Amylyx's Relyvrio: Strong Market Potential Overshadowed By Impending PHOENIX Data

Summary

- Amylyx's Relyvrio, a novel combination of sodium phenylbutyrate and taurursodiol, offers potential functional and survival benefits for ALS patients.

- The drug has gained approval in the US and Canada, with efforts to secure approval in Europe underway.

- PHOENIX trial results will be crucial for Relyvrio's long-term success, but the trial faces challenges due to its longer duration and enrollment of more advanced ALS patients.

- Despite uncertainties surrounding the PHOENIX trial, Amylyx's commercialization efforts in 2023 and 1H 2024 could yield positive results.

- The investment recommendation for Amylyx is "Sell" due to the uncertainties surrounding the PHOENIX trial's outcomes and their potential impact on the company's stock price. Investors should consider both short-term gains and long-term risks associated with the trial when making decisions.

koto_feja/iStock via Getty Images

Introduction

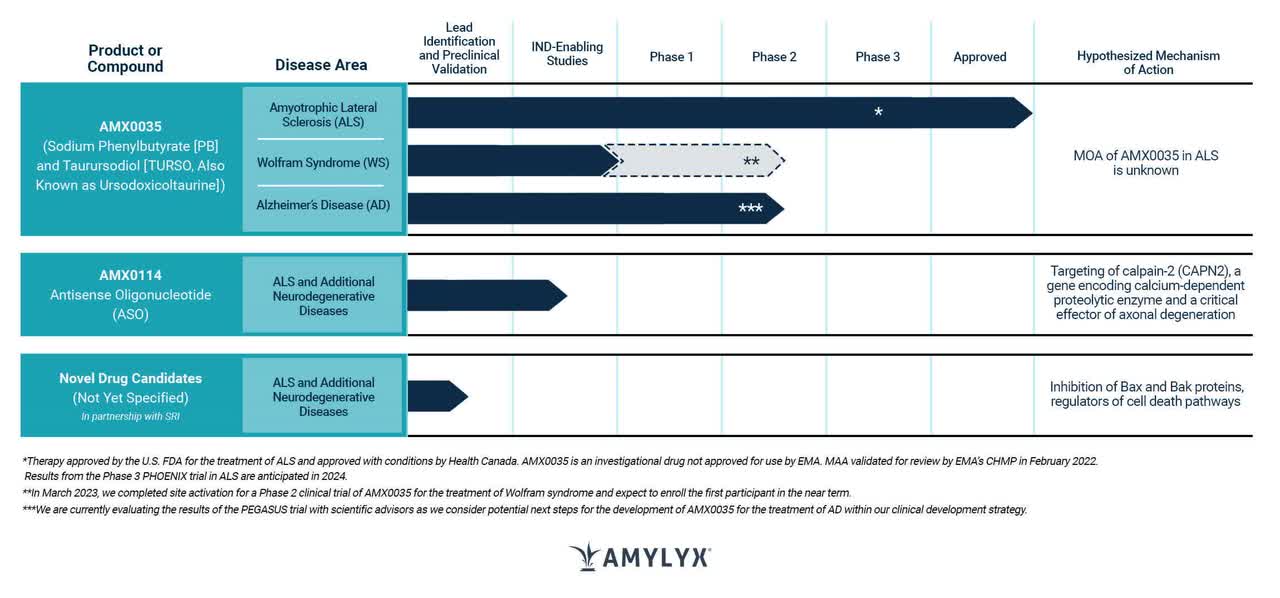

Amylyx (NASDAQ:AMLX) is a biopharmaceutical company with a mission to develop innovative treatments that could one day bring an end to the suffering caused by neurodegenerative diseases. Its first product, Relyvrio (sodium phenylbutyrate and taurursodiol), previously known as AMX0035, is currently approved (September 2022) for the treatment of Amyotrophic Lateral Sclerosis (ALS) in adults in the US and Canada. Amylyx believes that Relyvrio is the first drug to show both functional and survival benefits in a large-scale clinical trial of patients with ALS. Amylyx is currently seeking regulatory approval for Relyvrio in Europe and is focused on the development and commercialization of the drug globally.

