Verano Holdings: Misplaced Cannabis Fears

Summary

- Verano Holdings Corp. reported another solid quarter, though revenue growth rates are down to only 7%.

- The MSO generated $79 million of adjusted EBITDA profits in Q4 2022 and guided to upwards of $70 million in free cash flow in 2023.

- Verano Holdings Corp. stock is cheap at 4x EV/EBITDA profits.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Learn More »

GoodLifeStudio

The whole cannabis space has been decimated to the point where stocks are trading at extremely low multiples of adjusted profits. Verano Holdings Corp. (OTCQX:VRNOF) is a prime example, with the market cap dipping below $1 billion while profits are being racked up. My investment thesis remains ultra-Bullish on the stock of the MSO (multi-state operator), with knowledge investors might not step into the sector until federal legislation occurs.

Ramping Up Cash Flow

While the cannabis space doesn't have the same growth metrics now with pricing pressures in numerous states, the market is clearly overlooking the profit profile of the MSOs. Verano reported a huge adjusted EBITDA profit for the year that appears very disconnected with the stock valuation below $1 billion.

Verano reported Q4'22 revenues grew 7% to reach $226 million. The MSO is now running at a $900 million annualized run rate to nearly match the market cap.

The stock possibly trades below $3 due to the market being obsessed with GAAP profits in the current period and less interested in adjusted profits, such as adjusted EBITDA. For the December quarter, Verano reported a large loss due to a $229 million goodwill impairment charge.

As with most small cap stocks, GAAP numbers just don't work due to these non-cash charges impacting the view of the business. Verano actually reported an adjusted EBITDA profit of $79 million for a 35% margin despite some inventory hits to gross profits.

The difference between large GAAP losses and a strong adjusted EBITDA margin shouldn't be lost on cannabis investors. GAAP numbers don't provide the best metrics to value a MSO stock.

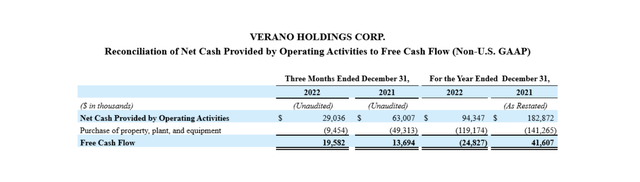

Verano was already free cash flow positive at $20 million in Q4 2022 and the company forecasts a solid increase in 2023. The company only forecasts capex spending for the year of $25 to $50 million.

Source: Verano Q4'22 presentation

The combination of positive operating cash flows and the end of the big capital spending phase in the cannabis space will leave Verano with a strong cash flow profile. The company will only spend $5 to $10 million per quarter in capex this year while generating up to $30 million in operating cash flows last quarter.

Along with business catalysts from the adult-use launch in Connecticut and Maryland, Verano is forecasting free cash flow ("FCF") generation for the year at $50 to $70 million. The ability to product positive FCF will help the MSO reduce their outstanding debt and cost of capital while smaller peers struggle with financing growth.

New Jersey’s recent legislation around 280-E and Illinois’ progress on the same issue is a big help to the prior cash flow issues in the sector. Verano spent $65 million on income taxes last year for a company reporting a large operating loss.

One should assume the FCF target for 2023 is compressed due to elevated 280-E tax payments. After Q3'22 (last available number), the income tax payable liability was $222 million, and the company traditionally pays the income taxes for the prior year, suggesting 2021 taxes will be paid in 2023.

Deep Value

Similar to the whole MSO space now, Verano trades at a deep value. The company has 333 million shares outstanding, placing the market cap below $1 billion.

The stock only trades at 3x 2022 adjusted EBITDA of $335 million. The valuation is even more remarkable considering Verano now forecasts generating up to $70 million in positive FCFs in a year where the company will likely pay in excess of the $65 million paid for income taxes last year from the 280-E.

Verano does have a debt balance of $413 million with an offsetting cash balance of $85 million. The MSO has a net debt position of $328 million, placing the EV/EBITDA valuation at ~4x.

Either way, Verano is extremely cheap, and the valuation multiple will shrink from the MSO repaying up to $70 million worth of debt this year. On the flip side, the company has the potential to use the positive cash flows to virtually steal some distressed cannabis businesses unable to obtain the capital needed to expand.

Either way, Verano Holdings Corp. is in the drivers seat in this market along with other big MSOs, and the market will eventually figure out this valuation opportunity. Of course, investors following this sector for the last couple of years realize the lack of federal legalization or progress on banking regulations could lead to ever-lower stock prices.

Takeaway

The key investor takeaway is that Verano Holdings Corp. is far too cheap here at a deep discount to adjusted EBITDA profits. The large MSO is set to start generating large cash flows making the market fears over the cannabis stock very misplaced.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.