Walker & Dunlop: Multifamily Lending Platform And Appears Undervalued

Summary

- Offering financial and technological services in the real estate market, Walker & Dunlop ranks as a highly recognized company in the field.

- Walker & Dunlop recently announced an impressive increase in guidance for the year 2023, including double digit adjusted EBITDA Growth, EPS growth, and 2025 net income close to $489 million.

- In my view, the accumulated know-how will likely help the company bring further Adjusted EBITDA margin and FCF generation in the coming years.

- Considering the recent increase in interest rates and investments on small-balance multifamily lending platforms, I believe that we could see significant FCF generation.

Torsten Asmus

Financial and technological services company Walker & Dunlop, Inc. (NYSE:WD) expects 2025 net income close to $489 million, and currently trades with a market capitalization of less than $2.61 billion. I believe that further investments on small-balance multifamily lending platforms and the recent increase in interest rates will definitely bring significant FCF generation in the future. Even considering risks from the deterioration of the multi-family real estate market or competitors, I believe that the stock is undervalued.

Walker & Dunlop

Offering financial and technological services in the real estate market, Walker & Dunlop ranks as a highly recognized company in the field. Its services include home rentals, property sales, searches and appraisals, broker services and real estate advice, and investment management. This package of complete and wide-ranging services is supported by a firm's technological development that, according to the company's own statements, facilitates the user experience, makes it possible to identify financing possibilities, and generates convenience in the management of assets and operations.

Considering the recent results reported by management and the current stock price, I believe that it is a great moment to review the business model of the company. Keep in mind that during the year 2022, new loans represented 62% of the refinancing volumes and 24% of the total volumes of new clients. During the same year, the company also acquired GeoPhy, a Dutch similar services company, which is technologically advanced, and will serve data analysis and information management. In my view, further internationalization in Europe could bring significant revenue growth in the coming years.

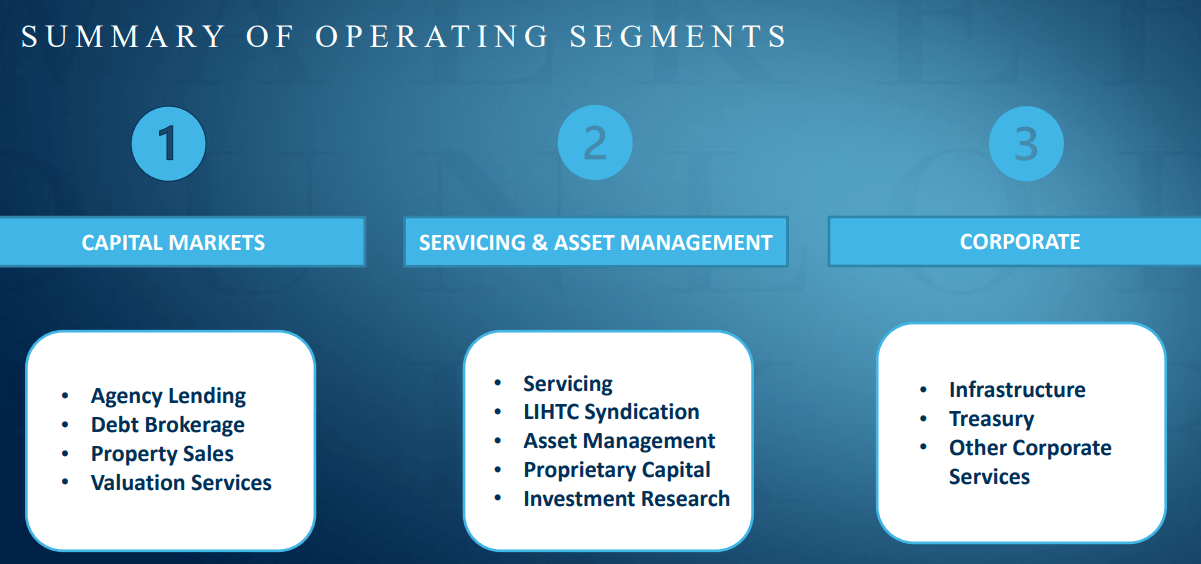

Walker & Dunlop has recently restructured its business model into three reportable segments: capital markets, corporate, and servicing & asset management.

