THQ: Attractive Yield And Trades At A Discount

Summary

- Tekla Healthcare Opportunities Fund (THQ) is a closed-end fund that specializes in large cap health care stocks.

- The fund currently trades at a 11.43% discount and yields 7.37%.

- THQ recently initiated a share buyback program which could help to reduce the discount to NAV.

- THQ is a better choice than sister fund THW which trades at a big premium.

- Vanguard's Health Care ETF (VHT) has similar holdings to THQ, and may be a better choice for long-term buy and hold investors.

- Looking for a helping hand in the market? Members of Yield Hunting: Alt Inc Opps get exclusive ideas and guidance to navigate any climate. Learn More »

shapecharge/E+ via Getty Images

The Tekla Healthcare Opportunities Fund (NYSE:THQ) had an inception date of July 28, 2014. It employs a growth and income investment strategy across all healthcare sub-sectors.

(Data below is sourced from the Tekla Capital Management website unless otherwise stated.)

Investment Philosophy

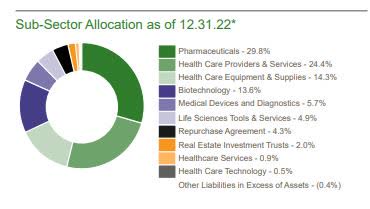

The Tekla management team believes that aging demographics and adoption of new medical products can provide long-term good performance for healthcare companies. They invest in 11 sub-sectors which include biotechnology, healthcare technology, managed care and healthcare REIT's.

Sector Allocation for THQ (Tekla web site)

The portfolio manager is Daniel Omstead, PhD who has 40 years experience and has worked at Merck, Johnson & Johnson, CytoTherapeutics, Retrogenesis and JP Morgan. He is backed up by an investment team of eleven professionals with impressive credentials

THQ is currently trading at a discount to NAV of -11.43% compared to the 6 month average discount of –9.99%.

The longer term Z-scores for THQ are all negative, which means the discount is well above average for these time periods.

3 month Z-score= -1.30

6 month Z-score= -1.32

1 year Z-score = -1.43

(Source: cefconnect)

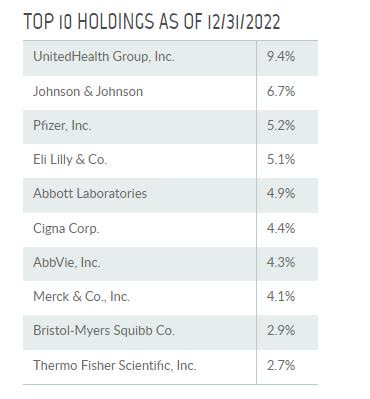

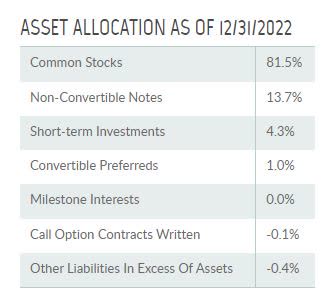

THQ is primarily invested in larger cap healthcare stocks, but they also have smaller allocations to non-convertible notes, convertible notes and short term investments.

Top 10 Holdings THQ (Tekla web site) Asset Allocation THQ (Tekla web site)

Distributions

THQ has a managed distribution policy They have consistently paid out $0.1125 per month over the last few years.

Distribution Ex-Date | Payment Date | Amount |

03/17/2023 | 03/31/2023 | $0.1125 |

02/17/2023 | 02/28/2023 | $0.1125 |

01/19/2023 | 01/31/2023 | $0.1125 |

12/16/2022 | 12/30/2022 | $0.1125 |

11/18/2022 | 11/30/2022 | $0.1125 |

10/19/2022 | 10/31/2022 | $0.1125 |

09/19/2022 | 09/30/2022 | $0.1125 |

08/19/2022 | 08/31/2022 | $0.1125 |

07/20/2022 | 07/29/2022 | $0.1125 |

06/17/2022 | 06/30/2022 | $0.1125 |

05/19/2022 | 05/31/2022 | $0.1125 |

04/20/2022 | 04/29/2022 | $0.1125 |

THQ Historical NAV Performance Record (as of March 27, 2023)

Total Return THQ (NAV) Health

5 Years | +9.65% | + 7.24% |

3 Years | +13.93% | +10.14% |

1 Year | - 7.21% | - 5.89% |

YTD | - 5.32% | - 2.77% |

(Source: Morningstar)

THQ has produced good performance since its inception in 2014. In spite of paying out generous monthly distributions, the current NAV of $20.68 is still well ahead of its inception NAV of $19.06.

