SolarEdge Poised To Benefit From European Solar Push

Summary

- SolarEdge Technologies, Inc.'s strong market position in Europe bode well as the region tries to become less reliant on Russian natural gas.

- The company is less exposed to NEM 3.0 and the Californian market than competitors.

- SolarEdge Technologies, Inc. stock looks like a solid "Buy" at current levels.

sl-f/iStock via Getty Images

While the California solar market faces some uncertainty with NEM 3.0, SolarEdge Technologies, Inc. (NASDAQ:SEDG) looks well positioned given its strong position in European markets.

Company Profile

SEDG is a provider of direct current (DC) optimized inverters that are used in the solar industry. As I noted in my write-up of rival Enphase Energy, Inc. (ENPH), SEDG’s solution consists of power optimizer, which according to solar.com is:

"a module-level power electronic (MLPE) device that increases the solar panel system's energy output by constantly measuring the maximum power point tracking (MPPT) of each individual solar panel and adjusts DC characteristics to maximize energy output. The panel optimizers relay performance characteristics via a monitoring system to facilitate operations and any necessary solar panel maintenance."

The technology is different from traditional string inverters, which takes the power produced by solar panels and sends it to a central inverter that converts it from DC to AC power for your home. ENPH, meanwhile, uses microinverters, which convert DC to AC power at each individual panel.

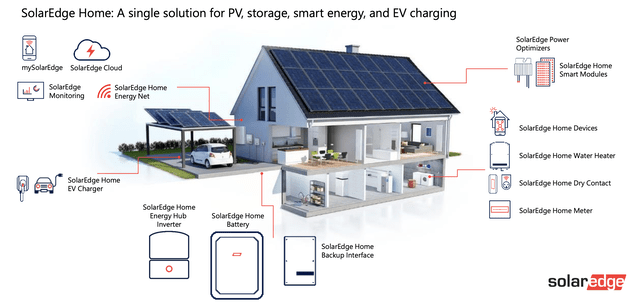

The company also offers energy storage systems, home backup systems, electric vehicle components & charging capabilities, home energy management systems, grid services & virtual power plants, and lithium-ion batteries. In 2022, 36.5% of its sales came from power optimizers and 36.6% from inverters.

Opportunities and Risks

Similar to ENPH, SolarEdge Technologies, Inc. is also looking to transform itself from a simple inverter company into a solar solutions company. The company now offers a home battery storage system, electric vehicle ("EV") charger, home hot water heat, and smart energy devices. It also has commercial solutions as well, with microgrids, energy management, commercial storage, EV chargers, and rooftop and carport PVs.

CEO Zvi Lando discussed its new offerings on its Q4 earnings call, saying:

“From a segment point of view, we saw significant revenue growth and portfolio expansion in both of our key segments. On the residential side, we launched SolarEdge home, offering a complete energy management system for the home, including PV, battery backup, EV-charging, load control and the homeowner app to manage them all in one single place.

“SolarEdge Home is now available in the U.S., Europe, Australia and Brazil. And combined with our designer software, it provides our customers an end-to-end solution for design, proposal, installation and commissioning, all working together out of the box. In the commercial segment, our growth this year is attributed to market share gains, expansion into new applications such as floating PV as well as the successful adoption rate of our commercial portfolio with its safety offering in the fast-growing segment of corporations, progressing their ESG programs.”

This is still a new and growing area for SEDG, with only 11.1% of new residential installations having a battery attached to its inverters. However, attach rates are higher in some European countries such as Germany at 61%, Italy at 56%, and the U.K. at 31%.

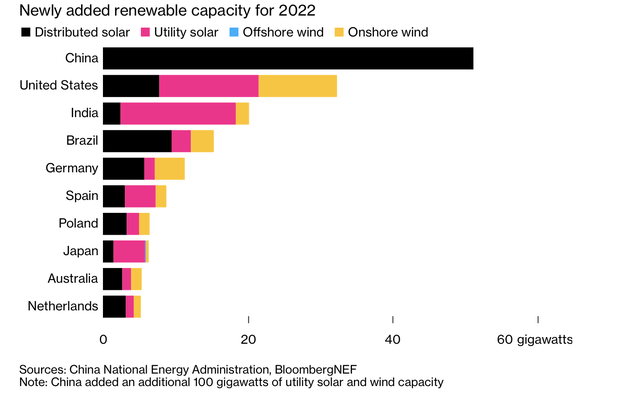

Europe is a big opportunity for SEDG, with the company having a strong presence in the region. In fact, nearly two-thirds of SEDG’s business is outside the U.S. It saw 89% growth in Europe in 2022 and about 145% growth in Q4. And while not guiding for specific European revenue growth, when pressed by an analyst the company said at a Roth conference in mid-March that it would see between 50-100% growth in Europe in 2023, perhaps even over 100%.