Source: Presentation, March, 2023

The capital markets segment offers a wide variety of services in the field of real estate to its clients. Among these, the sale of properties, legal or financial advisory services as well as investments, and the search for land or assets in the market stand out.

The service and asset management segment is intended for the administration of the company's assets as well as that of some of its clients, mainly referring to the loan portfolio for agencies, some insurance and coverage companies, and capital management firms. The company generates profits through fees.

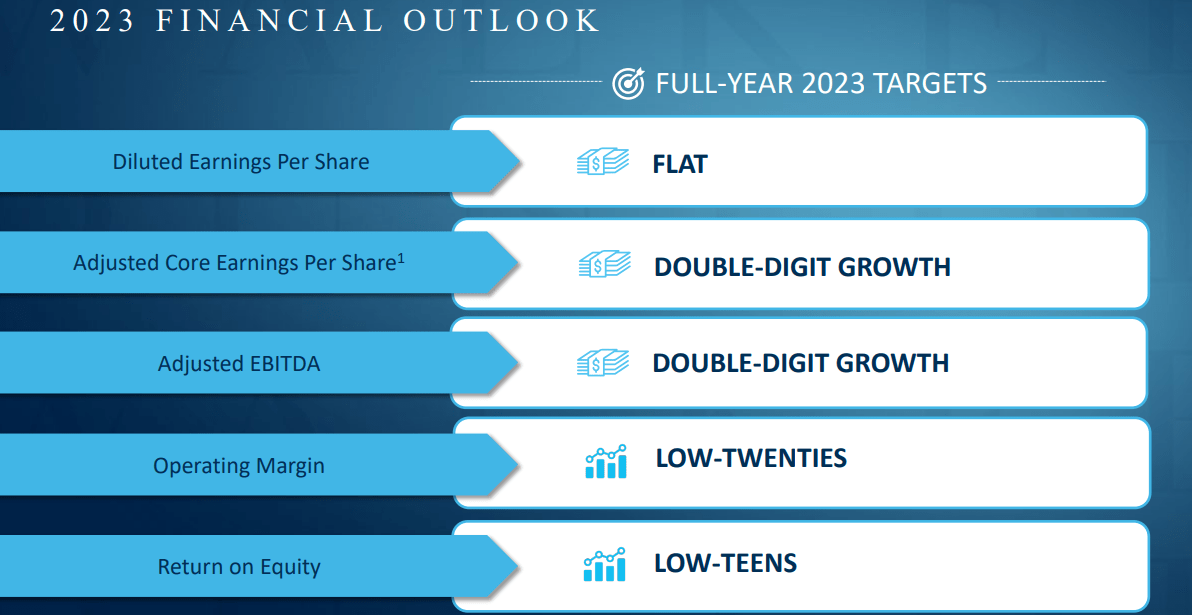

The Financial Outlook For 2023 Includes Double Digit Adjusted EBITDA Growth, But My Expectations Are A Bit More Conservative

In a recent presentation, management offered an impressive and optimistic vision about the year 2023. We are talking about double digit Adjusted EBITDA, positive return on equity, and double digit EPS growth.

