PGX: The Low, Low Price Of A High Yield

Summary

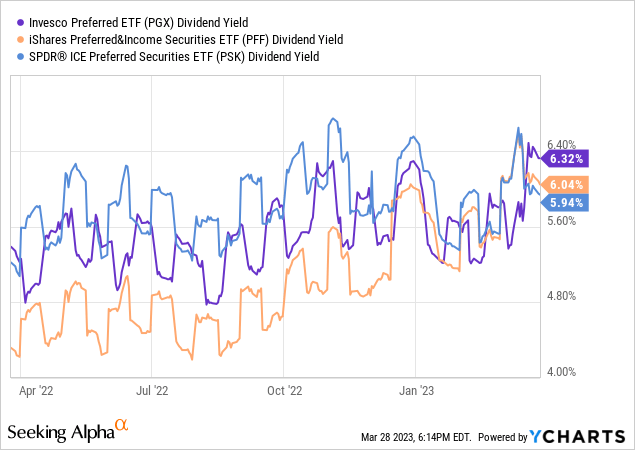

- PGX's yield has climbed over the past few years and stands at an attractive 6.3%.

- The fund's high level of qualified dividends makes the ETF's yield more appealing.

- Some investors may find the fund's concentration in the financials sector, its comparatively high expense ratio, and its credit risk concerning.

FreezeFrameStudio/E+ via Getty Images

Investment Thesis

When I first began writing articles for Seeking Alpha, I published two articles for in which I examined six of the most popular preferred stock ETFs. In the first of those articles, I took a look at the Invesco Preferred Portfolio ETF (NYSEARCA:PGX), the iShares Preferred and Income Securities ETF (PFF), and the VanEck Vectors Preferred Securities ex Financials ETF (PFXF). In response to a lively discussion in the comments of that article, I penned a second article in which I looked at another three preferred stock ETFs that, in my estimation, were somewhat less appealing.

A few months later, in November, I was invited to revisit PFXF in a follow-up piece for Seeking Alpha. Then, in February, I was invited to revisit PGX. This past July, I published an article in which I re-examined PFF and a follow-up in which I took a closer look at the SPDR Wells Fargo Preferred Stock ETF (PSK).

Towards the end of 2020, I revisited PGX to see how the fund had held up during the early phases of the coronavirus pandemic and concluded that the ETF remained my favorite preferred stock vehicle. Now that another two years have passed, I thought it would be a good idea to take another look at PGX in our current bear market.

Why Invest In Preferred Stock?

For the benefit of readers who may not be as familiar with preferred stock, I think it is important to review some of the basic reasons investors might want to include it in their portfolios. Preferred stock is a rather unique type of equity that might best be described as a hybrid investment vehicle combining characteristics associated both with bonds and common stock. Like bonds, preferred stocks tend to appeal to income-oriented investors seeking a steady, predictable stream of cash. While preferred stock can appreciate or depreciate, shares have a par value that tends to prevent them from trading outside of a comparatively narrow price range.

Thus, preferred stock rarely offers investors much in the way of capital appreciation. Instead, it offers investors a substantial yield, often well in excess of 5%. Furthermore, preferred stockholders enjoy preferential treatment in the event of a company's financial distress. If, for instance, a company must liquidate its assets to pay its creditors, bondholders will be paid first, followed by preferred stockholders. Common stockholders will get whatever is left, if anything. Similarly, when a company suspends or cuts its dividend to common shareholders, preferred stockholders will continue receiving their checks. Lastly, preferred stockholders often benefit from qualified dividends that are classified as capital gains rather than ordinary income.

Why Preferred Stock May Not Be Right For You

Those benefits understandably appeal to many income-oriented investors, but there are some significant downsides to investing in preferred stock that must also be taken into consideration when looking to initiate or add to a position. As I mentioned above, preferred stock almost never offers investors significant capital appreciation. Thus, if you're seeking growth, you'd best look elsewhere. Another drawback to preferred stock that investors may want to consider is the very real possibility that a company will issue a share call. Like bonds, preferred stock generally has a maturity date set decades in the future.

However, after five years, a company can call the outstanding shares of its preferred stock, which they will often do if it is financially advantageous for them to do so. They'll pay you the par price, and you'll have lost an income stream. A third consideration investors will want to keep in mind before buying preferred stock is interest rate sensitivity: When interest rates go up, the appeal of preferred stock tends to weaken. In a rising interest environment, common stock becomes more appealing because they can offer higher yields while the fixed yield of preferred stock may even pull their share prices down - and prices can drop hard. With the Fed slashing interest rates in 2019 and virtually eliminating them earlier this year, this last consideration might not seem all that pressing, but it is well worth bearing in mind when looking at preferred stock.