SEDG is benefiting from the Russia-Ukraine war and less natural gas flowing into Europe from Russia. The EU wants to lower its reliance on Russian natural gas and has been pushing its alternative energy initiatives. The EU was able to reduce its gas demand by over 19% from August to January, but has had to rely on LNG imports, including from Russia. As such, there has been a push towards solar, especially given the continent’s high electricity prices.

Discussing the topic at a Wells Fargo conference earlier this week, Faier said:

“What we continue to see is the combination of relatively low interest rate environment, where usually in Europe, most installations are done, at least in residential using private money, not based on loans like you see in the United States. So it means that there is no good alternative for investment, plus the fact that electricity prices hiked so much that in Germany, for example, you pay today EUR 0.70 per kilowatt hour. I think that in the U.S., the average will be based on time of use, but around $0.25 creates a situation where in most European countries, you see ROI on an investment of 2.5 to 4 years. Germany will be about 2.5. Netherlands will be around 4 years. This is something that is unchanged. The result is that the demand is booming.

“And we see right now a situation where for at least commercial, we are fully booked to the end of the year, not because the customers want to get next year, but because this is what we can provide right now. On residential, we are having a lot of orders. We can still take orders for the year, but we're relatively limited there. From a supply point of view, our situation is that on the single-phase inverters, which are mostly going to countries like the Netherlands old houses, U.K., Belgium, France, most of the supply issues that we had are somehow improved, where we believe that you will be able to see about 3 months to 4 months of lead time in about a quarter or so.”

While Europe has been growing, the U.S. represents a bit more risk. Faier noted at Goldman conference in January that there are signs that the U.S. market could begin to slow in 2023. He noted earlier this week that NEM 3.0 adds more uncertainty to the market, which is why he thinks the U.S. will be a flattish to small growth market this year.

As a reminder, California proposed updating its Net Energy Metering policies in December and it will now go into effect in mid-April. The new tariff, called NEM 3.0, will charge new solar customers a Grid Access Fee of $8 a month per kW of solar installed, as well as cut their average surplus energy payments by about 75%. While a negative, it does encourage California homeowners to install back-up battery storage systems instead of returning excess energy back to the grid.

SEDG also does face some customer concentration risk. Consolidated Electrical Distributors (CED) represented 18.5% of its revenues in 2022. CED is one of the largest electrical distributors in the U.S., and any falling out in that relationship would greatly hurt is business.

Valuation

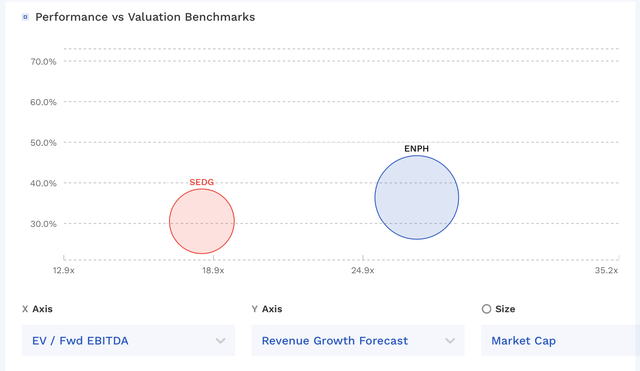

SolarEdge Technologies, Inc. currently trades at 19x 2023 EBITDA estimates of $763.8 million. Based on the 2024 consensus projecting EBITDA of $990.3 billion, it trades at an under 15x multiple.

On a P/E basis, the stock trades at an over 30x forward P/E ratio. The current consensus is that the company will generate EPS of $9.06 in 2023. For 2024, it is projected to produce EPS of $11.84, which would be good for a P/E of 23x based on 2024 estimate.

The company is projected to grow its revenue by over 30% in 2023, compared to 69% growth in 2022. For 2024, sales growth is forecast to be a robust 21%.

It trades at a discount to ENPH, albeit it is expected to grow slightly slower.

SEDG Valuation Vs ENPH (FinBox)

Conclusion

SolarEdge Technologies, Inc. is much more of a play on the European solar market, as compared to ENPH, which is more U.S.-dominant. This isn’t a bad place to be, as European households are more incentivized to switch to solar given higher electricity prices compared to the U.S. European policies are also generally pretty friendly to alternative energy, although can take longer to implement.

Meanwhile, SEDG has less exposure to NEM 3.0 and California than ENPH. NEM 3.0 might not end of being a bad thing for these companies given their evolution to whole home solar solution companies with batteries, but it does add uncertainty. It could also be a boost to Q1 results as California residents try to get grandfathered in.

Given its strong European growth, I think SolarEdge Technologies, Inc. looks attractive at current levels. I see upside to around $375, which would be a 20x multiple on 2024 estimates.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.