Hycroft Mining: The Loss Widens And The ROM Operation Is History

Summary

- The loss from operations soared to $20.4 million in Q4 2022 as the ROM operation was shut down in December 2022.

- Cash declined to below $142 million and I think that there could be significant stock dilution in a year or two to fund the initial CAPEX.

- In my view, the momentum here is low, and this is crucial for exploration-stage mining companies.

- Short selling seems viable as the short borrow fee rate is below 6% but it could be best for risk-averse investors to avoid this stock.

- Forsaken Value and Yield members get exclusive access to our real-world portfolio. See all our investments here »

24K-Production

Introduction

I’ve written four articles on SA about U.S. gold miner Hycroft Mining Holding Corporation (NASDAQ:HYMC) so far, the latest of which was in November when I said that the company continued to bleed money while the initial drill results from its 2022-2023 exploration drill program were nothing special.

On March 28, Hycroft Mining released its annual report and I think that the Q4 2022 financial results were weak as the loss from operations soared to $20.4 million. In addition, cash and cash equivalents decreased to below $142 million and I think there could be significant stock dilution in a year or two. Let’s review.

Overview of the 2022 financial results

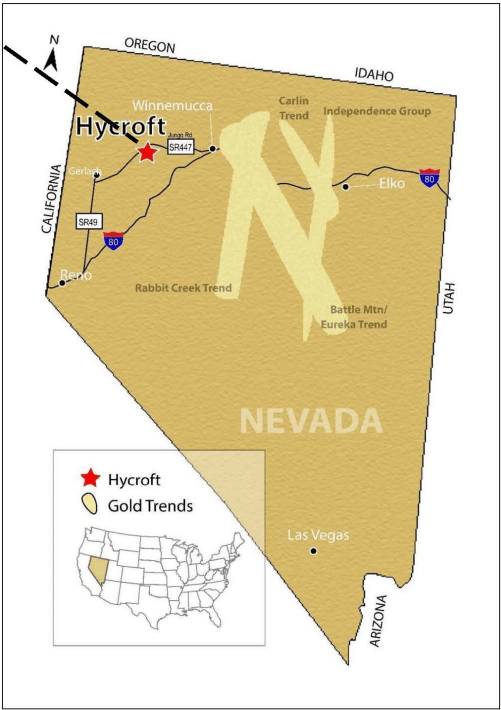

In case you haven't read any of my previous articles about Hycroft Mining, here's a short description of the business. The main asset of the company is a gold and silver project in the northern part of the state of Nevada named Hycroft Mine, where it had a pre-commercial scale direct leaching run-of-mine (ROM) operation until December 2022. The mine has historical production of around 2.1 million ounces of gold and 7.5 million ounces of silver and has been shut down several times so far, usually due to low gold prices. Its most active period was from 1983 to 1998 when it produced 1.2 million ounces of gold and 2.5 million ounces of silver.

Hycroft Mining

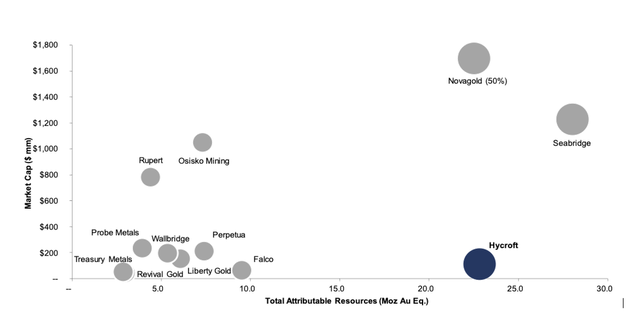

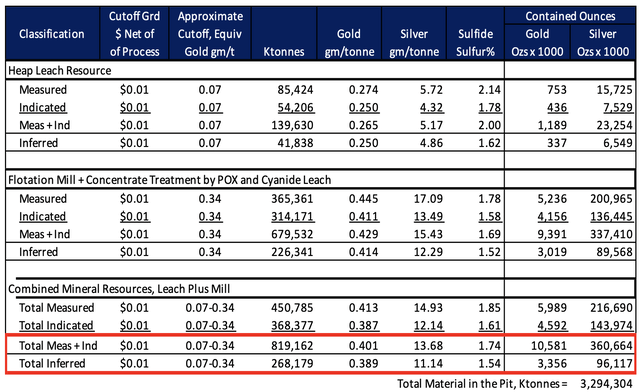

Today, Hycroft Mine is among the largest undeveloped gold and silver projects in the world with measured and indicated mineral resources of 10.6 million ounces of gold and 360.7 million ounces of silver and inferred mineral resources of 3.4 million ounces of gold and 96.1 million ounces of silver.