Amylyx pipeline (Amylyx, 2023)

The following article explores Relyvrio's potential for ALS.

Financials

Let's start by going over Amylyx's latest financial report. In the fourth quarter of 2022, the net product revenue was $21.9 million, and the cost of sales was $2.8 million. For the whole year of 2022, the net product revenue was $22.2 million, and the cost of sales was $3.0 million. These sales came from Relyvrio in the U.S. and ALBRIOZA in Canada since there were no sales or costs in 2021 for comparison. In the fourth quarter of 2022, the research and development expenses were $22.8 million, while for the whole year, they were $93.5 million, mainly due to the Phase 3 PHOENIX clinical trial's costs and new personnel expenses. In the same period, selling, general, and administrative expenses were $40.8 million for the fourth quarter and $127.1 million for the whole year, mainly due to personnel-related expenses and commercial launch activities. In the fourth quarter of 2022, the net loss was $42.7 million, while for the whole year, it was $198.4 million. As of December 31, 2022, the company had cash, cash equivalents, and short-term investments of $346.9 million.

FDA-Approved Treatments for ALS: Mechanisms and Efficacy of Riluzole and Edaravone

ALS is a progressive neurodegenerative disorder affecting nerve cells in the brain and spinal cord. It is a rare disease, with about 15,000 people living with it in the US. There is no cure, and treatments mainly focus on managing symptoms and slowing progression. Relyvrio is only the third "disease-modifying therapies" [DMTs] available for ALS. The other two are described below.

Riluzole, approved for ALS in 1995, has an unknown therapeutic mechanism but is believed to modulate the neurotransmitter glutamate. Its approval was based on two trials that initially showed no statistical significance, but an alternative statistical method revealed significant survival effects.

Edaravone, approved for ALS in 2017 (intravenous) and 2022 (oral), also has an unknown therapeutic mechanism but is thought to have antioxidant effects. Its approval was based on a single 6-month study with a statistically significant difference in ALSFRS-R decline. The FDA deemed the study sufficient to provide substantial evidence of effectiveness due to its multicenter nature, consistency across subsets, and persuasive results with strong p-values.

Relyvrio Approval by FDA and Health Canada: A Promising ALS Treatment with Sodium Phenylbutyrate and Taurursodiol

The approval of Relyvrio by the FDA and Health Canada represents a significant step forward in the treatment of ALS. Relyvrio consists of both sodium phenylbutyrate and taurursodiol are two distinct compounds that have shown potential benefits in the treatment of ALS.

Sodium phenylbutyrate is a chemical compound often used as a prodrug to treat urea cycle disorders. It acts as a nitrogen scavenger, helping the body eliminate excess ammonia by converting it into a less toxic compound, phenylacetylglutamine, which is then excreted in urine. In the context of ALS, sodium phenylbutyrate is thought to help by reducing endoplasmic reticulum (ER) stress and promoting the clearance of misfolded proteins, which are common features in the disease.

Taurursodiol, also known as tauroursodeoxycholic acid (TUDCA), is a bile acid that plays a role in digestion and cholesterol metabolism. It has been shown to have cytoprotective, anti-inflammatory, and anti-apoptotic properties. In ALS, taurursodiol is believed to help by protecting motor neurons from damage, reducing inflammation, and inhibiting apoptosis (programmed cell death) associated with the disease.

The exact mechanism of how sodium phenylbutyrate and taurursodiol work together in treating ALS is not yet fully understood. However, it is hypothesized that their combined effects on reducing protein aggregation, ER stress, inflammation, and promoting motor neuron survival may contribute to their potential benefits in managing the progression of ALS.

Relyvrio Shows Promise in Treating ALS in 24-Week Study

Relyvrio's effectiveness in treating ALS was assessed in a 24-week, Phase 2 study (CENTAUR) involving 137 adult patients diagnosed with ALS. The participants were randomly assigned to receive either Relyvrio (89 patients) or a placebo (48 patients). The primary goal was to compare the rate of decline in ALSFRS-R scores, which measure functional ability, between the two groups from the beginning to the end of the study. Results showed a significant difference in the rate of reduction in ALSFRS-R scores in favor of Relyvrio-treated patients (p = 0.034). An additional analysis suggested longer median overall survival for patients treated with Relyvrio compared to the placebo group, although, according to the drug's label, this finding should be interpreted with caution due to potential confounding factors.

