Bank Of Hawaii: Unjustifiably Punished

Summary

- Bank of Hawaii has, like so many other banks in recent weeks, been hit hard by fears over collapse.

- Fortunately for investors, the company is far more stable than those that have declined, and recent deposit data indicates as much.

- More clarity should be provided by management, but the picture as a whole for the business looks appealing.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Jonathan Ross

During times of crisis, the losses that investors incur, particularly when invested in assets that are most affected by the crisis in question, can be significant. At the same time, crises can open the door to some really attractive opportunities. This is because the market often overreacts to the developments, even going so far as to push down shares of companies that don't deserve to be punished. One such company, in my opinion, is Bank of Hawaii (NYSE:BOH). Although the stock has recovered some from its lows, it is still down 41% from its 52-week high. Most of that hit occurred in the month of March, with shares currently down 31.2% from where they ended in February. Although I will definitely say that no company, including this one, is without risk during this time, what data is available suggests to me that the business likely deserves some upside from here. Because of this, I've decided to rate the business a ‘buy’ at this time.

A look at transparency

In response to volatile market conditions and worries that the banking industry might experience a tremendous amount of contagion following the collapse of Silicon Valley Bank, a firm owned by SVB Financial Group (OTC:SIVBQ), and other financial institutions like Signature Bank (SBNYP) and Silvergate Capital (SI), the management team at Bank of Hawaii came out with a rather detailed update of the company's financial position back on March 15th of this year. The objective of this update is to assure investors that the financial condition of the company remains solid. On the one hand, this update does serve to give investors a firm understanding of how the company has fared up to the recent crisis. But on the other, it's important to note that most of the financial data provided ends February 28th of this year. So in short, it does not capture most of the carnage that might have developed throughout the month of March, with the exception of incredibly important change in deposit results.

With that said, I do think that there is some value in what management has provided investors. For starters, the company has been very detailed in terms of discussing its position in the market and what kind of exposure, if any, it might have to the pains facing the banking industry. Unlike the financial institutions that have been heavily exposed to the venture capital, private equity, and startup markets that have been most affected by rising interest rates, Bank of Hawaii is much more concentrated around things like real estate.

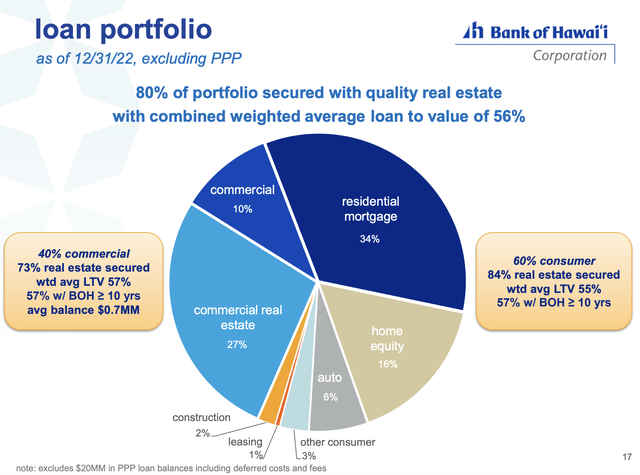

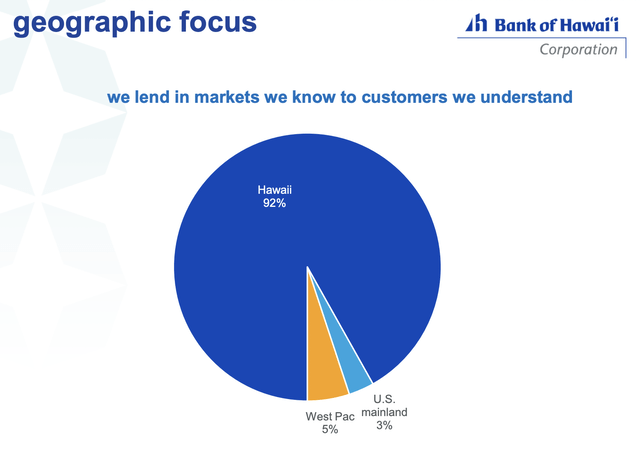

For instance, as of the end of the 2022 fiscal year, 34% of the loans on the company's books were for residential mortgages, while another 27% were attributable to commercial real estate. A further 16% of loans by value were in the form of home equity lines of credit and similar arrangements. Commercial loans, meanwhile, comprised only 10% of the company's loan base, with auto loans accounting for a further 6%. It's also worth noting that, while many of the companies that have been most impacted have had a major concentration in California and New York, 92% of Bank of Hawaii’s business involves customers in Hawaii. Mainland US business accounts for a modest 3% of the company's exposure.