Hycroft Mining

The main issue here is that grades are low and the oxide ore is almost depleted. As a result, the small direct leaching ROM operation at the site was recently shut down and the company will need to build brand-new processing facilities for its vast sulfide resource.

Hycroft Mining

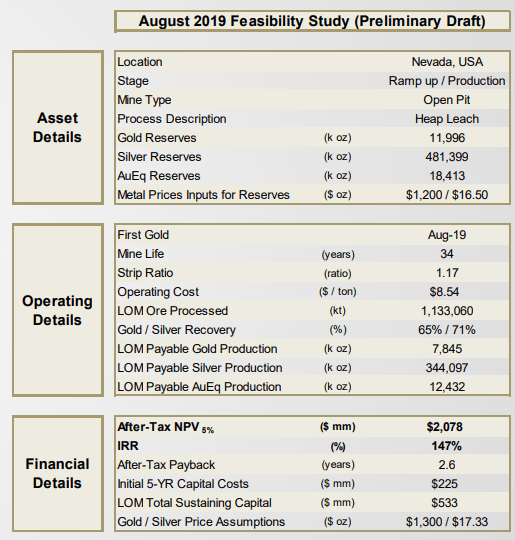

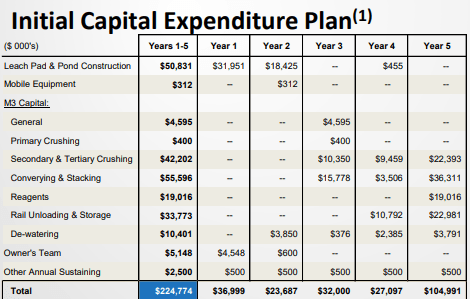

In March 2022, Hycroft Mining became a meme stock as movie theater chain AMC Entertainment (AMC) agreed to invest $27.9 million as part of a larger equity raise of $138.6 million. Many investors were expecting the mining company to use the fresh funds to put the Hycroft Mine back into commercial production. After all, Hycroft Mining released the results of a feasibility study for a heap leach mining operation in 2019, which is usually the last step before the construction of a mine. According to the feasibility study, initial CAPEX was estimated at $225 million over the first five years and Hycroft Mine would have a net present value [NPV] of over $2 billion at $1,300 per ounce of gold. At today’s gold price of over $1,900 per ounce, the NPV would be over $4.5 billion.

Hycroft Mining

Hycroft Mining

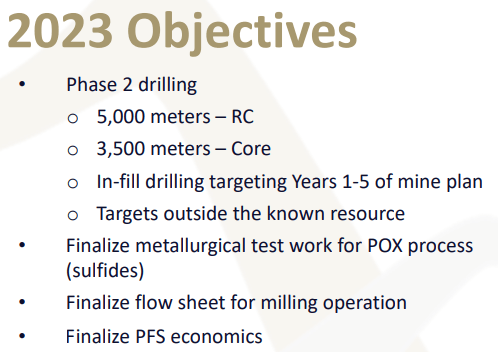

Yet, Hycroft Mining decided to use the proceeds from the equity raise on a drilling campaign ahead of a pre-feasibility study [PFS] focused on utilizing a milling and partial oxidation (POX) process for the sulfide mineralization. In my view, this is the right move as processing sulfidic ore is challenging and the recovery rate in the 2019 feasibility study was likely over-optimistic. You see, sulfide ore is refractory, which means that the gold particles are ultra-fine and this requires more sophisticated treatment methods in order to achieve oxide-ore recovery rates. In 2022, Hycroft Mining completed 25,000 meters of reverse circulation [RC] drilling and 4,000 meters of core drilling with the aim of extending mineralization and converting waste to ore. I think that the drill results were underwhelming as they boosted measured and indicated resources by just 0.4 Moz of gold.

