What To Expect From The April JMMC - OPEC Meeting

Summary

- Russia’s production declined by 500,000 bpd in March. Seasonality supports the energy commodity.

- OPEC has cited China as a reason for no production increases. Chinese diplomacy could mean "special pricing."

- WTI and Brent crude oil found bottoms at $64.12 and $70.12. No sign of U.S. SPR buying.

- The trend is shifting higher. The cartel will fan the bullish flames to support Russia and squeeze the U.S. Prices remain closer to the March 2023 low than the March 2022 high.

- Long oil could be the optimal approach for the coming months.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Timon Schneider/iStock Editorial via Getty Images

OPEC's Joint Ministerial Monitoring Committee (JMMC) meets on Monday, April 3. At the previous February 1 meeting, the committee committed to cutting overall output by two million barrels per day.

While the oil market will be on the edge of its chair waiting for the results early next week, JMMC is nothing more than an advisory committee that makes recommendations to OPEC+. The cartel members and its leading non-member will not meet again until June. Production policy will likely continue to be a function of negotiations between Riyadh, Saudi Arabia, and Moscow.

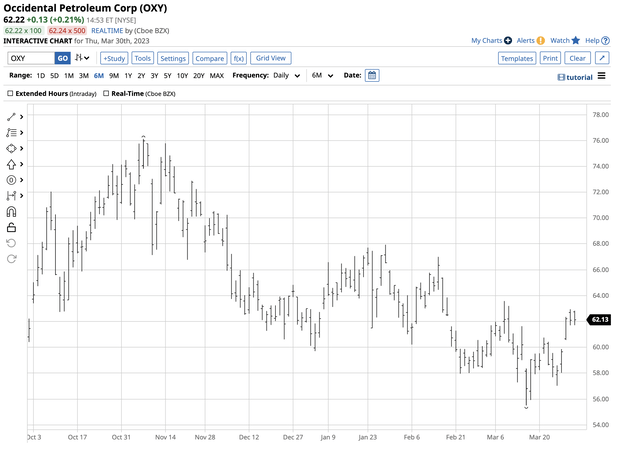

Meanwhile, technical and fundamental factors are pointing to higher oil prices after the price found what appears to be a significant bottom on March 20, 2023, when nearby WTI NYMEX futures fell to $64.12 and nearby Brent futures reached a $70.12 low. The United States Crude Oil Fund (NYSEARCA:USO) and The United States Brent Crude Oil Fund (NYSEARCA:BNO) are the ETFs that follow the short-term price action in WTI and Brent futures. Occidental Petroleum Corp. (OXY) has become Warren Buffett's favorite play in the oil sector.

Russian production and seasonality

As the crude oil market moves into 2023's second quarter, gasoline demand will likely rise as the weather entices drivers to put more clicks on their odometers. The spring and summer are typically the peak driving season, leading to increased U.S. gasoline and crude oil demand.

The JMMC will discuss the current petroleum market fundamentals early next week. Still, the most influential non-member made a significant statement about production policy since the February 1 meeting. Russia cut its oil production by 5%, or 500,000 barrels per day, on February 10. At the same time, Russian Oil Minister Alexander Novak said Russia would "not sell oil to those who directly or indirectly adhere to the principles of the 'price cap'" at $60 per barrel.

The odds favor a JMMC recommendation of continuing the current production policy at the April 3 meeting.

China warms up to OPEC

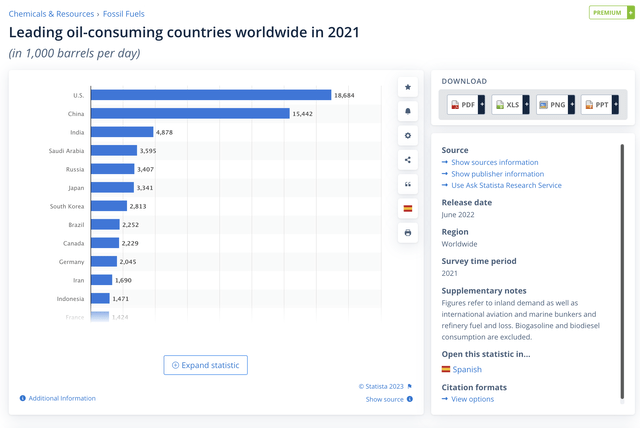

Over the past year, OPEC+ has consistently cited weak economic conditions in China for its production cuts.

