Broadstone Net Lease: High Yield You Can Count On

Summary

- Broadstone Net Lease is a well-diversified net lease REIT with strong exposure to the fast-growing industrial segment.

- It enjoys solid operating fundamentals, management is de-risking the portfolio from office exposure.

- It also carries a strong balance sheet and pays a well-covered and high dividend yield.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

IvelinRadkov

It's been a while since I last visited Broadstone Net Lease (NYSE:BNL) and the stock has performed admirably since my last bullish take here in November, giving investors a 4% total return, which nearly matched the 5.5% rise in the S&P 500 (SPY) over the same time. In this article, I highlight recent developments and discuss why it remains a bargain choice in the net lease sector.

Why BNL?

Broadstone Net Lease is a relative newcomer in the REIT space, with 804 properties spread across 44 states and 4 Canadian provinces. It's also reminiscent of the net lease giant, W. P. Carey (WPC) in that it has exposure to industrial and mission-critical office properties, which represent 51% and 7% of annual base rent, respectively. The rest of the portfolio is comprised of Healthcare properties (17% of ABR), Restaurant (13%), and Retail (12%).

BNL is also well-diversified, as its top 10 tenants make up just 19% of portfolio ABR, and it has 221 tenant brands across 55 sub-industries. Like its peers, BNL provides stability through long-duration leases with a weighted average lease term of 10.9 years and 2% annual escalators.

Plus, BNL has very high occupancy, which currently sits at 99.4%, and does not appear to see a shortage of investment opportunities. This includes closing on $310 million worth of deals during the fourth quarter with an attractive weighted average initial cash cap rate of 6.7% and very long weighted average lease term of 20 years.

Thankfully, management was able to partially fund this deal with equity raised at a higher (and thereby more accretive) price of $21.35. This secondary offering of 13 million shares resulted in $273 million worth of equity proceeds, which nearly covers the entire investment activity during the fourth quarter before having to tap debt. This contributed to BNL's respectable full year AFFO per share growth of 6.9% to $1.40.

Potential headwinds to BNL include general macroeconomic concerns, and the lower current share price, which make it less likely that management will raise equity to fund accretive deals. However, BNL still had some remaining dry powder at the start of the year, which I would expect to be deployed in the current first quarter. This is supported by management's comments during the recent conference call:

We are currently focused on deploying available dry powder in hand that supports a creative spread investing at prevailing market cap rates. With quarter end, we currently have $5.2 million of investments under control, which we define as having an executed contract or letter of intent.

In addition, we currently have $30.6 million in commitments to fund revenue generating capital expenditures with existing tenants. We continue to see creative ways to partner with our existing tenants in an effort to supplement our routine sourcing efforts. In addition, we will continue to creatively recycle capital through strategic dispositions in 2023.

Plus, BNL carries a strong BBB rated balance sheet with a safe net debt to EBITDA ratio of 5.2x, sitting comfortably below the 6.0x level that most ratings agencies consider to be safe for REITs. Management is also strategically reducing exposure to office properties, after having reduced office from 6.5% of ABR at 2022 year-end to 5.9% in the first couple of months of this year. Lastly, BNL has great line of sight with regards to interest rates, as it has no material debt maturities until 2026.

Importantly for income investors, BNL raised its dividend twice last year, and the current dividend rate is well-covered at a 79% AFFO payout ratio. Turning to valuation, BNL stock is currently in value territory at $16.90, which equates to a forward P/FFO of just 11.0.

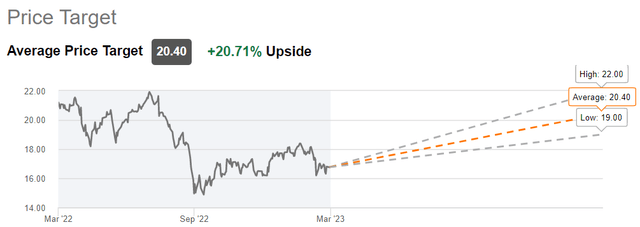

This compares favorably to the 15.0 P/FFO of WPC, which has a similar property portfolio with a slightly stronger credit rating. Analysts have a consensus Buy rating on the stock with an average price target of $20.40, which equates to a potential 27% total return over the next 12 months.

Seeking Alpha

Investor Takeaway

In summary, Broadstone Net Lease is a well-diversified net lease REIT that has high exposure to the fast-growing industrial segment. It also carries a strong balance sheet and has long-duration leases with annual escalators. At present, BNL stock trades at a material discount to its larger peer, WPC, and pays investors a well-covered and attractive 6.5% dividend yield. As such, BNL could be the right stock to own at present for those looking for portfolio stability, growth potential, and high yield.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of BNL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.