FlexShares STOXX US ESG Impact Index Fund: Rhetoric Instead Of Substance

Summary

- The FlexShares STOXX US ESG Impact Index Fund ETF has some structural weaknesses.

- The success rate of ESG activism appears to be falling.

- Solid exposure to tech and large-cap stocks could abet ESG during a potentially tricky period for risk assets.

- The Lead-Lag Report members get exclusive access to our real-world portfolio. See all our investments here »

pidjoe/E+ via Getty Images

The anti-ESG issue is getting global and seems to be expanding rapidly. - Giuseppe Perone.

Introduction

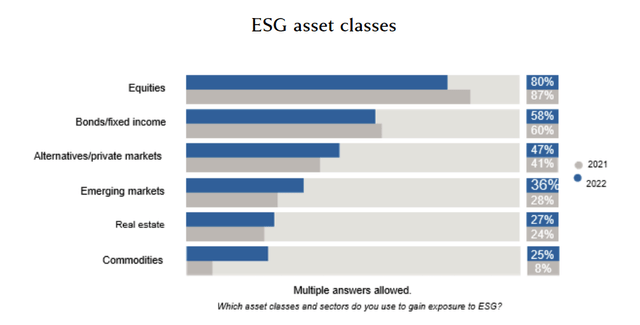

The ESG (environmental, social, and governance) equity marketplace is a crowded arena, with over 100 alternatives vying for your attention; this overdose shouldn't come as any great surprise, as the average investor has long expressed a predilection to gravitate to the equity class in order to gain ESG exposure.

Nonetheless, today's article will focus on yet another ESG-themed exchange-traded fund, or ETF - the FlexShares STOXX US ESG Impact Index Fund (BATS:ESG). ESG is centered around 265 U.S. companies that meet ESG principles dictated primarily by the UN Global Compact Principles. Such principles include participation in carbon disclosure projects, emission reduction targets, policies against child labor, and generally accepted corporate governance standards. Overall, I have a mixed opinion about the ESG ETF and will attempt to cover the good and bad facets of this product in this article.

The Bad

As a structure, the ESG ETF has a lot of foibles which may put off a few investors. It's not the most popular ESG product around, with only $165m in assets under management ("AUM"), and a median daily volume of less than 300K. Worryingly, the average daily spread is quite steep at $0.08, making it challenging to get a good fill if you want to take a large position.

Ostensibly, most investors who pursue ESG-type products tend to have a long investment horizon, thus enabling them to ride out through different cycles. Unfortunately, ESG is one of those ETFs where you're unlikely to see the benefit of sticking around for the long haul, as the portfolio is prone to significant churn; last year, 46% of the holdings were churned (typically for most ETFs, only around a third of the holdings get churned)

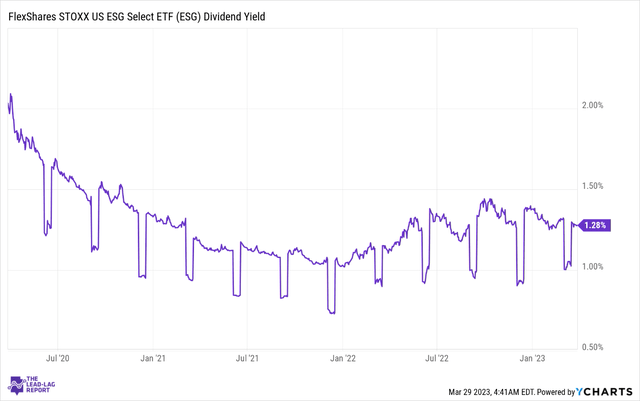

I also don't see enough dividend-oriented qualities for income investors to get excited about; currently, ESG's yield is quite underwhelming at 1.28%, almost 100 bps lower than the median ETF range, and also lower than its own average of 1.36%. Besides, over the last three years, while most ETFs have grown their dividends by a CAGR of over 2%, ESG has seen just minuscule growth of 0.16%.

