CoLabs Int'l Readies Plan For $6 Million U.S. IPO

Summary

- CoLabs Int'l, Corp. has filed proposed terms for a $6 million U.S. IPO.

- The firm is developing topical skin care technologies in the U.S.

- CLLB is still at a very early stage of development and commercialization, is thinly capitalized and up against large, entrenched competitors in a slow-growing business.

- I'll pass on the IPO.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

verona_S

A Quick Take On CoLabs Int’l, Corp.

CoLabs Int’l, Corp. (CLLB) has filed to raise $5.85 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing technologies that promise to improve the delivery of topical formulations for better skin care results.

Given the firm’s early stage of development and tiny level of capitalization, I'm on Hold for the IPO.

CoLabs Overview

Huntington Beach, California-based CoLabs Int’l, Corp. was founded to develop its QuantaSphere Technology [TM], which 'places OTC drugs, pharmaceuticals, and chemicals into micro-sized, electrostatically charged encapsulates as well as into other types of micro-encapsulates.'

Management is headed by Chairman and CEO Laura Cohen, MD, who was previously Clinical Professor of Medicine at the University of California School of Medicine Irvine and has held other teaching positions within the field of dermatology.

Management says the firm's technologies enable topical formulations to:

target the delivery of topically applied drugs; limit unwanted absorption of chemicals, drugs, and cosmetics through the skin; and provide a designed release of active ingredients with a prescribed depth of skin penetration.

As of December 31, 2022, CoLabs has booked fair market value investment of $17.5 million from investors.

The company is developing a 'user-friendly sunscreen' and has sought to 'prove our scientific premise using the Confocal Stain Test ("CST").'

Management has proposed its methodology to the US FDA but has not yet received a direct response, although the FDA 'has conducted tests based upon the comments we previously supplied to them.'

CoLabs’ Market & Competition

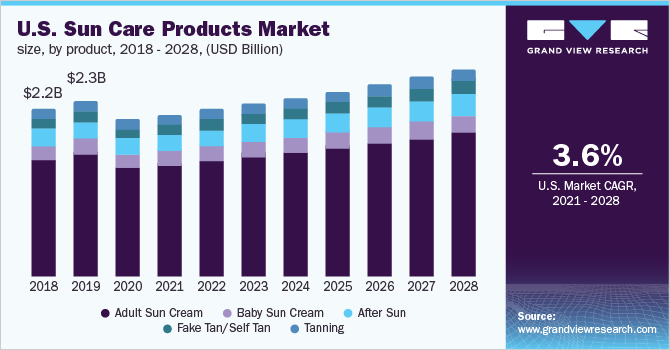

According to a 2021 market research report by Grand View Research, the global market for sun care products was an estimated $10.7 billion in 2020 and is forecast to reach $14.6 billion by 2028.

This represents a forecast CAGR of 4.0% from 2021 to 2028.

The main drivers for this expected growth are a growing concern by consumers about the negative effects of harmful sun rays on skin.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. Sun Care Products market:

U.S. Sun Care Products Market (Grand View Research)

Major competitive or other industry participants include the following:

Beiersdorf AG

Groupe Clarins

Johnson & Johnson

Coty Inc.

Shiseido Co., Ltd.

L'Oreal

The Estee Lauder Companies Inc.

Burt's Bees

Bioderma Laboratories

Unilever

Others

The company's technologies may also have relevance to other large topical skin care markets.