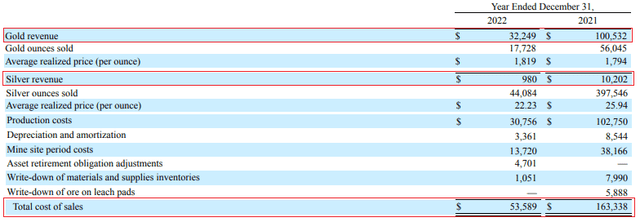

Turning our attention to the 2022 production results, Hycroft Mine produced a total of 14,032 ounces of gold and 37,281 ounces of silver in 2022. This is significantly below the levels from 2021 as grades fell and the ROM operation was shut down in December 2022. This led to a large increase in unit costs and the business was unprofitable in 2022 once again.

Hycroft Mining

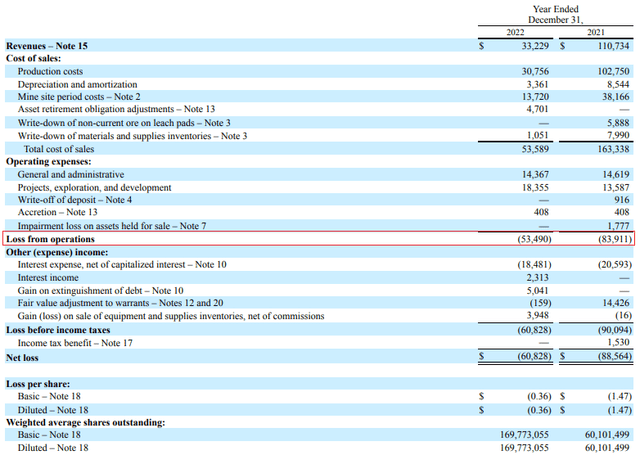

And with Hycroft Mining ramping up exploration expenses during the year, the loss from operations in Q4 2022 alone came in at $20.4 million. The amount for the full year stood at $53.5 million.

Hycroft Mining

Turning our attention to the balance sheet, cash and cash equivalents declined by $11.4 million quarter on quarter to $142 million as of December. I’m concerned that the company will need to tap into the equity markets to fund the construction of its mine and this could lead to significant stock dilution unless the share price increases over the coming months. Looking at the future, Hycroft Mining plans to complete 5,000 meters of RC drilling and 3,500 of core drilling in 2023 as well as finalize PFS economics. In my view, a construction decision could be taken in 2024.

Hycroft Mining

At the moment, we have no indication of the levels of initial CAPEX, NPV, and unit costs in the new study. In my view, it’s impossible to tell whether this is an economically feasible project, and considering there are few catalysts for the coming months, I think the momentum here is low. And momentum is crucial for exploration-stage mining companies. In view of this, I’m bearish on Hycroft Mining.

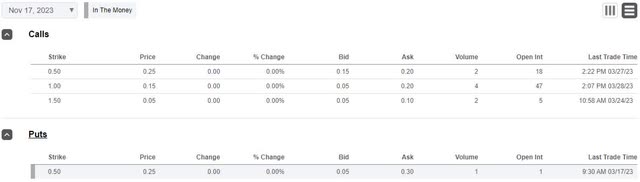

So, how do you play this one? Well, opening a small short position seems like a viable idea as data from Fintel shows that the short borrow fee rate stands at 5.79% as of the time of writing. However, the prices of commodities are notoriously volatile, and hedging opportunities here seem limited as call options are expensive at the moment.

Seeking Alpha

Looking at the risks for the bear case, I think there are two major ones. First, it’s possible that Hycroft Mining finds a large zone of oxide mineralization during Phase 2 of its 2022-2023 exploration drill program which is likely to boost the share price. Second, the share prices of microcap companies can sometimes increase for spurious and unknown reasons.

Investor takeaway

The operating loss of Hycroft Mining widened in Q4 2022 as the ROM operation came to an end and I think that Phase 1 of the 2022-2023 exploration drill program was underwhelming as measured and indicated gold resources didn’t increase by much. In my view, the momentum here is low and there are no catalysts on the horizon. That being said, short selling seems dangerous, and I think risk-averse investors should avoid HYMC stock.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Forsaken Value and Yield. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys. Both long and short ideas.

So, what can you expect to get from this service?

- Exclusive articles

- Access to my portfolio and watchlist

- Interviews, ideas, portfolios, watchlists, and comments from other investors I've invited to the service

- A chat room with access to me and the other investors

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.