The loan side of the equation is definitely important. But perhaps more important is the deposit side. According to management, 49% of the company's deposits come from consumers, with commercial deposits accounting for another 42.5%. On the consumer side of things, 23.9% of the company's deposit exposure involves high-net-worth clients, with 38.4% involving those who are affluent but not necessarily high net worth. On the commercial side, an impressive 17% of the company's deposits involve real estate and rental and leasing businesses. Finance and insurance firms comprise 12.5% of commercial deposits.

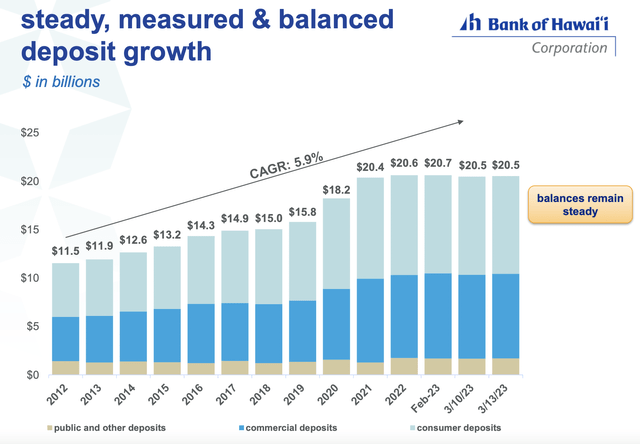

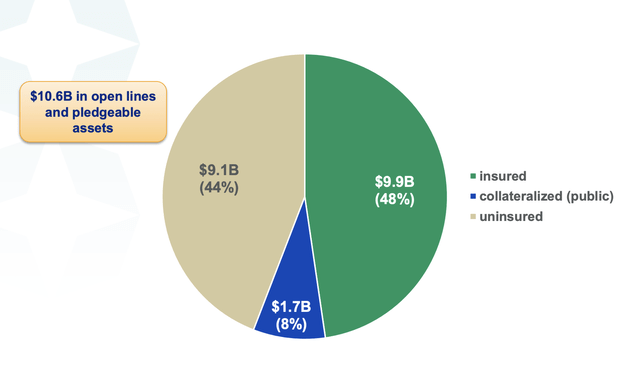

The company has no material amount of exposure to venture capital, private equity, or very early-stage startups. This is not to say that the company is without risk. Of the $20.6 billion worth of deposits on the company's books, about $10.7 billion was uninsured at the end of the 2022 fiscal year. By February 28th of this year, the company saw its overall deposits inch up to $20.7 billion. Of this amount, $10.6 billion was uninsured. One piece of information that management did provide more recent data on is the deposit amount. As of March 13th, total deposits at the bank were $20.5 billion. Considering the extreme uncertainty in the space, this is a very small drop from what it was at its peak.

This is noteworthy because it's the uninsured deposit amount that creates the risk of a bank run. Fortunately for investors, the available liquidity for the company as of the March 15th date that it provided this information to shareholders was $10.6 billion. This is factoring in $2.3 billion in available-for-sale securities, with another $4.7 billion representing capital available to it by the Federal Reserve and programs that it runs, but not including the new Bank Term Funding Program that the company could tap into for an unspecified amount. Given the company's geographic exposure, I don't see a tremendous amount of risk of a bank run and the company being forced to tap into this liquidity.

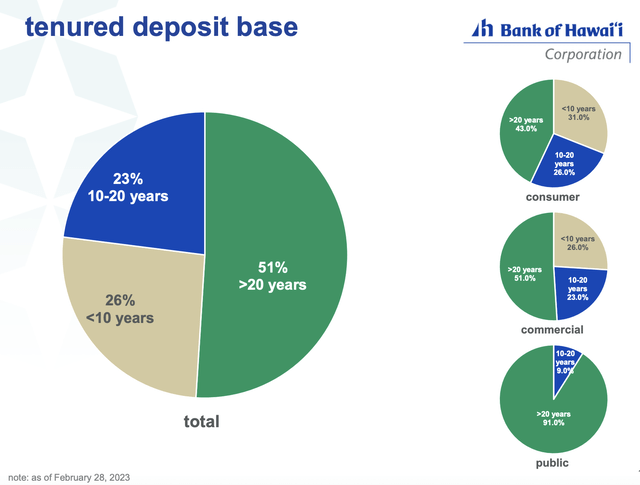

My views here are further bolstered by the fact that the company's clients are largely long-term in nature. An impressive 51% of the company's deposit base comes from customers that have been with the business for more than 20 years. A further 23% of its deposit base involves customers who have been with it for between 10 and 20 years. If this seems extreme, keep in mind that Hawaii is a very isolated place and that Bank of Hawaii has the second-largest market share in that state, totaling about 33.4% of all bank deposits. This is not to say that the company could not see bank run. While 52% of its deposits are uninsured, its uninsured deposits involve only about 2% of the company's clients. It does appear that the company has enough liquidity at this time to stave off any realistic bank run. But if the firm were to be forced to sell off assets, the result would likely be painful. After all, 63.3% of its loans are fixed rate in nature. As interest rates rise, fixed-rate loans experience the greatest pain.