CoLabs Int’l Financial Performance

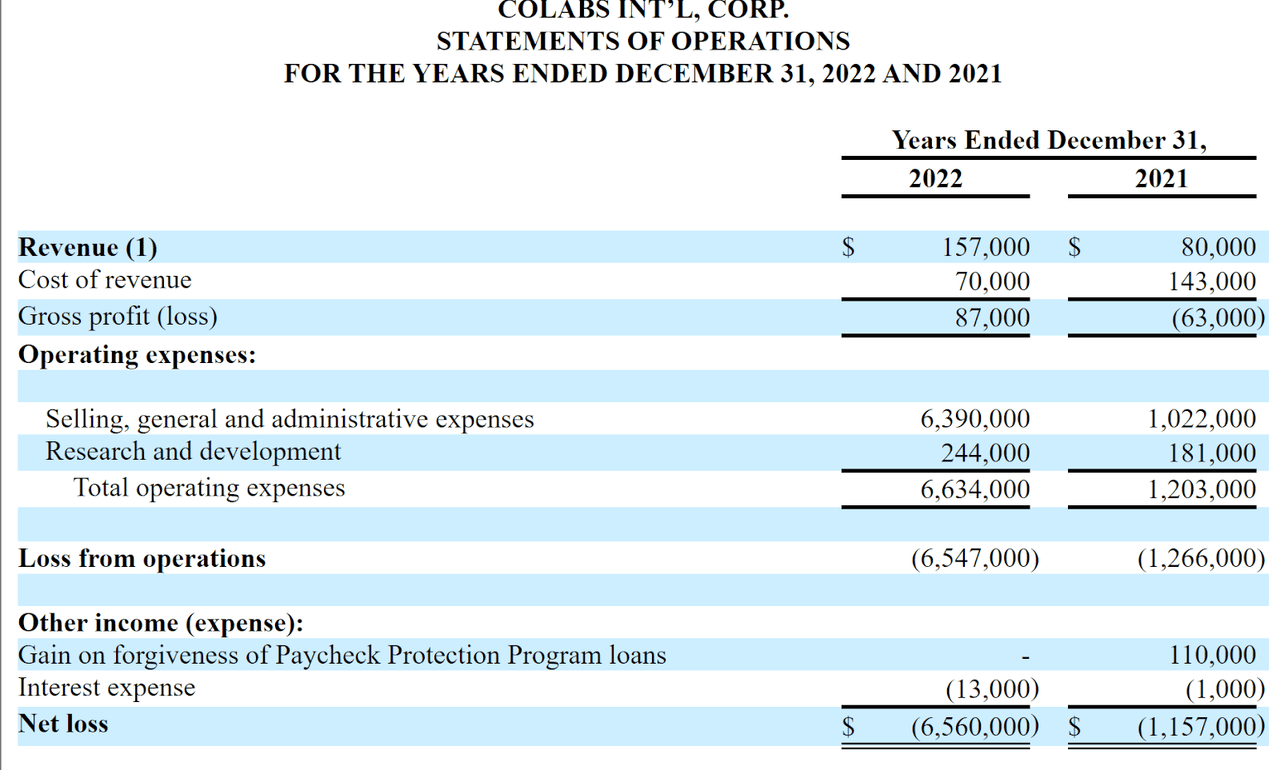

Below are relevant financial results derived from the firm’s registration statement, indicating little revenue and significant SG&A expenses:

Statement Of Operations (SEC)

(Source - SEC)

As of December 31, 2022, CoLabs had $9,000 in cash and $671,000 in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($880,000).

CoLabs Int’l, Corp. IPO Details

CoLabs intends to raise $5.85 million in gross proceeds from an IPO of its common stock, offering 1.3 million shares at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Immediately following the IPO, Chairman Laura Cohen and CFO William Cohen will retain majority control over the company.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $149 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 3.8%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

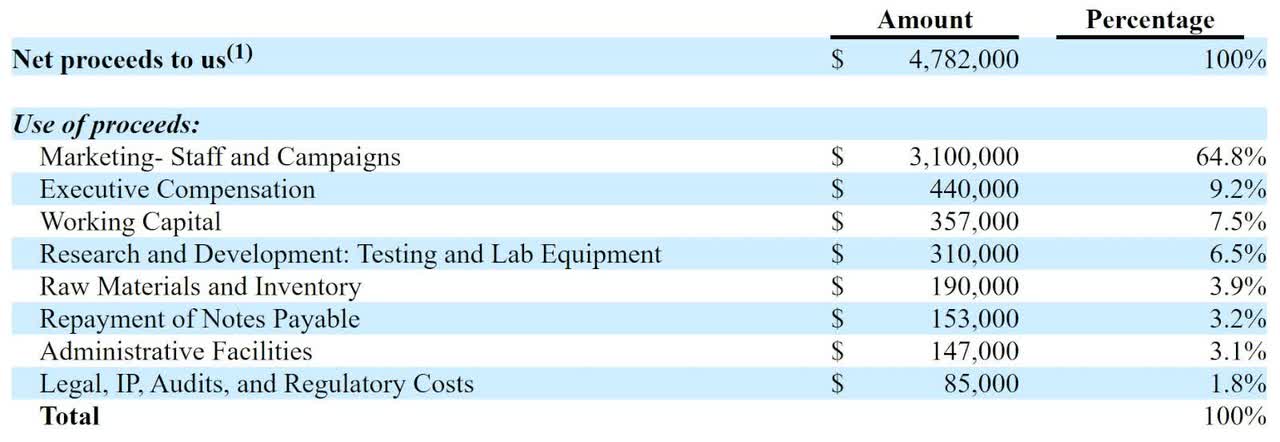

Management says it will use the net proceeds from the IPO as follows:

IPO Proposed Use Of Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not a party to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Craft Capital Management and R.F. Lafferty & Co.

Commentary About CoLabs’s IPO

CLLB is seeking U.S. public capital market investment to fund its commercialization efforts.

The firm’s financials show little revenue history and high SG&A expenses.

Free cash flow for the year ended December 31, 2022 was negative ($800,000).

Management has proposed its methodology to the US FDA but has not yet received a direct response, although the FDA 'has conducted tests based upon the comments we previously supplied to them.'

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the firm's development, growth and working capital requirements.

The market opportunity for the company's first potential market of sunscreen products is large but expected to grow at a relatively low rate of growth.

The sunscreen market also features intense competition from large, entrenched industry participants.

Craft Capital Management is the lead underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (59.4%) since its IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its tiny size and thin capitalization.

As for valuation expectations, management is asking investors to pay an Enterprise Value of approximately $149 million.

Given the firm’s early stage of development and tiny level of capitalization, I'll pass on the IPO.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.