. Thanks to the timing of when that loan was struck and some financial move on management's part, that loan had a locked-in interest rate of only 2.45%. As I highlighted in a recent article on Medical Properties Trust, it would not take much of a change in cash flows for the company to no longer be able to afford the distribution it's paying out. And an interest rate increase of even 5% would require $40.9 million in additional interest expense on that particular term loan each year.

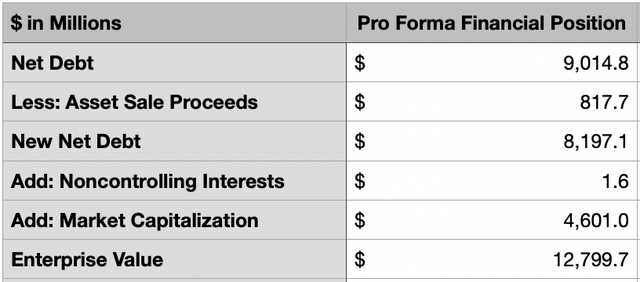

In his downgrade, Dennerlein estimated that the healthcare REIT should be able to monetize those assets for around $655 million this year. Part of the surprise move higher, it would seem, stems from the fact that, on March 29th, management struck a deal to sell the assets for AUD$1.2 billion. That happens to match the cost of the term loan that the company currently has. Based on exchange rates as of the end of 2022, this would translate to proceeds of roughly $817.6 million. Irrespective of what exchange rates look like between now and when the company officially divests of these properties in the second half of this year, the fact that these numbers match means that the company will be able to fully prepay the term loan, effectively reducing net debt for the company from $9.01 billion to just under $8.20 billion.

This improves the firm’s picture

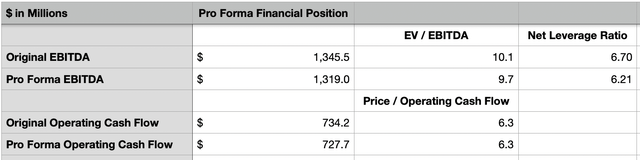

In the aforementioned article that I recently wrote about Medical Properties Trust, I made some calculations regarding what the cash flow picture of the company might look like in this current fiscal year. Based on my assessment, operating cash flow would come in at around $734.2 million, while EBITDA would come in at roughly $1.35 billion. Some revision here is needed based on this change. While it is true that a completion of the sale in the second half of this year that means that for a good part of the year the company will still have the impact of the assets on its books, we can calculate pro forma figures to see what the company should look like moving forward without the assets and the debt.

Author - SEC EDGAR Data

Using the 2.45% fixed interest rate on the Australian term loan, the reduction in interest that Medical Properties Trust should enjoy will be roughly $20 million annually. The tricky part is figuring out the impact that not having the assets on its books will have. According to the management team at Medical Properties Trust, the properties being divested generate annual rents of roughly $54 million. We don't know what the bottom line picture looks like. But a fair assumption to make would be that the operating cash flow from them would be a proportional share of the operating cash flow of the company relative to the revenue of the company. This would imply cash flow of about $26.5 million per annum being lost.

Author - SEC EDGAR Data

Running these numbers, we should end up with pro forma operating cash flow of $727.7 million. EBITDA, meanwhile, should fall to around $1.32 billion. This latter metric only is adjusted for the decline in cash flow that's now no longer going to be coming from the assets. There is no interest adjustment here since EBITDA, by definition, ignores interest expense. Using these data points, we can easily quantify the impact of this transaction. First, we should touch on leverage. In my prior article on the company that I already cited above, I figured that the net leverage ratio the firm for 2023 would be 6.70. Following the completion of this transaction, the pro forma figure would be 6.21. By comparison, the average net leverage ratio of the five healthcare REITs I compared the business too totaled to 5.95 in my prior article. This puts the company on decidedly better ground from a risk perspective, though I would make the case that further deleveraging would be wise and perhaps even necessary.

When it comes to valuing the company, the picture also looks quite positive. Even after seeing the share price rise and operating cash flow fall marginally, the firm is trading at a pro forma forward price to operating cash flow multiple of 6.3. Due to rounding, this is not materially different than if we didn't make the adjustment to cash flows. However, the EV to EBITDA multiple does now seem to come in at 9.7. That compares favorably to the 10.1 reading that we got using results that did not take into consideration this recent development.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Medical Properties Trust | 6.3 | 9.7 |

| CareTrust REIT (CTRE) | 12.8 | 35.5 |

| Omega Healthcare Investors (OHI) | 10.5 | 11.4 |

| Physicians Realty Trust (DOC) | 13.6 | 14.3 |

| Sabra Health Care REIT (SBRA) | 8.2 | 22.8 |

| National Health Investors (NHI) | 12.3 | 18.5 |

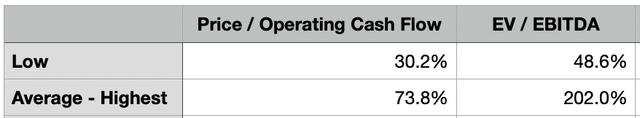

Repeating the process that I showed in my last article on the REIT, I created the table above. In it, you can see how shares of the other REITs stack up against Medical Properties Trust from a valuation perspective. Using both the price to operating cash flow approach and the EV to EBITDA approach, our prospect ends up being the cheapest of the group. In the table below, I then decided to look at a couple of different scenarios. In the most conservative scenario, I calculated what kind of upside potential the company might offer if it were to trade at the price to operating cash flow multiple or the EV to EBITDA multiple of the cheapest of the five competitors I looked at. And in the more aggressive scenario, I removed the most expensive of the five firms, averaged out the multiples of the other four, and assumed that Medical Properties Trust would trade at that average. What this shows is that, under the conservative scenario, Medical Properties Trust would have upside of between 30.2% and 48.6%. Meanwhile, using the more aggressive scenario, upside would be between 73.8% and 202%. Frankly, I do believe the entire space is undervalued at this time. As such, I would make the case that actual upside for the business could be greater than this range suggests.

Author - SEC EDGAR Data

Takeaway

Investors in Medical Properties Trust stock should be elated by these recent developments. There is some uncertainty, particularly around the impact that the transaction will have on the company's bottom line. It's also awful to see the firm paying off low-interest debt. But based on my own calculations, the overall benefit to the business should be positive on a net basis. This, combined with how cheap shares are, both on an absolute basis and relative to similar firms, further solidifies my view that the company offers investors attractive prospects moving forward and that it should be considered a ‘strong buy’ candidate for investors right now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.