Source: Presentation, March, 2023

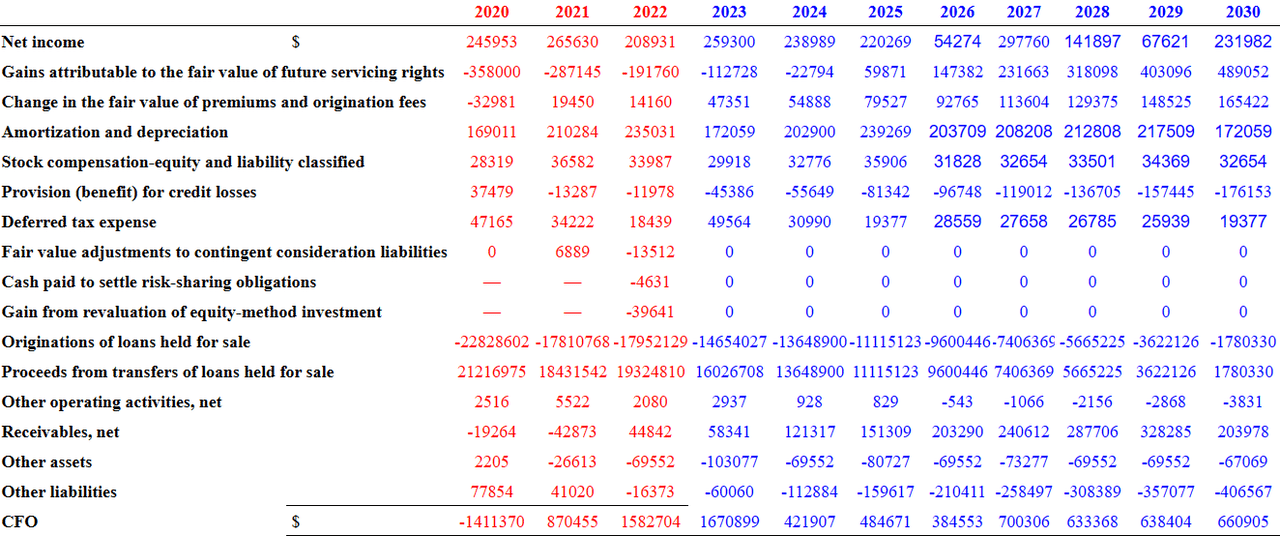

More in detail, the guidance given by Walker & Dunlop includes a net income close to $489 million in 2025, 2025 Adjusted EBITDA of $575 million, D&A close to $295 million, and gains attributable to mortgage servicing rights of close to $441 million. My numbers were a bit more conservative than those of management. However, I believe that readers may want to have a look at them.

Source: Presentation, March, 2023

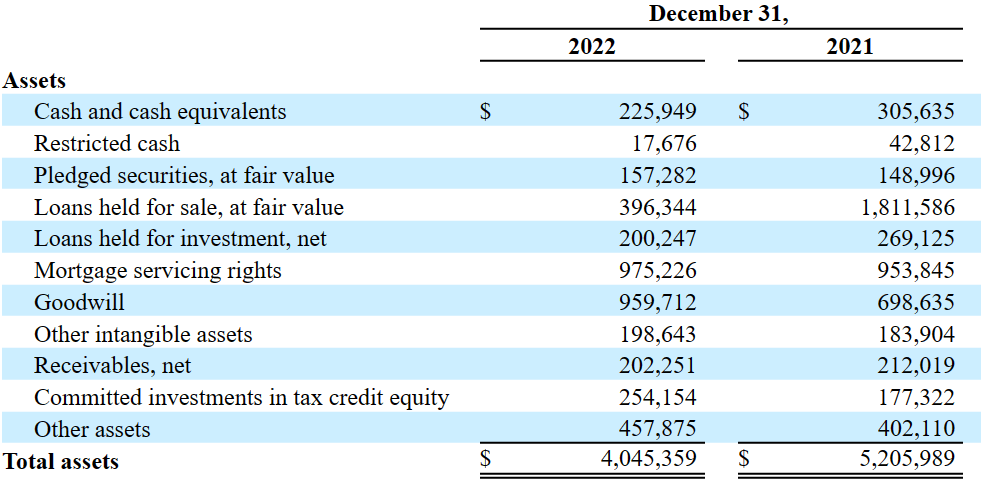

Balance Sheet

In 2022, Walker & Dunlop reported a decrease in the total amount of assets driven by a decrease in the total amount of loans held for sale. Cash in hand decreased too, but I believe that the balance sheet looks better because the total amount of debt decreased substantially.

