Alexandria: Cheap By Association

Summary

- Alexandria's fundamentals have continued their upward trajectory.

- The market price has sunk.

- We examine the bear arguments to determine if there is merit to the price declines.

- I do much more than just articles at Portfolio Income Solutions: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

onurdongel

In the ancient world, the Library of Alexandria in Egypt was the center of knowledge. In a time before data was easily recorded it contained texts and scrolls detailing the most advanced science of the era. Today, Alexandria Real Estate Equities (NYSE:ARE) owns the real estate that houses the most advanced science in the world. It is a company that has long been admired until the last 15 months as investors sell it into obscurity.

What changed? How did this great company fall so far?

This article will examine the forces behind the epic drop in ARE's share price and determine whether it is cheap or cheap for a reason.

The great fall

At the start of 2022 ARE's share price approximated $225 and in just 15 months it has fallen to under $125.

S&P Global Market Intelligence

It is now trading below where it was 5 years ago. In searching for reasons for the fall I have come across 2 bear arguments.

- Busted growth thesis

- Office weakness

I believe these are collectively responsible for the price decline so we shall examine each with full attention.

Bear thesis #1: Busted growth

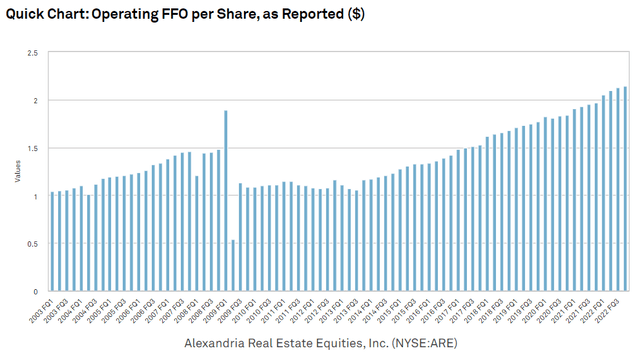

Back in 2018 when ARE was trading around $125, it had $6.60 of 2018 FFO. Today it has a share price of $116 with 2023 estimated FFO of $8.97. That is 36% FFO growth and yet the stock price has declined.

The FFO multiple has dropped by about 40% to 13X. Generally, there are 2 reasons for a stock's multiple to come down.

- Higher risk

- Lower growth

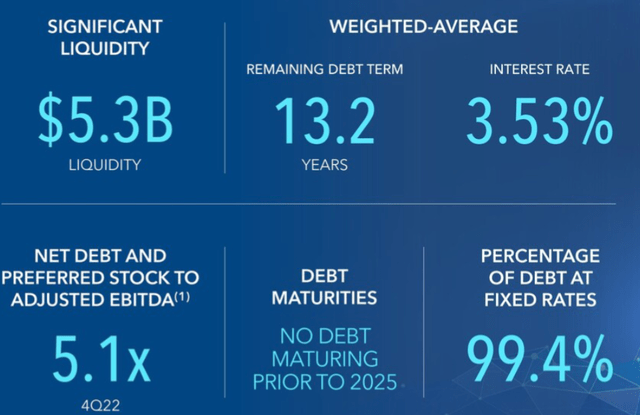

I don't really see any reason why someone would think ARE is higher risk now. It has reduced leverage to just about the lowest level in its history and the balance sheet is pristine. The debt is beautifully termed out 13.2 years into the future at the very low fixed rate of 3.53% on average. This is exactly the kind of balance sheet a REIT wants to have in this environment.

Thus, the reason for the decline in earnings multiple must be that investors think the growth thesis is busted. It is well known that ARE has had decades of moderate to fast paced growth.

S&P Global Market Intelligence

Historically, it was this growth that justified its above market multiple. If this growth were to stop, it would be entirely rational for the multiple to come down. I think the growth concerns come from a valid thought process based on some industry level information.

- Office conversions to labs

- Venture capital funding has dried up

- Weaker leasing in biotech (from white hot to only moderately strong)

With office struggling and lab space leasing well, there is some merit to the idea of converting vacant offices to lab space. Not all buildings can do this, but some do have the right bones and are putting in the capex to convert. Naturally this creates increased supply.

