XLY: Challenging Time Likely To Continue

Summary

- The drop in the share price of the Consumer Discretionary Select Sector SPDR ETF does not appear to be a buying opportunity because the ETF has not yet bottomed.

- Due to the Fed's rate hike strategy and the banking crisis, market fundamentals are probably going to get worse in the upcoming months.

- High valuations and sluggish earnings growth could also limit the upside potential of consumer discretionary stocks and related ETFs.

happyphoton

The Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY) is expected to struggle in fiscal 2023, with signs that the sector has not yet bottomed out. Financial markets have recently begun to experience volatility as a result of the Fed's rate-hiking strategy, resulting in a rapid deterioration of market dynamics for cyclical sectors. Aside from the general market environment, the consumer discretionary sector is likely to struggle due to high valuations and weak earnings growth. Dip buyers should therefore hold off until there is a better entry point.

Economic Distress is the Biggest Headwind

The economy appeared to be picking up steam as fiscal 2023 began, thanks to stronger-than-expected retail sales and job growth. As a result, stock prices in the extremely vulnerable consumer discretionary, information technology, and communication services sectors skyrocketed. The Consumer Discretionary Select Sector SPDR ETF's share price increased by more than 20% between January and mid-February, outpacing the S&P 500's 10% growth. However, due to concerns about additional rate hikes in 2023, the surge turned out to be a bear market rally. Last week, the Federal Reserve increased the federal funds rate by 0.25%, bringing it to a range of 4.75% to 5%. Furthermore, given the strong job and retail market data, more rate hikes are expected in the coming months, which is not a favorable scenario for cyclically sensitive ETFs like XLY.

In addition to the negative impact of high-interest rates on economic growth, the recent banking crisis has dashed hopes for a soft landing. The failure of regional banks like Silvergate Capital, SVB Financials, and Signature Bank, as well as the high risk of liquidity problems at several other regional banks, has raised the risk of contagion. Although the Fed has set up a fund to assist with liquidity issues, banks, hedge funds, and analysts have warned that the crisis could spread throughout the financial sector and the US economy. For example, Bill Ackman of Pershing Square believes that instilling false confidence is a bad idea, whereas Luke Ellis of Man Group believes that many smaller regional banks will fail in the next 12 to 24 months. Regional banks are among the biggest lenders to sectors like technology and real estate, and their failure or tightening of lending standards would have a significant effect on economic expansion. The Fed and Goldman Sachs estimate that the impact of the banking crisis would be the same as a 0.25 percent rate increase, but many people think it could be as high as 1.5 percent.

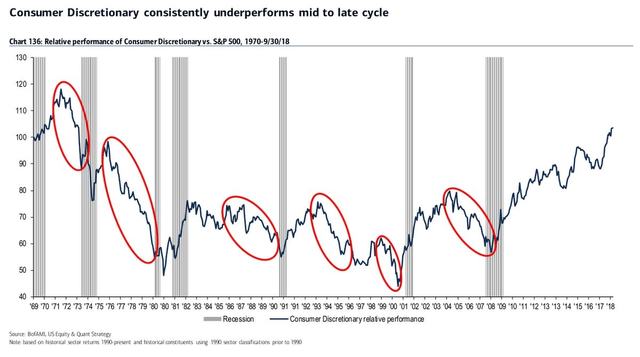

Consumer Discretionary Sector Performance in Various Cycles (Bank of America)

According to the Bloomberg survey, the odds of a recession hitting the US economy have increased to 65%, compared to the previous forecast of 60%. Higher-than-expected inflation, the banking crisis, and the Fed's rate hike policy all increased the likelihood of a recession. This means that market dynamics are likely to become more difficult for cyclical stocks and ETFs. Historically, the consumer discretionary sector has been more volatile before recessions. Therefore, investing in stocks or ETFs that react strongly to slowing economic conditions would be a risky move.

Sluggish Earnings Trends Add to Challenges

Earnings Forecast 2023 (FactSet)

According to FactSet data, earnings in the consumer discretionary sector is projected to grow 25% year-over-year in 2023. However, a closer examination of the earnings growth forecast reveals a different picture. Only three industries are expected to report an increase in earnings over the previous year, while the remaining seven industries are expected to report a year-over-year decline. A 10% year-over-year earnings decline is predicted for five of these seven industries, including leisure products, durable goods for the home, and automobiles. Moreover, earnings growth in the sector is expected to be driven primarily by the internet and direct marketing retail industry, with Amazon (AMZN) being the largest contributor. The data also shows that, excluding Amazon's earnings, the expected earnings growth rate for the entire consumer discretionary sector could be in the low single-digit percentage range.