As of December 31, 2022, the company reported cash and cash equivalents of $225 million, restricted cash of $17 million, pledged securities, at fair value of close to $157 million, and loans held for sale of $396 million.

Besides, mortgage servicing rights stood at $975 million with goodwill of $959 million, other intangible assets of $198 million, receivables worth $202 million, and total assets of $4.045 billion.

The book value stands at close to $1.7 billion, which is not far from the current market capitalization. In my view, the balance sheet indicates that Walker & Dunlop is not at all expensive.

Source: Annual Report

The list of liabilities included warehouse notes payable of $543 million, notes payable of $704 million, deferred tax liabilities of $243 million, commitments to fund investments in tax credit equity of close to $239 million, and total liabilities worth $2.328 billion. I believe that the balance sheet looks a bit better than that in 2021 because the warehouse notes payable diminished significantly.

Source: Annual Report

My Assumptions And My Financial Model Indicate That Walker & Dunlop Is Significantly Undervalued

I believe that the company stands out for its experience and recognition in relation to offering real estate services, financing products and loans for construction or housing access as well as mortgage guarantee services. In my view, the accumulated know-how will likely help the company bring further Adjusted EBITDA margin and FCF generation in the coming years.

Besides, considering the recent increase in interest rates, I believe that Walker & Dunlop could experience a significant increase in its activity as banks may offer more debt to clients. It is worth noting that the company does not seem to suffer from unhedged interest rate risks from loans held for sale to Fannie Mae, Freddie Mac, and HUD.

For loans held for sale to Fannie Mae, Freddie Mac, and HUD, we are not currently exposed to unhedged interest rate risk during the loan commitment, closing, and delivery processes. The sale or placement of each loan to an investor is negotiated prior to closing on the loan with the borrower, and the sale or placement is typically effectuated within 60 days of closing. The coupon rate for the loan is set at the same time we establish the interest rate with the investor. Source: Annual Report

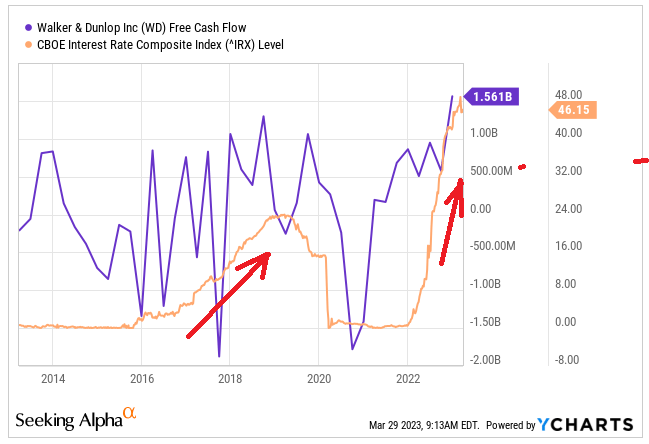

If we take a look at the past, Walker & Dunlop seems to deliver FCF growth when the interest rates are higher. With this in mind, I would be expecting free cash flow to creep up.

Source: Ycharts

I am quite optimistic about the new strategy, which consists of investments on small-balance multifamily lending platforms. In my opinion, higher volume of transactions with smaller loan balances may bring further business growth in the coming years. In this regard, the recent acquisition of GeoPhy is a clear example of the announced strategy.

As part of our overall growth strategy, we are focused on significantly growing and investing in our small-balance multifamily lending platform, which involves a high volume of transactions with smaller loan balances. To further this strategy, during the first quarter of 2022, we acquired GeoPhy to support our small-balance lending platform with data analytics and to further advance our technology development capabilities in this area. Source: Annual Report

It is also worth noting that the risks of sold loans are not that elevated. For instance, when Fannie Mae loses money because of loans, Walker & Dunlop only absorbs losses on the first 5% of the unpaid principal balance of a loan, and also reports a maximum loss capped at 20% of the balance of loans. In my view, in case of a financial crisis, Walker & Dunlop will not suffer as much as larger financial institutions.