At the same time, rising interest rates have cut off investor appetite on the higher end of the risk spectrum which is where startup biotech falls. Venture capital funding has been slow for a while, and with the failure of Silicon Valley Bank, it has ground to a halt. Since startup biotech firms were a significant component of incremental demand for lab space, there might be a slowdown in demand.

Slower demand in combination with extra supply from conversions could indeed weaken leasing in either price or occupancy.

My counterpoints to the bear thesis on growth

Biotech real estate has had sluggish leasing for a few quarters now due to the aforementioned difficulties, but it simply has not applied to ARE. 2022 leasing activity for ARE was nothing short of explosive with near record leasing volumes and cash rent increases of 22.1%.

Supplemental

I suppose one could suggest 22.1% is a slowdown from 22.6% in 2021, but it is still historically strong growth, especially for a company trading at a 13X multiple.

Going forward I think growth will slow a bit to the mid-teens as opposed to the low 20s, but that is not really a symptom of growth weakness going forward so much as it was 2021 being an unusually strong leasing year.

At an industry level, growth will slow more than that, but ARE is positioned to be largely immune to the industry slowdown as it was in 2022 for 3 reasons:

- Superior property locations. ARE's labs are in the best biotech hubs in the world with access to the most talented employment pools. These areas are quite landlocked so new supply in the premium locations is minimal

- ARE's property quality is unmatched. The office conversions to lab mostly consist of taking a regular office building and putting in about $100 capex per foot. It technically counts as a lab and will serve certain lab tenants with basic needs, but it does not compete with ARE's high end space. ARE's labs are closer to $900 per square foot of value and provide research capabilities that are above what the converts can handle.

- ARE's tenants are mostly well established big pharma type companies. This area does not depend on venture capital to expand. In fact, growth in megacap biotech should be accelerated by the VC pullback because they will now be able to acquire the cash starved startups.

ARE's rents are still significantly below market rates so they are likely able to continue their long pattern of marking rents up to market as leases expire.

S&P Global Market Intelligence

Particularly notable in the above chart is that organic growth dropped in the financial crisis but remained positive. While there might be some challenges in the coming years, I don't foresee anything even close to as bad as the GFC.

I anticipate continued moderate to rapid growth for ARE and the sell-side analysts that follow the company seem to agree.

S&P Global Market Intelligence

Longer term, I think there is secular growth in demand for biotech real estate.

A virtuous cycle of ever-increasing demand

Alphabet's (GOOG) (GOOGL) AlphaFold2 has successfully catalogued the structures of a large portion of known proteins. Meta Platforms (META) has an AI system that is attempting to anticipate the structures of an even larger set of proteins.

Human understanding of biology is rapidly expanding and as each discovery is made it unlocks new pathways of research. There is cancer research going on right now that is using a method of attack that only recently was even considered. Further genome mapping will spur research into a wide variety of preventive and predictive treatments.

I don't have the background to even remotely understand this stuff, but the trajectory is clear. Humans are nowhere near the endpoint of biotech research and each discovery only expands the field of valid research topics. As the topics get increasingly complex, researchers will need increasingly advanced facilities with integrations of wet lab tools and technology. ARE has the expertise and reputation to deliver precisely the facility tenants need.

Bear story #2: Office lump-in

This bear thesis is less valid fundamentally yet more impactful with regard to market price.

Despite lab space being entirely different, ARE is classified as an office REIT. I'm sure you already know what has happened to the office REIT sector as office struggles are a daily topic on financial news. This sloppy official classification of ARE as office has 2 effects:

- It gets lumped-in and sold along with office

- It gets sold as a form of window dressing.

Portfolio managers want to be able to tell their clients they have no exposure to office but they can't do that if ARE is in their portfolio due to its official tag. I suspect many have offloaded it to fix their portfolio pie charts.

Ultimately, this sort of lump-in selling is temporary and will reverse. However, there is an odd aspect of REITs in which even without fundamental damage a low share price can actually hurt the company.

A low price causing actual harm

When REIT prices get too low it chokes off capital availability. Equity issuance becomes far too expensive to be worth it for shareholders and it can even harm debt availability by messing with ratios like Debt/total capital.

Thus, before we dismiss the office lump in as a non-factor we should verify that ARE does not have near term capital needs, particularly given their large development pipeline.