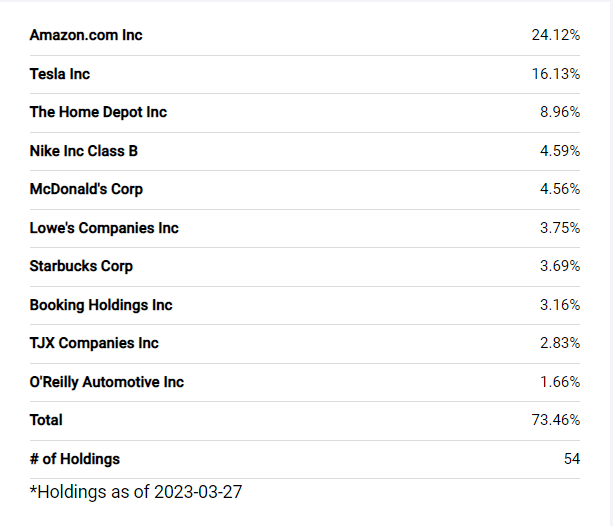

XLY's Portfolio Holdings (Seeking Alpha)

Amazon's performance is crucial because it makes up more than 24% of the Consumer Discretionary Select Sector SPDR ETF's portfolio. In fact, Amazon's earnings growth trend appears unimpressive when compared to previous years. Aside from 2022, when the company reported a loss due to a one-time charge, Amazon's projected earnings per share of $1.44 in 2023 represents a significant decrease from $3.24 in 2021 and $2.09 in 2020. The company's recent strategy of quickly expanding its businesses as well as the significant increase in the cost structure brought on by inflation are the causes of the sharp decline in earnings.

With a portfolio weight of 16%, Tesla (TSLA), the second-largest holding in XLY's portfolio, has seen a decline in earnings estimates. According to data from Seeking Alpha, 31 analysts have downgraded their earnings forecasts for the largest manufacturer of electric vehicles over the past 90 days. The median earnings estimate for 2023 is $3.99 per share, a 2% decrease from the previous year. Lower prices for its Model S and Model X will likely have an impact on its profit margins in 2023. The article by Seeking Alpha contributor Anna Sokolidou can help you read in-depth about why the company is forced to significantly reduce its pricing on Model S and Model X.

The Home Depot (HD), the third-largest stock in the Consumer Discretionary Select Sector SPDR ETF with an 8% portfolio weight, has received a D grade on earnings revision from SA's quant system. In the past 90 days, 29 out of 30 Wall Street analysts have lowered their earnings projections for the company. Its projected median earnings of $15.87 in 2023 represent a mid-single-digit decrease from the previous year. Nike (NKE), XLY's fourth-largest holding, is also expected to report a double-digit drop in earnings compared to 2022. On the positive side, restaurant stocks such as McDonald's (MCD) and Starbucks (SBUX) are expected to post earnings growth in 2023. Overall, the earnings growth quality of the majority of consumer discretionary stocks is expected to deteriorate in 2023, which is bad news for growth stocks that entice investors with their strong growth trend.

Valuations

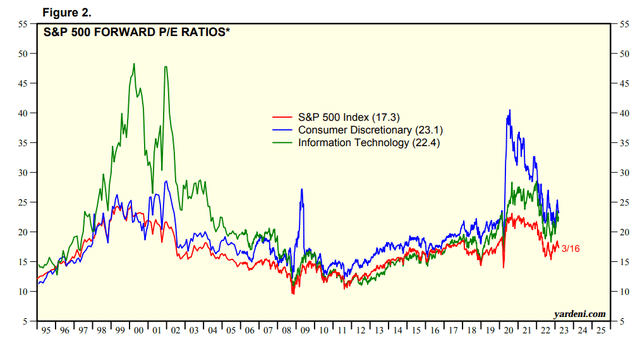

XLY's Forward PE Vs S&P 500 (Yardeni.com)

Another alarming metric is the consumer discretionary sector's high valuations. As shown in the chart above, its forward PE is significantly higher than that of the technology sector and the S&P 500. Aside from the sector level, the majority of its top ten portfolio holdings appear to be overvalued. Amazon is currently trading at approximately 67 times its projected earnings. Tesla also appears to be overpriced, with a negative D grade on valuation from the SA quant system. It has significantly higher forward price-to-book, earnings, and sales ratios than the sector average. The remaining top ten holdings of the Consumer Discretionary Select Sector SPDR ETF also received low grades on valuations. Nike, McDonald's, and Starbucks, for example, received an F grade on valuations, while Lowe's (LOW) and Booking Holdings (BKNG) received a D grade.

Quant Score

Quantitative analysis is one of the most effective methods for removing emotion from investment analysis. The system is also worth considering because it uses a variety of metrics to predict future performance. For ETFs, SA's quant system takes into account factors such as momentum, expenses, liquidity, risk, and dividends. In the case of stocks, the quant system considers valuations, profitability, growth, earnings revisions, and momentum. When it comes to XLY, the quant system predicts that the ETF will perform poorly in the future. With a quant score of 1.58, the ETF earned a sell rating. Furthermore, the SA quant system assigned a hold rating to the majority of XLY's top ten holdings, owing to their high valuations and negative earnings revisions.

In Conclusion

The Consumer Discretionary Select Sector SPDR ETF has limited upside potential going forward as a result of deteriorating market fundamentals. Real GDP growth is expected to be less than 1% in 2023, with growth falling below zero (-0.1%) in the second half. Furthermore, the highest valuations in S&P 500 sectors, as well as sluggish financial performance, may limit upside potential. Therefore, investing in the consumer discretionary sector appears to be a risky move.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.