XSW: This Software ETF Could Struggle Amid Rate Hikes, Despite Growth Potential

Summary

- XSW invests in United States technology stocks that are primarily involved in software services.

- As the world digitalizes, the software industry continues to expand, and could accelerate even faster with the increasing influence and integration of artificial intelligence.

- Despite software’s strong growth forecasts, high inflation continues to take a toll on technology companies, which has so far manifested in XSW’s underperformance against its peers.

metamorworks

I rate the SPDR Series Trust - SPDR S&P Software & Services ETF (NYSEARCA:XSW) a hold for the time being, but this could be subject to change in the coming periods. However, I believe right now there are better alternatives that one could easily resort to.

My view on the technology sector remains bullish, and I believe industries like software have ample room for expansion in the long term. Especially with the concurrent growth of artificial intelligence and its integration into software systems’ development, software investors could experience notable profits in the long term. XSW unfortunately has some alternatives that have, in the last year, produced greater returns while having a similar composition to that of this ETF. Investors could therefore just as easily attain an alternative fund that could serve them better, as many technology securities continue to struggle in the current market. Therefore, it is hard to rate XSW ETF anything greater than a hold.

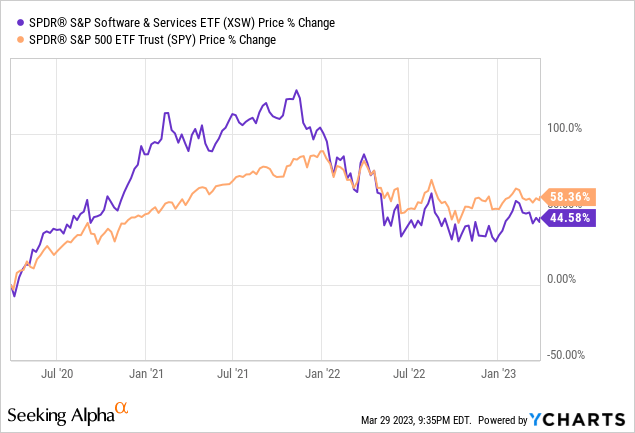

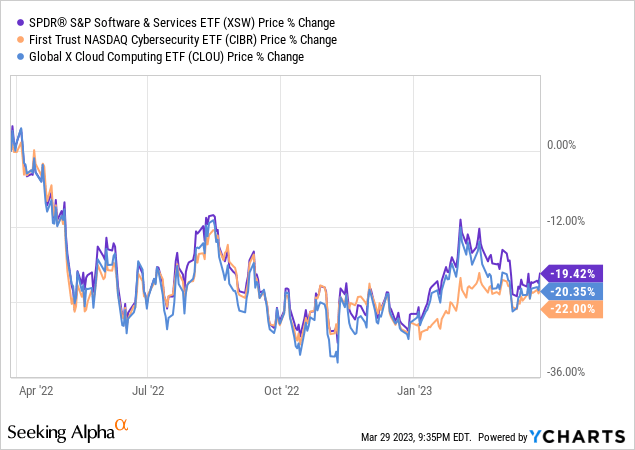

In this same regard, XSW is by no means a low-quality asset. I believe that investors could experience generous returns from this ETF as the market recovers and the software industry expands. XSW outperformed the broader market for the most part until the onset of the 2022 bear market. This shows that though recent macro events hurt this ETF, eventual market recovery could serve XSW quite well. This ETF has also slightly outperformed popular funds in other technology subsectors I’ve covered previously, including cybersecurity and cloud computing.

Strategy

XSW tracks the S&P Software & Services Select Industry Index and uses a representative sampling technique. This technique may provide investors with quality exposure to companies that better reflect this ETF’s fundamental goals and characteristics. This ETF invests in both growth and value stocks of varying market capitalizations. However, XSW might be more focused on growth stocks just based on this ETF’s low yield as well as the general growth-oriented nature of the technology sector.

Holdings Analysis

This ETF invests primarily in technology stocks. Within the technology sector, XSW’s holdings are focused mainly on software services and information technology (IT). These companies are located solely within the United States. Therefore, despite being capable of long-term growth, one should not expect this ETF to strongly diversify their portfolio on a sector or geographical basis.

The top 10 holdings in this ETF comprise 8% of the total portfolio, while the top 25 account for 19%. Therefore, XSW is not particularly top-heavy, and I would not consider concentration risk a remarkable caveat of this ETF. XSW’s weightings are also more dispersed than that of any ETF I have covered thus far, with not one single holding responsible for more than 1% of the total portfolio.

Strengths

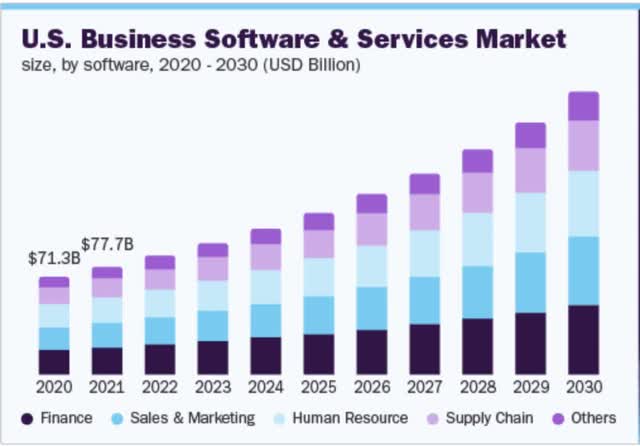

The software industry is well-positioned for growth in the long term, as displayed by its forecasts. The global business software and services market could grow to over $1.1T by 2030 at a CAGR of roughly 10%. Companies held in XSW could therefore experience greater profits, which could subsequently manifest in increased returns for investors.