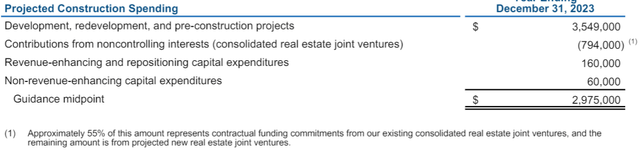

In 2023, ARE estimates spending $2.975B on developments and redevelopments.

So, with equity capital choked off by the share price, where is the money going to come from?

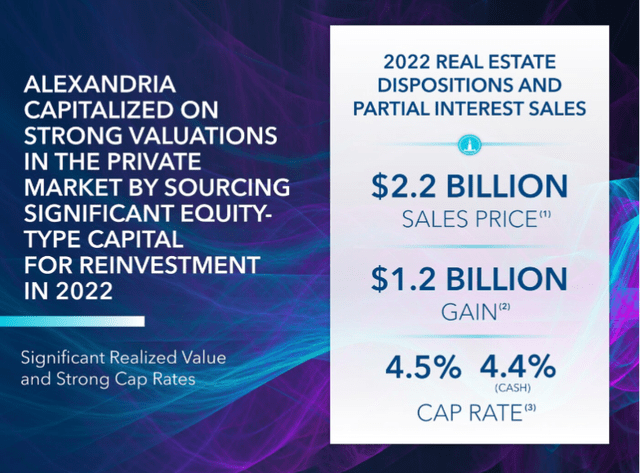

Fortunately, ARE is well positioned with roughly $5.3B of liquidity. $2.2B came from 2022 dispositions in which they sold at an impressive 4.4% cash cap rate booking a gain of $1.2B

The rest comes from 3 sources:

- Recently issued $1.8B of 22 year bonds at 3.28% fixed.

- Increased line of credit to a cap of $4.0B

- Joint Venture funding for some of the developments

Forward outlook

With funding largely secured for the developments this becomes a source of growth that will stack summatively with the organic rental rate growth. As these developments come online over the next 4 years, the incremental revenues will flow through to FFO as most of the costs are already in place.

Absolute growth rate will depend on whether or not there is a recession, but I see it as a range of moderate to fast growth with only black swan scenarios taking it negative.

Why ARE is appealing as an investment

ARE has had excellent fundamentals for a long time and has generally produced an above market return for investors. At times it has been overpriced, but right now it is close to the best value it has been. This is a company that normally trades at a premium FFO multiple and a premium to NAV but with the price declines, that has changed.

At 13X FFO it is now cheaper than the REIT index and I find that multiple inappropriately low given the growth trajectory.

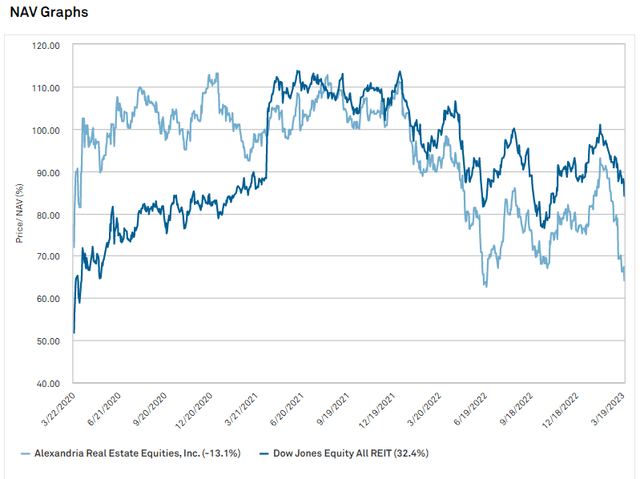

NAV looks perhaps even more attractive with ARE at about 65% of NAV compared to its typical 105% of NAV.

S&P Global Market Intelligence

Fundamentals are business as usual for this strong company, but the investment opportunity is unusually favorable given the valuation.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a variety of ways to invest with us. Our focus is on maximizing client returns while staying within risk their risk parameters. To learn more about our advisory services you may schedule a 15 minute intro meeting here: https://calendly.com/2mc/intro

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Disclosure: I/we have a beneficial long position in the shares of ARE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.