Daily Oil Consumption by Country (Statista)

The chart shows while the U.S. remains the world's leading crude oil consumer, China is a close second. The end of COVID-19 protocols will likely increase China's petroleum demand.

Meanwhile, China's recent deals with Saudi Arabia and Iran and its "no-limits" alliance with Russia put the significant oil consumer in a position to influence crude oil production.

Chinese diplomacy, establishing close ties with Russia, Saudi Arabia, and Iran, places China in a pivotal position as OPEC+'s leading customer. The net meeting of the cartel's Joint Monitoring Committee (JMMC) was on April 3. Over the past years, production decisions have been a function of negotiations between Riyadh, Saudi Arabia, and Moscow. While Russia is not an OPEC member, the Russians are the +, as they have cooperated with and driven output decisions since 2016.

The continuing war in Ukraine has caused Russia to use crude oil, gas, and other commodities as economic weapons against "unfriendly" countries supporting Ukraine. Russia, the Saudis, and Iranians are likely selling oil to China at below-market prices while working to keep international prices at high levels to punish the U.S., Western Europe, Japan, and other countries that have sanctioned Russia.

WTI and Brent crude oil found bottoms

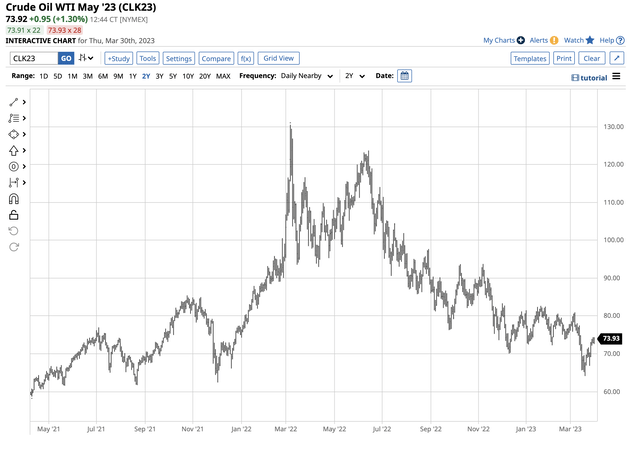

After reaching the highest price since 2008 in March 2022, nearby NYMEX WTI futures ran out of upside steam.

Two-Year NYMEX WTI Crude Oil Futures Chart (Barchart)

The two-year chart highlights the bearish pattern of lower highs and lower lows that pushed NYMEX futures to a $64.12 low on March 20, 2023. The price dropped 50.9% from March 2022 through March 2023.

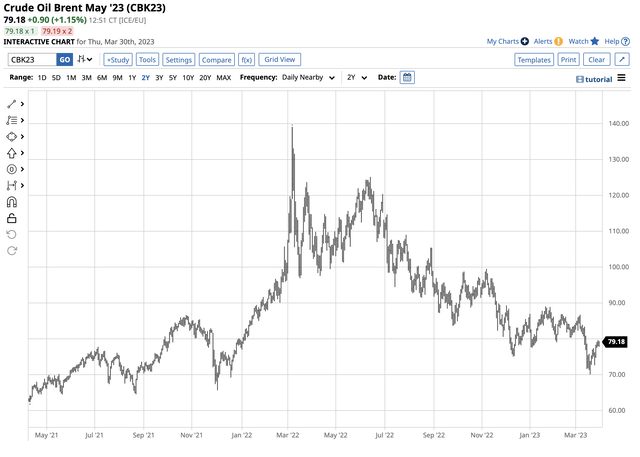

Two-Year ICE Brent Crude Oil Futures Chart (Barchart)

Over the same period, nearby Brent futures fell from $139.13 to $70.12 per barrel or 49.6%.

After reaching the most recent lows on March 20, WTI May futures were at the $73.92 level on March 30, with Brent at $79.16 per barrel. The leading crude oil benchmarks increased by 15.3% and 12.9%, respectively, since the lows. Meanwhile, the U.S. SPR sales that took the reserves from around the 595-million-barrel level in early 2022 to 371.6 million barrels as of March 24 weighed on petroleum prices. The Biden administration sold from the SPR to push prices lower and control inflation and had stated it would replace the sold barrels at $70 and below. Crude oil hit its most recent low during the week of March 20, and while the administration has not yet reported any buying, the price action implies upward pressure below the $70 level.