The safety profile of Relyvrio appears benign, with the most common side effects including diarrhea, abdominal pain, nausea, and upper respiratory tract infections. These adverse reactions occur in at least 15% of patients and are at least 5% more frequent than in the placebo group.

UpToDate recommends that all patients with ALS should receive Relyvrio along with edaravone and riluzole, as it has been found to slow down the clinical deterioration in such patients. It is important to note that this recommendation is considered weak and is based on moderate-quality evidence.

Estimating Potential Annual Revenue for Relyvrio in the US ALS Market Based on Market Penetration Scenarios

I estimate that there will be around 20,000 people living with ALS in the US each year. This estimation is based on the assumption that there will be 15,000 existing cases of ALS in the US in 2023, and 5,000 new diagnoses each year. The median survival rate of ALS is assumed to be four years. However, this estimation does not account for other factors that could impact survival rates, such as changes in diagnosis rates or treatment improvements.

Now, to estimate the maximum annual revenue for Relyvrio, which has a list price of $158,000 per year, we will use the assumption of 20,000 people living with ALS in the US each year. We will then calculate the revenue for three market penetration scenarios:

- Low market penetration (20%): In this scenario, 20% of the estimated 20,000 ALS patients, or 4,000 patients, would use Relyvrio. This would result in an annual revenue of $632,000,000.

- Medium market penetration (35%): In this scenario, 35% of the estimated 20,000 ALS patients, or 7,000 patients, would use Relyvrio. This would result in an annual revenue of $1,106,000,000.

- High market penetration (50%): In this scenario, 50% of the estimated 20,000 ALS patients, or 10,000 patients, would use Relyvrio. This would result in an annual revenue of $1,580,000,000.

In summary, the peak annual revenue for Relyvrio could be $632 million, $1.106 billion, or $1.58 billion, depending on the level of market penetration achieved.

PHOENIX Trial for Relyvrio in ALS: Full Approval Received but Phase 3 Data Crucial for Success

Relyvrio has received full approval, which is a significant step in its journey towards becoming a successful treatment for ALS. However, the ultimate success of the drug may depend on the Phase 3 data, which is yet to be released. To this end, Amylyx launched the PHOENIX trial in November 2021 to evaluate the safety and efficacy of Relyvrio in treating ALS. The trial was conducted globally in clinical sites across the US and Europe, with enrollment completed in March 2022 and February 2023, respectively. The topline results of the trial are expected to be announced in mid-2024.

The PHOENIX trial has set primary endpoints that include measuring the composite survival rate and ALSFRS-R total score progression over 48 weeks, as well as evaluating the safety and tolerability of the drug over the same period. Additionally, the trial will also examine secondary endpoints such as slow vital capacity [SVC], ALSAQ-40, EQ5D-5L, decline in King's and MiToS stages, ventilation-free survival, and long-term survival. To be eligible for the trial, patients must have clinically definite or probable ALS as per El Escorial criteria, be less than 24 months from symptom onset, have an SVC greater than 55%, and be permitted to use riluzole/edaravone.

There are significant differences between the CENTAUR and PHOENIX trials. Firstly, the PHOENIX trial will enroll more advanced ALS patients with symptom onset less than 24 months, compared to less than 18 months in CENTAUR. Additionally, the PHOENIX trial will require a lower SVC of greater than 55%, while the CENTAUR trial required an SVC of greater than 60%, indicating more stable breathing in CENTAUR.

Secondly, the PHOENIX trial will assess its primary endpoint after 48 weeks, whereas CENTAUR assessed the same after only 24 weeks. This extended duration is particularly significant for a disease like ALS.

Lastly, the PHOENIX trial permits the use of other disease-modifying therapies (DMTs) such as edaravone and riluzole, while the CENTAUR trial excluded their use.

The drug's efficacy may be challenging to demonstrate in the PHOENIX trial due to its longer duration and enrollment of more advanced ALS patients, especially considering its p-value of 0.034 in CENTAUR. Furthermore, the inclusion of other DMTs in the trial may also make it harder to detect significant differences in disease progression between the treatment and control groups. This is due to the potential for slower disease progression in patients on other DMTs, which could obscure any significant treatment effect.

