Revisiting TUI And What Upside There Is For 2023

Summary

- You may recall that I looked at TUI AG a few times both during and after the worst of the company's crash.

- In my recent article, I actually went positive on the company - and this stance has resulted in near-double digit market outperformance, validating it as "correct".

- However, the near-term risks and issues are not to be underestimated. After nearly 10% change, I may change my rating on this company - and here is why.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Ceri Breeze

Dear readers/followers,

You may recall my work on TUI AG (OTCPK:TUIFF) and what has happened to the company over the last 2 years. During the worst of COVID-19, this once-high-yielding business went into a tailspin. It did not quite crash, meaning go bankrupt, but it did sputter and stall for long months before managing to gain altitude and slowly go up again.

As we now revisit the company, we find my "BUY" stance has paid off with better-than-market performance.

Seeking Alpha TUI Upside (Seeking Alpha)

So what are we left with after a year of TUI and with this sort of performance after essentially declining even further?

Let's take a look.

TUI AG - What once was great, might be again

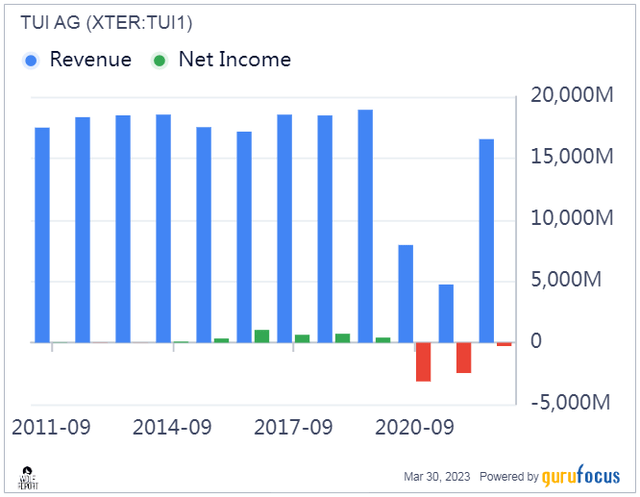

What happened to companies in travel like TUI with COVID-19 was essentially a black swan event that could not have been forecasted. The company's challenges during these years can be viewed through many lenses. However, for me as an investor and analyst, I like looking at them through the lens of earnings and revenues. Numbers don't lie, and understanding and seeing them helps quite a bit.

TUI has always been a company that has eked out a meager net income on a relatively high revenue number - and what happened to things like:

- Revenue

- Net income/margin

- Cash/Debt

- ROIC/WACC

- Operating cash flows

- Shares outstanding and shareholder equity/debt

- asset ratios

- Income breakdown

All of these things show me just how a company is "feeling". And for TUI, what happened was the company equivalent of a serious illness. Take a look at what happened to revenues and income.

TUI Revenue/Net Income (GuruFocus)

We can see similar type trends in cash/debt, where we can see the company's cash going close to zero, while the company took on nearly €8B in debt starting in 2020, and started paying it off in the recent few years. The company's cash flows took a jump off a cliff, and are still only recently positive - and the company's return numbers went deeply into the red, with both negative ROIC and heavy WACC. Shareholder equity has been wiped out, turning negative in 2020 and not turning positive after that.

All of these are symptoms of "corporate illness" if you know where to look. Then it is up to us to diagnose them and see what to do about them in terms of valuing the company. Something else we can see when looking at it is that things are improving.

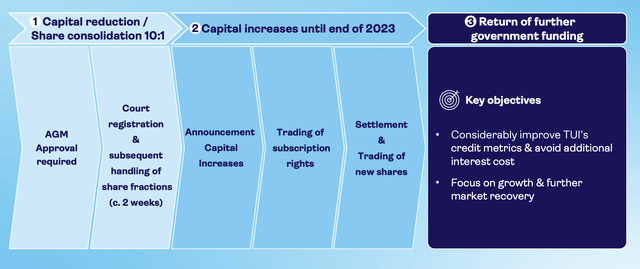

This is also something we can confirm when we go through the company's filings and reports for the year 2022. A few things are worth noting. First off, TUI intends to pay back the Corona state aid in full - this is a relatively new piece of news. This is based on a relatively recent cap raise of €1.8B, which in part will be used to repay the debt and the credit line, to reduce ongoing interest costs and overall debt in exchange for diluting shareholders. The company's claim through its CEO that it will have a "good balance sheet" must be seen. While improved at this point, I don't believe it is exaggerated to say that the company's balance sheet is still in shambles.