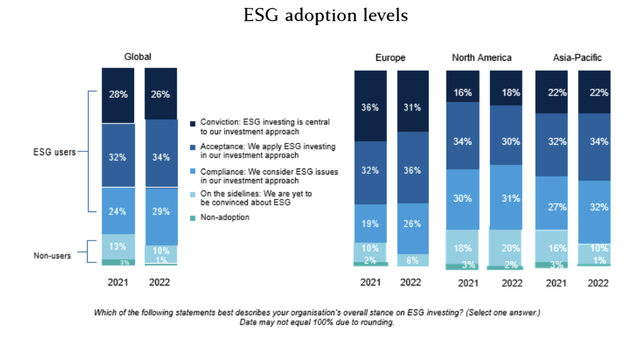

Then when it comes to ESG per se, those of you who've followed my work across different platforms would note that I've been relatively skeptical about the efficacy of it, and looks like I'm not alone. A study by Harvard Law showed that North American companies had the least degree of conviction about adopting ESG.

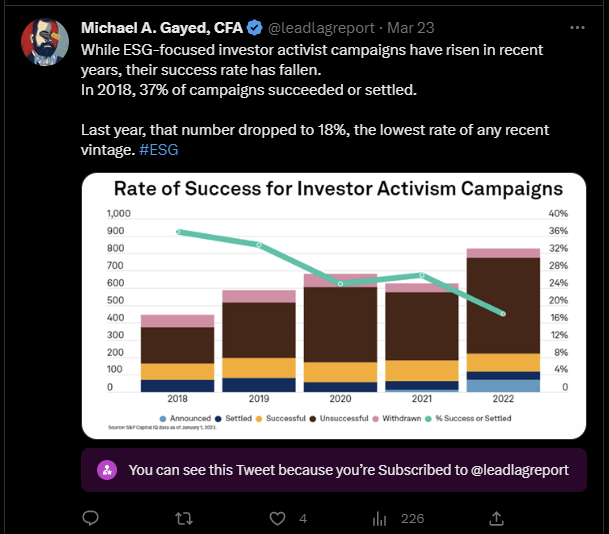

As noted in The Lead-Lag Report, I can recognize that most investor campaigns (80%) continue to be primarily driven by ESG agendas, but how successful have they been?

Twitter

Well, results show that as the years have progressed, the success of these activist campaigns has only halved. Last year it came in at just 18%.

Twitter

Broadly, I believe the whole ESG brouhaha is just fluff, and corporations should stick to the primary objective of delivering the most optimal ROI rather, than diverting their resources to meeting sub-optimal ESG objectives which eventually end up destroying investor wealth.

For instance, a recent guest on Lead-Lag Live, Kevin Bambrough, was speaking about dispiriting conditions in the resources sector. He flagged that all these unnecessary financial encumbrances and taxes will only further limit mine investments, thereby tilting the supply-demand position adversely. This could eventually prove to be very damaging for inflation and affordability in general.

The Good

While I'm not overly enthused about the whole ESG rhetoric, I do think the ESG ETF's portfolio has some useful qualities that could come in handy in the medium term.

As noted in a post on The Lead-Lag Report Instagram page, a breakdown in some of my inter-market signals suggests that it looks all but certain that April could prove to be a dicey month for risk assets in general.

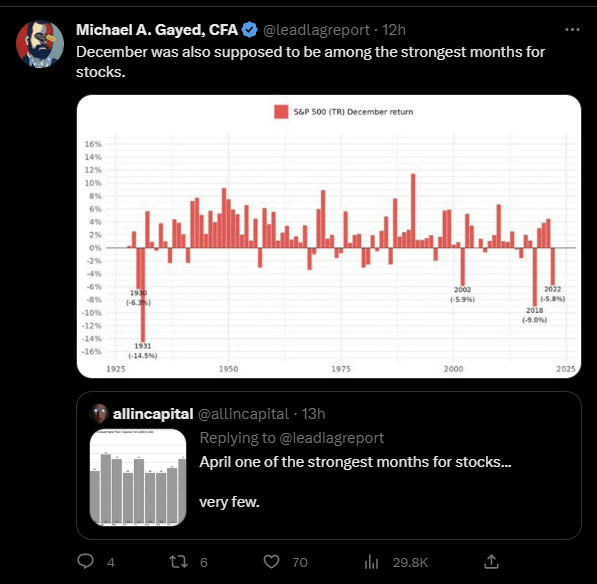

I recognize that calling out conditions for a potential accident in April won't be taken well by a lot of market participants, particularly as that month has typically proven to be a breeze for risk-taking. But then again, so was December, and we saw what happened last year.

