Alibaba: Unlocking Shareholder Value

Summary

- Alibaba's stock lost approximately 80% from peak to trough in its downturn recently.

- However, now that many concerns are alleviated, Alibaba can focus on making money.

- The proposed splitting of the company is a genius idea to increase growth, spur competition, and unlock shareholder value.

- Alibaba's businesses are worth significantly more than its market cap implies, and its share value will likely go much higher.

- This idea was discussed in more depth with members of my private investing community, The Financial Prophet. Learn More »

maybefalse

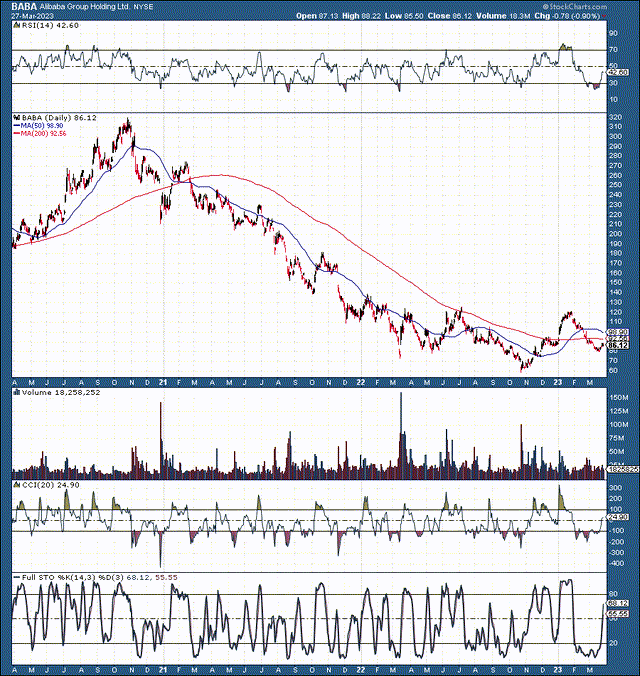

Alibaba's (NYSE:BABA) stock has been beaten down for years, dropping to a low of around $60 recently, representing a staggering 81% from its all-time high in 2020. While Alibaba's stock quickly doubled from the significant low, shares remain volatile. Nevertheless, Alibaba recently successfully tested the $80 support level, and the stock's chart has a bullish reverse head and shoulders pattern developing.

Alibaba 3-Year Chart

BABA (StockCharts.com)

Furthermore, Alibaba's stock remains cheap, and I mean dirt cheap. Alibaba is trading at a forward P/E ratio of around ten here, and that's relative to the lowered consensus estimates. Alibaba should regain significant growth momentum as it achieves higher than anticipated revenues and more profitability in the coming years. Despite resolving the delisting concerns and other issues about its stock, Alibaba's shares remain incredibly cheap here and represent an excellent long-term buying opportunity.

I began writing this article before the sensational announcement that Alibaba plans to split into six separate entities. In yesterday's session, Alibaba's stock quickly bounced on the news, elevating it by approximately 14%. The break-up announcement is excellent news for the company as Alibaba has suffered from government scrutiny and has become too big to sustain robust double-digit revenue growth.

After all, we're looking for growth from a growth company, paying a premium for its shares. Unfortunately for Alibaba, the company became too big and bureaucratic. This dynamic led to less efficiency, negatively affecting margins and Alibaba's overall profitability. Instead of continuing its stellar growth, Alibaba stalled, and its share price tumbled by more than 80% (from peak to trough).

However, now that Alibaba is splitting into separate entities, the significant value should be unlocked for shareholders. An essential factor weighing down the company's stock is its unprofitable secondary businesses which are treated more as liabilities than valuable assets that should grow and become profitable in time.

The Company Will be Split up into Six Units

- The Cloud Intelligence Group - Cloud and artificial intelligence segments.

- The Taobao Tmall Commerce Group - Online shopping platforms like Taobao and Tmall.

- The Local Services Group - Alibaba’s food delivery service and mapping.

- The Cainiao Smart Logistics - Alibaba’s logistics service.

- The Global Digital Commerce Group - Alibaba’s international e-commerce businesses AliExpress and Lazada.

- The Digital Media and Entertainment Group - Alibaba’s streaming and movie business.

This genius breakup should create significant growth for Alibaba's businesses, improve sentiment, and reduce regulatory pressures, unlocking enormous shareholder value simultaneously. Businesses that seemed unprofitable and unpopular could receive an influx of capital, implying that Alibaba's market cap is significantly undervalued here.

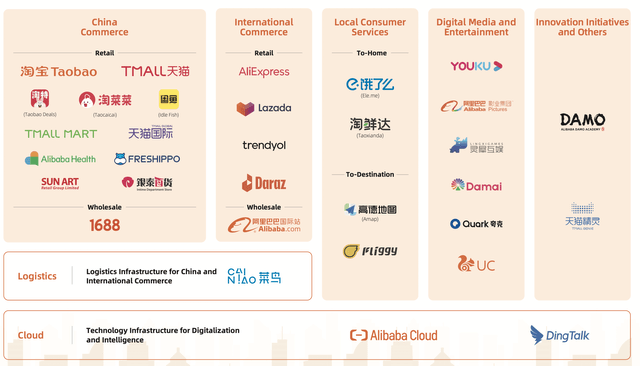

Alibaba's Diverse Business Portfolio

Alibaba segments (data.alibabagroup.com)

Alibaba is a diversified conglomerate that should be worth much more as individual units rather than Alibaba's current "all in one." We should see substantial investments flow into Alibaba's units, leading to growth and increases in valuations. Moreover, in time, Alibaba's smaller segments could blossom into precious and profitable stand-alone companies.