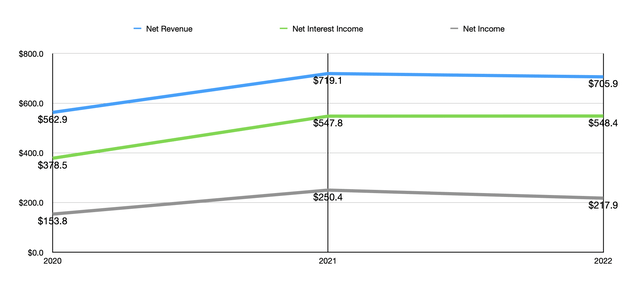

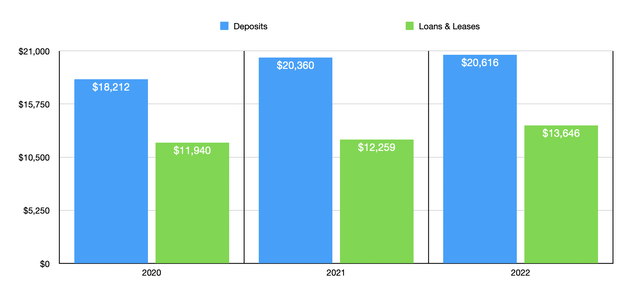

Financially speaking, Bank of Hawaii has been on pretty solid footing in recent years. From 2020 to 2022, for instance, the company saw its net interest income climb from $378.5 million to $548.4 million. Total net revenue for the company during this time rose from $562.9 million to $705.9 million. The difference between the net interest income and the net revenue comes from a variety of other activities that the company offers. The largest chunk of sales, for instance, comes from fees, exchange revenue, and other service charges. That works out to about $54.9 million for the 2022 fiscal year. Next in line you have trust and asset management activities at $43.8 million, followed by service charges on deposit accounts at $29.6 million.

This growth in revenue over time was really made possible by growth in both deposits and loans. Deposits grew from $18.2 billion in 2020 to $20.6 billion at the end of 2022. Over that same window of time, loans and leases jumped from $11.9 billion to $13.6 billion. This increase, combined with the positive impact associated with rising interest rates, helped to push the company's revenue higher. In turn, profits also improved. Net income, for instance, expanded from $153.8 million in 2020 to $217.9 million in 2022. Though it is worth noting that weakness in some areas, particularly mortgage banking, combined with a rise in costs centered around things like salaries and benefits, as well as net occupancy, pushed the company's net income down from the $250.4 million it reported for 2021.

Those who are critical of the company will point out accurately that the company is trading at a premium to its book value still. While this is true, it's also important to note that significant share buybacks and the decision to classify repurchased stock as treasury stock has materially reduced the company's shareholder's equity. For instance, the book value of the company per share declined from $40.04 per share in 2021 to $33.06 per share in 2022. While treasury stock plays a role here, it's also the case that the company saw a rather significant swing in its accumulated other comprehensive income during the year. This was driven by net unrealized losses on investment securities. But the fact that they are unrealized means that the company has not sold the investments in question and should benefit from an eventual swing higher. Making an adjustment for this to match the loss experienced in 2021 would yield a book value per share of the company of $40.44. While that is still lower than the $51.51 per share that the company is trading for, I believe that some premium to book value is warranted given the probability that the company can survive current market conditions.

Takeaway

All things considered right now, I do believe that Bank of Hawaii is a fairly solid player in the banking industry at this time. Frankly, it would have been nice for management to provide more updated information than what they did. After all, it's what began to occur in March that really would impact the health of the business. On the other hand, what data is available suggests that the company is just fine at this time. Although it does have uninsured deposits, those who have given deposits to the bank are mostly long-term depositors in a geographic area that should be more or less insulated from the havoc experienced by the companies that have already gone under. This is further strengthened by the composition of the company's portfolio in that its overall exposure to clients that would be problematic is remarkably low. Because of all of these factors, and the continued growth of the company leading up to this point, I do believe that it warrants a ‘buy’ rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.