Hershey: Current Valuation Looks Unsustainable With Growth Expected To Slow

Summary

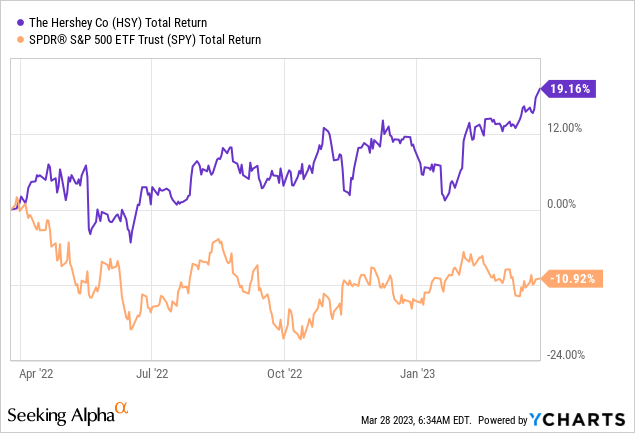

- Hershey significantly outperformed the broader index in the past year, with shares up nearly 20%.

- Soaring inflation was a substantial tailwind for the company, as price increases boosted revenue.

- However, inflation has been trending down in the past few months, and growth should start to normalize.

- The current valuation is also unsustainable, as growth is expected to slow while multiples remain elevated.

- I rate the company as a sell.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Hershey (NYSE:HSY) has performed extremely well in the past year, with shares up nearly 20%, while the S&P 500 Index slumped roughly 10%. Unlike most companies that struggled with soaring inflation, the company benefited from it thanks to strong pricing power. This is reflected in its latest earnings with double digits growth in both the top and the bottom line. However, inflation has been easing and growth rates should start to decelerate. The current valuation is also elevated compared to peers and its historical average. I believe the slowing growth rates and lofty valuation may present meaningful downsides, therefore I rate the company as a sell.

Fading Tailwinds

Inflation has been the biggest topic in the past year, as the US CPI (consumer price index) soared to 9.1% in June last year. This pressured many companies as high inflation increased operating costs and weakened demand. However, Hershey was a rare outlier that benefited from it. Thanks to strong branding and pricing power, the company was able to increase prices at a rate that is even higher than inflation, allowing it to pass all the incremental costs on to customers while also seeing a huge boost in sales. For context, over 50% of sales growth is driven by price increases in FY21 and FY22.

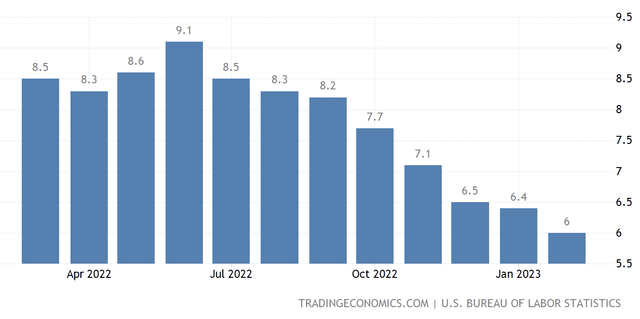

I believe this tailwind should start to fade as inflation eases. While the current CPI is still elevated at 6%, it has been trending downward steadily in the past few months, as shown in the chart below. The unemployment rate remains low but the economy is starting to weaken as consumer spending slows. According to the US Census Bureau, retail sales in February dipped by 0.4% MoM (month over month). This makes future price increases much harder and less accretive as it will start to cause outsized impacts on demand.

Trading Economics

Financials

Hershey’s latest earnings continued to show strong broad-based growth, but the guidance suggests a slowdown is coming. The company reported revenue of $2.65 billion, up 14% YoY (year over year) compared to $2.33 billion. Organic revenue growth on a constant currency basis was 10.7%. The growth is mostly driven by price increases, which accounted for 8.5%. The remaining 2.2% was contributed by volume gains.