Given these challenges, it appears that the company is aware and taking measures to prepare accordingly.

We have stratified PHOENIX based on whether people would meet the CENTAUR inclusion criteria or not, and plan to analyze the subset of participants who strictly meet the CENTAUR criteria, as well as the broader population. CENTAUR met its pre-specified primary outcome with all clinical secondary outcomes trending in the same direction, plus an observed difference on overall survival in a post hoc analysis and a well-tolerated safety profile. We are looking forward to PHOENIX top line results anticipated in mid-2024.

In my experience, it is rare for a company to reveal plans for subgroup analyses prior to releasing topline data. Therefore, I suspect that the probability of the PHOENIX trial successfully achieving its primary endpoint at 48 weeks is low, with an estimated likelihood of 15-25%.

My Analysis & Recommendation

In summary, the approval of Relyvrio by the FDA and Health Canada signifies a pivotal advancement in the battle against ALS. The drug's combination of sodium phenylbutyrate and taurursodiol has shown encouraging results in the CENTAUR trial, offering potential functional and survival benefits to ALS patients. However, the ultimate success of Relyvrio, in my view, will be determined by the results of the PHOENIX trial, which faces considerable obstacles due to its longer duration and inclusion of more advanced ALS patients.

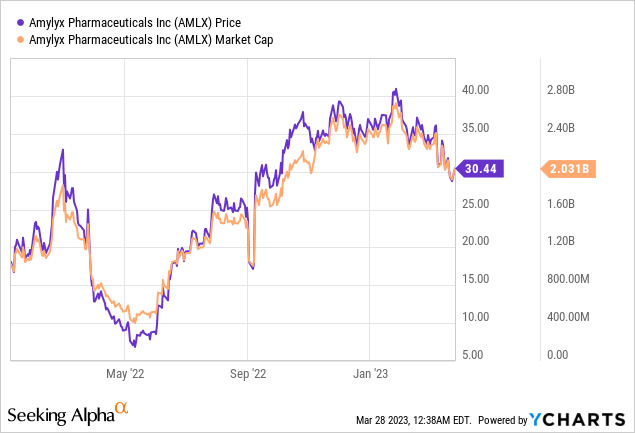

Amylyx appears to be a company committed to making a difference in the lives of those affected by neurodegenerative diseases. While the approval of Relyvrio is a noteworthy achievement, the uncertainty surrounding the PHOENIX trial raises concerns about the drug's long-term potential. Despite these challenges, Amylyx is actively pursuing global development and commercialization of Relyvrio, with potential annual revenues reaching up to $1.58 billion, depending on market penetration.

Given the current landscape, my investment recommendation for Amylyx is a "Sell." The uncertainty surrounding the PHOENIX trial's outcomes casts a shadow over the drug's future prospects, which could potentially impact Amylyx's stock price. However, it is important to acknowledge that commercialization efforts in 2023 and the first half of 2024 may yield positive results for the company, as Relyvrio's approval has created a new opportunity for addressing the unmet needs of ALS patients. In the end, investors must weigh the potential short-term gains against the long-term risks associated with the PHOENIX trial when making their investment decisions.

Risks to Thesis

“When the facts change, I change my mind.” - Paul Samuelson, economist

Some risks that could challenge the negative outlook on Amylyx include:

- Faster-than-expected regulatory approval in Europe and other regions, which could boost Relyvrio's global market penetration and increase revenue potential.

- Positive interim results from the PHOENIX trial, indicating better-than-anticipated efficacy and safety profile of Relyvrio, which could strengthen investor confidence and raise stock value.

- Discovery of new applications for Relyvrio in treating other neurodegenerative diseases, potentially diversifying Amylyx's revenue streams and increasing its market value.

- Improvement in the company's financial performance, such as higher-than-expected sales growth or cost reduction strategies, which could lead to increased profitability and a more positive outlook for the stock.

These factors could challenge the current "Sell" recommendation, potentially making Amylyx a more attractive investment opportunity.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.