Segment Revenues

- The Cloud Intelligence Group - $5.4 billion (six months)

- The Taobao Tmall Commerce Group - $39 billion (six months)

- The Local Services Group - $3.33 billion (six months)

- The Cainiao Smart Logistics - $3.59 billion (six months)

- The Global Digital Commerce Group - $4.4 billion (six months)

- The Digital Media and Entertainment Group - $2.2 billion (six months)

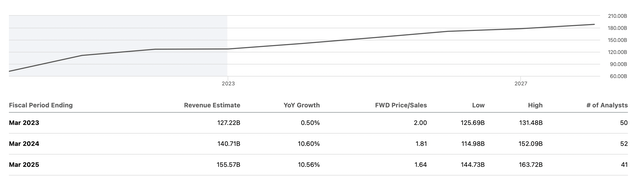

If we annualize the revenues, we can see Alibaba's units recently delivering approximately $116 billion. Alibaba's total revenues in 2022 came in at $126.6 billion, and its 2023 consensus revenue estimate is roughly $127.2 billion. However, next year's consensus estimates point to approximately $141 billion in revenues and about $156 billion in revenues in 2025.

Revenue Estimates - Could be Too Low Now

Revenue estimates (SeekingAlpha.com )

The estimates could be lowballed now, and Alibaba will provide approximately $150 billion in revenues next year and approximately $160-165 billion in 2025. Alibaba's market cap is only around $250 billion here, illustrating that its shares are dirt cheap, trading at about 1.67 times forward sales.

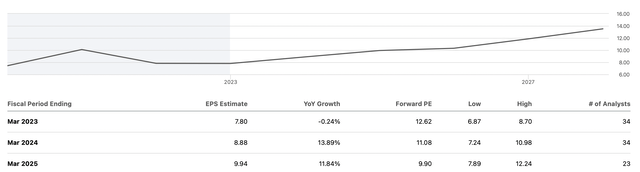

EPS Estimates - Could Move Higher Soon

EPS estimates (SeekingAlpha.com )

EPS estimates have been brought down recently, and Alibaba continuously beats the lower estimates. This trend will probably persist, implying Alibaba should achieve higher than anticipated EPS as the company advances. Next year's consensus estimates are around $9, but Alibaba could earn $10. Furthermore, instead of delivering $10 (in EPS) in 2025, Alibaba's EPS could be closer to $12. Therefore, if the company earns $10 next year, its shares are trading below a ten-forward P/E rate.

So, What's Each Unit Worth?

First, let's estimate each segment's revenues next year. The company can deliver approximately $150 billion in revenues next year, so we can approximate how much each unit could provide. Moreover, this assessment should provide an approximate value for each unit as they get spun off.

- Cloud Intelligence Group - $13 billion (revenues) x 6 times sales = $78 billion valuation.

- Taobao Tmall Commerce Group - $100 billion (revenues) x 2.5 times sales = $250 billion valuation.

- Local Services Group - $8 billion (revenues) x 3 times sales = $24 billion valuation.

- Cainiao Smart Logistics - $9 billion (revenues) x 3 times sales = $27 billion valuation.

- Global Digital Commerce Group - $13 billion (revenues) X 3 times sales = $39 billion valuation.

- Digital Media and Entertainment Group - $7 billion (revenues) 2 times sales = $14 billion valuation.

- Total Revenues - $150 billion in revenues (2024, my estimate)

- Total Proposed Post-Breakup Valuation: $432 billion

The Bottom Line

Alibaba's businesses may be undervalued by about $182 billion here. Moreover, this valuation is relatively conservative and doesn't factor in future growth probabilities and other factors that may provide additional catalysts for higher valuations of the individual spinoffs. Provided the company's valuation of around $250 billion now, a $432 billion valuation represents approximately a 73% upside. The company's stock price is around $98, and a 73% upside implies a price worth roughly $170.

Moreover, the $170 price target may only be the beginning as the separate spinoffs should unlock substantial value and may be worth significantly more in the coming years. Regardless, Alibaba's stock price should be worth much more due to increased potential for growth, higher margins, increased profitability, fewer regulation risks, and other constructive factors associated with the break up of the company. Investors could see significant returns if it becomes apparent that the sum of Alibaba's parts is worth much more than the market implies the "entire company" is worth today.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet's All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don't Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!

This article was written by

Hi, I'm Victor! It all goes back to looking at stock quotes in the old Wall St. Journal when I was a kid. What do these numbers mean, I thought? Fortunately, my uncle was a successful commodities trader on the NYMEX, and I got him to teach me how to invest. I bought my first actual stock in a company when I was 20, and the rest, as they say, is history. Over the years, some of my top investments include Apple, Tesla, Amazon, Netflix, Facebook, Google, Microsoft, Nike, JPMorgan, Bitcoin, and others.

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.