The Pros And Cons Of PGX

Pro #1: Yield

As I have discussed in my previous articles on the subject, since most investors turn to preferred stock as a way to generate a predictable stream of income, the first thing I look at when evaluating a preferred stock ETF is the fund's yield. PGX, like the other funds I have examined in this series, consistently offers a yield north of 5%. As of the close of trading on Tuesday, March 28, however, PGX's yield far exceeds that mark, landing at 6.32%, putting it roughly 0.30-0.40% higher than PFF and PSK:

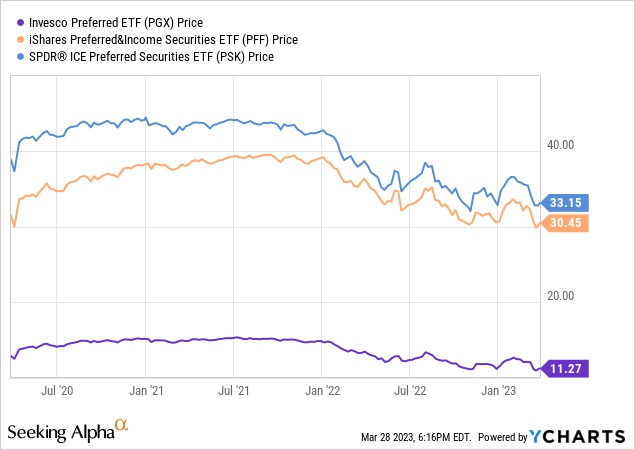

Of course, the yield for all three funds have climbed because the share prices have dropped as treasuries and other, safer fixed-income vehicles have become more appealing:

While PGX's share price has dropped 25% from a high just north of $15 per share when I last evaluated the fund, the higher yield is attractive for those investors seeking comparatively stable, predictable current income. Put differently, investors seeking exposure to preferred funds should be less concerned with the ebbing and flowing of share price, which will naturally--and predictably--drop when interest rates climb and focus, instead, on the stability of the yield. In the case of the latter, it appears to be both quite safe and high enough to merit serious consideration.

Con #1: Credit Risk

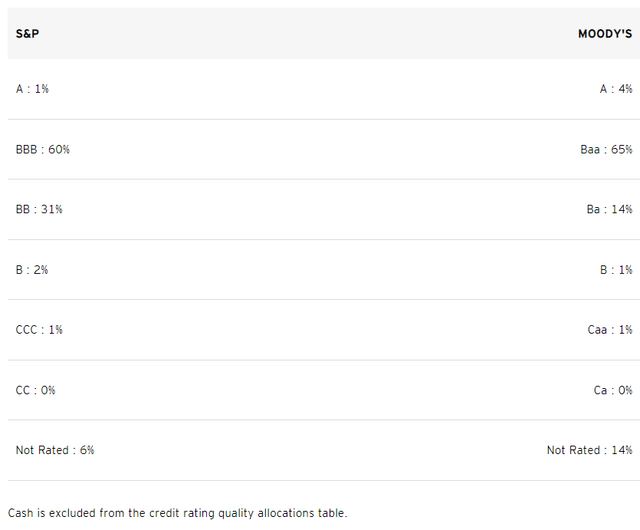

Back in my last pre-pandemic article on PGX for Seeking Alpha, I noted that PGX "assumes a slightly higher credit risk than PFF, with a full 64% of its holdings rated BBB and another 28% rated BB." By the time I revisited the fund in late November of the year, the quality of the fund's holdings had taken a bit of a hit, as the percentage of holdings rated BBB by S&P had decreased from 64% to 54% while the percentage of holdings rated BB had climbed from 28% to 37%. Since then, the percentages of holdings rated BBB has climbed back to 60% while the percentage rated BB has dropped back down to 31%:

As S&P maintains on their website, it applies BB ratings to obligations "having significant speculative characteristics." Thus, I prefer when the percentage of a fund's holdings below BBB account for no more than one-third of its total portfolio. PGX is right at that point.

Pro #2: No Mandatory Convertibles

On the other hand, it is worth noting that one reason PFF offers a higher yield than either PGX or PSK is because roughly 11% of PFF's holdings are mandatory convertibles, which convert to common equity. While mandatory convertibles can add a few percentage points to a fund's yield, they can inject a degree of volatility into an ETF by increasing the equity sensitivity of its portfolio, causing it to deviate from the risk-return tradeoff more conservative investors may be looking for. In contrast with PFF and like PSK, PGX does not hold any mandatory convertibles in its basket. As a result, PGX's yield may be slightly lower, but the ETF will likely experience less volatility than funds with higher percentages of mandatory convertibles.

