ConocoPhillips: Further Decline Is Likely (Technical Analysis)

Summary

- The possibility of a recession in the United States affects oil prices and the profitability of ConocoPhillips.

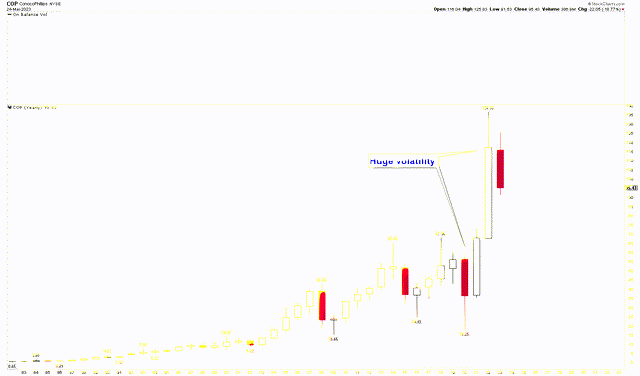

- A massive increase in ConocoPhillips' share price in 2022 indicates significant market volatility and the potential for a market correction.

- The emergence of an inside bar at the apex of ascending broadening wedge indicates that any drop below $91.53 might be a steep decline.

JHVEPhoto

This article provides financial and technical analysis to determine the potential future direction of ConocoPhillips (NYSE:COP). After the Covid-19 pandemic, the company generated substantial revenue in 2022 due to the rapid recovery of Crude Oil Futures (CL1:COM). However, the decline in oil prices during the fourth quarter of 2022 may impact profit projections for 2023. Moreover, the possibility of a recession in the United States could also affect the company's profitability and the stock price of ConocoPhillips. Oil prices are likely to fall further as a result of the symmetrical triangle's break, which will hurt ConocoPhillips. On the other hand, ConocoPhillips also produced an inside bar, indicating that a decline below $91.53 would result in a significant decline in the stock price of ConocoPhillips.

Financial Performance of ConocoPhillips

According to the latest financial statements, ConocoPhillips had $80.57 billion in total revenue and $18.68 billion in net income in 2022. This is a significant increase from the company's financial performance in 2021 when it generated $46.66 billion in total revenue and $8.08 billion in net income. The strong financial performance of ConocoPhillips in 2022 is attributable to the recovery of oil prices following the Covid-19 pandemic. The high revenue in 2022 was due to the company's strong revenue in the second and third quarters of 2022, which was $21.69 billion and $21.57 billion, respectively. However, the fourth quarter revenue for 2022 was $19.13 billion.

A significant decline in the oil price in the fourth quarter of 2022 suggests that ConocoPhillips may reduce the profit forecast. In addition, the company generated a record free cash flow of $21.63 billion in 2022, a 62.3% increase from 2021. The cash flow was sufficient to cover the company's capital requirements and was also distributed to shareholders in the form of share purchases and dividends. ConocoPhillips returned $15 billion to shareholders in the form of dividends, variable cash returns, and share repurchases. However, the free cash flow is also affected by oil prices and can change over time due to the volatility in the oil market.

Impact of Recession On ConocoPhillips

The Federal Reserve increased interest rates by 25 basis points last week, with a target range of 4.75 to 5%. Fed made a point during his press conference to control inflation. Additionally, he mentioned that tighter financial conditions and more stringent lending decisions by banks may have similar effects on rate hikes.

In my opinion, the Fed will likely pause after one or two more rate hikes, with tighter credit conditions slowing economic activity. The United States economic growth is slowing, and the risk of a recession in 2023 is increasing. The chart below shows the 10-year treasury constant maturity minus the 2-year treasury constant maturity, which is falling below zero, indicating the possibility of a recession in the United States. When the curve trades below zero, the United States enters a recession, as indicated by the shaded area in the following chart.

10-year Treasury constant maturity minus 2-year Treasury constant maturity (red.stlouisfed.org)

ConocoPhillips's stock price is significantly impacted by the possibility of a recession. During a recession, consumers reduce spending on oil and gas due to a decline in economic activity and job losses. This results in a decrease in the price of crude oil, which hurts the revenue and profitability of ConocoPhillips. The fluctuations in supply and demand can also cause significant short-term price swings, making it difficult for the company to maintain consistent profitability. Therefore, ConocoPhillips may face a challenging profit outlook for 2023 and 2024. Moreover, investors become risk-averse during a recession and may withdraw their investments from the stock market. This causes a decline in ConocoPhillips' stock price, regardless of the company's financial performance.

Given current conditions, it's reasonable to assume that crude oil prices have already peaked in 2022. While ConocoPhillips may seem like a good investment due to its current strong financial position, investors should be aware that this level of profitability is unlikely to persist over a long period of time.

