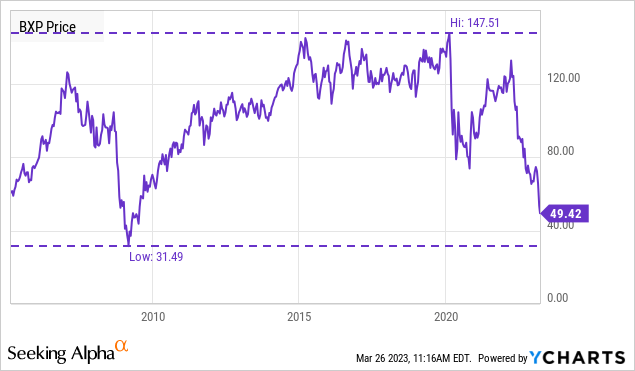

Boston Properties: Put Writing Strategy To Generate 17% Yield With -29% Downside Protection

Summary

- Office REITs have seen tremendous pain this year.

- A put writing strategy on the class A office, BXP.

- Generate 17% annualized yield or buy BXP at a -29% discount from today's price by July 21st, 2023.

- Looking for higher risk/reward options trading ideas? I offer this and much more at my exclusive investing ideas service, Cash Builder Opportunities. Learn More »

kennethnokman/iStock via Getty Images

Author's note: A modified version of this article was shared with Cash Builder Opportunities members on March 15, 2023.

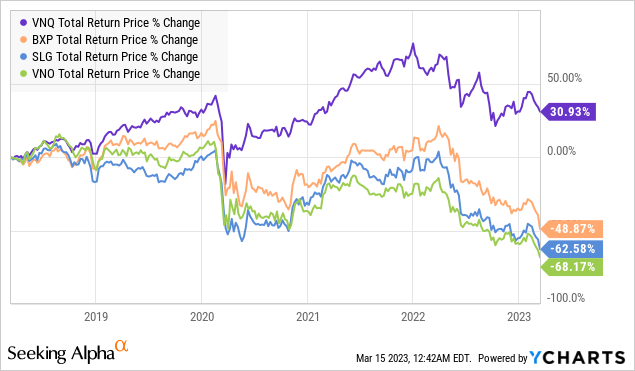

Office REITs have seen tremendous pain this year and have been by far the worst-performing REIT sector since the pandemic due to reduced demand for office spaces resulting from low utilization rates ("work from home") and economic recession concerns. Selected office REITs, including Boston Properties (NYSE:BXP), SL Green Realty Corp (SLG), Vornado Realty Trust (VNO), are down over -50% from pre-pandemic levels, even while the broader REIT index (VNQ) has recovered.

YCharts

According to Seeking Alpha REIT author Hoya Capital, the pain has been largely been priced in to office REITs at these low valuations:

Property-level fundamentals have clearly softened, but the outlook is not as dire as office REIT market valuations imply. Even using the most bearish cap rate estimates, the NAV discount for office REITs is very real and meaningful in the ballpark of 20-25% - the steepest discount in the public REIT sector - and Office REITs now trade at P/FFO multiples below that of Mall REITs. With Office REITs trading at historically deep discounts to peers in public and private markets - and average dividend yields near 6% - there appear to be some emerging pockets of value - notably in REITs focused on secondary and tertiary markets with net population growth, shorter commute times, and a more favorable industry mix.

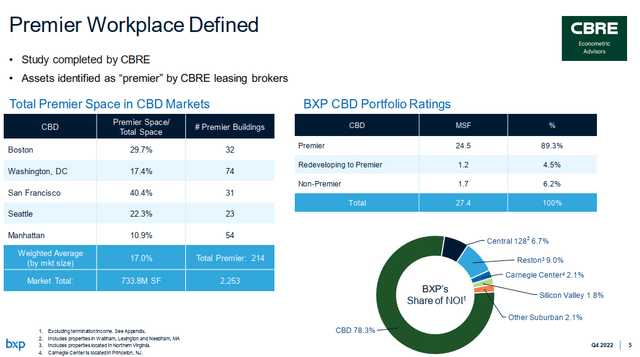

While BXP isn't focused on secondary and tertiary markets, it is the largest office REIT by market cap and definitely a class A REIT in terms of the properties that it owns. According to BXP's Q4 2022 Investor Presentation, 89.3% of BXP's CBD portfolio is considered "Premier".

BXP Q4 2022 Investor Presentation

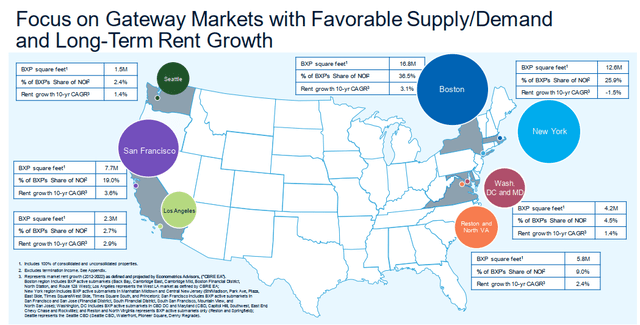

BXP focuses primarily on high-income, coastal CBD markets, including Boston, New York, San Francisco and Los Angeles. These areas have been disproportionately affected by WFH dynamics, as remote workers are able to save significantly on rent and commute times by relocating to a lower cost-of-living cities.