Con #2: Lack of Diversification

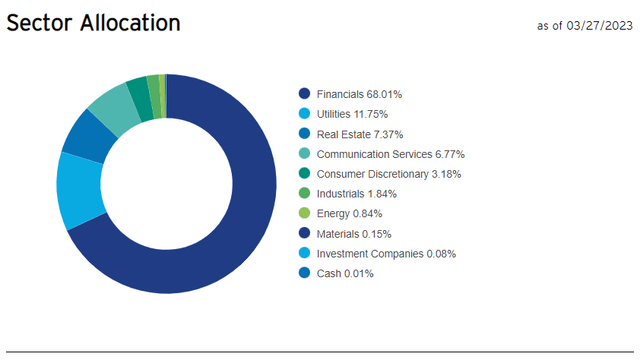

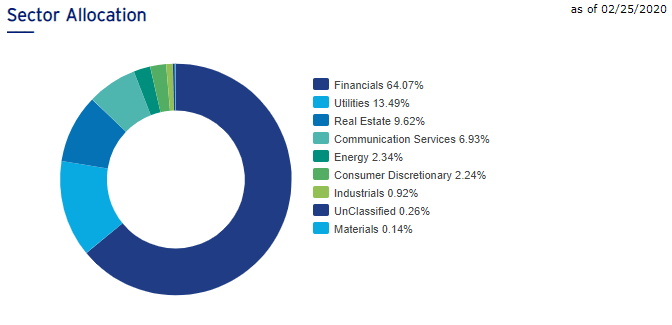

A second risk potential investors may want to consider when looking to buy PGX is the fund's lack of diversification. As opposed to the aforementioned PFXF, which markets itself as a diversified basket of preferred stocks deliberately excluding the financial sector, both PGX and PFF are highly concentrated in financials. Of the two, PGX is significantly less diversified, with roughly 68% of its holdings in the sector:

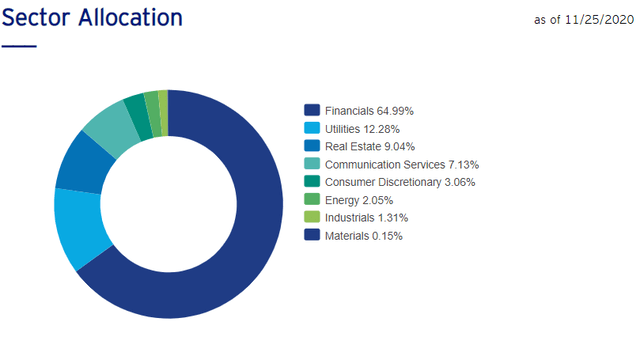

This represents a 3% increase in that particular concentration since the last time I had looked at PGX:

While nominal, it is worth noting that PGX had become more concentrated in financials (as well as communication services) since I had written about the fund in late February, just before the WHO declared the coronavirus pandemic:

Invesco

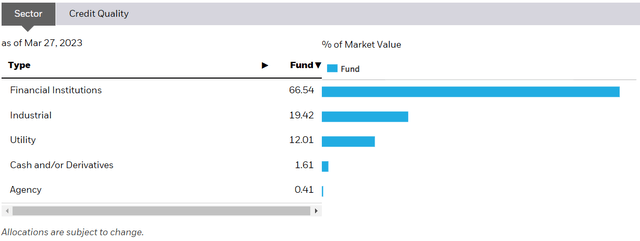

When compared with PFF, which also maintains a high concentration of holdings in financials, however, PGX's limited sector diversification looks a bit more appealing since the former now has an even greater concentration in the sector than the latter:

Thus, PGX is particularly vulnerable to disruptions in the financial sector. While I do not think we are on the cusp of the sort of widespread financial collapse we saw in 2007-2008, I do understand that the sudden downfall of Silicon Valley Bank and the subsequent shockwaves that rocked the financials sector in the aftermath may make some investors wary of investments so heavily concentrated in banks. Thus, those investors wary of the financials sector may understandably want to avoid PGX.

Pro #3: The Taxman Takes Less Money.

While some people may be wary of PGX's concentration in the financial sector, the fund's lack of diversification does offer one significant benefit: qualified dividends. Qualified dividends are dividends that are taxed as capital gains rather than the rates on non-qualified dividends. Because financial institutions tend to issue more preferred stock that offer qualified dividends than issuers in other sectors, nearly 80% of PGX's dividends are qualified. In other words, PGX's investors keep more money than investors who buy shares of a fund like PSK (which has about half of its holdings in preferred stocks paying qualified dividends).

Con #3: The Expense Ratio is a Bit High

According to the Wall Street Journal, the average expense ratio for an ETF is 0.44%. Of the three funds I discuss in this article, PGX has the highest expense ratio at 0.52%. Both PFF (at 0.46%) and PSK (at 0.45%) are closer to the average. This means that, for every $1,000 you invest in the fund, PFF will charge you $4.60, PSK will charge you $4.50 and PGX will charge $5.20. While $0.60 or $0.70 out of a thousand dollars might not seem like much, it adds up over time and some investors may find that PGX's higher expense ratio may detract from the fund's higher yield and lower tax numbers.

Final Thoughts

As has been the case for several years, I own shares of PGX ETF in my personal taxable investment portfolio and have no plans to sell at the moment. While I dislike seeing the share price drop as much as it has, I have enjoyed a steady flow of dividends that I fully expect to continue collecting moving forward. I like the monthly dividends and I appreciate the fund's tax implications. At current prices, the yield is quite attractive. While I could see it dropping even lower, I consider prices in the $11-$12 range to be a reasonable entry point. While there is a small amount of credit risk in PGX's portfolio and while it is highly concentrated in financials, the fund's holdings are generally stable and the regular payouts have been consistent. For this reason, I have been comfortable adding shares at the current price and fully intend to continue doing so.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PGX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.