Raiffeisen: Still Not Ready To Sell Its Russian Division

Summary

- Raiffeisen Russian division might be sold at a steep discount.

- There is pressure from the ECB (and the US) to exit Russia.

- Ex-Russia, Raiffeisen reported solid results. However, we prefer other names in the banking & diversified financial sector.

Sergio Delle Vedove/iStock Editorial via Getty Images

Here at the Lab, we recently deep-dived into the EU banking sector and we have not forgotten about Raiffeisen Bank International AG (OTCPK:RAIFF, OTCPK:RAIFY). Last year, it was a good call to remain neutral and as a reminder, our main concerns were due to its economic exposure toward Russia. During today's shareholders' meeting and after the ECB pressure, Raiffeisen Bank International said it plans to sell or spin off its Moscow subsidiary. We recently commented on SocGen, but it is important to mention that Raiffeisen is not the only bank still doing business in Russia, there is also Unicredit. Looking to the press release, the CEO confirmed that "RBI Group will continue to progress potential transactions which would result in the sale or spin-off of Raiffeisenbank Russia".

Raiffeisen president, Erwin Hameseder, once again during the meeting, accused the ECB of "black & white thinking" and explained how most of the Western firms did not leave Russia. Compared to the CEO's words, Hameseder specified that Raiffeisen will continue to reduce its activity in Russia but will maintain some activities in order not to lose its banking license.

In addition, we should also mention that a potential sale would require Russian government approval and according to Reuters, this transaction would likely be at a discount of at least 55%.

On the other hand, it seems that a Russian subsidiary spin-off would lead to a likely IPO in Vienna, and this would be the preferred shareholder's option at this stage (thanks to this latest news, Raiffeisen is currently up by almost 5%). However; both possibilities may not come to fruition and Raiffeisen has not yet set a timetable for any sale agreements.

The ECB has been monitoring banks' exposure to Russia both direct (through subsidiaries) and indirectly. In this context, the Supervisory Authority would appreciate a rapid exit from the country to neutralize the risks. But, leaving the country is a very difficult strategy to implement, especially after the last summer decree with Vladimir Putin's government effectively froze Western financial groups' exits. In addition, there are no investors on the horizon willing to take over from European banks on assets for an uncertain value. This is demonstrated by the fact that so far only the French SocGen has left Russia, collecting a heavy loss.

In the meantime, Raiffeisen become one of the few channels for international payments in and out of Russia and recorded record fees. In the press release, and considering this pressure from regulators and governments Raiffeisen announced a strategic review by cutting the loan Russian portfolio and further "reduce the overall volume of foreign currency transactions. This will lead to a reduction in the size of the RBI Group's payments business".

Our analysis and conclusion

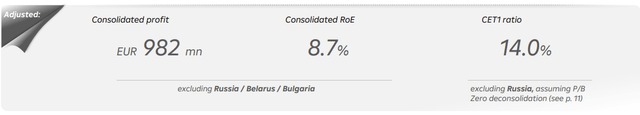

As a memo in 2021, RBI's loan to Russia and Ukraine was for €11.6 billion and €2.2 billion which was respectively 11.5% and 2.2% of RBI's total loan book value. Looking to the latest 2022 annual report, Russia's loan book value was down by 30% with €481 million in cost of risk, while Ukraine's capital situation remained solid with a supportive cost of risk. Last time, we anticipated that Raiffeisen Common Equity Tier 1 ratio was solid and the bank was "robust enough to support any blocking of operations in the Russian area". Our assumption was a minus 100 basis points from the group's CET 1 ratio; however, the impact was more pronounced. In detail, the CET1 ratio reached 16.0% and was driven by strong consolidated profit, but according to the company's release, including Russia, the CET1 ratio is at 14.0% (so minus 200 basis points). In our last analysis, we should recall that the company's solidity was at 13.1%, and Raiffeisen managed to increase its profit and recorded a net interest income of €3.3 billion, up 37% on a yearly basis. This was due to volume growth and higher interest rates. Downside risks are equally important and given the recent EU banking sell-off and our insightful analysis providing MACRO and MICRO upside (ISP, BNP, Crédit Agricole, UniCredit, and SocGen), we continue to have an equal weight valuation on Raiffeisen Bank International AG.

Raiffeisen Financials in a Snap

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.