Hello Group: Worst Is Behind It

Summary

- Underperformance creates an opportunity.

- Management focuses on returning cash to shareholders.

- Attractive valuation and risk – reward ratio.

We Are/DigitalVision via Getty Images

Quick pitch

Hello Group (NASDAQ:MOMO) is a Chinese player in online dating and live streaming apps. Its online dating app, Tantan, is known as Chinese Tinder. On the other hand, live streaming apps such as Momo, Sochio, Dui dui and Hertz are used for facilitating social interaction. Combination of operational underperformance, Covid lockdowns in China and resentment towards Chinese stocks resulted in deeply discounted MOMO’ stock. MOMO ‘s current market value is slightly above its cash position and its stock trades with a substantial discount compared to other Chinese technology companies. Its strong liquidity position gives MOMO enough flexibility to withstand negative performance and stabilize its business going forward.

Genesis of underperformance

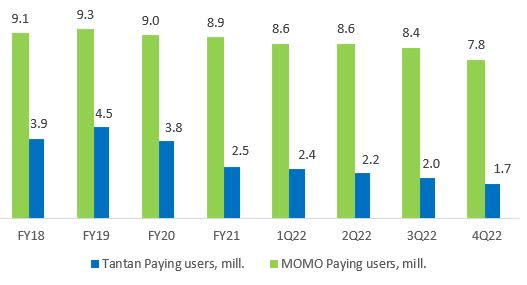

Hello Group has all characteristics of value investor’s dream. It is underperforming stock for a prolonged period, cheap with a low probability of default and additionally generating enough of cash to pay regular dividends. Let’s talk about each point. Since its peak in 2018, Hello Group lost over 85% of its market value. With such a long period of underperformance, even the most patient investors usually lose interest in holding the stock and eventually sell their position. There are several reasons for Hello Group’s underperformance. Firstly, both of its main applications, MOMO and Tantan have been losing monthly active users (MAU) as well as paying users for over five years. This is very unfortunate especially for Tantan. In order for an online dating app to attract attention, it needs to have enough users to stay relevant. With the benefit of hindsight, it is clear that Tantan’s management did a lot of missteps. However, since Q4 2021Tantan has a new management team and new vision how to stabilize the outflow of paying users. Prolonged Covid lock downs in China postponed this target, but there is a reasonably good chance that relative outflow of MAU’s in both apps reached its bottom in 4Q2022 and could stabilize around current numbers. In last quarterly call, management mentioned that MAU numbers have recovered since Zero Covid Policy rules have been canceled. If it is true, we could see stable revenues in the second half of this year and possibly return to growth in FY24.

Tantan vs MOMO paying users (Corporate reports)

Shareholders’ friendly management

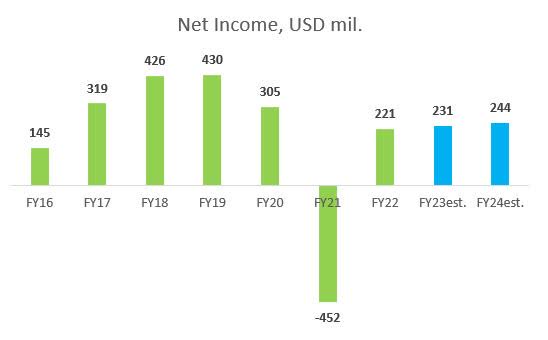

Despite negative operational development in past three years, MOMO has been able to achieve profitability on operating level basis. Even more admirable is fact, that excluding FY2021, MOMO has been profitable on GAAP net income basis every year since IPO. MOMO is one of very few Chinese companies, which has a history to pay regular dividend and at the same time has substantial share repurchase program in place. With proposed dividend of USD0.70 per share on ex-date 27th of April, current dividend yield exceeds 8.4% p.a. Additionally, remaining share buy-back program of USD143 mil. is equal to 8.75% of current market cap. In FY2022, MOMO earned USD221 mil. in net income and proposed to pay USD137 mil. in dividends. This gives MOMO over USD80 mil. for reinvestment into business in FY2023. This is formidable performance and MOMO was able to achieve this in extremely challenging year.

Valuation

There are several ways how investors can look at the valuation of MOMO. We can either look at MOMO through income approach analyzing its P&L or through balance sheet approach. Either way MOMO looks undervalued by a wide margin. Given the fact that MOMO is a technology company, income approach seems more suitable. MOMO trades with market capitalization of USD 1.7 billion. Subtracting cash and investments on hand (USD 1.5bill.) and adding leases (USD0.4 bill.), Enterprise Value of the company is USD 0.6 billion. Average 5Y earnings are equal to USD320 million. Using 5Y average earnings in valuation gives us an earnings yield of 50%. This gives investors a reasonable margin of safety even if things to turn around the business takes longer than expected. If we are more conservative and we use FY2022 earnings of USD220 million, we get an earnings yield of 37%, still attractive valuation. In the corporate world, weaker years of profitability are usually followed by stronger years and this mean reversion might be characteristic also for MOMO. Therefore, I believe that average 5Y earnings are more representative of MOMO’s future earnings performance and is also aligned with management expectation to see the business growing in next quarters. This attractive valuation reminds me of Mohnish Pabrai’s description of ideal investment: “If I lose, I lose little. If I win, I win substantially”. Low MOMO’s valuation provides appealing risk-reward ratio and should protects investors from accruing big losses.

Net Income, USD mil. (Corporate reports)

What could go wrong?

Putting myself into a role of devils’ advocate, MOMO could end up as a value trap. Its decline in MAU and paying users could continue for a prolonged period, which would negatively impact earnings and subsequently dividend. However, with current cash and investments on hand of USD1.5 billion and annual dividend payment of USD137 million, it would take substantial time to burn through this cash buffer. I find this scenario possible but unlikely.

Summary

MOMO has attractive valuation, no net debt and plenty of cash so its ability to go bankrupt is virtually zero. Substantial cash buffer gives MOMO a lot of flexibility to turn around business, to introduce new apps and to grow revenues again. As a leap of faith, Alibaba increased its stake in MOMO in 3Q2022 from 5.0 million shares into 8.4 million shares, which I see as a clear vote of confidence in MOMO’s management. I would assume that MOMO has one, maybe two more quarters of lower year over years revenues before return to growth of revenues and share price will be visible again. For patient investors this might be an opportunity worth taking.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MOMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.