The trend is shifting higher

The price action over the past ten days shows the bearish trend is attempting to turn bullish. The first technical resistance level in the NYMEX WTI futures is at the March 7, $80.94 high. Above there, the January 23 $82.64 high is the next technical hurdle.

In Brent, resistance is at $86.75 per barrel, the March 7 peak, and $89.09, the January 23 high. A move above these technical barriers will end the year-long bearish trend in the crude oil benchmark futures markets.

U.S. energy policy under the Biden administration has shifted pricing power to the international oil cartel. The EIA recently reported that U.S. output stood at 12.2 million barrels per day as of the week ending on March 24. Meanwhile, in 2022, the EIA reported the U.S. consumed an average of 20.28 million barrels per day, making the U.S. dependent on foreign crude oil production.

OPEC's mission is to provide a "steady income to producers and a fair return on capital for those investing in the petroleum industry." Reading between the lines, the cartel's goal is the highest possible oil price that "balances" supply and demand fundamentals. At below $80 per barrel on March 30, oil prices are much closer to the March 2023 lows than the March 2022 highs, creating no reason for the cartel to increase output. Moreover, Russian influence and the bifurcation of the world's nuclear powers make petroleum an economic weapon. Higher oil prices increase Russia's ability to fund its war in Ukraine, even if supplies flowing to China are at discounts to the international price benchmarks.

The cartel could leave production policy at current levels as the U.S. SPR at the 371.6-million-barrel level is at the lowest since December 1983, and the U.S. must replace those barrels over the coming weeks and months. If the price returns below $70, the U.S. SPR buying will provide support without OPEC's intervention. If prices rise, the Biden administration is out of bullets for suppressing petroleum prices. The bottom line is OPEC+'s alignment with China/Russia via the recent Chinese diplomatic moves creates an environment to squeeze U.S., European, and Japanese consumers and other "unfriendly" countries supporting Ukraine.

Long oil could be the optimal approach

The most direct route for a risk position in crude oil is via the NYMEX WTI and ICE Brent futures and futures options contracts. Crude oil is a highly volatile commodity, and futures involve margin and leverage, making them inappropriate for many investors and speculators. The United States Oil Fund (USO) and the United States Brent Oil Fund (BNO) are ETF products that track oil prices on a short-term basis.

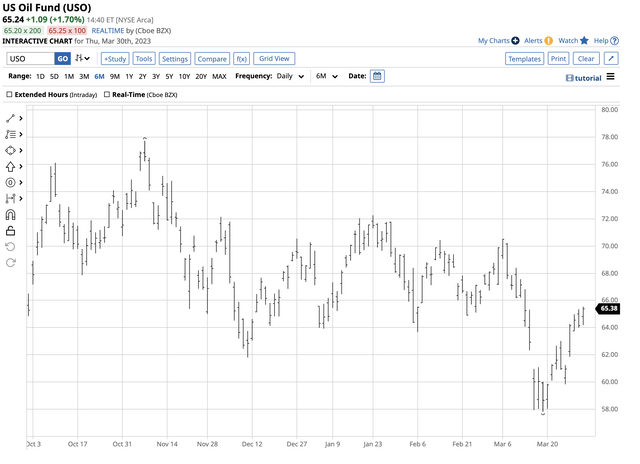

At $65.24 per share, USO had over $1.592 billion in assets under management. USO trades an average of more than five million shares daily and charges a 0.81% management fee.

Short-Term USO ETF Chart (Barchart)

Over the period when NYMEX crude oil rose 15.3% from March 20-30, USO rose from $58.05 to $65.54 per share or 12.9%.

Short-Term BNO ETF Chart (Barchart)

Meanwhile, BNO rose from $23.84 to $26.33 per share, or 10.4%, while Brent futures appreciated by 12.9%. While crude oil trades around the clock, the ETF products are only available during stock market hours, accounting for some differences.

Warren Buffett remains one of the greatest value investors in history. Over the past months, the Oracle of Omaha has accumulated Occidental Petroleum shares (OXY). He recently added another 3.7 million shares to his position, boosting his stake to 212 million, or 23.6%.

The chart highlights OXY's rise from $55.51 on March 15 to its latest high at $62.94 on March 29, a 13.4% increase. At over the $62 level, OXY shares were sitting near the recent high. Warren Buffett believes OXY will profit from higher crude oil prices.

The upcoming JMMC meeting is not likely to change OPEC policy. Markets reflect the economic and geopolitical landscapes, which remain bullish for the energy commodity as we move into Q2 2023.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.