PC Connection: Will Likely Weather The Storm Just Fine

Summary

- Last quarter saw declines in sales in all segments but saw improvements in margins.

- If the company manages to improve margins even by the slightest, the company has promise.

- I will show a DCF analysis with declines in revenues and margins for the first two years to see how well the company performs.

- A strong balance sheet and conservative estimates suggest the company will likely be just fine in the long run.

Delmaine Donson

Investment Thesis

Q4 earnings missed estimates, with many declines in all segments may look worrying, however, PC Connection, Inc. (NASDAQ:CNXN) managed to improve margins across the board, which gives me hope that the company will manage to weather any uncertainty with ease in the upcoming 12-24 months. In this article, I will argue that the company will survive the uncertainties. I will model revenue decreases for the next 12-24 months as a worst-case scenario for the company while we will see some margin improvements due to cost-cutting measures implemented in Q1 '23. The company will do just fine because it has a strong balance sheet and good management that is focusing on operational efficiency. The company is a good buy at current levels but if one is not in a hurry to invest, one may find a better entry point once the economic environment settles down and becomes less volatile and more predictable.

FY2022 Results

The fourth quarter was quite tough for the company. Endpoint devices experienced a 15% decline because the customers were more cautious in this uncertain economic environment and so ended up spending less on IT. Net sales declined by 8.5% while gross profit declined by only 2.1%. The company saw margin improvements of 110bps for the segment.

The business solutions segment saw declines in sales, however, due to a margin expansion of 229bps, gross profit increased by 3.6%. The efficiency improvements can be attributed to strong demand for higher-margin data center products, including software, networking, and servers.

Public Sector saw a 9.4% decrease in net sales, however, sales to the federal government increased 46% from the prior year. Despite of decrease in sales, the company still managed to eke out a slight margin expansion of 10bps.

Enterprise Solutions sales also decreased by 8.9% for the quarter, and yet gross margins expanded slightly, by 41bps.

Full-year results saw record revenues. 8% increase in y-o-y sales, while EPS increased by 27.2% y-o-y to $3.37 per share.

At the first glance, it looked like the company did not perform very well, however, the company seemed to have become much more efficient and saw margin improvement across the board.

Outlook and Margin Improvements

The management sees continuing headwinds for endpoint devices going forward in '23 as they saw in Q4 '22. This in my opinion is not going to last long as these uncertainties won't last forever and by the 2nd half of the year, the demand will start to pick back up. In the meantime, there is a strong demand for advanced technologies, which should offset some of the endpoint devices.

Enterprise solutions so far have been the leading revenue generator; however, Business Solutions is starting to catch up in recent years and may outpace Enterprise in the next couple of years. Business solutions target mainly SMB customers with outbound telemarketing, on-site sales solicitation, and through online sales. Enterprise Solutions focuses mainly on large enterprises by offering web-based efficient solutions for outsourcing, evaluating, and tracking many different IT products and services.

The company is expecting to grow at the same pace as the growth of the IT industry plus around 2%. The IT industry is expected to grow at around 9% CAGR by 2025, so the company expects to see 10%-11 % growth. I will not take their estimates and will focus on the worst-case scenario which will see a declining revenue for the next 2 years and will see a conservative recovery thereafter.

The outlook that I will be focusing on is not in terms of how much more or less the company is going to be able to sell in the future, but rather their ability to become more efficient.

The management implemented a cost-cutting structure in Q1’23 which will save $8m-$10m annually, which will be fully implemented by Q4 of this year. This will improve gross margins by around 30-40bps per year alone. I believe the company will manage to improve margins even more than I will model because, in terms of price pressures, the company did not experience any and was able to pass on any increases to the customer without a blowback. This tells me that the company's services are quite valuable, and the customers are willing to pay for the quality they are getting.

With such tight margins, it is good to hear that the management is going to be focusing on improving operational efficiency.

Financials

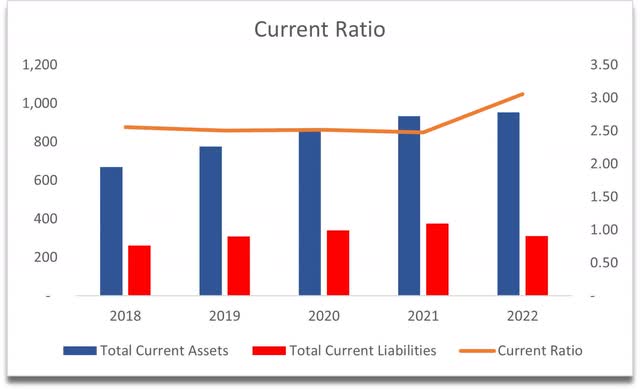

The company has seen a steady improvement in its cash position over the years, coupled with no debt on the books, it already looks like a company that is managed quite well. Continuing on liquidity, the current ratio of the company is also in a very healthy position, and will not have a problem paying their short-term obligations any time soon.