When a Fannie Mae DUS loan is subject to full risk-sharing, we absorb losses on the first 5% of the unpaid principal balance of a loan at the time of loss settlement, and above 5% we share a percentage of the loss with Fannie Mae, with our maximum loss capped at 20% of the original unpaid principal balance of the loan (subject to doubling or tripling if the loan does not meet specific underwriting criteria or if the loan defaults within 12 months of its sale to Fannie Mae). Source: Annual Report

Under conservative assumptions, I obtained the following forecasts. 2030 net income would be close to $231 million with gains attributable to the fair value of future servicing rights of close to $489 million, change in the fair value of premiums and origination fees of $165 million, and amortization and depreciation of $172 million.

I also assumed that originations of loans held for sale would be close to -$1781 million with proceeds from transfers of loans held for sale of $1780 million, changes in receivables of close to $203 million, changes in other liabilities of -$407 million, and a CFO of $660 million. Finally, with 2030 capital expenditures close to -$103 million, 2030 FCF would be close to $558 million.

If we assume an EV/FCF of 3.6x, the enterprise value would be close to $5.11 billion. Besides, if we add cash worth $225.9 billion, and subtract warehouse notes payable of $543 million and notes payable of $704 million, the equity valuation would be $4.09 billion. Finally, the implied price would be close to $123 per share.

Competitors And Risks

Walker & Dunlop competes in the commercial real estate services markets with Wells Fargo (WFC), CBRE Group (CBRE), Marcus & Millichap, Inc. (MMI), Eastdil Secured, PNC Real Estate (PNC), and Berkadia Commercial Mortgage, LLC among many others peers. Companies with similar services include some banks or subsidiaries of large banks, public and private investment funds, and insurance companies. Many of the competitors have greater resources and recognition than Walker & Dunlop.

Walker & Dunlop competes on its ability to offer good insights to its partners, pricing, and other factors. In my view, larger competitors may have more resources and technology to identify potential clients as well as to analyze credit risks. As a result, they may offer more suitable products for clients and even better credit conditions.

We compete on the basis of quality of service, the ability to provide useful insights to our borrowers, speed of execution, relationships, loan structure, terms, pricing, and breadth of product offerings. Our ability to provide useful insights to borrowers includes our knowledge of local and national real estate market conditions, our loan product expertise, our analysis and management of credit risk and leveraging data and technology to bring ideas to our clients. Our competitors seek to compete aggressively on these factors. Source: Annual Report

I believe that any disruption or break in the relationships with regulators would generate drastic changes in the operations of the company in the short term. Also, a large part of the company's income comes from the payment of fees. If demand for loans decreases significantly, it could cause major damage to Walker & Dunlop. Additionally, a significant decrease in the payment price for the loans could seriously affect current operations.

Similarly, Walker & Dunlop depends on the success of the multi-family real estate market, where it allocates the greatest amount of operational effort. If real estate prices go down, or there is a decrease in the demand for real estate services or mortgages, in my view, future FCF expectations would most likely decline.

My Takeaway

Walker & Dunlop recently announced an impressive increase in guidance for the year 2023, including double digit adjusted EBITDA Growth, EPS growth, and 2025 net income close to $489 million. The current market capitalization is not far from 4.9x forecasted 2025 net income, which, in my view, indicates that the stock is undervalued. Besides, considering the recent increase in interest rates and investments on small-balance multifamily lending platforms, I believe that we could see significant FCF generation and, perhaps, demand for the stock. Yes, I saw some risks from changing regulations, larger competitors, or deterioration of the multi-family real estate market, but the stock price could definitely be higher in my view.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.