THQ: Three Year Discount History

THQ Discount History (cefconnect)

Institutional Ownership (as of Dec. 31, 2022)

Institutional investors own about 21% of the shares outstanding. I do not see any activist investors among top holders. Morgan Stanley and Raymond James are the top two holders which are probably shares held by investment advisors for their clients. I believe it is unlikely that THQ will be targeted by any activist investors in the near future.

Renewal of Share Buyback Program

On March 16, 2023, THQ announced a renewal of its share repurchase program. The current program allows the Fund to purchase up to 12% of shares outstanding for the one year period ending July 14, 2023. The renewal allows the Fund to purchase up to 12% of its outstanding shares for the one year period ending July 14, 2024.

The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund’s shares and the Fund’s net asset value.

Unfortunately, during the years ended September 30, 2022 and September 30, 2021, the Fund did not repurchase any shares through the repurchase program. But the recent increase in the THQ discount, may be the catalyst need for the Fund to start using the repurchase program.

Comparison To Sister Fund

Tekla World Healthcare Fund (THW) is a "sister" fund to THQ. THW has a bit more of a global orientation, but is quite similar to THQ. The correlation between the two funds 0.83. But the correlation of the NAV's of the two funds is 0.96.

The main problem with THW is that it trades at a 8% premium above NAV. The premium price is partially due to the high distribution yield of THW, which is 10.45%. This yield is a managed distribution, but the total return NAV performance of the fund has underperformed THQ.

On Fidelity, THW is "hard to borrow" and short sellers are paying 10% interest to borrow the shares. These borrowing fees paid by short sellers are likely also adding to the premium, since investors who participate in share lending programs can earn about half of this fee from their broker.

I would definitely choose THQ over THW at the present time.

Comparison to Vanguard Health Care ETF (VHT)

For long term buy and hold investors who are not active traders, it may be better to invest in VHT, rather than THQ. The correlation between VHT and the NAV ticker for THQ is 0.97, so the two funds are very similar. But VHT has an expense ratio of only 0.10%, while the expense ratio for THQ is 1.46%.

An active investor or trader who can exploit differences in the discount of THQ may be able to outperform VHT. An investor who is strictly buy and hold may do better owning VHT over the long term.

(THQ) Tekla Healthcare Opportunities Fund

- Total Investment Exposure= $1080 MM

- Total Common Assets= $855 MM

- Annual Distribution Rate= 7.37%

- Dividend Frequency= Monthly

- Current Monthly Distribution= $0.1125 per share ($1.35 annually)

- Baseline Expense ratio= 1.46% (omits interest expense)

- Discount to NAV= -11.46%

- 6 month Avg. Discount= -9.98%

- Leverage= 20.83%

- Average 3 Mos. Daily Trading Volume= 113,000 shares

- Average 3 Mos. Daily $ Volume= $2,000,000

Sources: cefconnect, Yahoo Finance

THQ trades over 100,000 shares a day. Normally the bid-asked spread is only one or two cents a share. But care should be taken when executing orders since the bid-asked spread sometimes widens to five cents or higher. I would recommend using limit orders or smaller market orders.

Marketplace Service For Those Hunting For Yield

George Spritzer's top investment ideas are being featured on Alpha Gen Capital's "Yield Hunting" marketplace service.

This service is dedicated to yield/income investors who wish to avoid market froth. We encourage investors to benefit from yield opportunities within closed-end funds, business development companies, and other niche areas. For safe and reliable income streams, check out Yield Hunting.

This article was written by

George Spritzer, CFA is a registered investment advisor at Southland Investments and specializes in managing closed-end funds for individuals. George uses the following investment strategies:1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc. Some of my premium articles are published on Alpha Gen Capital's "Yield Hunting: Alt Inc Opps" https://seekingalpha.com/author/alpha-gen-capital/research

Disclosure: I/we have a beneficial long position in the shares of THQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.