BXP Q4 2022 Investor Presentation

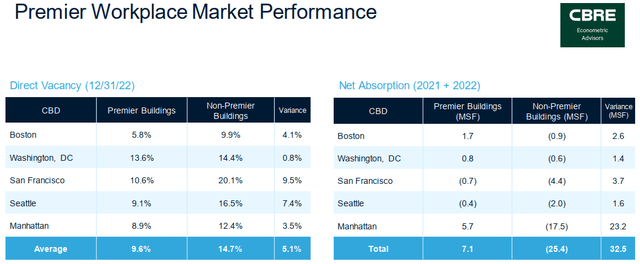

As a result, BXP's portfolio shows elevated vacancy rates, averaging 9.6% for its premier buildings and 14.7% for its non-premier buildings.

BXP Q4 2022 Investor Presentation

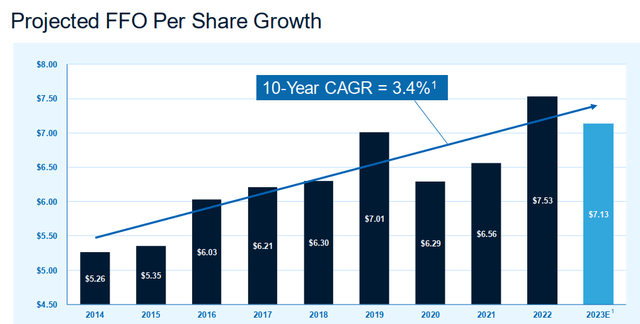

Moreover, the projected FFO is anticipated to fall by -5.3% in 2023. At the current share price of $49.42 (as of the close on March 24, 2023), the 2023E P/FFO is just 6.93.

BXP Q4 2022 Investor Presentation

Moody's recently affirmed BXP's credit rating as Baa1 (i.e., BBB+):

Boston Properties' Baa1 ratings reflect its large and high-quality portfolio of office assets in coastal CBD markets, diverse tenant base, laddered lease maturity schedule, proven track record of leasing execution for its new developments, and healthy liquidity position. Other important credit considerations include the challenging operating environment for office landlords, the REIT's elevated net debt to EBITDA, and its large development pipeline.

However, the outlook was revised from stable to negative "due to the high likelihood that Boston Properties' net debt to EBITDA will remain elevated through year-end 2024 and its fixed charge coverage will decline in the same period."

Clearly, BXP is beset by negative factors all-around right now but has the pain been priced in? BXP is down over -60% from its 1-year high of $132.51. The current share price is the lowest since 2009 (!). The forward P/FFO for 2023 is 7.49, the lowest in a very long time.

YCharts

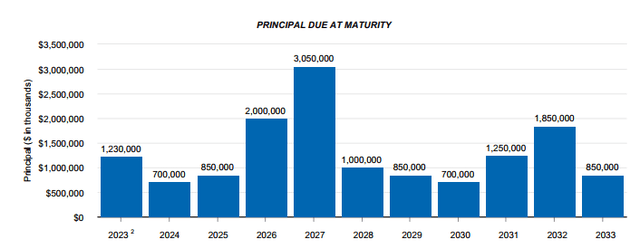

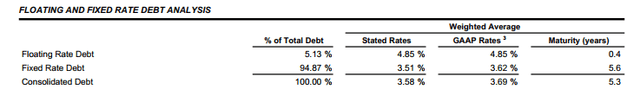

BXP has a well-laddered debt maturity profile, with a weighted average interest rate of 3.58% and maturity of 5.3 years. It also has a strong liquidity position, with $0.7B cash on hand and a $1.5B revolving credit facility as of Q4 2022. Therefore, the near-term bankruptcy risk is low.

BXP Q4 2022 Supplemental

BXP Q4 2022 Supplemental

The trade

(numbers have been updated as of March 24, 2023)

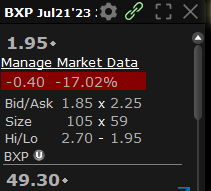

The Trade: Boston Properties (BXP) Sell to Open July 21st, 2023 $35 Puts - price $1.95

Ticker: BXP

Expiration: July 21st, 2023

Type: Sold Puts

Strike Price: $35

Price Move Until Strike: -29.2% decline

Premium Collected: $1.95 or $195 per contract

Days To Expiration: 119 days

Annualized Return: 17.09%

Breakeven: $33.05 (Max loss $3,305 per contract achieved if the stock goes to $0)

Option Volume: Moderate, with a $1.85/$2.25 bid-ask spread at the time of writing. Use limit orders or be prepared to accept a worse fill.

Interactive Brokers

Dividend Equivalent: 1.22x the quarterly dividend of $0.98

To further increase my margin of safety, I went with the $35 puts expiring July 21st, 2023, which is 119 days from now. This strike price represents a further -29% decline from current market prices. For reference, BXP's GFC low was $31.49, which was reached on March 9, 2023. This put yields 17.09% annualized.

YCharts

An investor writing this put should be comfortable with either of these two following scenarios on the expiry date of July 21st, 2023:

- BXP closes above $35: The option will expire worthless, and the investor pockets the $1.95 premium and earns 17.09% annualized yield over the life of the option.

- BXP closes below $35: The investor will be forced to take assignment of BXP shares at $35 (but you still get to keep the $1.95 option premium, effectively reducing your cost basis to $33.05).

Remember that each option contract represents 100 shares of the underlying.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor's income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.

This article was written by

I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs, ETFs, dividend stocks, and options. My guiding philosophy is to help teach members not "what to think", but "how to think". This account is affiliated with the Stanford Chemist contributor account and publishes content for the Cash Builder Opportunities service.

Disclosure: I/we have a beneficial long position in the shares of BXP, SLG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.