Current Ratio (Own Calculations)

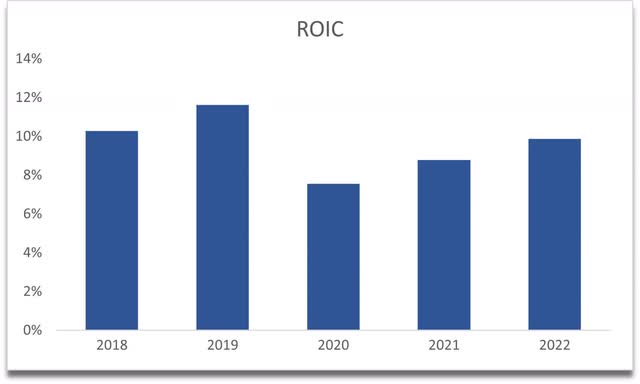

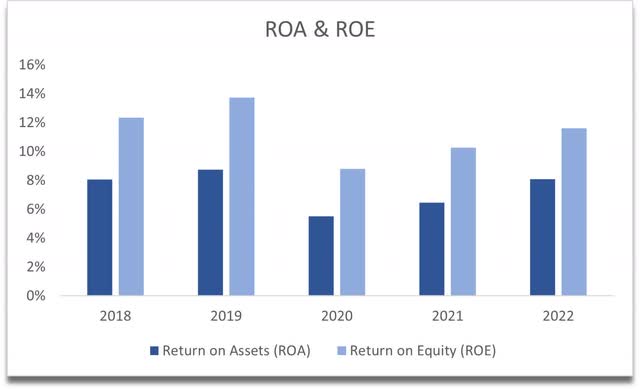

Looking at efficiency and profitability metrics, the company seems to be able to use the available capital to fund positive NPV projects for a while now and if this continues, the long-term shareholders will be rewarded in due time. ROA and ROE are coming off of their 2020 lows and we will have to wait and see how this develops in the future. Hopefully, the uptrend is strong.

ROA and ROE (Own Calculations)

We can see the same pattern on ROIC too, which is coming off of 2020 lows with a clear upward trajectory. Both metrics are coming back up to their 2019 levels and I hope will continue to go further up in the future.

Overall, the company has a very strong balance sheet which will certainly help it weather any potential downturns in the economy. I see no red flags here.

Valuation

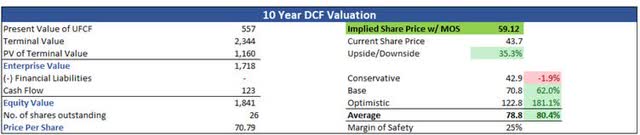

For the model, I wanted to see how the company would fare in a tougher economic environment that will lead to declines in revenue and a slight contraction of margins for the next two years or so to see how well the company is equipped for such an outcome.

My model has three scenarios: a base case, an optimistic case, and a conservative case. For the revenue growth for the base case, I decided to implement a slight recession that saw the company lose around 10% of revenues y-o-y in '23, -5% in '24, and then a recovery in revenue growth of 5%, and average around 4% a year until '32. I believe these are very reasonable and conservative assumptions. If we look back at the company's historical revenues, we can see that in 2018 revenues declined by 7.3%, and in 2020 declined by 8.2%. Note that every decline in sales saw an increase in sales the year after. Mine has a subsequent decline to make it more conservative. Even if we go back to the '08 financial crisis, the company saw -a 10% in revenues one year and then a 25% increase the next year.

For the conservative case, I took away 2% from each period from the base case, meaning the revenue declines go from -10 to -12% while revenue increases go from +5% to +3%. The opposite is true for the optimistic case.

The next part that I wanted to focus on is the margins. In the next two years, I assume that due to the recession, the company will see slightly worse margins of around 50bps for the next two years and by the end of the model in '32 the margins have linearly improved by 100bps from the current FY22 margins due to cost-cutting measures. I believe that these assumptions are very reasonable and conservative, as it's been already three months of '23 and we still haven't seen much of a downturn. For the conservative case, I've subtracted 75bps from the base case while for the optimistic case, I have added 75bps.

Seeing that the company has a very strong balance sheet, I am inclined to add a small margin of safety to the intrinsic value. In this case, a 25% discount will suffice. With that said 10-Year DCF valuation with decreases in revenue and margins suggests that the company is still undervalued with an implied share price of $59.12, meaning there is a 35% upside from current valuations.

10-Year Conservative DCF Valuation (Own Calculations)

Closing Comments

PC Connection Inc. is currently undervalued according to my conservative DCF analysis and has a strong balance sheet that should withstand a downturn in the economy. While I am not opposed to opening a position right now, there may be a better entry point in the future due to economic uncertainties. If management is unable to improve margins, it could significantly affect the valuation. It is recommended that investors conduct further research before committing to their funds. PC Connection Inc. stock could be a good long-term investment for patient investors.

Does that mean the company is going to perform well? No one knows. Over the last 365 days, the company has lagged S&P500 by around 9%, in the last 3 years, total returns were around 11% for CNXN and 61% for S&P500. Only if we go back 5 years, we see a 20% outperformance, and going back 10 years it is about even with the index. I would expect similar results in the future unless the company acquires some growth catalysts that will propel revenues and improve margins further.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.