Alibaba Group: A Great Move Aimed At Boosting Shareholder Value

Summary

- The management team at Alibaba Group announced that they were restructuring the company in a drastic shift away from a centralized model.

- This move should allow each unit today to focus on optimizing shareholder returns in a way that wasn't possible until now.

- The strategy should prove accretive to shareholder value and will likely benefit the company from a regulatory perspective as well.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Robert Way

Most people would view a successful business as one that continues to expand its horizons from an operational perspective. But sometimes, the most important thing to do when it comes to focusing on maximizing shareholder returns is to take the opposite approach. Some companies become too large for their own good, and the best solution to this is to break up their operations, sometimes into multiple different businesses. This seems to be the case now with Chinese e-commerce giant Alibaba Group Holding Limited (NYSE:BABA). Due to a number of factors, such as intense regulatory scrutiny, an underperforming share price, and mixed financial performance, the company has decided to fragment its different holdings and to even consider allowing some of these entities to become publicly traded firms on their own. At this time, some rather important details regarding this maneuver have not been revealed by management. But what information has been made available suggests that management is doing what they should be in the current circumstances the company is faced with.

Prepare for major changes

According to a regulatory filing issued by the management team at Alibaba Group on March 28th, the company has decided to split up its existing operations into six different business groups, each one of which will be independently managed by its own CEO and board of directors. For those taking only a casual glance at the company's operations as they are today, and looking at the changes being made, it may seem as though the changes aren't all that drastic. Already today, the company has seven different operating segments. These are the Chinese Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Other units.

Following this change, the company will have six different business groups. Some of these, based on the data that are currently available, will look substantially the same as the seven segments that exist today. For instance, the company will still have a unit referred to as the Digital Media and Entertainment Group. Cainiao, which includes the company's domestic and international one-stop-shop logistics services and supply chain management solutions, will be rebranded as Cainiao Smart Logistics. Local Consumer Services, which includes the company's location-based businesses like Ele.me, Amap, and others, will be renamed Local Services Group but will consist of largely the same operations as before. The same will happen with the Cloud segment, which will be renamed Cloud Intelligence Group. The biggest changes will be that the China Commerce segment will be restructured as the Taobao Tmall Business Group, while International Commerce will be turned into the Global Digital Business Group.

Instead of the underlying operations of the company changing materially, it would be the management structure where the difference lies. As I mentioned already, each of these businesses will have their own autonomous management teams. The autonomy extends even to the point that some of these firms might decide to raise outside capital, including via IPO. The only exception will be that the Taobao Tmall Business Group, which comprises the bulk of Alibaba Group's operations today, will remain a wholly owned entity.

Hearing that the change is less of a physical business change and more of a leadership structure change may cause some investors to scratch their heads and wonder why the stock is currently up 14.5% on the news. However, when you really dig down into the company's operations as they stand today, you can start to develop a firm grasp on some of the challenges the company has been faced with. In an ideal world, large corporations could become so competent that they could take businesses that are radically different from one another, bring them under a single holding company, and experience significant value growth for investors. Perhaps the greatest example of this playing out well involves Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B). In addition to having a large investment portfolio that's dedicated to owning parts of major companies across the globe, Berkshire Hathaway owns 65 distinct companies that are divided up into more than 260 different subsidiaries. But not every company has the ability to pull this off, especially when you consider that the businesses under Berkshire Hathaway are developed businesses while those owned by Alibaba Group are more modern, rapid-growth enterprises.