The bottom line was solid thanks to the discipline in spending. The gross profit margin was down 30 basis points YoY from 43.5% to 43.2%, largely due to inflationary pressure on costs of sales. On the other hand, operating leverage improved, as the increase in spending continued to trail revenue growth. SM&A (selling, marketing, and administrative) expenses were up 11.5% YoY from $552.9 million to $616.4 million. Advertising and marketing expenses only grew by 3.3% YoY. Better operating leverage resulted in net income up 18.5% YoY from $339.8 million to $396.3 million. The net income margin was 14.9%. The diluted EPS was $2.02 compared to $1.69, up 19.5% YoY.

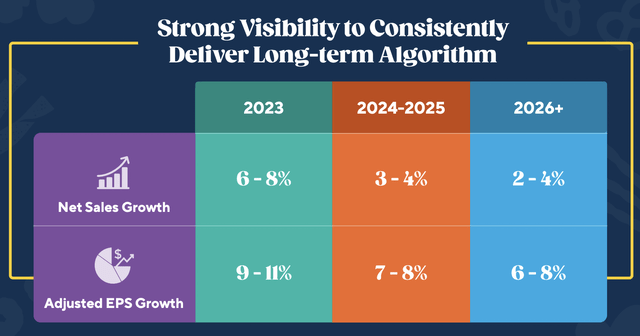

The company also initiated guidance for FY23, which suggests a slowdown. It expects revenue growth to be 6%-8% while adjusted EPS growth is expected to be 9%-11%. All of the growth is expected to be driven by price increases, partially offset by a slight decline in volume. During the latest investors' day, the management team also outlined their financial targets and expects long-term sales growth to be low in the single digits and adjusted EPS growth to be in the high single digits, which is underwhelming.

Hershey

Unsustainable Valuation

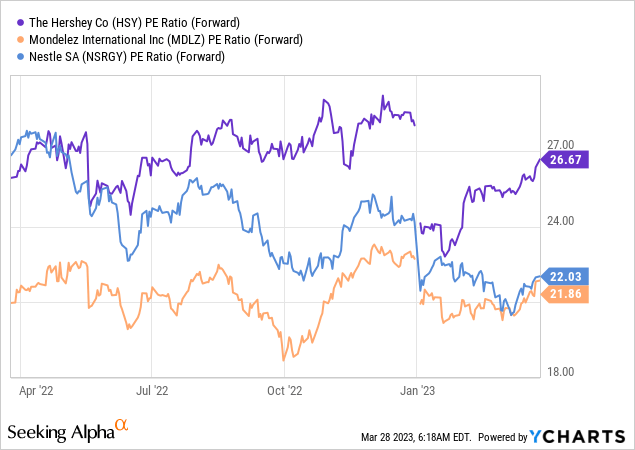

Hershey's valuation is a major problem in my opinion, as the current multiple looks vastly unsustainable. The company is now trading at an fwd PE ratio of 27.14x, which is extremely expensive for a consumer brand. The current multiple represents a meaningful premium of 11.5% compared to its 5-year historical average fwd PE ratio of 24.35x. It is also more expensive than other consumer brands such as Nestle (OTCPK:NSRGY) and Mondelez (MDLZ), as shown in the chart below. The two companies are trading at a fwd PE ratio of 22.03x and 21.86x respectively, which represents a significant discount of 18.8% and 19.5%. Considering its forward EPS growth rate at just high single digits, I believe a lower valuation may be warranted.

Investors Takeaway

Hershey is a great company with strong branding. However, its share price has run up a lot and the current valuation looks unsustainable. The market gave the company a significant premium in the past two years as high inflation significantly pumped up its sales, but the tailwind is now fading. Sales growth should start to normalize in the coming year as inflation continues to trend downwards. As mentioned by the management team, long-term EPS growth is expected to return to mid to high single digits. This level of growth should not be enough to support a fwd PE ratio of 27.14x, which is expensive compared to both its historical average and peers. As growth slows, I believe the company's valuation should also normalize to more reasonable levels, which will present potential downsides. Therefore, I rate Hershey stock as a sell.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.