Bearish Development in Oil Prices

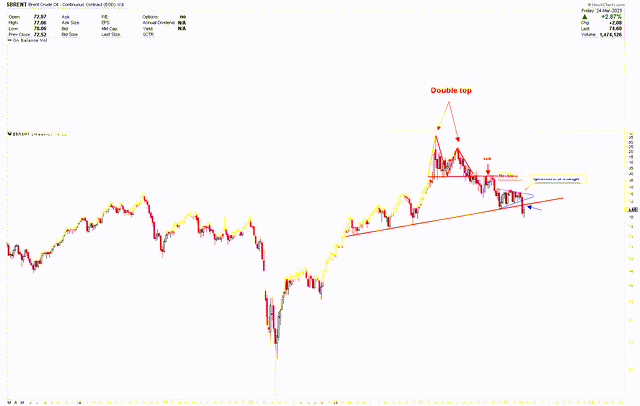

The historical picture of oil prices reveals a volatile market, with large price increases followed by sudden and dramatic price declines. This volatility in oil prices has resulted in an extremely volatile profit pattern for ConocoPhillips. The chart below depicts the formation of a double top in the Brent crude oil market, and the resulting sell signal. In addition, the price broke out of the symmetrical triangle two weeks ago. Following the breakout from the symmetrical triangle, the red trend line which had been protecting the bullish momentum of the oil rally was also broken. The formation of a double top and breakout of a symmetrical triangle suggests that oil prices are likely to decline further. A decline in the price of oil has a negative impact on ConocoPhillips's revenue, profitability, and stock price.

Brent Crude Oil (stockcharts.com)

Market Long-term Outlook

The fundamental outlook for ConocoPhillips is bearish, which is supported by the technical analysis. The technical picture can be observed by using the yearly chart below. The yearly candles for 2021 and 2022 were highly volatile, as the price increased by 647.95% from the 2020 low of $18.25 to the 2022 high of $136.50. This sharp increase in the stock price of ConocoPhillips was due to the recovery in oil demand as travel restrictions and economic activity were improved as vaccination efforts against Covid-19 advanced. The rally in oil prices also had a positive effect on the company's revenues, resulting in a substantial increase in stock prices. Rapid gains in the stock price of ConocoPhillips accompanied by high volatility indicate that the stock is overvalued and due for a correction. Overall, the yearly chart for ConocoPhillips shows a bullish trend, but the high volatility bars in 2021 and 2022 indicate a market correction.

ConocoPhillips yearly chart (stockcharts.com)

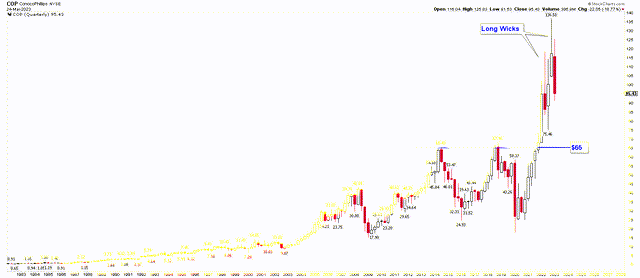

In addition, the quarterly chart below demonstrates the extreme volatility of the ConocoPhillips stock. The chart presents a wide range between $75.46 and $136.50. The quarterly candles for the remaining three quarters of 2022 have a long wick. The long wicks indicate that the trend is losing momentum, as the price has moved far from the opening price of quarterly candles but has not sustained its gains. The long wicks on the quarterly chart indicate a great deal of volatility in the final quarter of 2022 and suggest that a correction is imminent. This correction in ConocoPhillips may be triggered by the possibility of an upcoming recession.

The $65 level is considered significant because of the 2014 and 2018 peaks of $65.43 and $67.96, respectively. This level has been the resistance previously and now it is acting as the support. A correction in the stock price of ConocoPhillips is likely to provide strong support at $65.