Twitter

Given potentially challenging conditions in April, you ideally want to stay exposed to some of the stronger sides of the market. Those who subscribe to The Lead-Lag Report would note that every week, I highlight the relative strength of different pockets across the market. In this week's "Leaders-Laggers" section of my report, I've noted that tech has been the undisputed leader, bringing to light some of the safe haven qualities it exhibited during the post-COVID bear market. With people looking to stay away from some of the most economically-sensitive areas of the market, the tech to S&P500 ratio has ramped up to its highest point in a year's time. ESG stands to gain as its holdings are dominated by tech entities which account for a quarter of the total holdings.

From another dimension, I also think it's quite useful that ESG is heavily exposed to large caps (~99% of the holdings with no exposure to small caps whatsoever). As noted in this week's report, despite offering better value, the small-cap to large-cap ratio has collapsed to its lowest point in over 2 years, highlighting the degree of relative prudence that has taken over the markets.

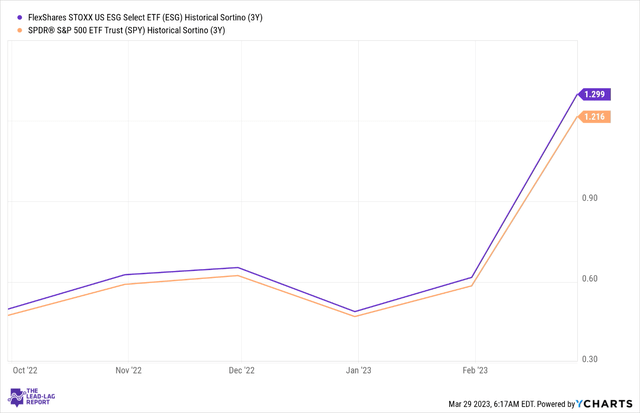

Investors should also note that over the last three years, the ESG ETF has coped relatively well in the face of downside deviation, as measured by the Sortino ratio. Data from YCharts shows that its Sortino ratio has been better than the broader markets.

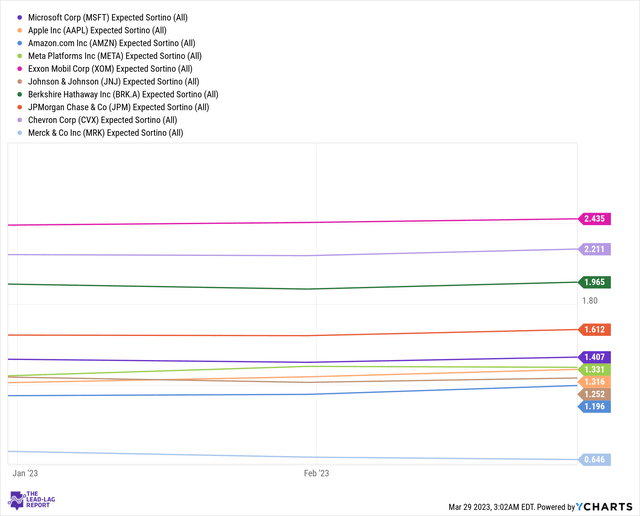

Separately, if you consider just the top 10 stocks of FlexShares STOXX US ESG Impact Index Fund (which have significant aggregate weightage), we can see that with the exception of Merck & Co., Inc. (MRK) (which has the 10th largest weight), all these other stocks look poised to deliver superior expected Sortino ratios over 1x. Put another way, even in the face of harmful volatility, these stocks may well be positioned to deliver excess returns.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.