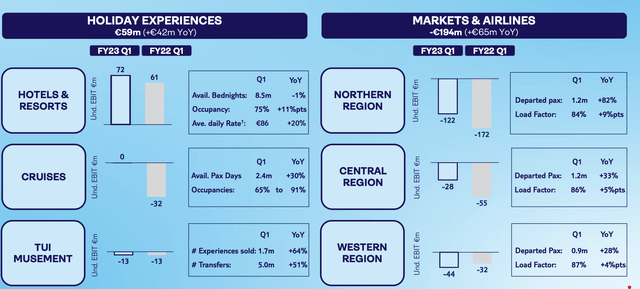

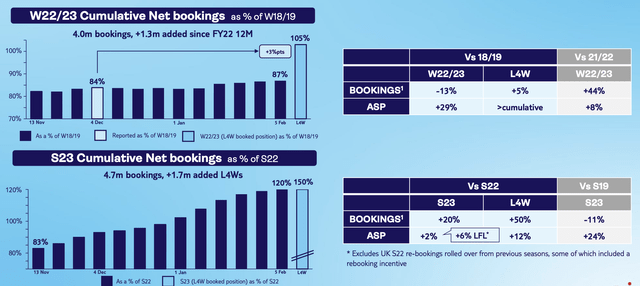

We do have 3Q21 results to consider, not just FY22. Those results showcase what is essentially a full pre-COVID recovery, at 93% of 2019 volumes and achieving an airline load factor of 85%. The 1Q23 revenue is more than double the revenue seen YoY - even if pre-tax profit still went negative, and not negative minor either (negative €153M). Net debt was larger than last year and is now at €5.3B, but the momentum in booking is what is positive here.

January 2023 saw record booking days in the company's core market, and the Summer 2023 bookings are 10% above pre-pandemic levels at even higher prices than in 2019. This is broadly what the travel industry is seeing across Europe despite the numerous issues - that customers want to return to travel, and are doing so.

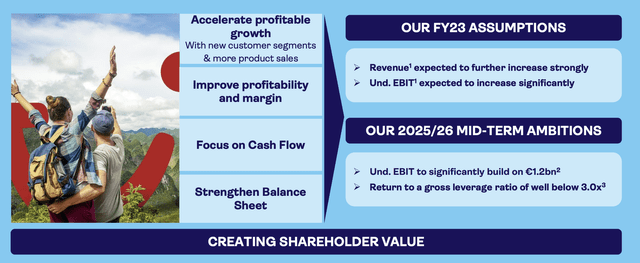

Nothing in the company's current strategy should be thought of or viewed as strange in terms of goals. TUI wants to return to growing its market share, attract new customers, and work with sustainability as an opportunity to grow. Overall, I believe this is sound - as only the largest of companies and most vertically integrated will likely remain competitive or profitable in this sort of market - vacation, and travel, given all the moving variables involved.

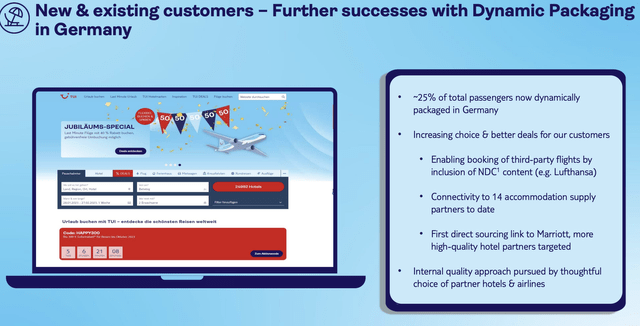

The company has a number of projects and initiatives through which it seeks to target these changes - including Acco (accommodation)-only initiatives in Scandinavia as a test market, the TUI Tours platform in Belgium - which is successful - and more dynamic vacation and trip packaging, which it is currently trying out in Germany.

By working based on a core customer ecosystem, as the company is attempting to do, TUI is increasing sales and also adopting more of an omnichannel approach, given that customers can now book things through the app. The booking momentum not just through the app but across all channels has been very impressive and encouraging for both TUI and TUI bulls.

Things are looking very well - but frankly, if things weren't looking as good as this, I'd be quite worried. TUI is in the middle of a recovery and a resurgence compared to where it was during COVID-19. The positive momentum, normalizing 2022-2023 numbers to where they "should" be if we take away COVID is a must for the company to continue to grow. It's good, I believe, to see this because it's the least we would be expecting.

Because of weak comps, the YoY EBIT or other developments really aren't as relevant as I see them. We're moving from travel restrictions to no restrictions. The company's FCF continues, unfortunately, to be negative.

However, this is mainly due to seasonal WC outflows, relatively normal considering the timing. A strong season in 2022 also lead to significant supplier payments, which in combination with lower bookings are also ratcheting up this negative overall WC.

Once the company pays off its loans and specifically the government funding, the company can then move back into a more normalized dividend environment. But this will take time - at least the end of 2023 until much of it seems to be resolved, insofar as expectations go.

TUI has come out of the crisis it entered in conjunction with the global pandemic. It did not come out of the pandemic unscathed - it came out somewhat broken and bleeding capital, requiring to be stitched up by the government to survive. This is not a disqualifying factor in itself when it comes to investing, but it certainly doesn't make the company more appealing.