ConocoPhillips quarterly chart (stockcharts.com)

Present Situation

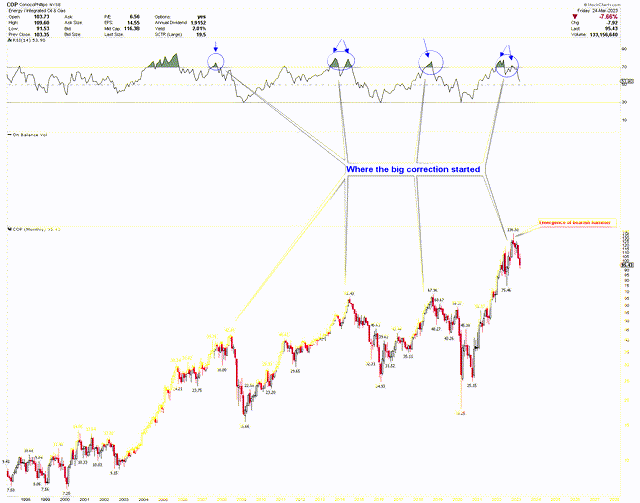

The monthly chart below elaborates on the discussed long-term perspective. When the RSI on the monthly chart detects an overbought condition in the ConocoPhillips market, the price corrects lower, as depicted in the following chart. The monthly candle for November 2022 has recently formed a bearish hammer by reaching a high of $136.50. RSI also formed a double top at this resistance and is currently dropping. The stock's overbought condition is comparable to that of 2007, 2014, and 2018, whereby the emergence of the price peak was followed by a significant decline.

ConocoPhillips monthly chart (stockcharts.com)

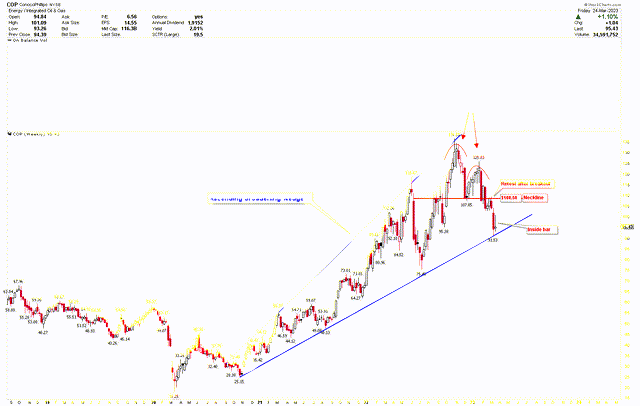

The formation of an ascending broadening wedge between October 2020 lows of $25.15 and 2022 high of $136.50 is another bearish indicator for ConocoPhillips. The share price has declined by forming a double top at $136.50 and $125.83. The neckline of this double top is $108.50, which was broken in February 2023. After breaking the neckline of a double top, the price has retested it to generate a sell signal. The price then fell to the wedge line at $91.53. This wedge line is acting as the market's short-term support, and the previous week was an inside bar because the lows and highs of the previous week were contained within the previous weekly candle. The appearance of an inside bar signifies a period of consolidation or indecision in the market, as traders are uncertain about the next direction of ConocoPhillips. A breach below $91.53 will execute a downward pressure and cause the ConocoPhillips market to decline.

ConocoPhillips weekly chart (stockcharts.com)

Risks

ConocoPhillips' stock price is highly sensitive to changes in crude oil and natural gas prices. The price is also affected by geopolitical events that affect the price of global oil and gas. The recent escalation of the Ukraine-Russia conflict had a significant impact on the volatility of oil prices. In contrast, changes in tax laws, environmental regulations, and export policies have a significant impact on ConocoPhillips' operations and earnings.

ConocoPhillips has a robust balance sheet and a diversified asset portfolio, allowing it to weather a recession better than its competitors. During a recession, the company's commitment to cost-cutting measures and investment in high-return projects could help it maintain profitability.

Technically, ConocoPhillips's stock price is trading at the apex of an ascending broadening wedge; if the price does not break below $91.53, the upside risk will be elevated.

Conclusion

According to the preceding discussion, ConocoPhillips generated high revenues in 2022; however, the possibility of a recession in the United States has a negative impact on the company's profitability and stock price. The enormous increase in ConocoPhillips' stock price in 2021 and 2022 was due to the oil price recovery, which had a positive impact on the company's revenues. The rapid price increase in 2022 is indicative of high volatility and suggests that the stock is overvalued and due for corrections. The preceding discussion also clarifies that $65 is a strong support level and that any corrections to this level could be interpreted as a pause in the decline. The monthly chart confirms the possibility of a topping pattern, whereas the weekly chart reveals the appearance of an inside bar. The appearance of an inside bar indicates that a drop below $91.53 would precipitate a sharp decline in the ConocoPhillips share price.

In conclusion, ConocoPhillips had an excellent financial performance in 2022 with total revenue of $80.58 billion, but the possibility of a recession and overbought conditions indicate that the stock price is due for a significant market correction. The overall revenue for the fourth quarter of 2022 was $19.13 billion, which was significantly lower than the revenue for the second and third quarters, indicating lower profit projections for ConocoPhillips. Investors can sell rallies to target $65 regions, whereas a breach below $91.53 will trigger a steep decline.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.