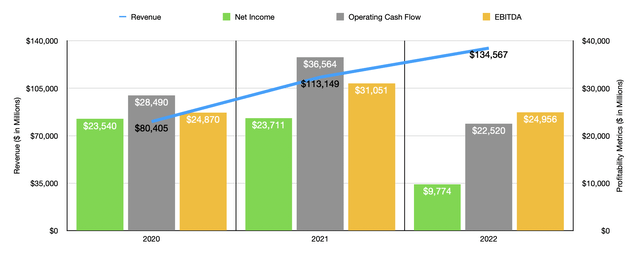

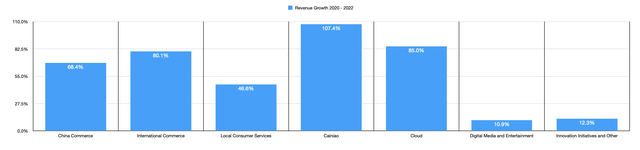

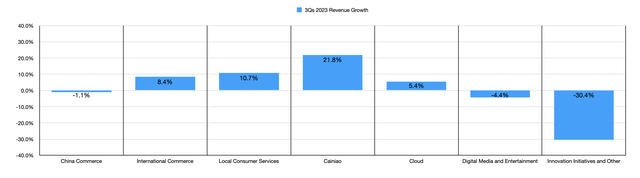

Operationally, Alibaba Group has done quite well for itself in recent years. Using a constant currency exchange rate that's based on results for the 2022 fiscal year for the business, I calculated the overall revenue expanded by 67.4% from $80.41 billion in 2020 to $134.57 billion in 2022. But the growth for the enterprise has not really been even. For instance, some of its operations have grown slower than others. The Digital Media and Entertainment segment of the company, for instance, saw revenue grow by just 10.9% over this window of time, while revenue growth under the Innovation Initiatives and Other segment totaled 12.3%. Although impressive, the Local Consumer Services segment also reported substandard growth compared to the rest of the business, with revenue climbing 46.6% over this timeframe. As you can see in the chart above, the real growth for the company came from its core commerce operations, as well as from both its Cainiao and Cloud segments. Generally speaking, when you have different businesses that are growing at significantly different rates and that have significantly different ways in which they make money, the financial and management needs of those businesses differ significantly as well. This is especially true if your goal is to optimize shareholder value creation.

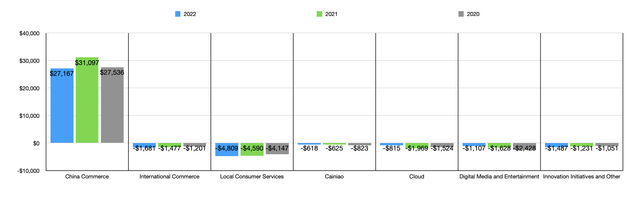

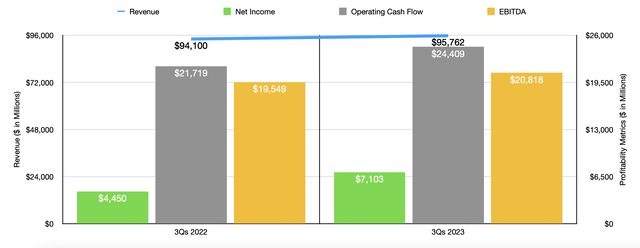

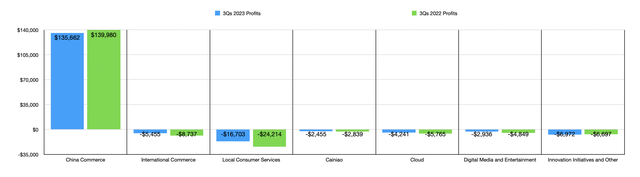

When you dig into bottom line results, it becomes even clearer why the company would do well to operate more autonomously. At first glance, you can see that the bottom line results for the company have been mixed over the past three years. Although when you look at data for the first nine months of the current fiscal year that are shown in the charts below, you will see a nice amount of improvement on this front even though revenue data came in rather mixed. But when you break up the company into its individual segments, you get a look at some real operational challenges the company is faced with. What is most obvious is the fact that all of the company's profits, and then some, come from its China Commerce segment. Literally, all of the other operating segments of the company negatively impact its bottom line. But even these differ materially from one another. For instance, the Cainiao segment of the company has seen its bottom line improve gradually over the past three years. The Digital Media and Entertainment segment, meanwhile, has seen drastic improvement. But when you look at segments like International Commerce, Local Consumer Services, and Innovation Initiatives and Other, you end up with a continued deterioration from a profitability perspective, even as revenue climbs. For the most part, the China Commerce segment has seen its bottom line results more or less stabilize, with only the Cloud segment posting a meaningful improvement in profitability.

Author - SEC EDGAR Data Author - SEC EDGAR Data Author - SEC EDGAR Data

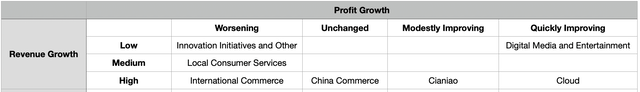

Again, this gives us the ability to categorize the different operations of the business based on growth and profit trends. And what you see, shown below, is that literally every segment can be placed in a different category from the other. The fact that these businesses are so different from one another and when considering how their performance has fared relative to one another, it only makes sense for the business to be broken up so that each management team can focus on optimizing returns for their own respective companies. Of course, there is another benefit behind this maneuver. On top of giving investors the opportunity to generate stronger returns, this move should also serve to reduce regulatory scrutiny that has been placed on the company. It wasn't just Alibaba Group that Chinese authorities were targeting. Rather, they have, for years, criticized the expansion of their nation's largest Internet companies as being 'disorderly' in nature. By breaking operations up into several separate enterprises, it's likely that the company will satisfy China's government to a sizable degree.

Takeaway

From a purely financial perspective, it takes some digging to understand why this move makes sense for Alibaba Group and its investors. But when you come to understand just how different the company's different units are, the pieces fall into place. By giving those running each business significant degrees of autonomy, you increase the likelihood that the emphasis placed by each individual management team will create value for the company moving forward. It's unclear exactly what the picture will look like by the time this transformation is done. But at the end of the day, I don't think the development will be anything other than positive.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.