In my last article, I saw the company as attractive based on a relatively unattractive market where TUI stood out as somewhat undervalued. That is not the case as I am writing to you today, and for that reason, the valuation cannot be viewed the same way - no matter how many positives the company sees in its near-term future, or the 2025-2026 period.

This brings me to the following valuation for TUI, as I see it.

TUI - The valuation remains compelling from certain views, but the market is now more attractive

As I said, in my last article I made clear that while I am not a risk-oriented investor, there is a "play" to be made for TUI at this time that could result in outperformance - and it did. These factors include(d)

- TUI AG's business model is intact and thriving.

- Travel isn't going anywhere.

- The trend for TUI is positive in a way where it's hard to see a negative potential impacting the business results from here on out - things have already been as "bad" as they're going to get.

- TUI is at heart, a dividend-paying company.

The tricky part is and was, how we account for investing in a turnaround business such as this, while quality businesses and investments are available at discounts on the market. It's a hard sell for me, to do so. Because while you could invest in TUI and potentially see upsides of 100-300% in a few years, the fact is that there are plenty of investments where we could much more realistically see 80-120% in the same time frame.

Only those investments come with significant safeties, a yield, and a proven upside based on forecasts/historicals. They also didn't crash and burn during COVID-19.

In my last article, I said that TUI will eventually go up - and it has. But we can't forget the negatives. TUI now holds B- and B3 from S&P and Moody's, both with "stable" outlooks. These ratings are up from CCC+ - but obviously, this is not something to really cheer about. It's still junk.

TUI wasn't a play that I was comfortable with in my last article, despite going "BUY" in terms of rating. For those of you that did accept the risk/reward - congrats, you've just outperformed the market. TUI also remains attractively valued to this day, if you just look at the book and other multiples that, for the company, are very relevant indeed. You cannot argue that the company is attractively priced. The company typically trades at a sales multiple of 0.35-0.62x, with a recent of 0.07x. This is even lower than the last time I wrote about TUI because the company's sales are up so much. It also means that TUI trades at a P/E of less than 3.7x, and an FCF multiple of less than 3x.

TUI is still clearly quite distrusted on the market. Turnaround potential does definitely exist for the company- I wouldn't follow the analyst average slavishly, because these analysts failed to forecast the drop. While down from over €30/share, the 8 analysts following TUI are still averaging a range of €11.2 on the low side and €21/share on the high side, with an average of €17.74.

However, here comes the interesting part - not a single analyst considers TUI a "BUY", despite a 125% upside. This is completely disingenuous. In fact, 4 analysts are at a "SELL", which is even more than the last time I wrote about it - 6 out of 8 are either at "SELL" or an "Underperform" rating.

TUI is a risky investment. It's a turnaround play. But there is plenty of "quality" in TUI overall, in a way that makes a turnaround and an upside potential possible.

However, in my last article, I made clear that the risk/reward ratio, as I see it, is not favorable next to the market as a whole. This is still a stance I hold to this day. If I had $10,000 or $100,000 that I could throw into an investment with the expectation of wanting a "turnaround" investment with a 500-1000% RoR potential, then TUI would be relatively high on that list, but this is not my M.O when it comes to current investing. I also don't see this becoming a vital part of my strategy anytime soon.

Where I currently am, I'd much rather invest $10,000 or $10,000 in an investment that gives me a 1-4% yield, and has a high potential of 11-18% total annualized RoR than I would an investment with 40-70% annualized, but without any of the safeties, dividends or qualities with the former.

However, I'm a valuation investor. That means that I will be able to give you a value for the company if I was interested in doing the former - otherwise, there'd be no point to this article.

The company did a split with its shares - namely a reverse stock split of 10:1. That means that my previous PT of €1.75 makes no sense at this time. Recalculating my target based on the reverse split, the cap raise the company is doing and the dilutive results, the continuing, low interest coverage, the overall distress of the business, and the fact that the company can't be argued to be a value-add in terms of its ROIC/WACC variance lead me to discount it somewhat and put the target a €14 - but this is a speculative buy at the very best.

This leads me to my current thesis.

Thesis

My thesis for TUI is as follows:

- TUI AG is one of the most appealing travel companies in all of Europe. Unlike many of its peers, it has survived - although the fact that it has survived is one of the best things that can currently be said for TUI.

- I believe the combination of current bottom-level valuation combined with a relatively well-established current trend of normalization only has one logical eventual outcome - an upside.

- However, the risk inherent to such an investment makes it incompatible with my current conservative portfolio.

- Still, as a speculative position, I cannot rate TUI anything but a "BUY" here. The company's cash flows are "too good" long-term, and the company's turnaround seems to be working.

- My PT is €14 - but keep in mind that this is a speculative and high-risk play - nothing else. You need to accept the risk/reward for this, and i currently do not.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.