United States Business Software & Services Market forecast (Grand View Research)

When dating the historical performance back to 2020, XSW outperformed its peers for the most part and emerged with the highest price after the 3-year run.

Therefore, this ETF could potentially come out on top of its peers in the long term, despite any bullish periods it may experience along the way. This could make XSW more attractive to long-term growth investors that are willing to possibly bear the brunt of market downturn along the way. Though this could be a quality long-term strength of XSW, fully realizing this strength might also require a certain amount of patience, trust, and emotional maturity.

Weaknesses

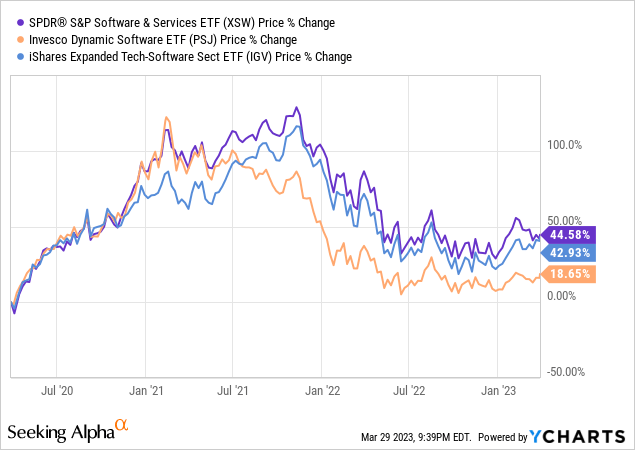

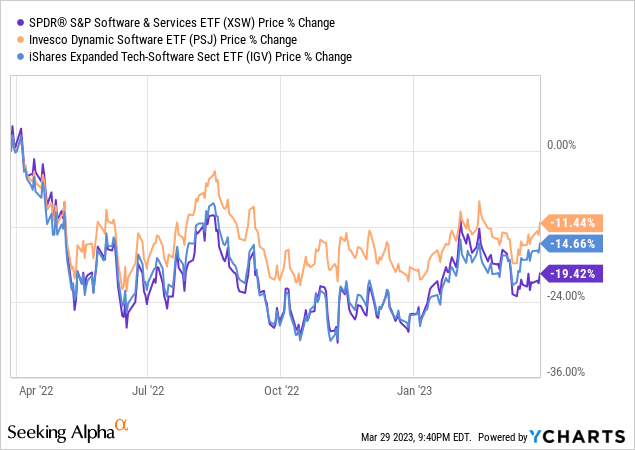

Though this ETF’s net price growth is positive and greater than that of peers over the past three years, XSW has also struggled in the past year amid high inflation. In the chart below, it’s evident that the onset of the 2022 bear market caused this ETF to dip below the Invesco Exchange-Traded Fund Trust - Invesco Dynamic Software ETF (PSJ) and the iShares Expanded Tech-Software Sector ETF (IGV).

XSW might therefore have a hard time prevailing amid the pressures of high interest rates, just based on how it has already adversely reacted to rate hikes. Though this doesn’t mean this ETF can’t generate quality long-term returns, investors can just as easily resort to PSJ as the very similar, but potentially safer alternative.

This ETF also has a very low dividend yield, which puts the majority of returns up to company growth. Growth remains difficult for many companies amid high inflation, and has shifted many investors’ focus toward value securities. Therefore, this aspect of XSW could deter value investors while also potentially sending growth investors to seek alternative funds.

Opportunities

This ETF could benefit from growth in the artificial intelligence industry. Artificial intelligence, particularly generative AI is a system whose capabilities and applications to everyday life continue to shock users. As this industry expands and gains traction, AI systems could pick up a prominent role in the software industry. Artificial intelligence systems have already shown to be capable of automating repetitive but essential tasks, such as data management and code generation. If AI is continuously proficient in this role, this could allow software engineers to focus more on greater, long-standing tasks like innovation and product development. This could ultimately increase the profits and accelerate the development of companies held in XSW.

Threats

Software systems are a primary target of cyberattacks, making their intellectual property like source code and trademarks somewhat vulnerable. Hacking has become a serious problem in recent years and is forecasted to increase in coming periods. The world becoming more reliant on technology has catalyzed systems like cloud computing. Though the cloud is revolutionary and used by many, its growth has also increased the amount of data stored in remote data centers that are susceptible to data breaches.

Many software companies store data in the cloud, making this data susceptible to breaches that could place these stocks in hot water. A cyber breach could generate costly repercussion expenses and legal liabilities, which together could threaten a company’s performance and reputation alike. As many stocks within XSW fit this description, investors might want to consider how hackers could threaten the software industry in the medium to- long term.

Conclusions

ETF Quality Opinion

XSW could provide investors with quality exposure to the software industry, which may see significant growth in the long-term as society and the workforce digitalizes. Though this ETF is currently underperforming the market and its peers, this trend could change as time passes and market conditions change. For these reasons, I plan to follow XSW closely.

ETF Investment Opinion

I rate XSW a hold. When rating ETFs in the past, it’s been hard for me to give any fund a greater rating than hold if it has at least one significantly better alternative. Furthermore, I believe this ETF could have a rough year ahead as elevated inflation continues to stifle the growth and performance of many technology companies. That does not mean this ETF can’t produce quality returns in the long-term, which is why I believe current owners should hold onto XSW.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.