What Is Term Structure Telling Us

Summary

- In the two weeks or so that the banking system has been under extreme scrutiny, the financial markets have moved in a way that seems positive.

- Investors seem to believe that the government is taking care of keeping the banking system afloat.

- Investors also seem to believe that the government is not backing off from its battle with inflation.

- Investors still believe that the U.S. economy will go into a recession, but the recession will perhaps not be as severe as once thought.

- A lot could still happen over the next six to twelve months, but for now, it appears as if investors still believe that things are relatively under control.

AntonioSolano

The term structure of interest rates has become less negative since March 8, 2023.

On March 8. 2023, the difference between the yield on the 10-year U.S. Treasury note and the 2-year U.S. Treasury note was a negative 1.096 percentage points.

On March 28, the difference was 0.512 percentage points.

When the negative slope of the yield curve becomes less negative, it usually can be interpreted that investors believe that there will be less of a chance of a recession coming in the future.

So, let's dissect the situation a little further and see if we can get some more insights from the data.

Why did I pick the date March 8, 2023, to begin this investigation?

Well, government bond yields hit a near-term peak on that date.

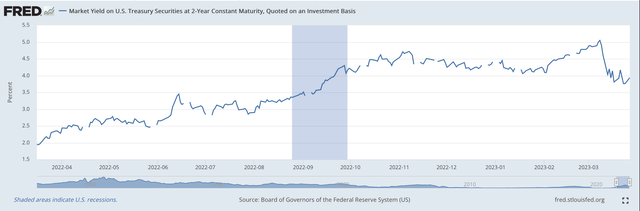

Yield on 2-year U.S. Treasury Note (Federal Reserve)

Note the rise in the yield on the 2-year note had been increasing since the middle of March 2022, the time when the Federal Reserve began its current program of quantitative tightening.

This path seems to be very consistent with what the Federal Reserve was doing in terms of raising its policy rate of interest to fight inflation.

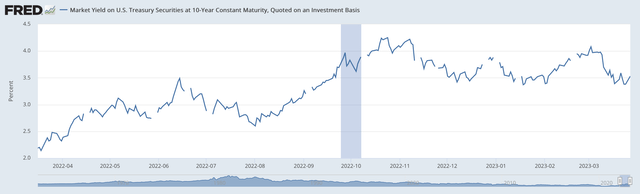

In terms of the yield on the 10-year U.S. Treasury note, the pathway is not so consistent.

Yield on 10-year U.S. Treasury note (Federal Reserve)

The financial market moved much more closely in the short-term market with what the Fed doing, than in the longer-term end of the market.

As can be seen in the chart, the yield on the 10-year maturity peaked toward the end of 2022, dropped off for a while and then peaked again on March 2, 2023, before declining.

The yield on the shorter-term maturity dropped much more rapidly than the yield on the longer-term maturity, hence the flattening out of the yield curve.

What Is Special About March 8?

Well, March 8 may not be the exact "special" date. Maybe March 10, 2023, should be the exact "special" date.

March 10, 2023, is the day that Silicon Valley Bank collapsed and was seized by the government.

On March 8, 2023, the yield on the 2-year U.S. Treasury note was at 5.062 percent at the close of the day.

On March 9, the 2-year note closed to yield 4. 872 percent and closed the week yielding 4.595 percent.

By the end of the next week, the yield on the 2-year U.S. Treasury note was 3.821 percent.

At the end of the next week, March 24, 2023, the yield had dropped to 3.767 percent.

On March 22, the Federal Reserve held a meeting of the Federal Open Market Committee, the group that sets the Fed's interest rate policy.

The FOMC decided to raise the Fed's policy rate of interest by 25 basis points on that date. The next two days, the yield on the 2-year Treasury stopped declining and bounced back a bit.

One could argue that between March 8... or, March 10 (when SVB was seized) investors became highly concerned about whether or not the Federal Reserve might back off of its restrictive monetary policy because of the bank failure and "pivot" away for its program of monetary tightness.

The short-term market stayed low.

The yield in the 10-year market bounced around a little more as the debate over what the Fed was going to do generated a little more market volatility, as can be seen from the second chart above.

The Term Structure Of Interest Rates

The term structure of interest rates fell.

The difference between the 10-year yield and the 2-year yield was a negative 1.096 percent on March 8. This difference was 0.512 percent on March 28.

The yield curve became less negative.

Could the market be saying that investors believe that the Federal Reserve would continue the battle against inflation. And, the banking crisis would not be that great.

This feeling is supported by the fact that the inflationary expectations built into the nominal U.S. Treasury yield curve remained around 2.20 percent during this time period.

That is, inflationary expectations remained constant during this period of market disruption. The Fed would not let inflation get worse.

Economic Growth

The other part of the equation?

The yield on the 10-year U.S. Treasury Inflation Protected securities dropped by about 40 basis points during this time period. On March 8, 2023, the yield on the 10-year TIPs closed at a 1.760% yield. On March 28, the yield had dropped to a 1.36% yield.

Interpretation: real economic growth would decline in the near future but the rate of decline would not be as great as had been expected.

In other words, investors had built into the market that the Federal Reserve was going to work to keep the banking system from collapsing, but would not forget the battle against inflation.

The very rapid drop in the yield on the 2-year U.S. Treasury security indicates that investors believe that the Fed will act fast, but will continue to keep up its overall restrictive monetary policy.

The opening of the stock market and other financial markets today seem to confirm this analysis.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.